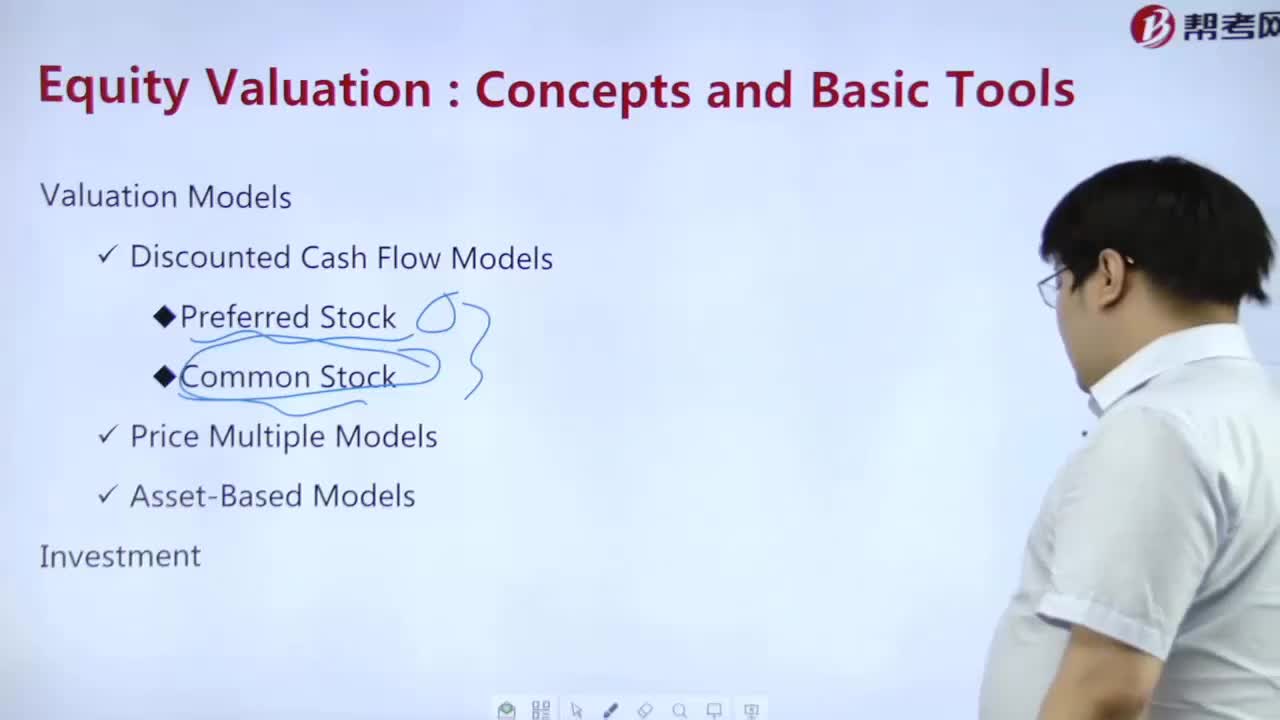

How to calculate the value of preferred stock?

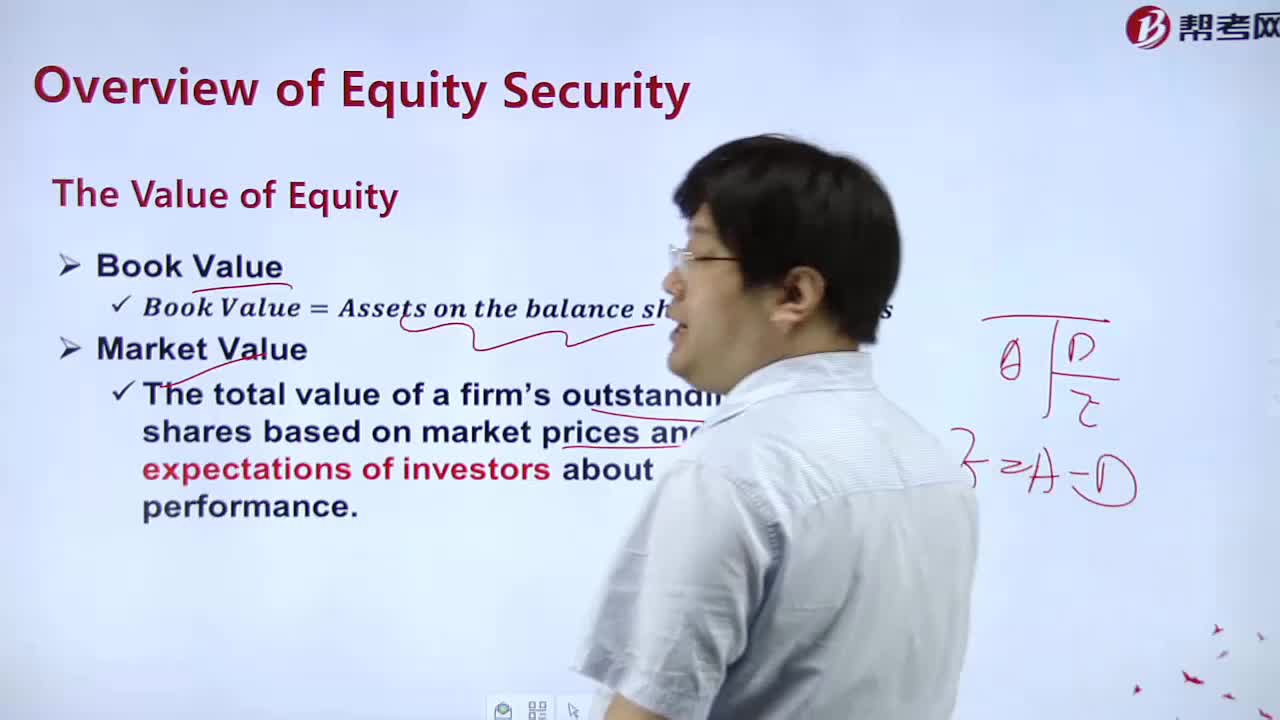

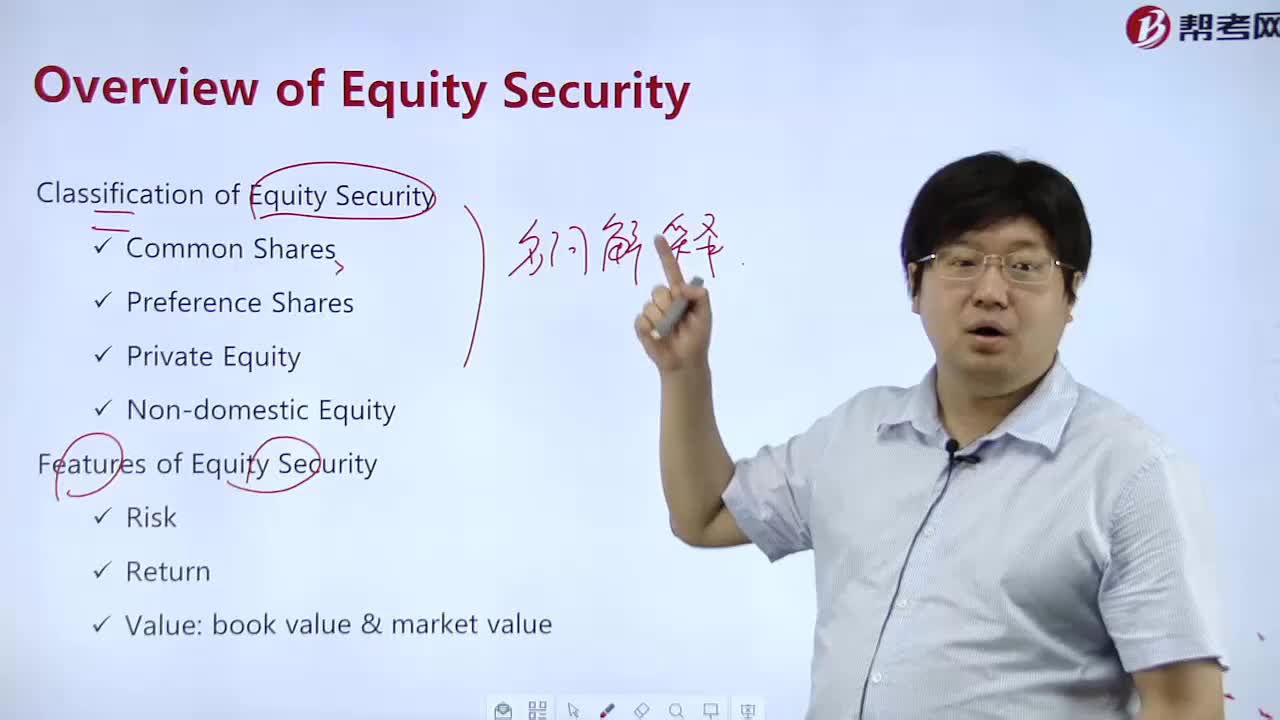

What is the value of the equity?

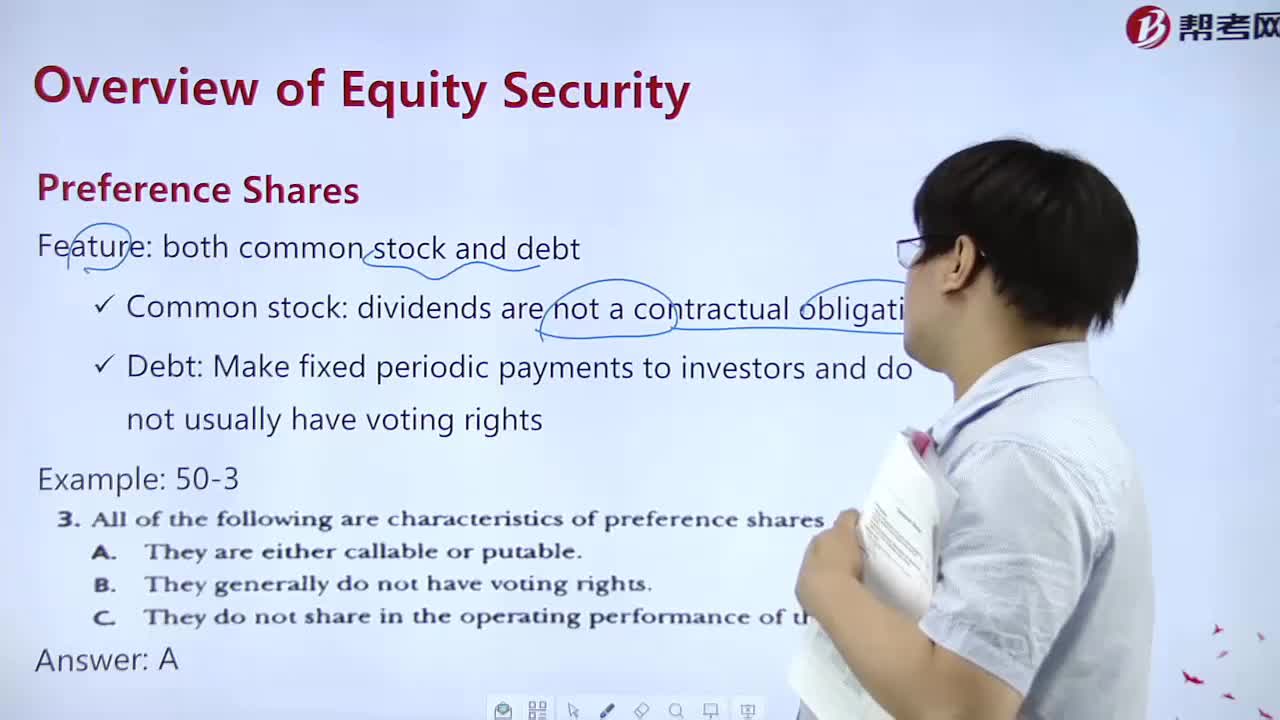

What is the nature of preferred stock?

What is the voting method for common stock?

What are the privileges of common stock?

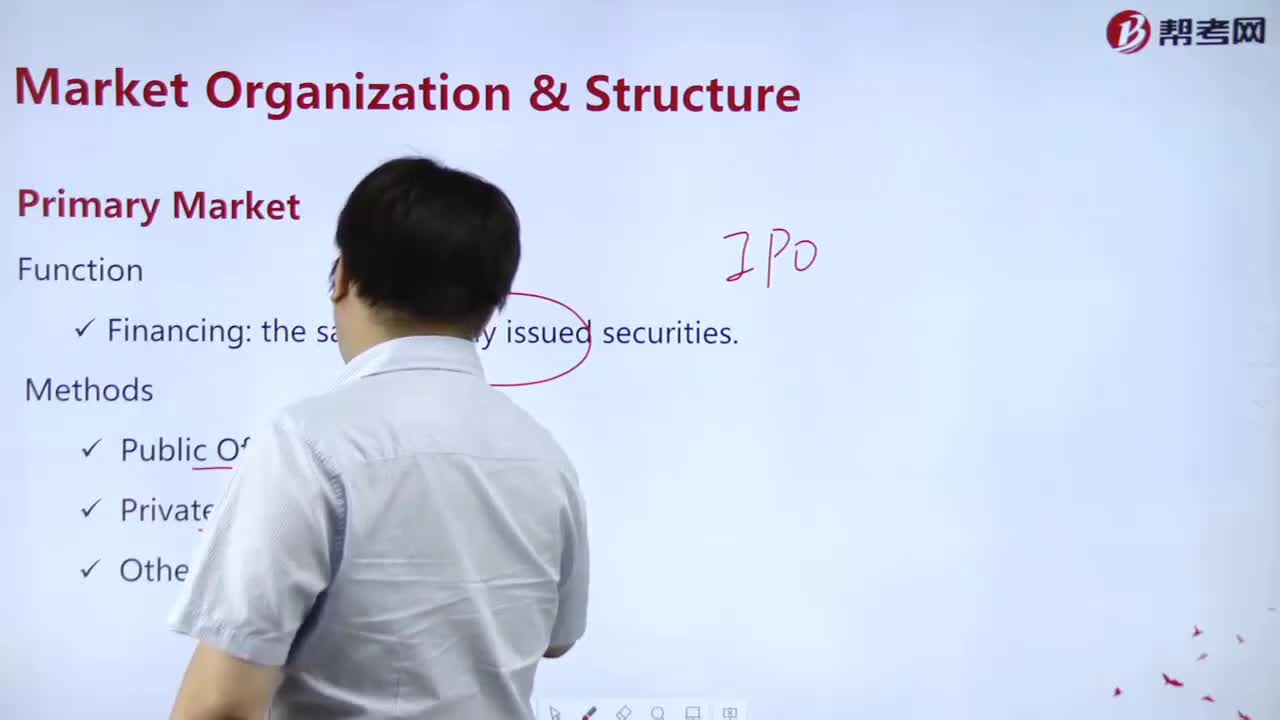

What is the function of the Primary Market?

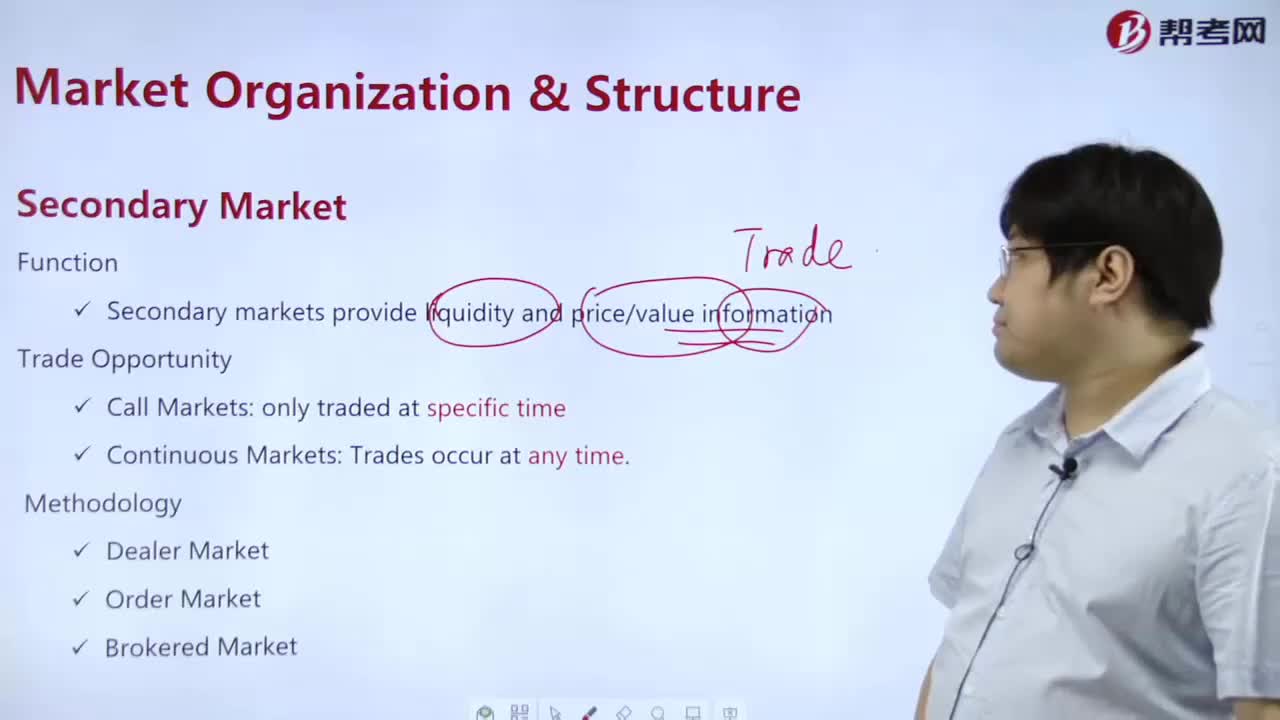

What is the role of the secondary market?

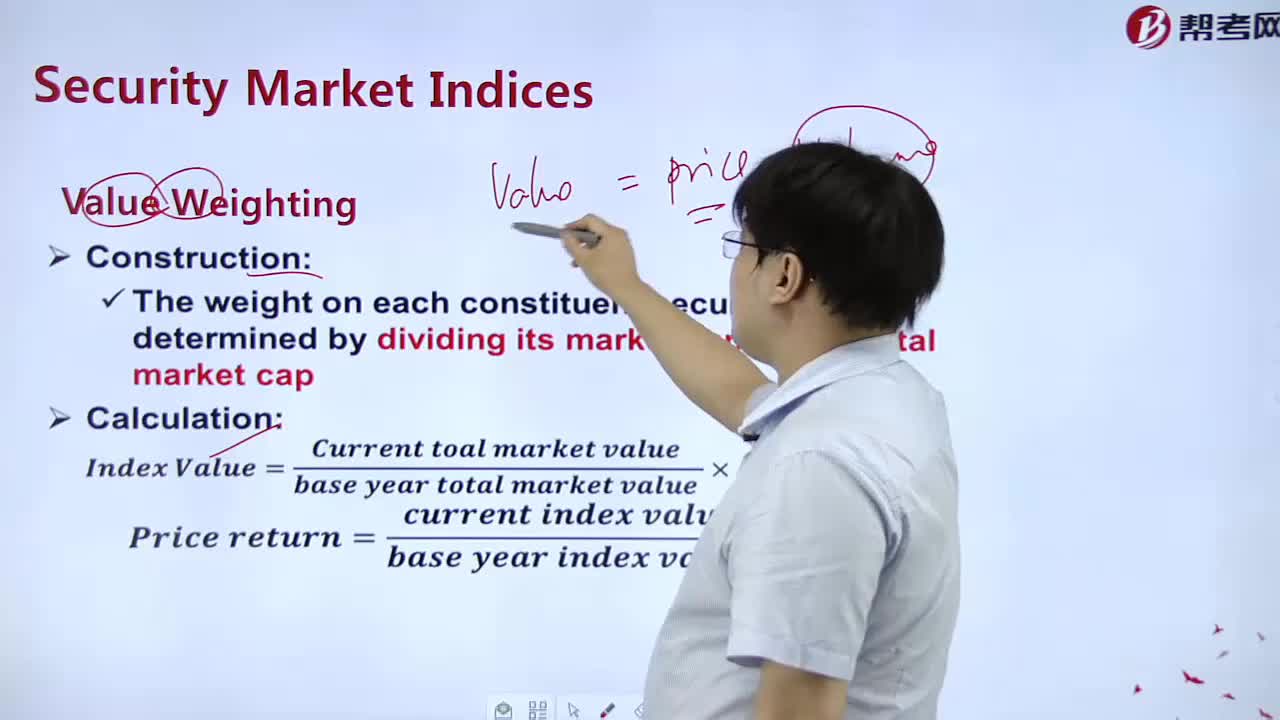

What is the measurement of Value?

What are the contents of the stock index?

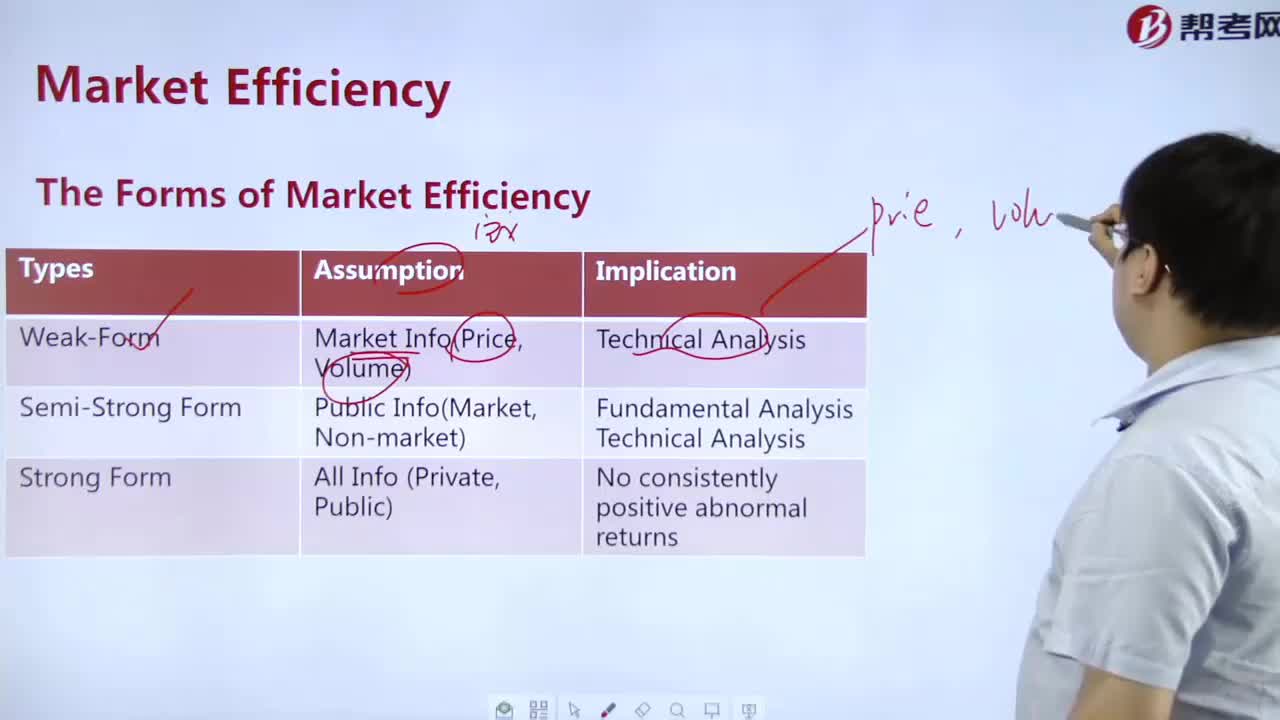

How many are there The Forms of Market Efficiency?

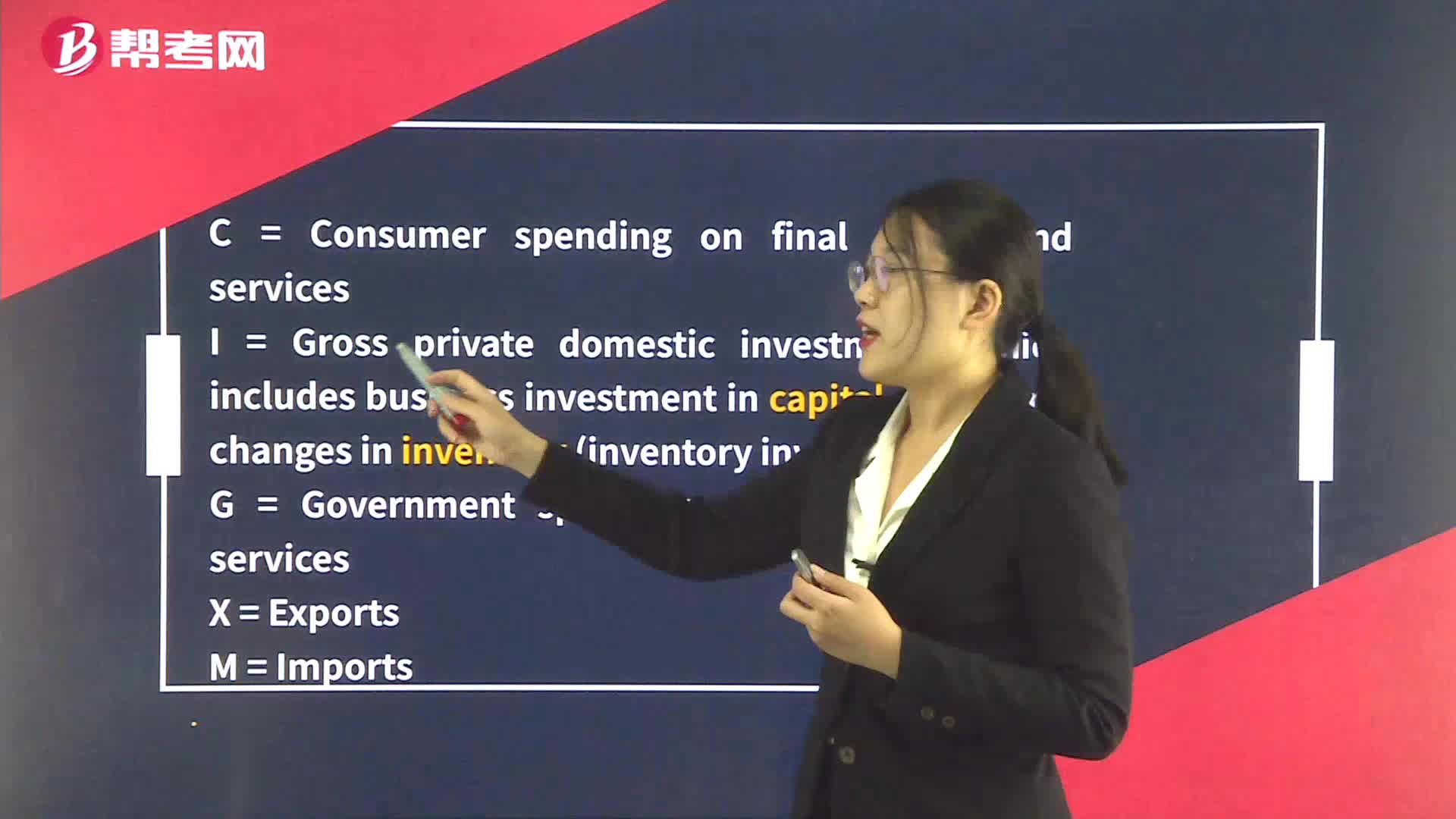

The Components of GDP

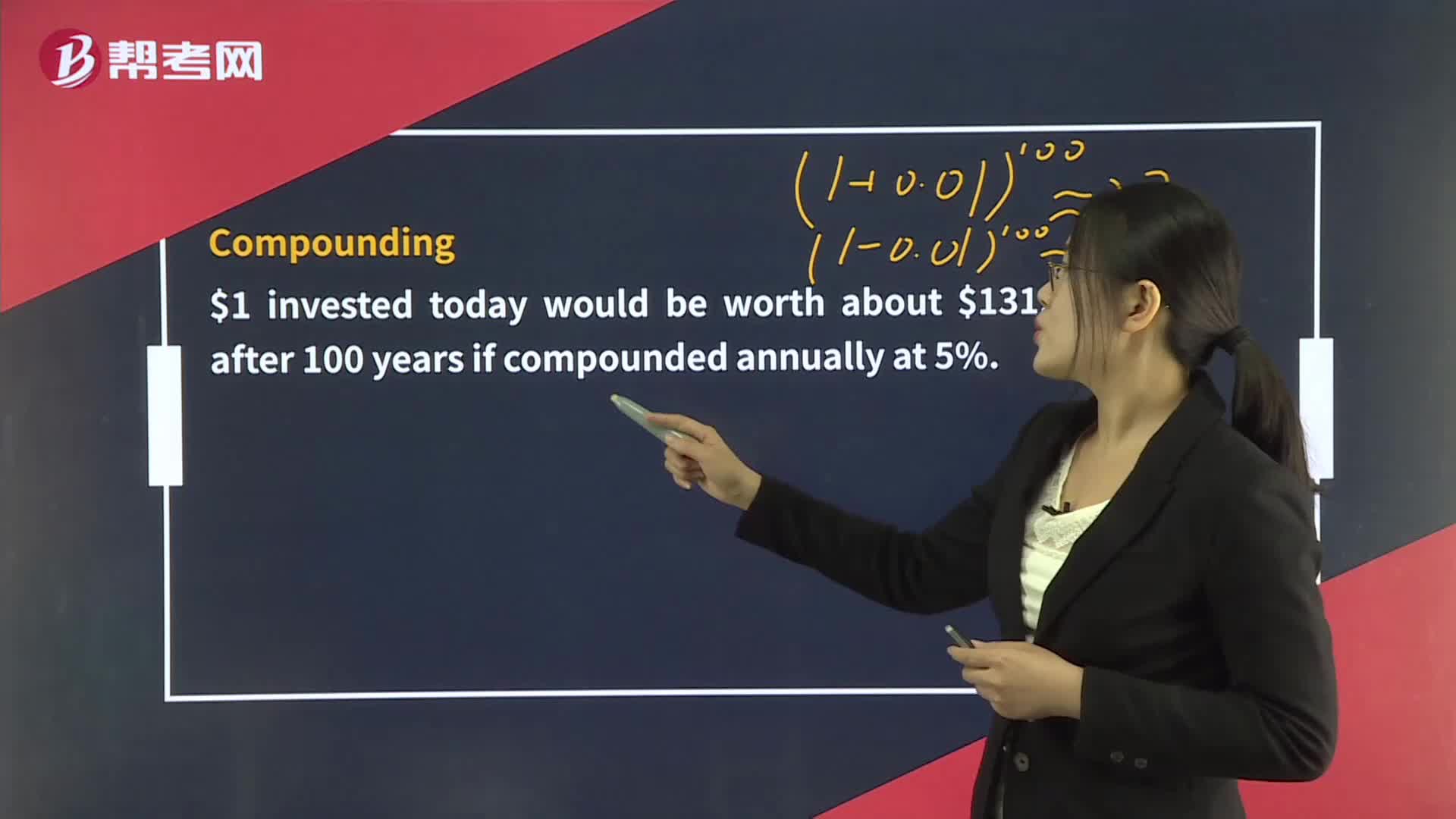

The Time Value of Money

下載億題庫APP

聯(lián)系電話:400-660-1360