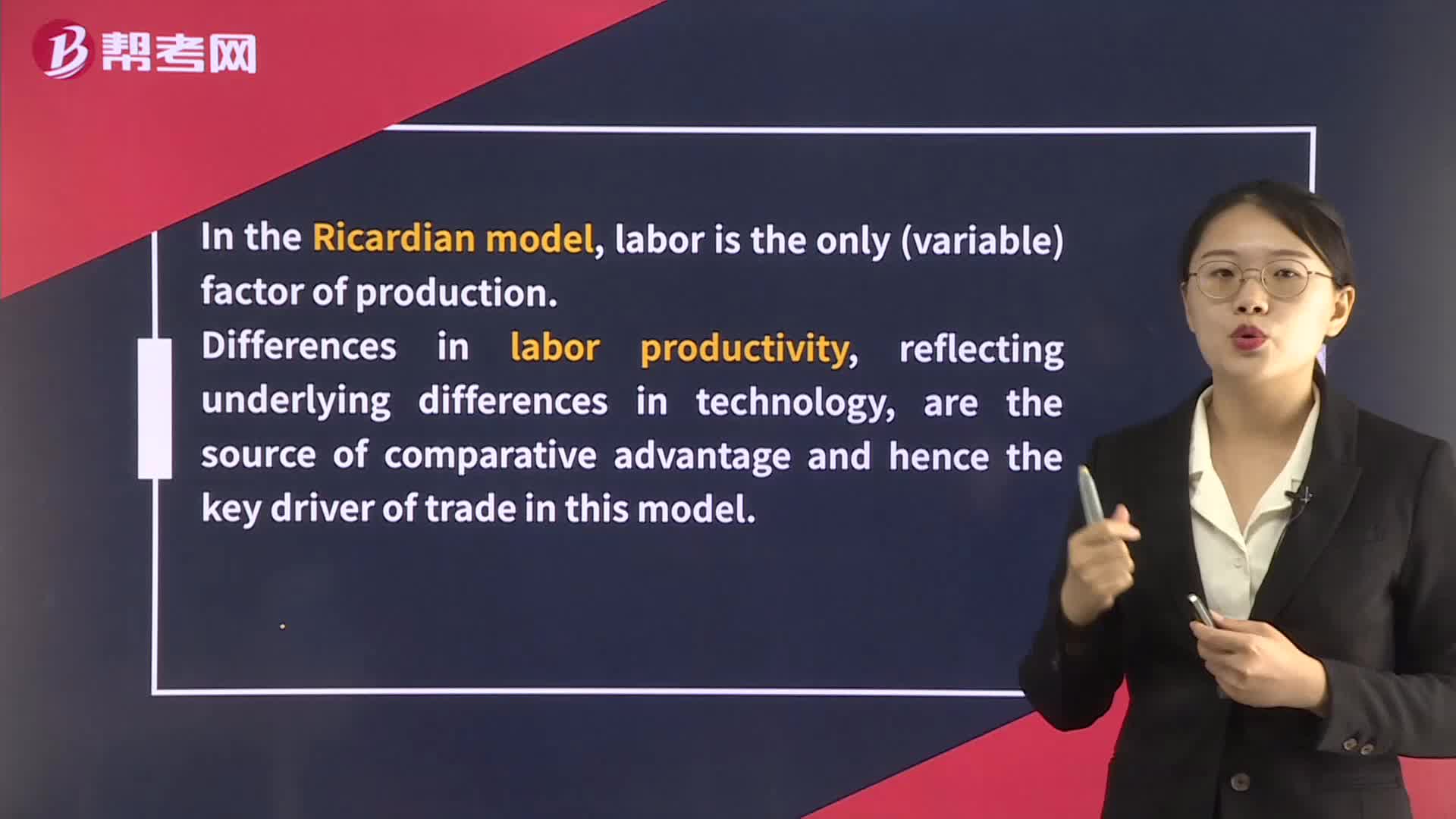

Ricardian and Heckscher–Ohlin Models of Comparative Advantage

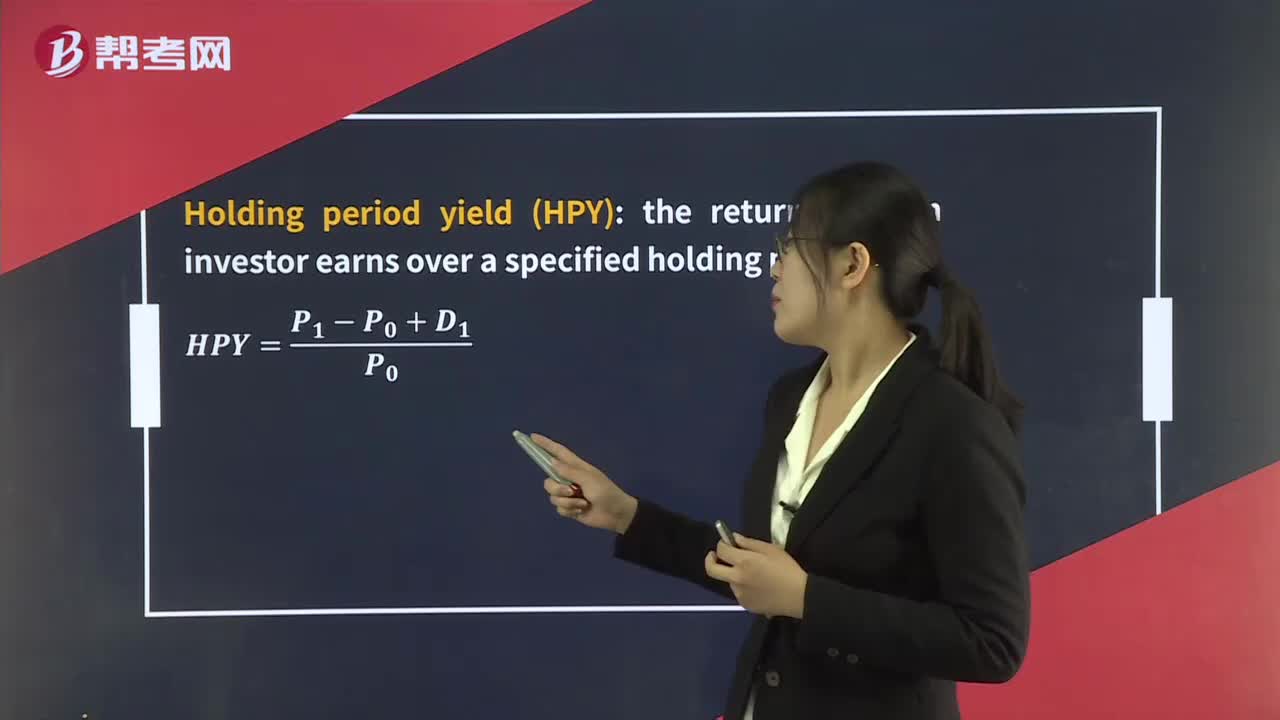

Money-Weighted Rate of Return & Time-Weighted Rate of Return

Point and Interval Estimates of the Population Mean

Imports and Exports

GDP and GNP

Benefits and Costs of Regional Trading Areas

National Economic Accounts and the Balance of Payments

Absolute and Comparative Advantage

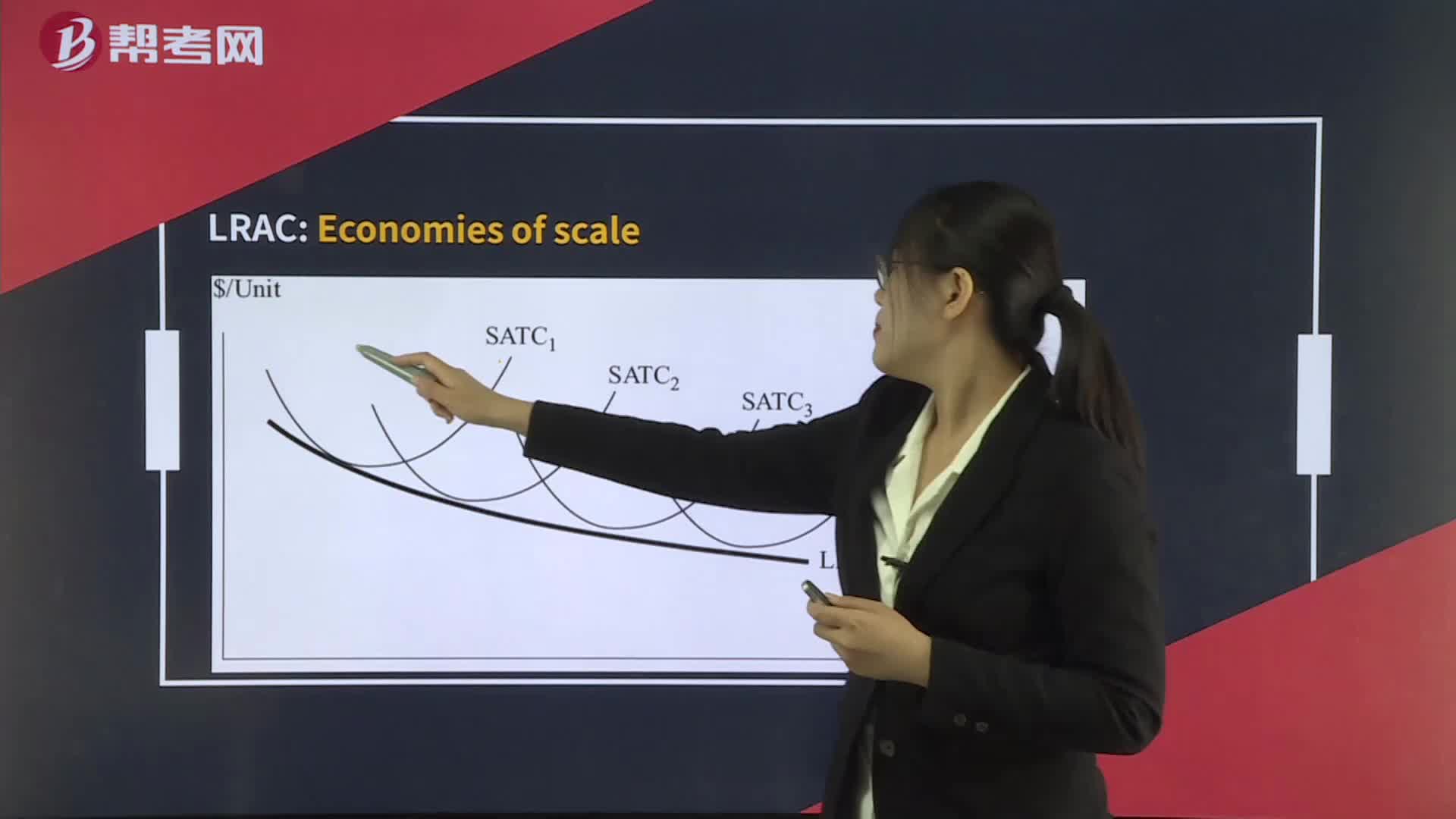

Economies of Scale and Diseconomies of Scale

Benefits and Costs of International Trade

The Objectives of Monetary Policy

Examination of a Company’s Performance

下載億題庫(kù)APP

聯(lián)系電話:400-660-1360