-

下載億題庫APP

-

聯(lián)系電話:400-660-1360

下載億題庫APP

聯(lián)系電話:400-660-1360

請謹(jǐn)慎保管和記憶你的密碼,以免泄露和丟失

請謹(jǐn)慎保管和記憶你的密碼,以免泄露和丟失

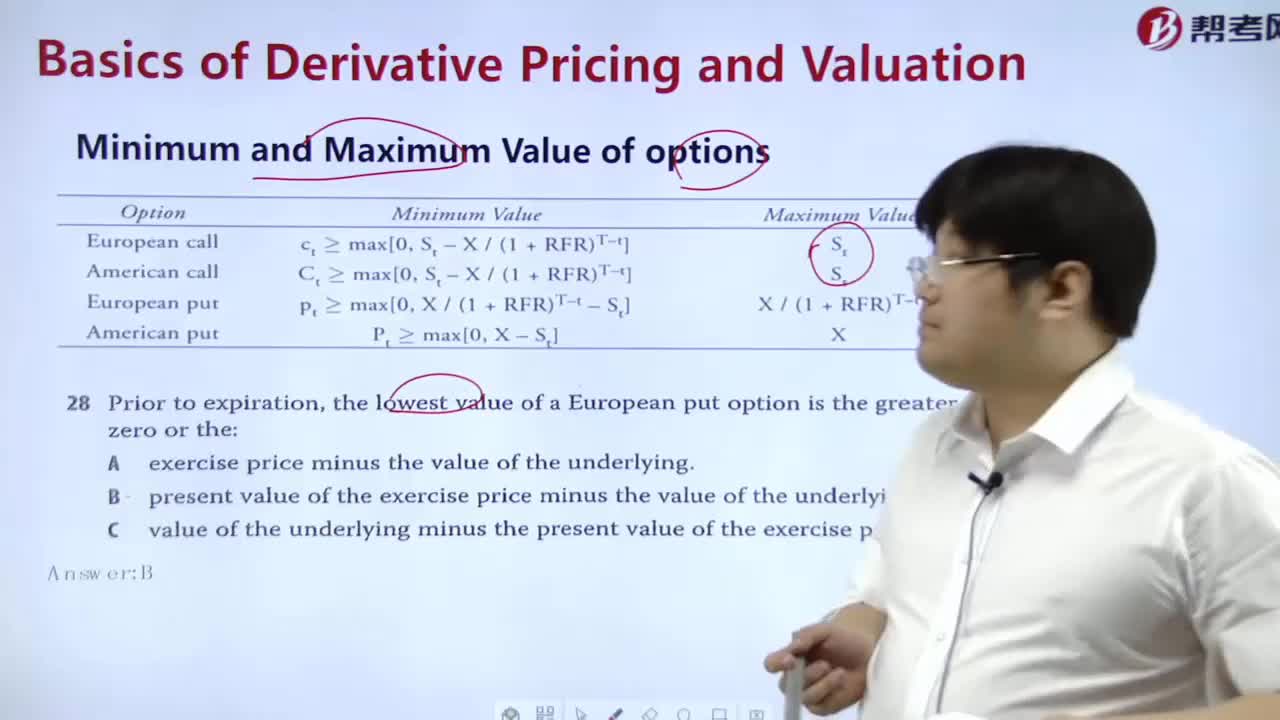

How to calculate the minimum and maximum value of the option?

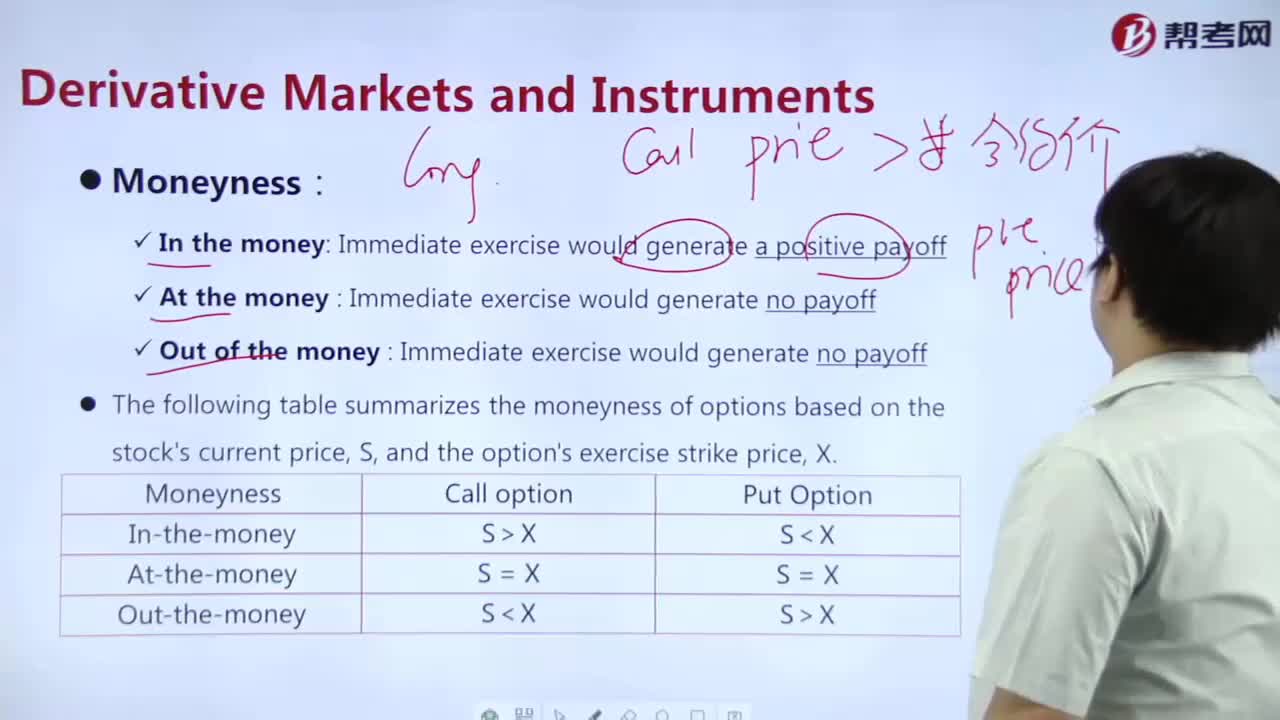

How to determine the value of an option purchased?

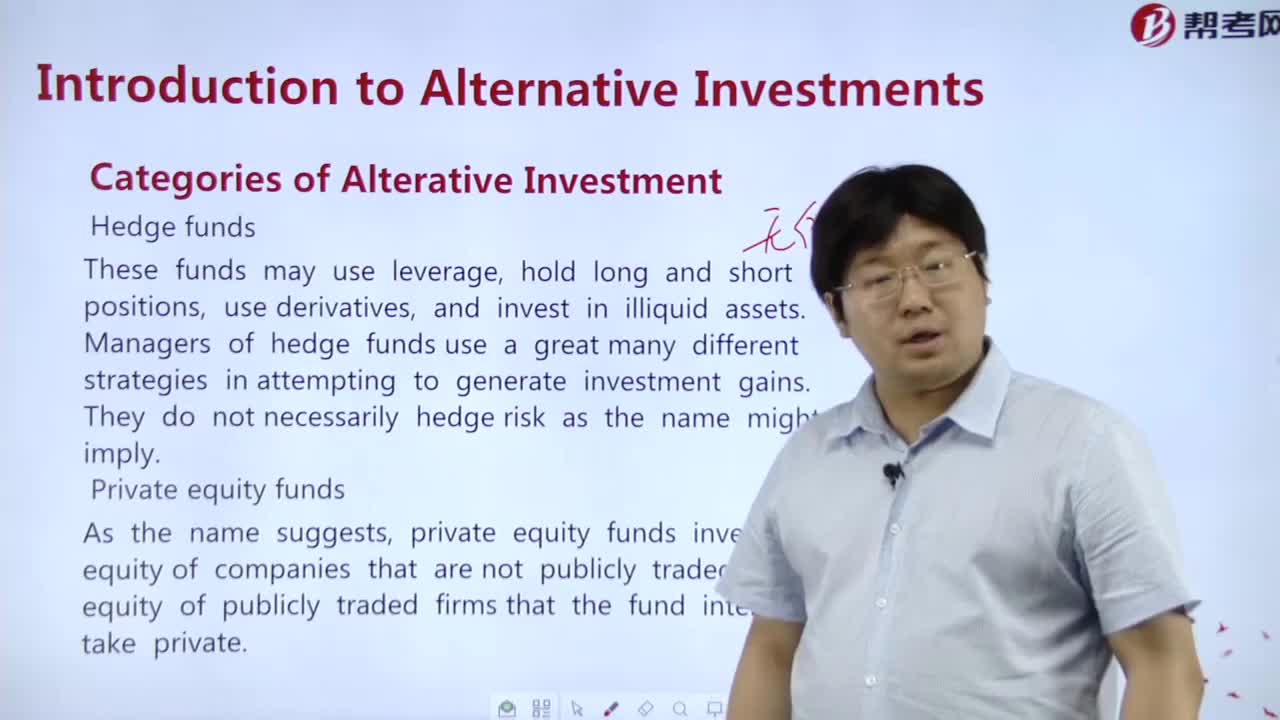

What are the types of alternative investments?

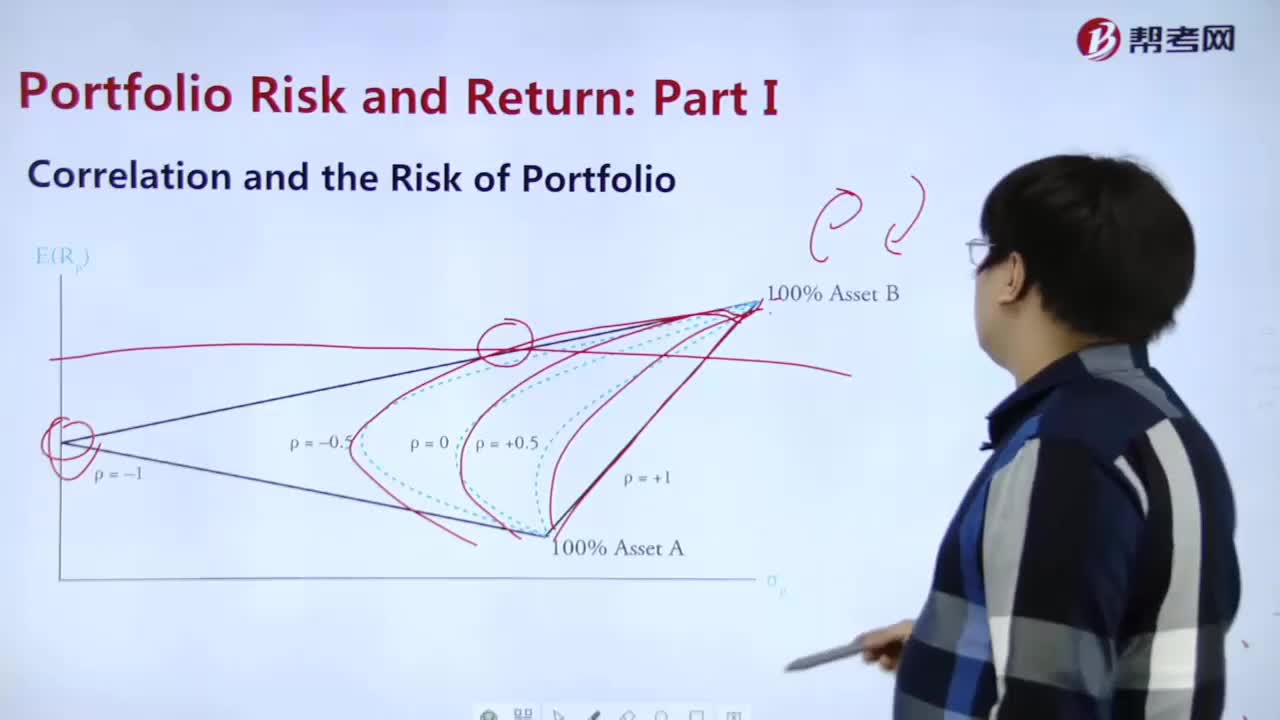

What are the correlations and risks of portfolio?

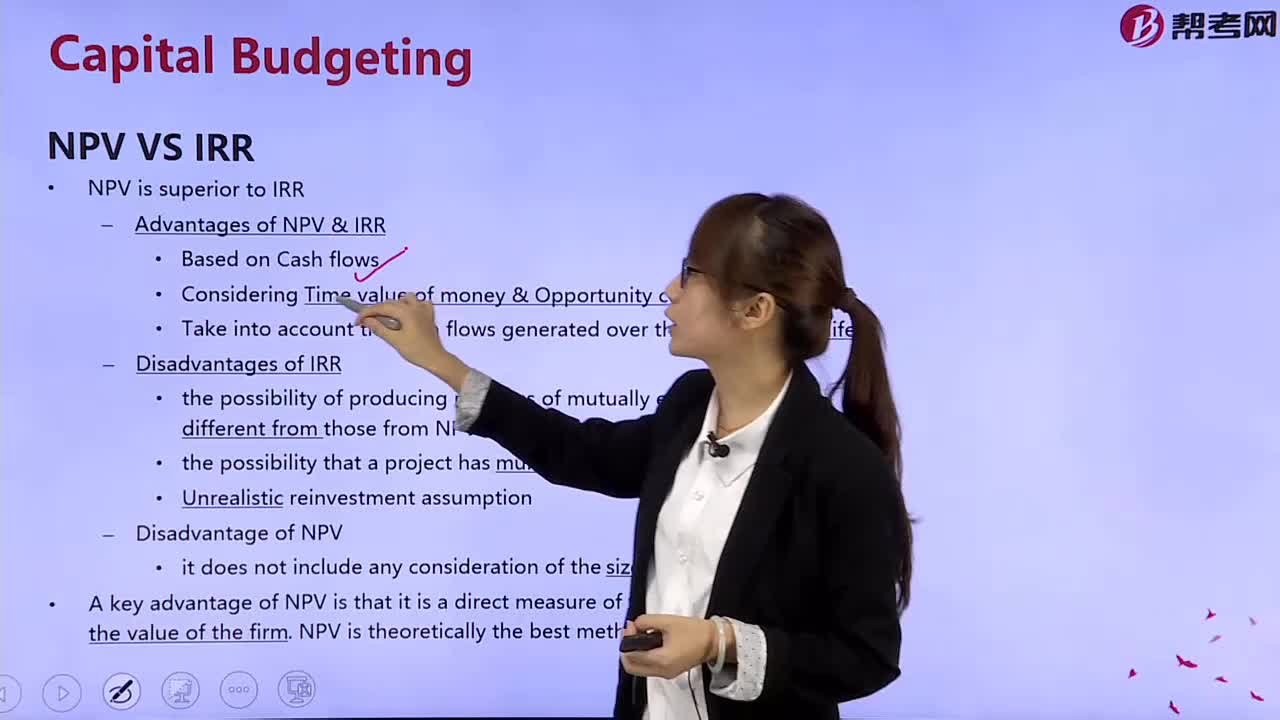

What is the difference between net present value and internal income?

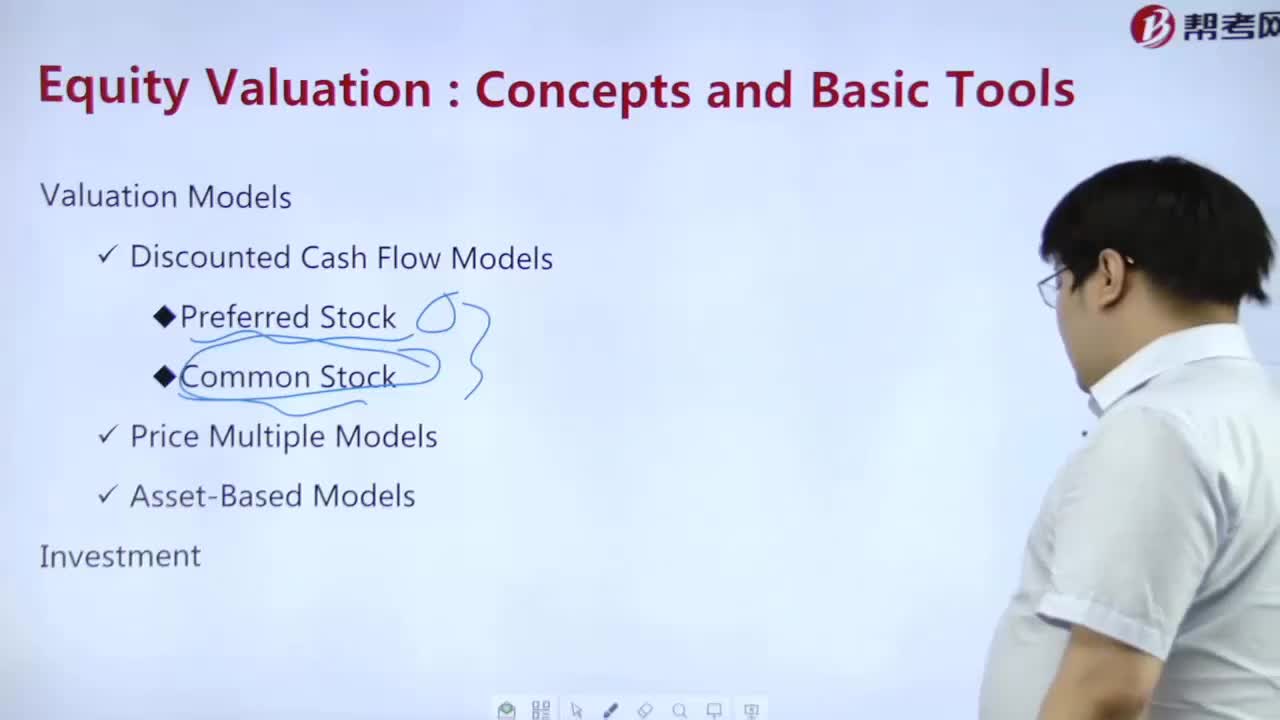

How to calculate the value of preferred stock?

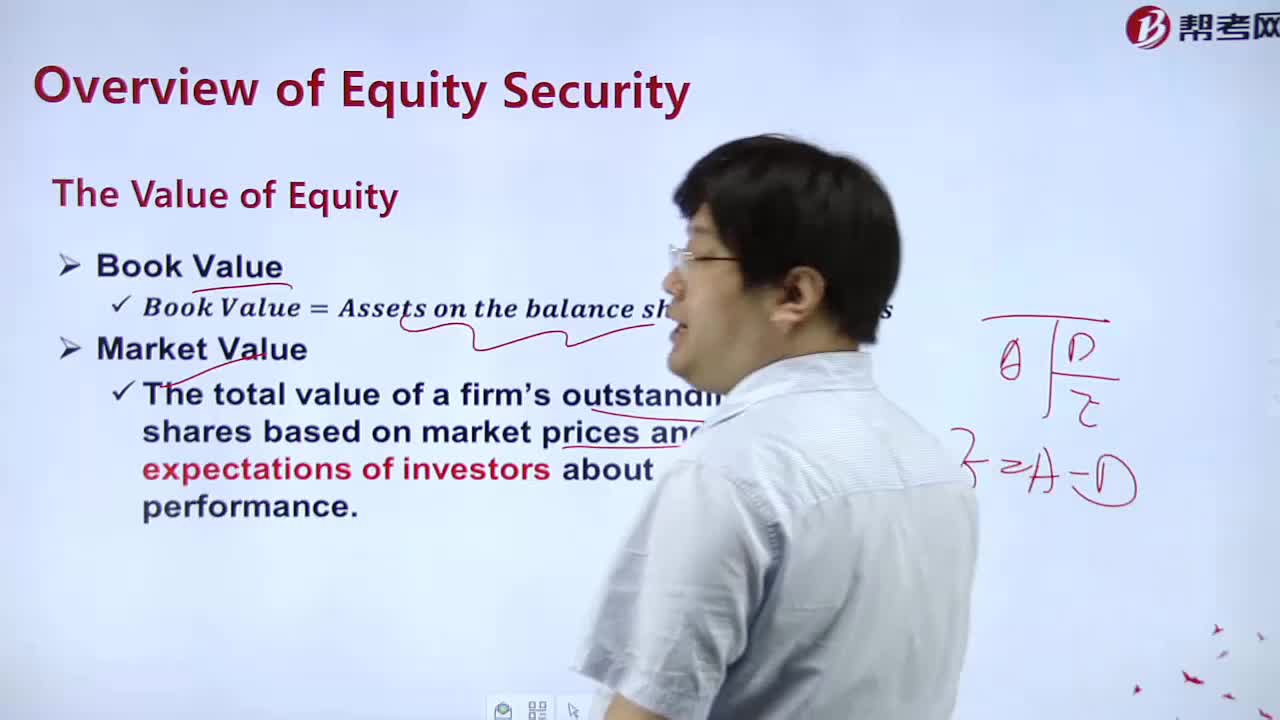

What is the value of the equity?

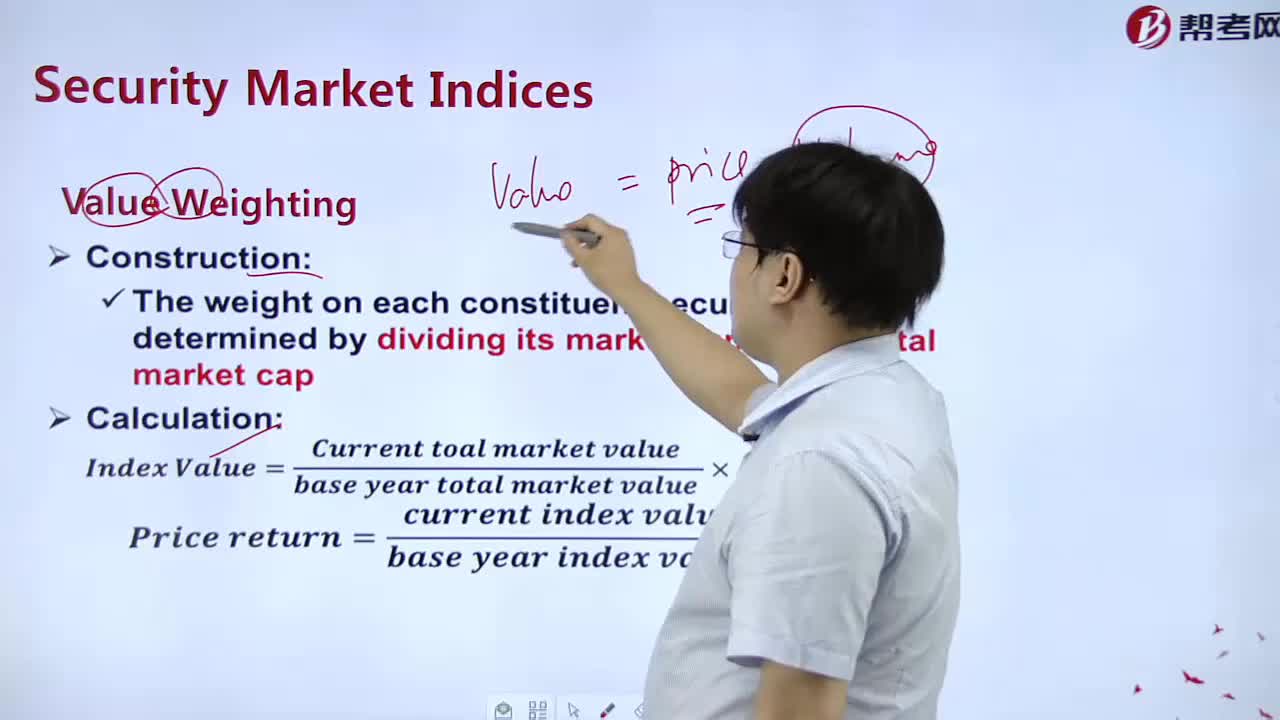

What is the measurement of Value?

Point and Interval Estimates of the Population Mean

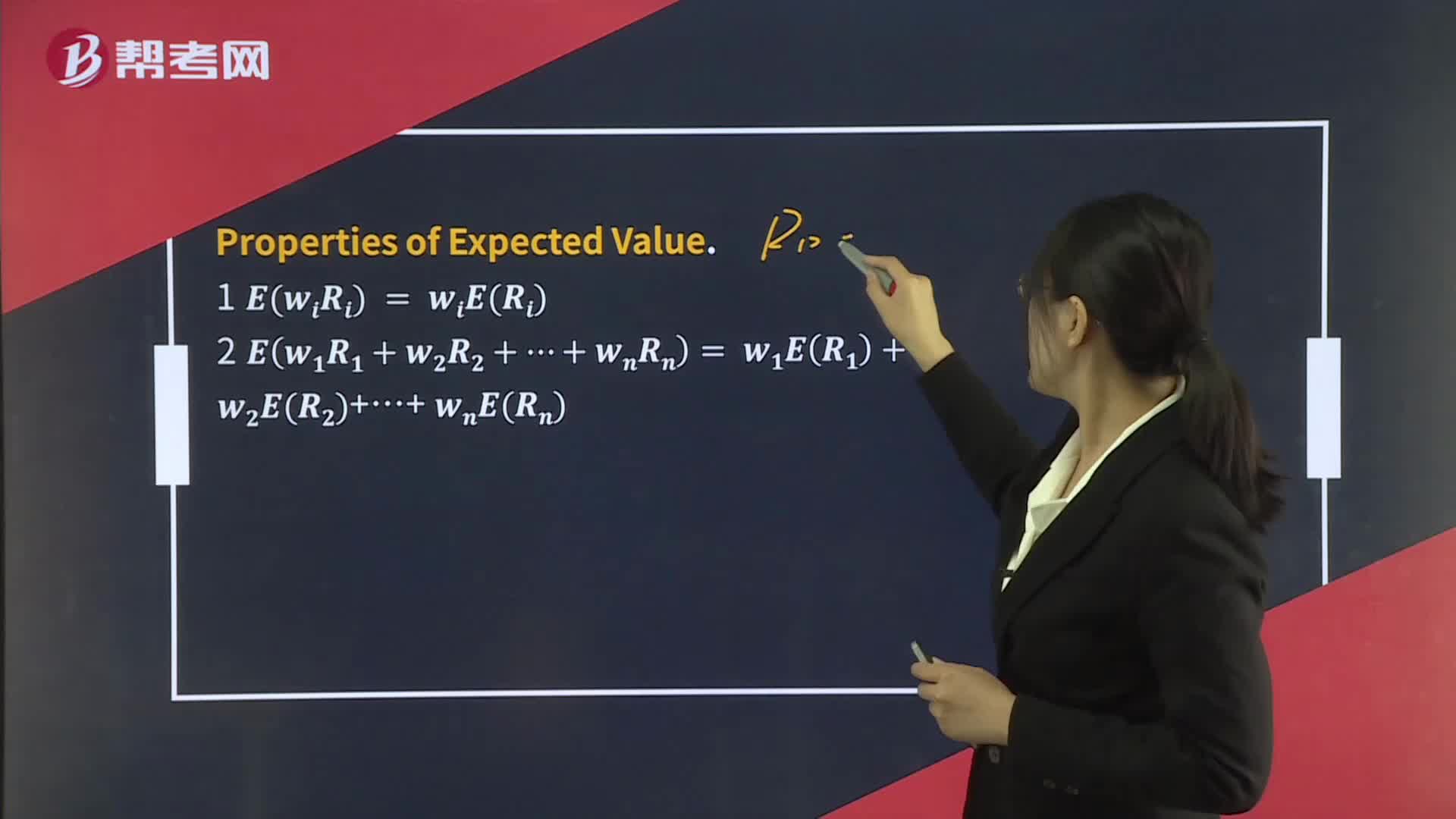

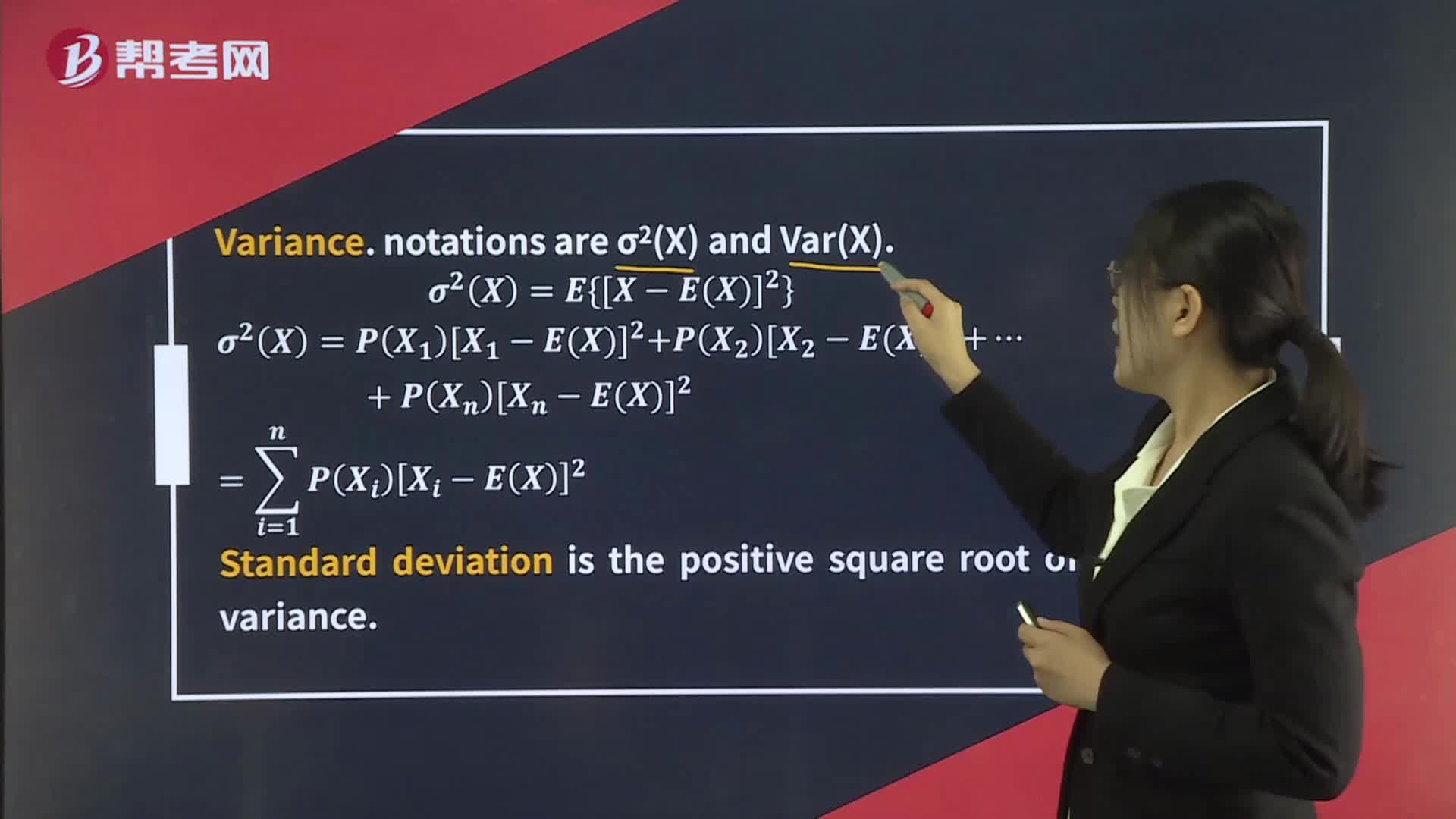

Portfolio Expected Return and Variance of Return

The Time Value of Money

Total, Average, and Marginal Product of Labor

07:26

07:26

Expected Value and Variance:A. $9.81:million.,0.05$70 – 37.752 + 0.70$40 – 37.752 + 0.25$25 – 37.752 = $96.18 million. The standard deviation is thus σ = $96.1812 = $9.81 million.,$63600.

02:50

02:50

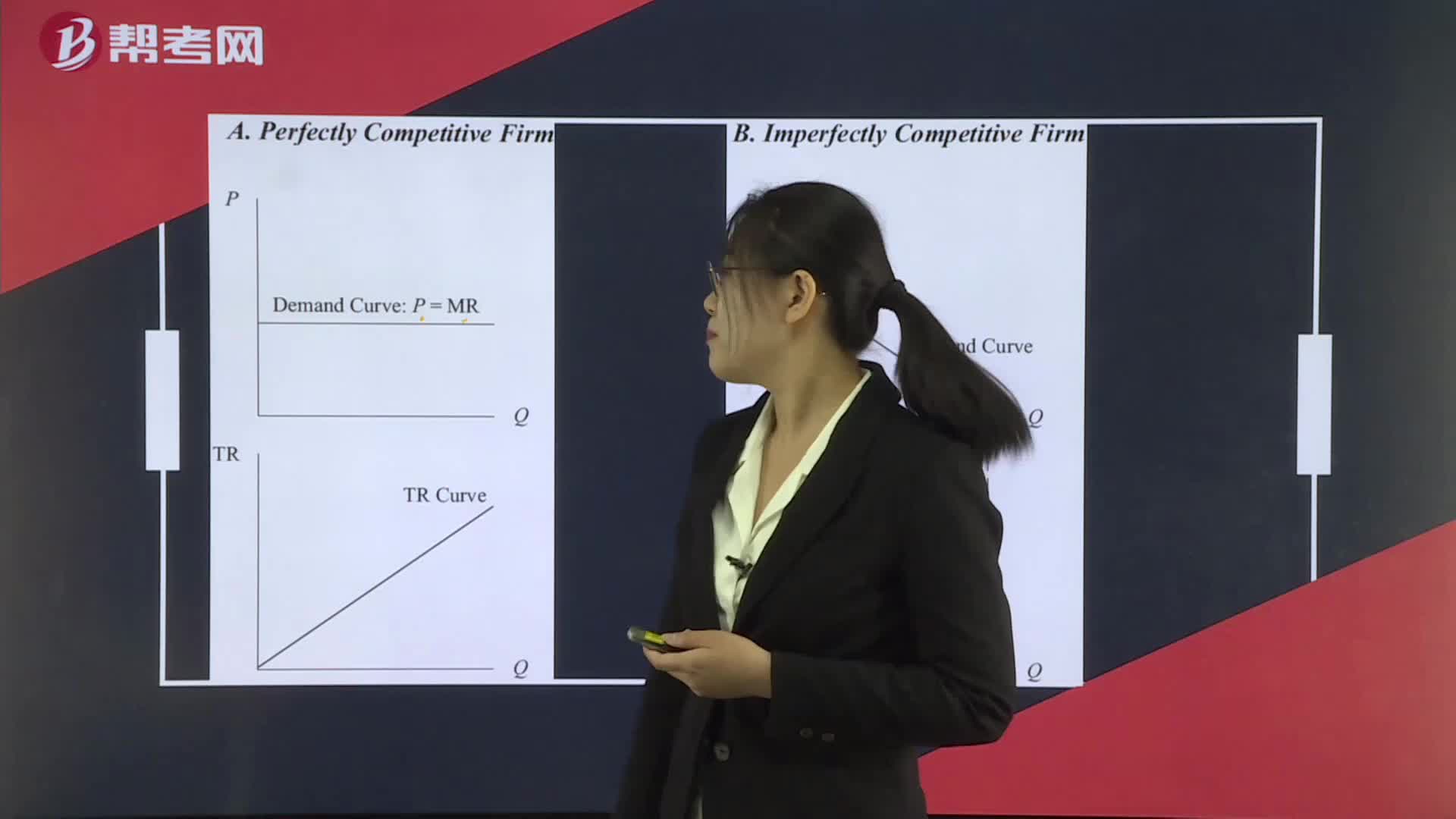

Revenue under Conditions of Perfect and Imperfect Competition:Imperfect Competition

02:05

02:05

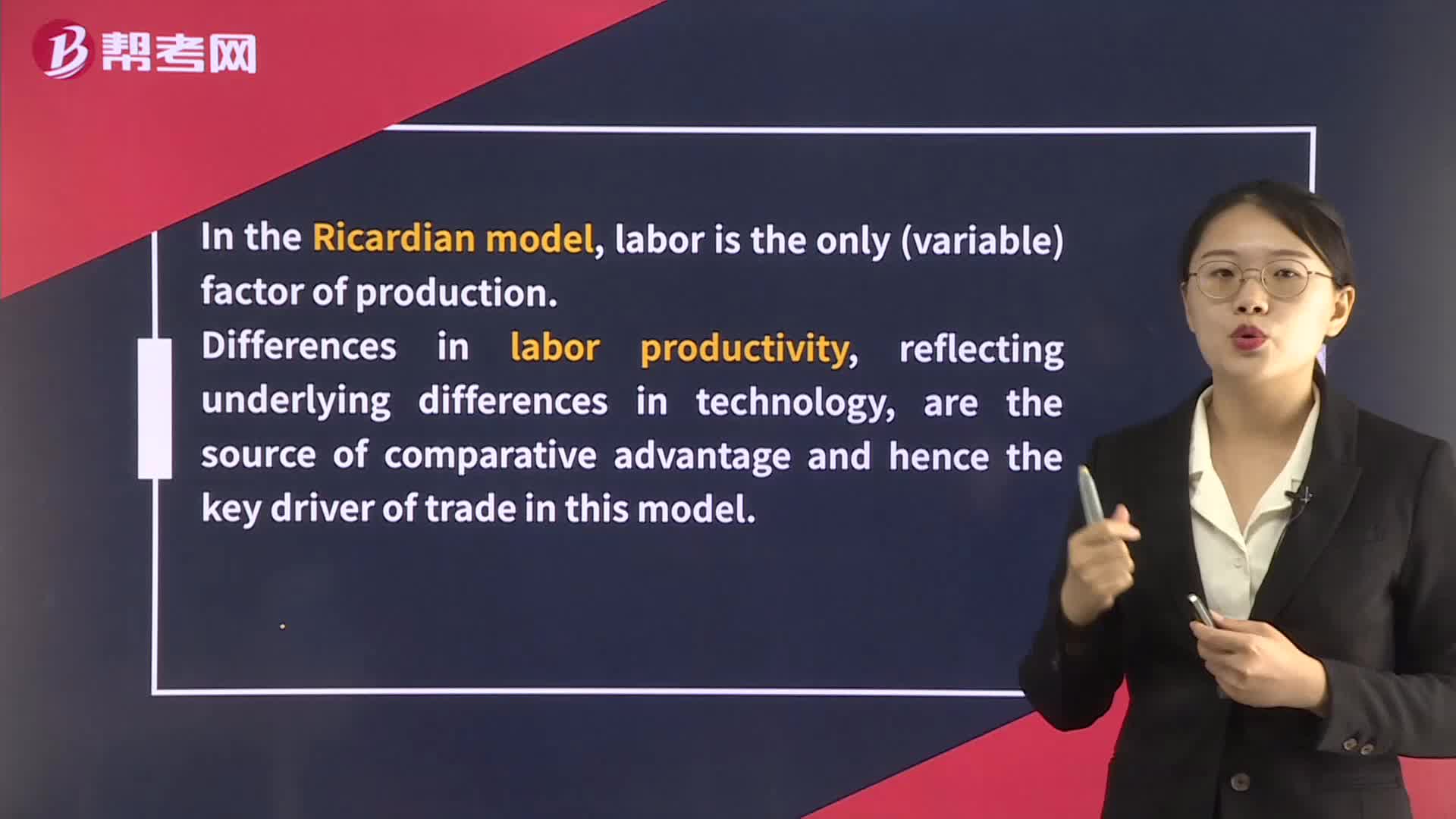

Ricardian and Heckscher–Ohlin Models of Comparative Advantage:In the Heckscher–Ohlin Model also known as the factor-proportions theoryendowment of these factors are the source of a country’s comparative advantage.

21:36

21:36

Point and Interval Estimates of the Population Mean:value that we calculate from sample observations using an estimator is:distribution.,meanEfficiency.[Practiceerror

03:28

03:28

Benefits and Costs of Regional Trading Areas:integration.cultureFirstSecondintegration limits the extent to which member countries can pursue independent economic and social policies.

09:33

09:33

National Economic Accounts and the Balance of Payments:where:SpC–Sg.productive resources and its ability to repay its liabilities.Current

04:21

04:21

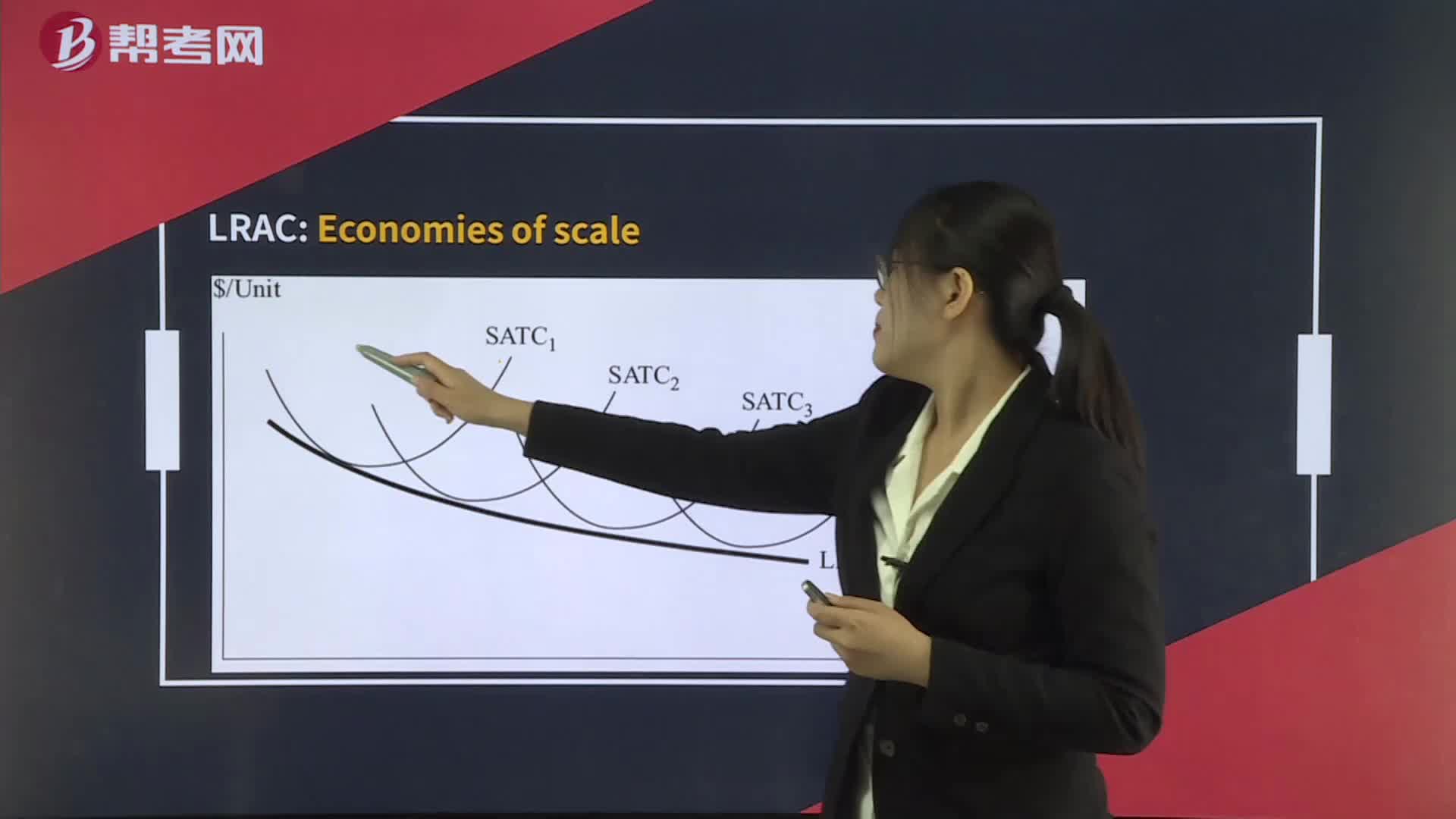

Economies of Scale and Diseconomies of Scale:as the firm increases its output:size under perfect competition over the long run.

03:09

03:09

Benefits and Costs of International Trade:Benefits and Costs of International Trade:households and firms have greater product variety;of jobs in developed countries as a result of import competition.

02:22

02:22

The Advantages and Disadvantages of Using the Different Tools of Fiscal Policy:Different Tools of Fiscal Policy:DirectCapitalpowerful as the direct effects.

16:32

16:32

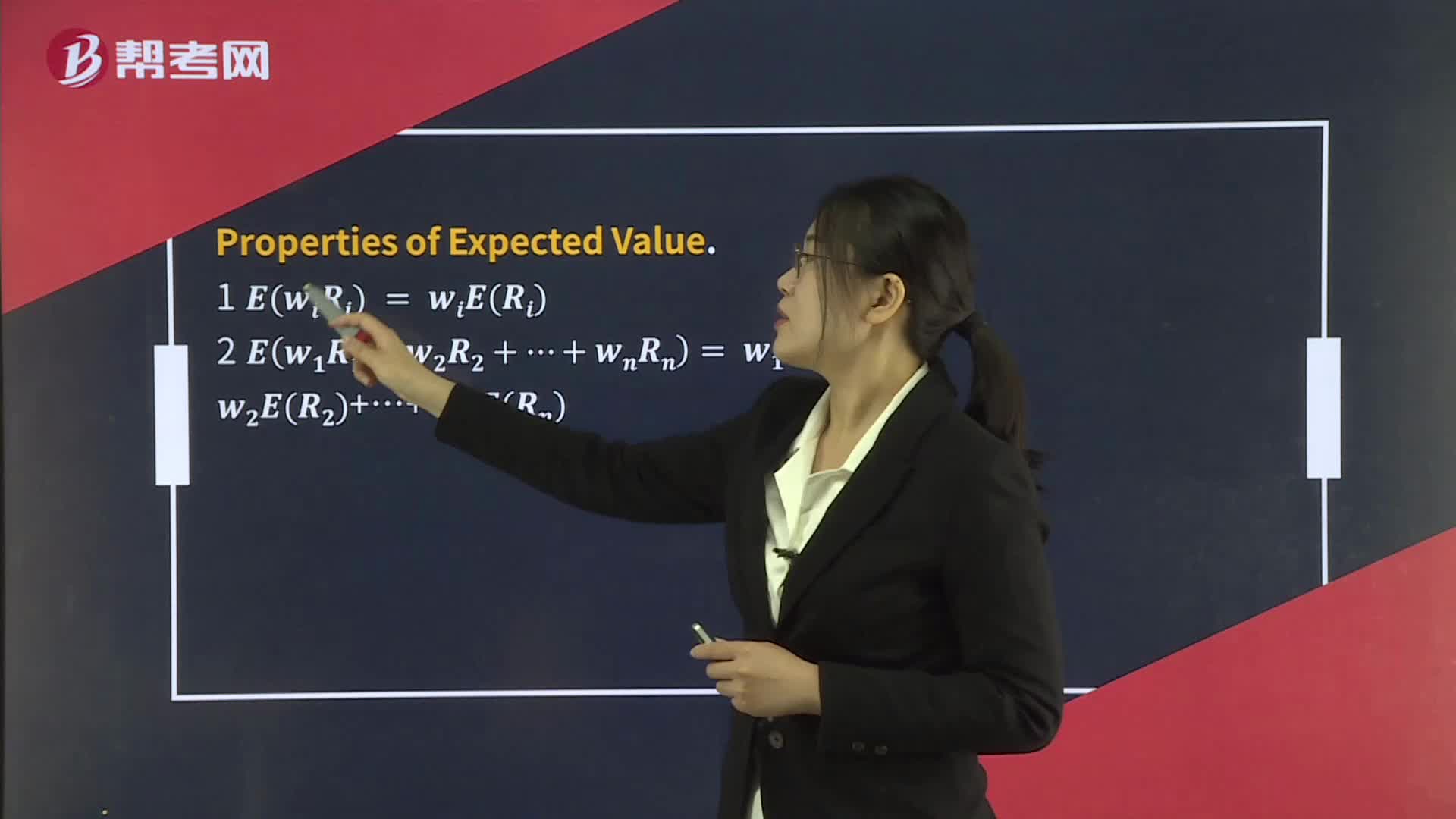

Portfolio Expected Return and Variance of Return:= 8112 = 9. Thus:RjB.C.FirstEXY = EXEY

10:40

10:40

What members and candidates should notice in CFA examinations?:or security of the CFA examinations.(不能惡心CFA),考試不能作弊:考試內(nèi)容要保密:A. No.:Responsibilities as a CFA Institute Member.right④Case

11:00

11:00

What's the meaning of independence and objectivity in professionalism?:or consideration that reasonably could be expected to compromise their own or another’s independence and objectivity.(那些被合理認(rèn)為將會影響?yīng)毩⒖陀^的威逼利誘都要不為所動),但在他人眼中會影響?yīng)毩⑿砸膊恍校┛赡艿脑捠孪扰督o雇主告訴雇主是為了引起雇主的同意

幫考網(wǎng)校

2022年06月22日

幫考網(wǎng)校

2022年06月22日

幫考網(wǎng)校

2022年06月22日

幫考網(wǎng)校

2022年06月22日

幫考網(wǎng)校

2022年06月22日

幫考網(wǎng)校

2022年06月22日

幫考網(wǎng)校

2022年06月22日

幫考網(wǎng)校

2022年06月22日

幫考網(wǎng)校

2022年06月22日

幫考網(wǎng)校

2022年06月22日