-

下載億題庫(kù)APP

-

聯(lián)系電話:400-660-1360

下載億題庫(kù)APP

聯(lián)系電話:400-660-1360

請(qǐng)謹(jǐn)慎保管和記憶你的密碼,以免泄露和丟失

請(qǐng)謹(jǐn)慎保管和記憶你的密碼,以免泄露和丟失

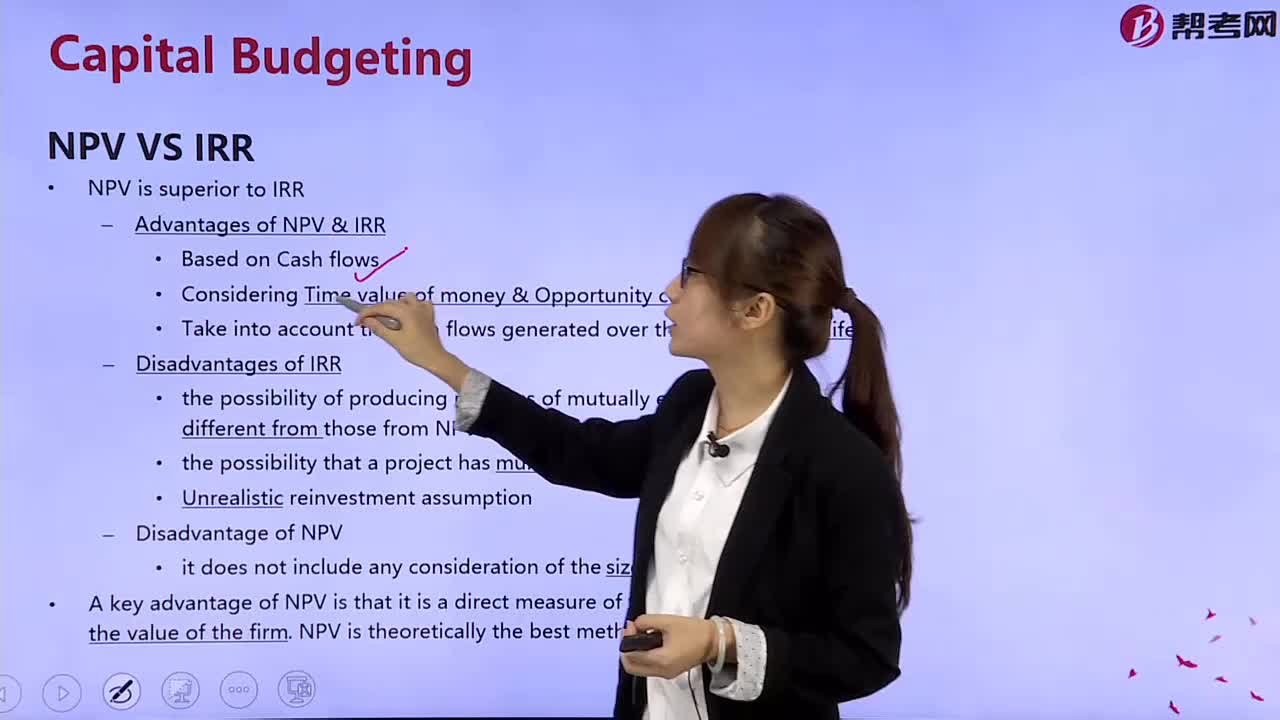

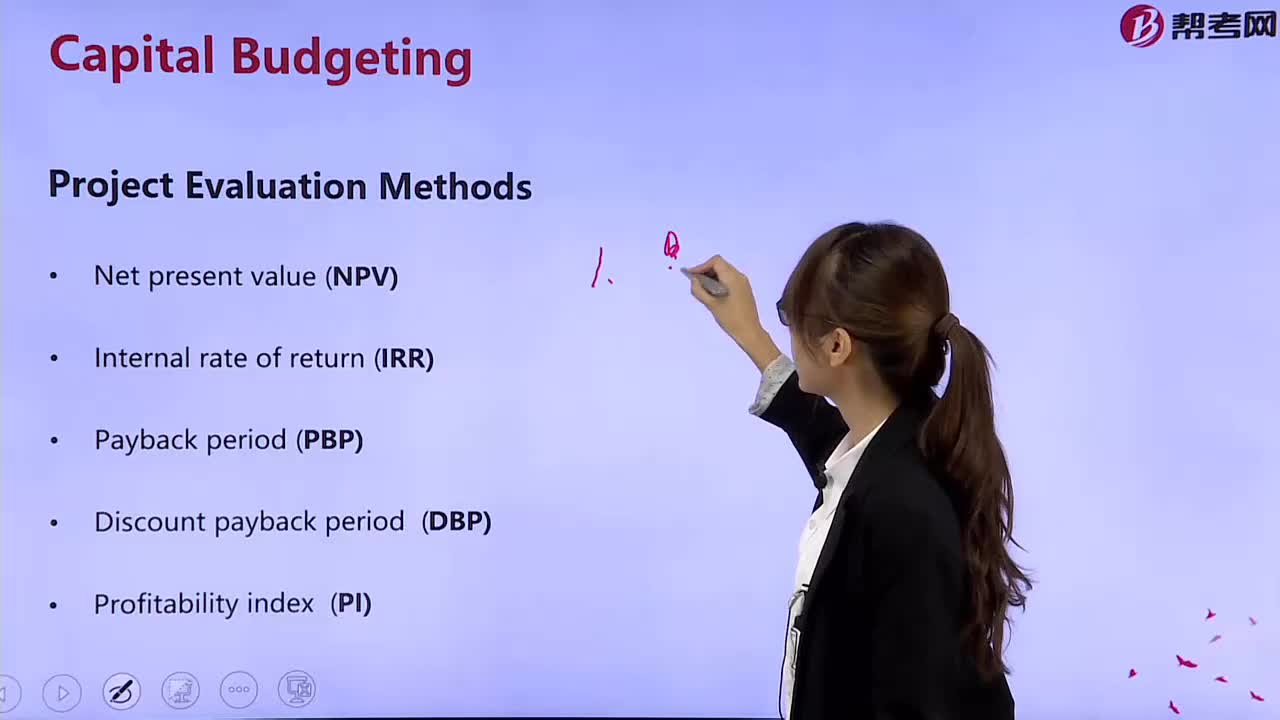

What is the difference between net present value and internal income?

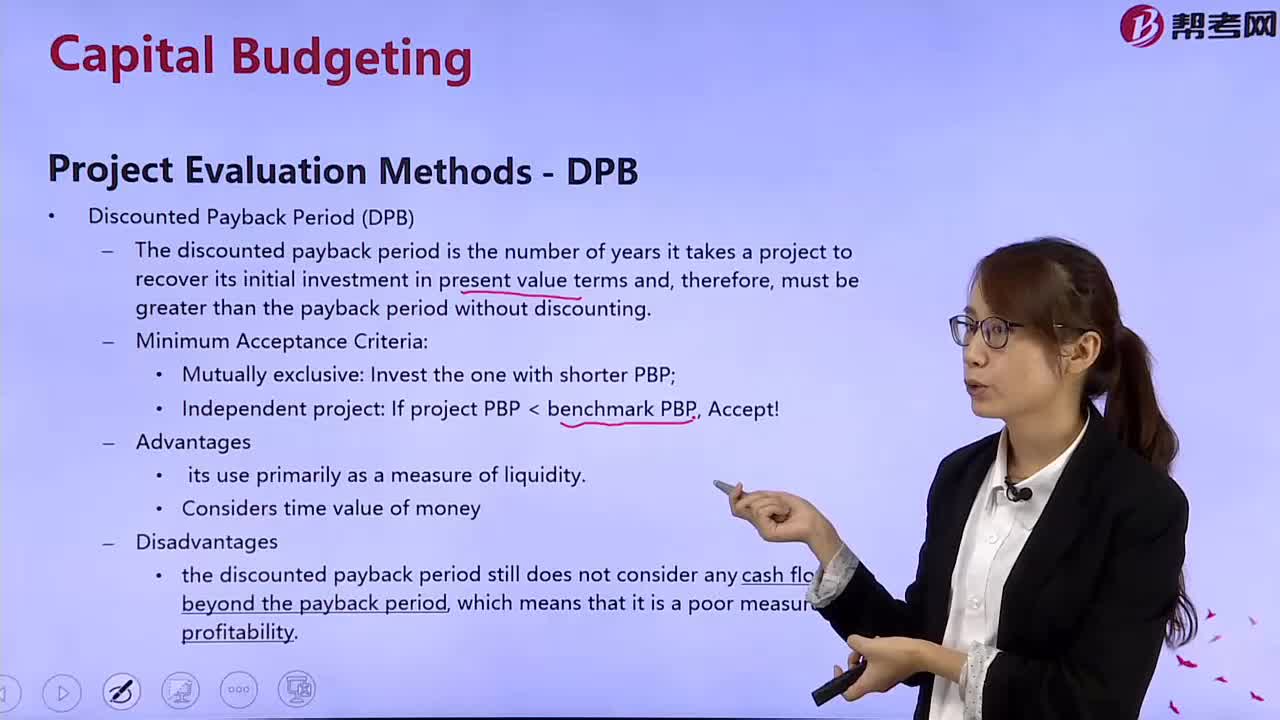

What is the discounted payback period?

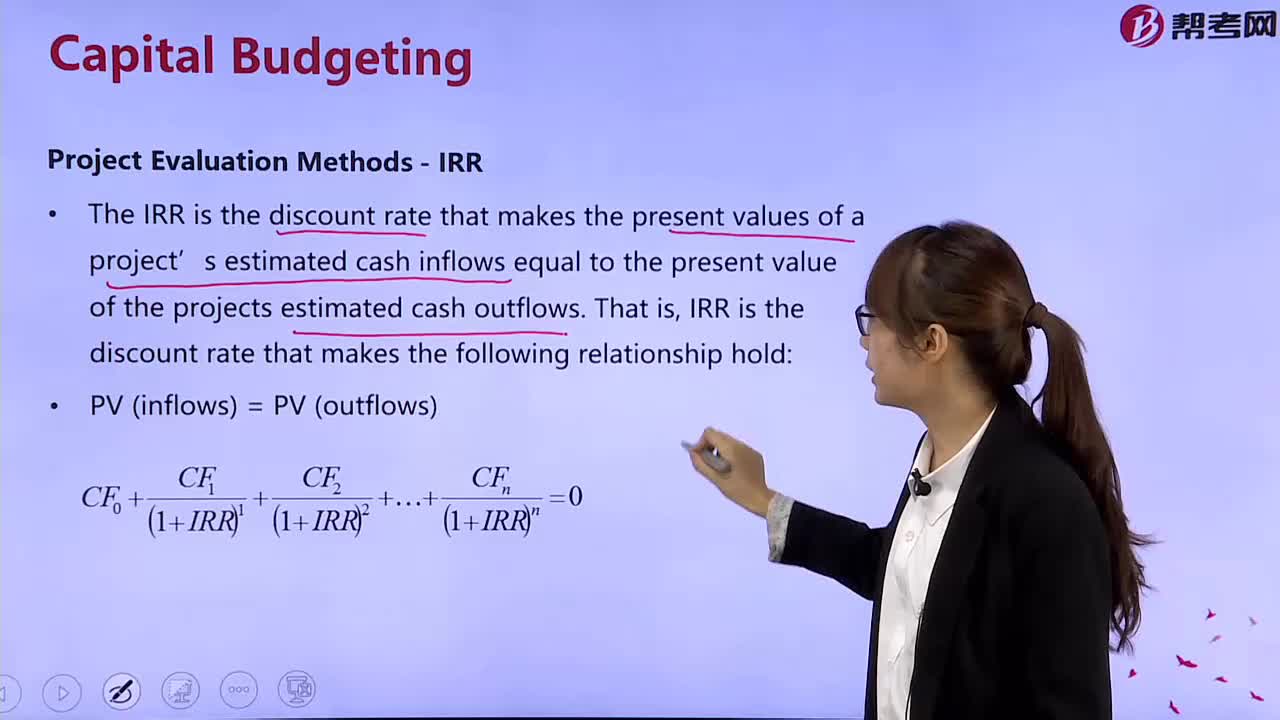

What is the IRR?

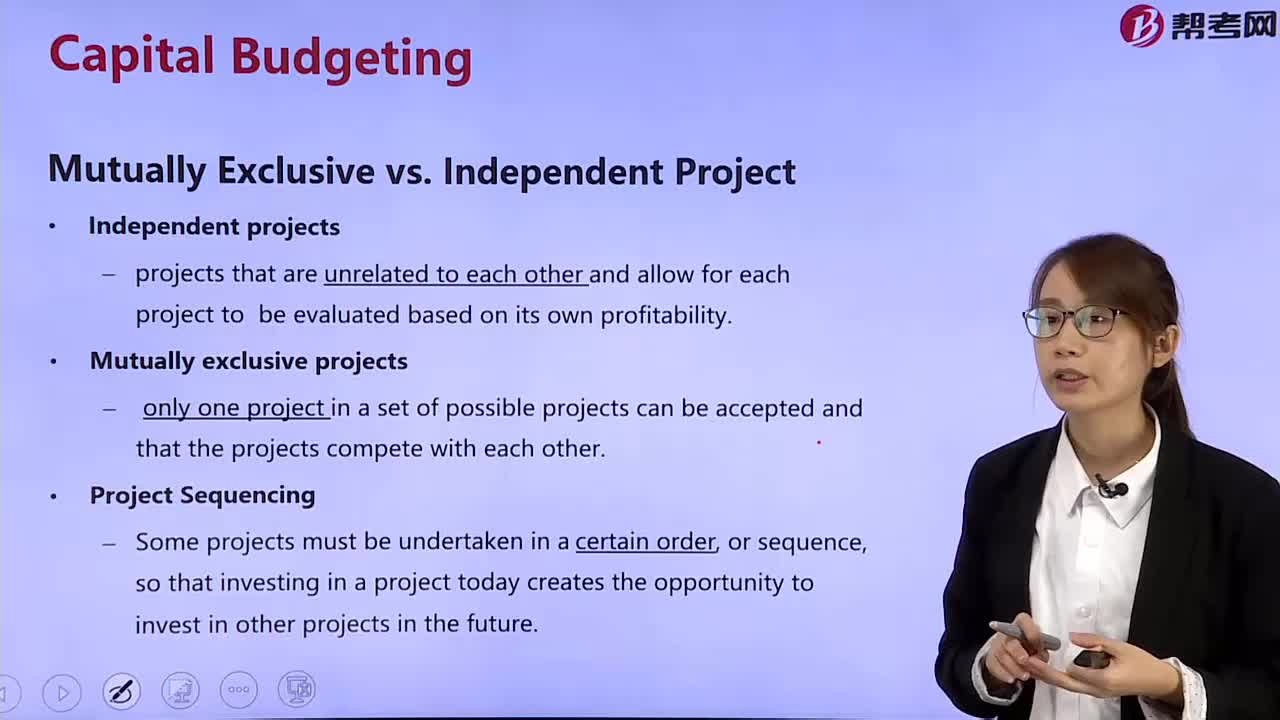

What's the difference between a mutually exclusive project and an independent project?

What is the net present value?

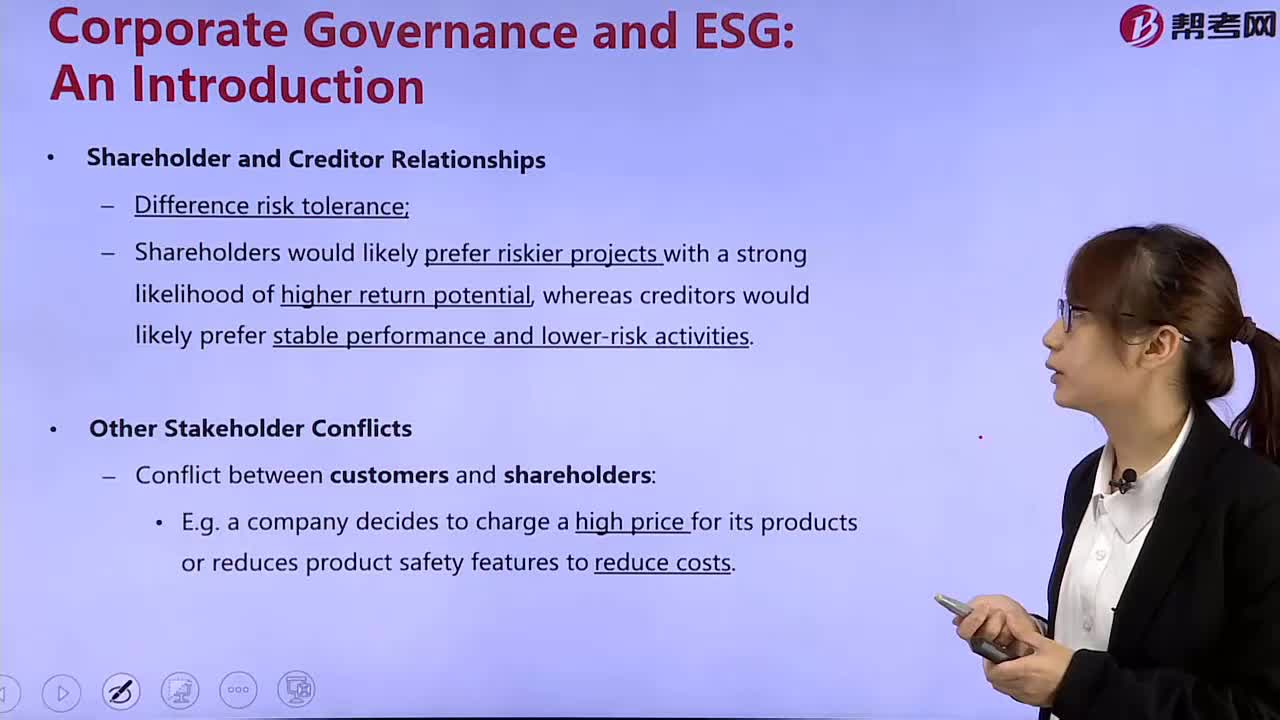

What is the relationship between shareholders and creditors?

What is the structure of common stock?

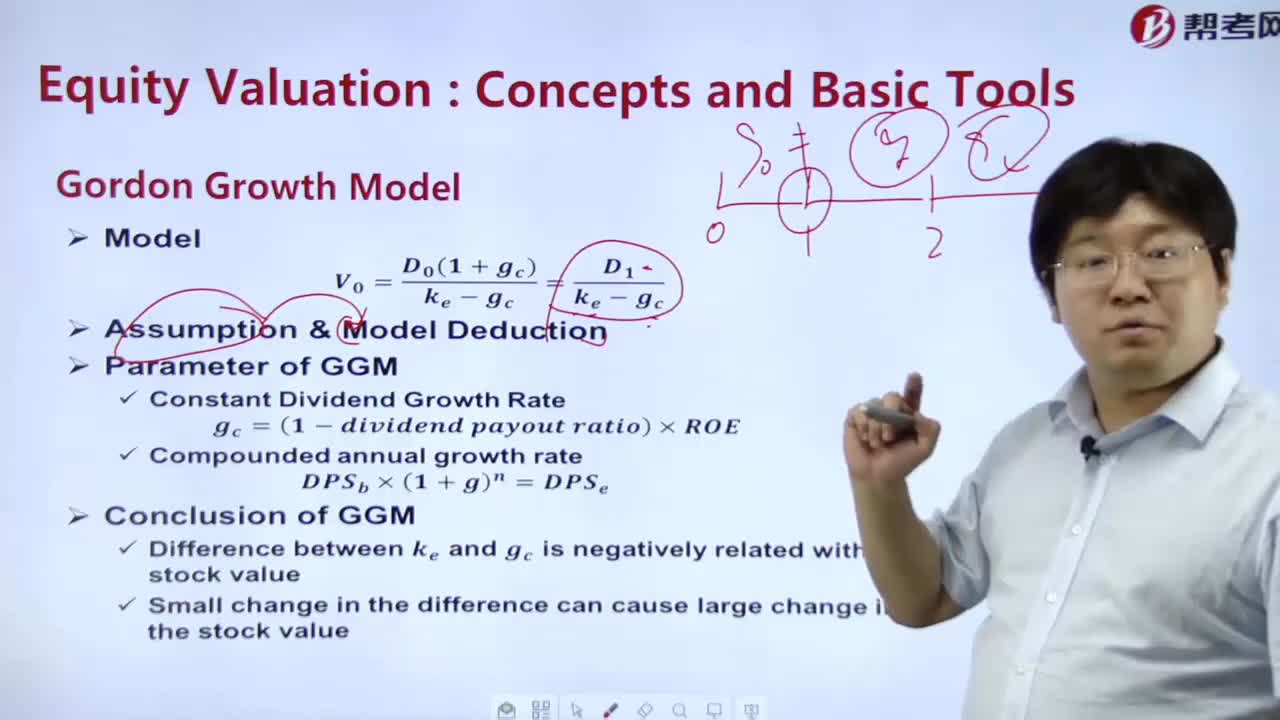

What is the formula of dividend discount model?

what is the moss stage?

What is the content of pricing power?

What is the job of industrial analysis?

What is the value of the equity?

09:54

09:54

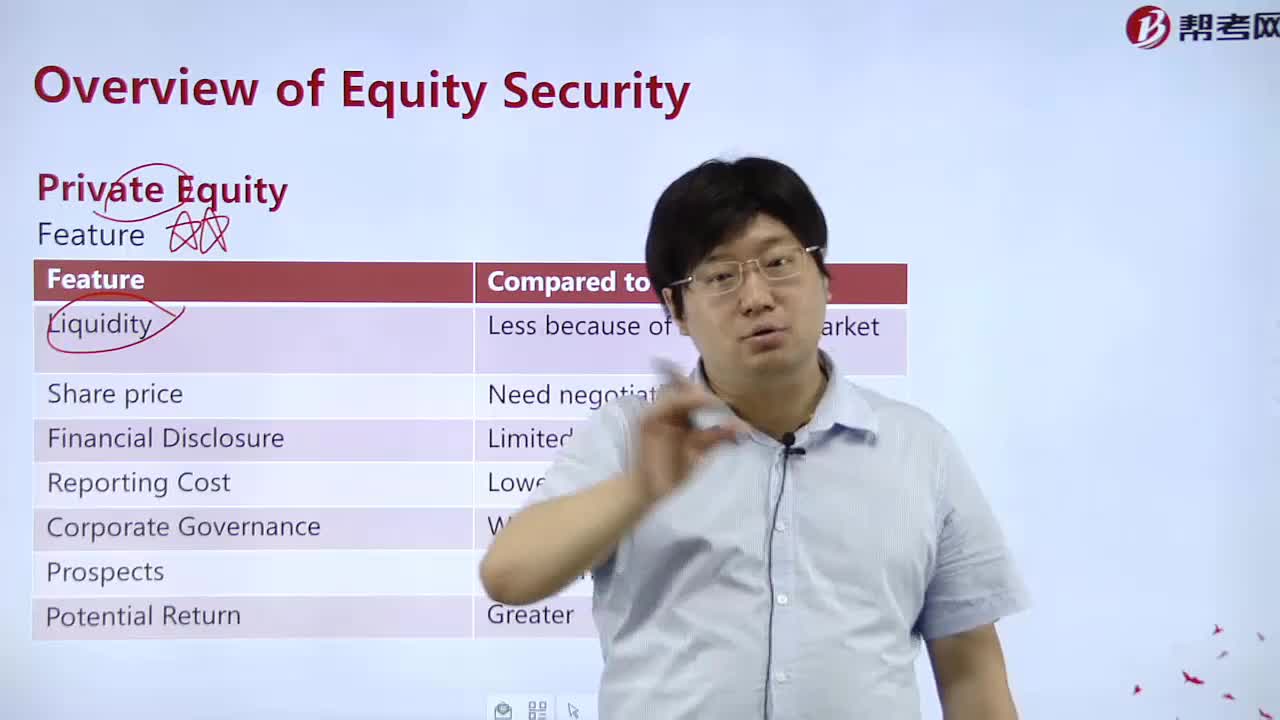

What is the nature of private equity?:What is the nature of private equity?

09:10

09:10

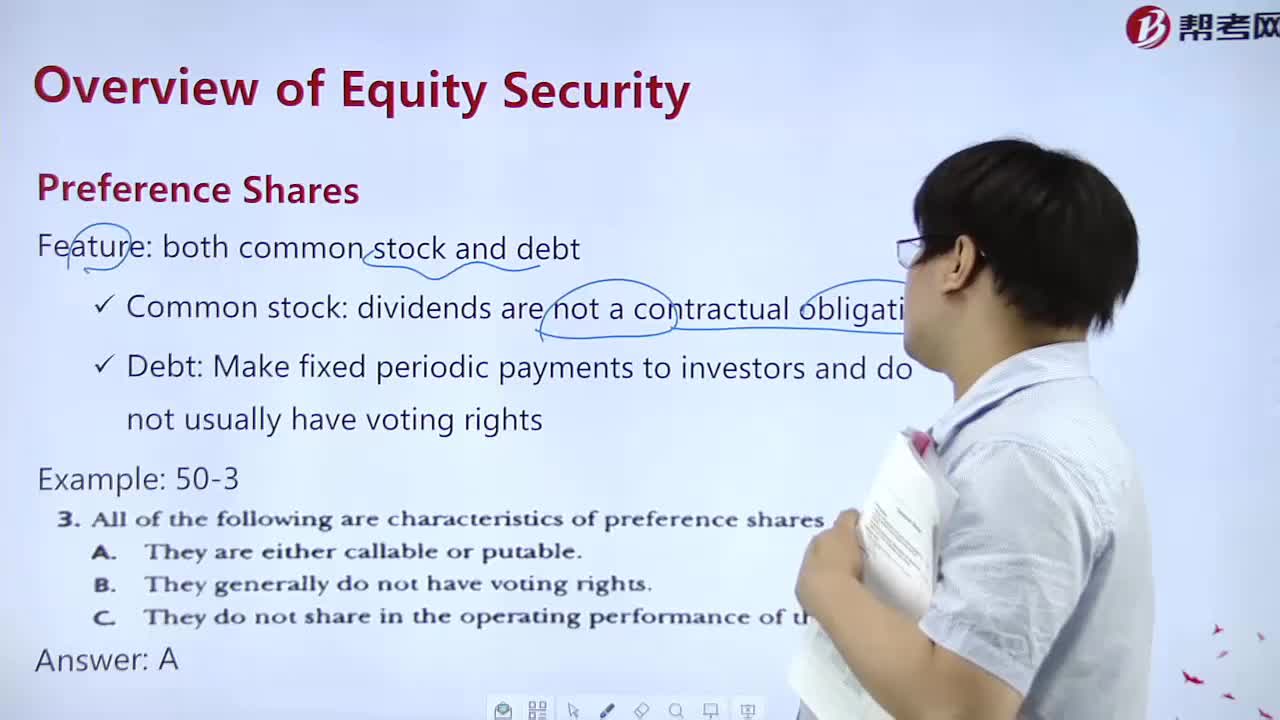

What is the nature of preferred stock?:What is the nature of preferred stock?

11:02

11:02

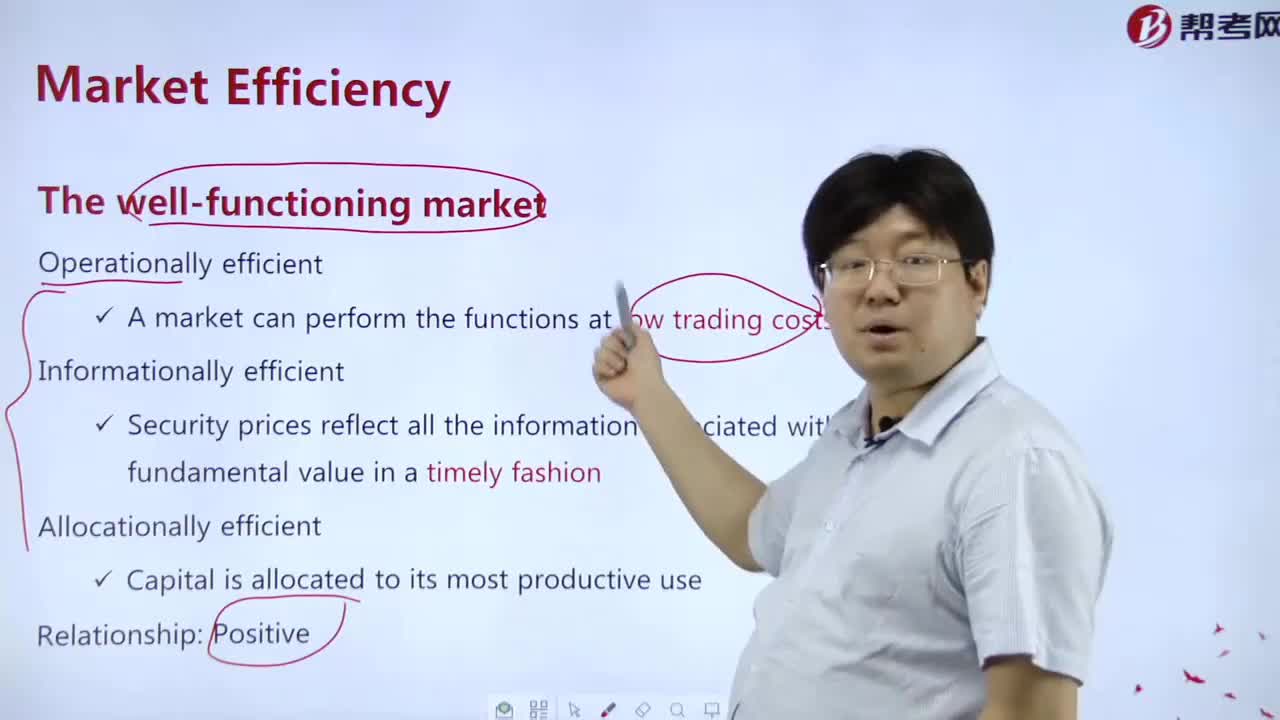

What is the representativeness of market efficiency?:What is the representativeness of market efficiency?

08:32

08:32

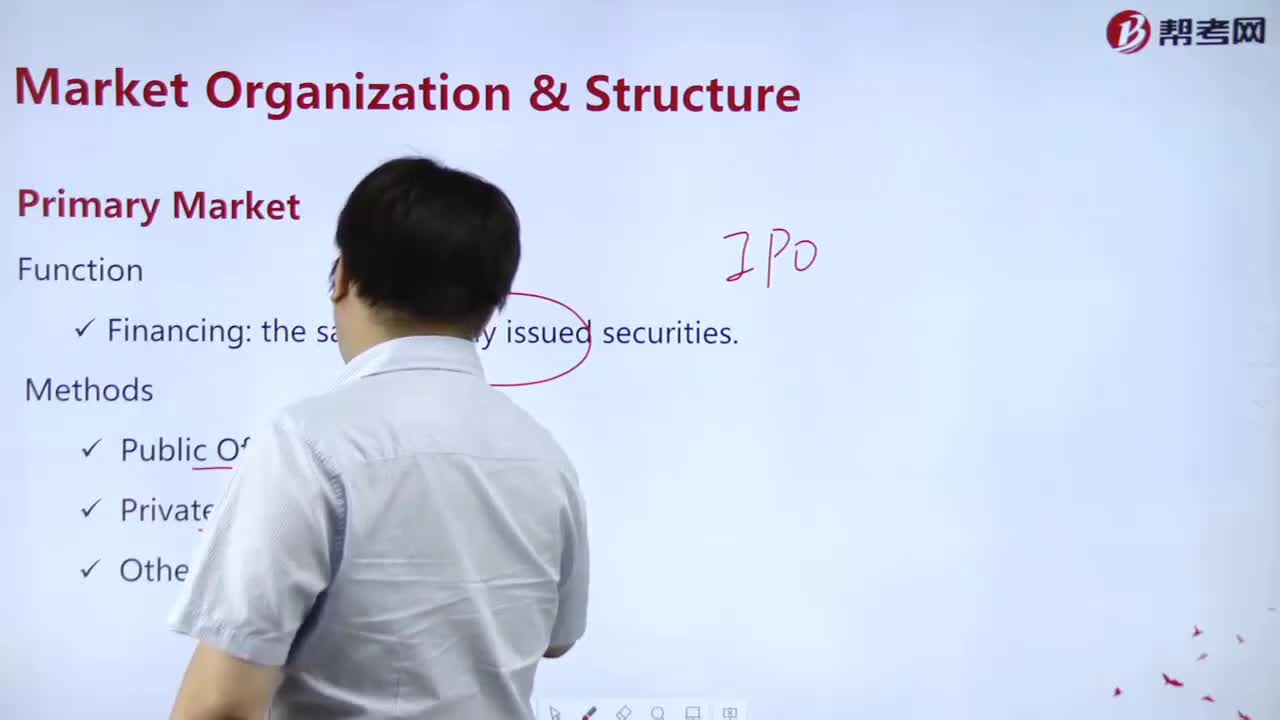

What is the function of the Primary Market?:What is the function of the Primary Market?

05:05

05:05

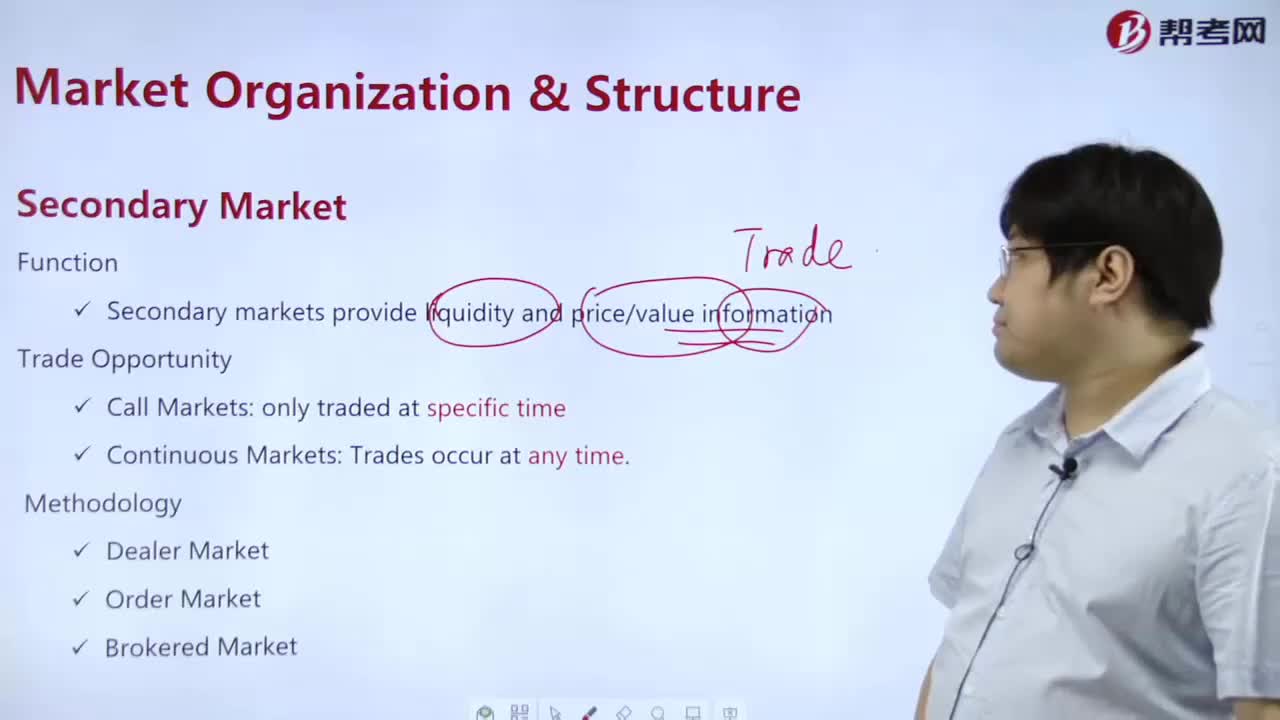

What is the role of the secondary market?:What is the role of the secondary market?

03:57

03:57

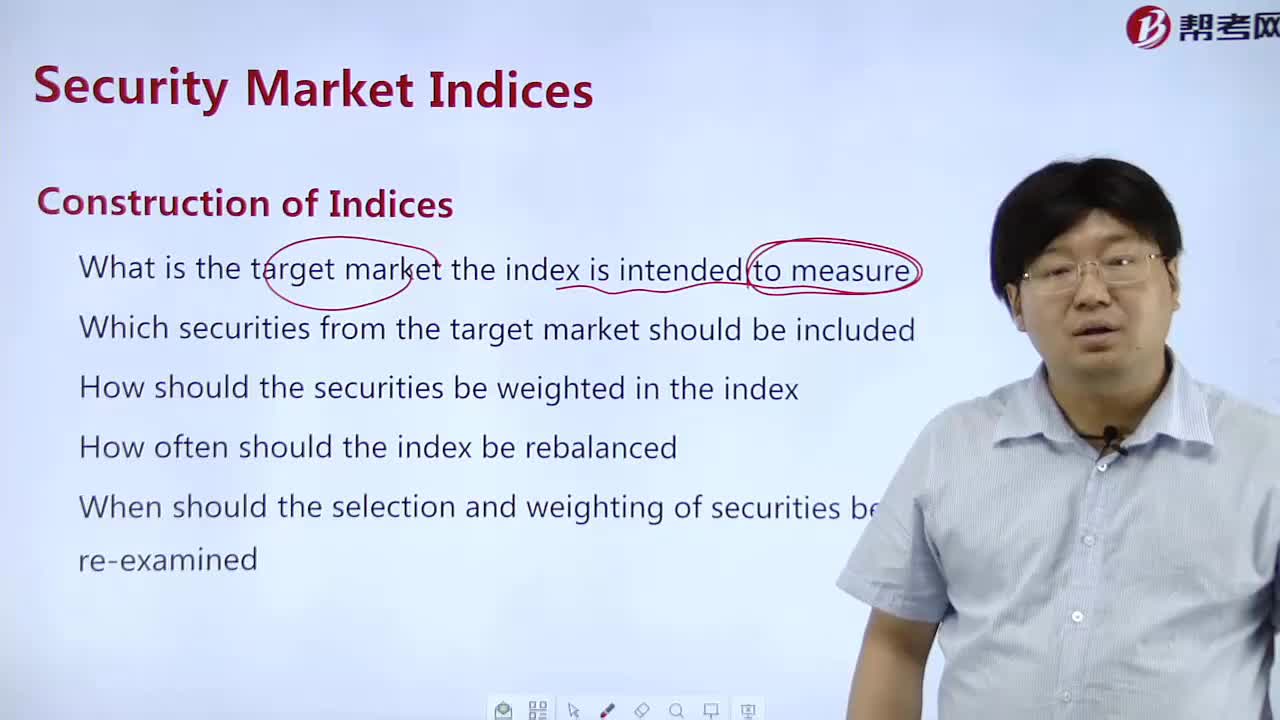

What is the construction of an exponent?:What is the construction of an exponent?

13:02

13:02

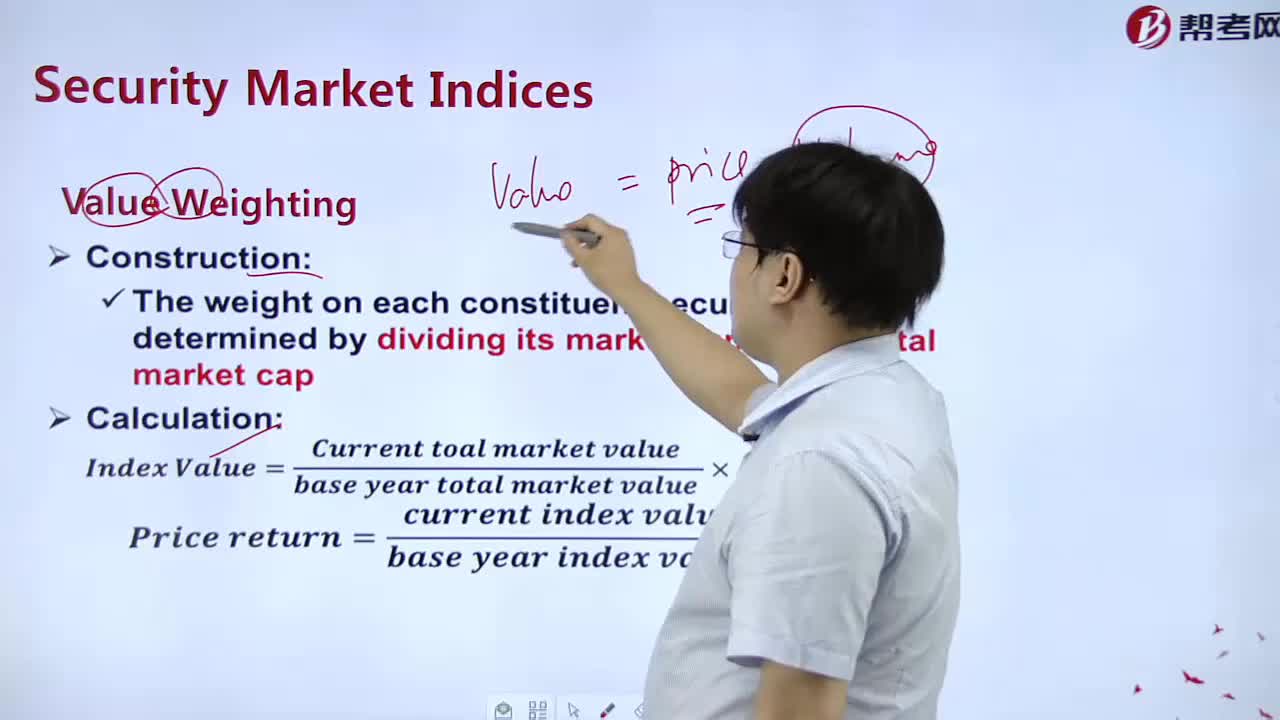

What is the measurement of Value?:What is the measurement of Value?

04:50

04:50

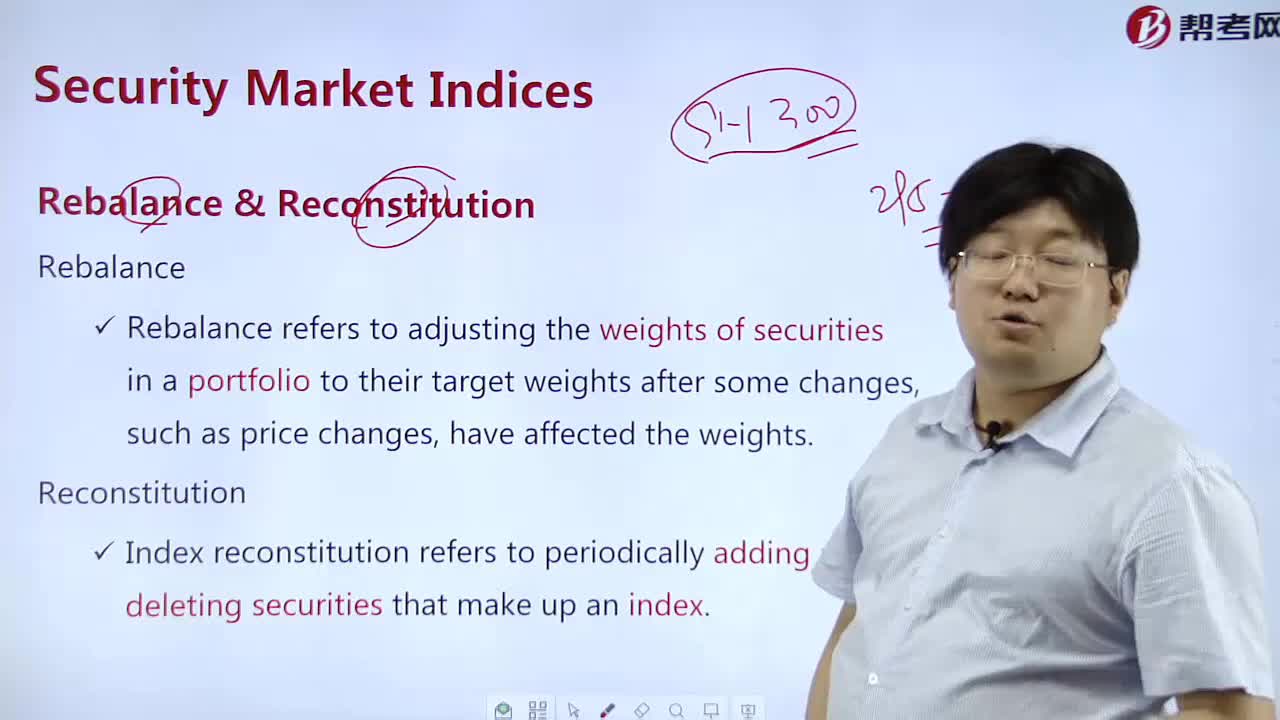

Rebalance and Reconstitution What's the difference?:Rebalance and Reconstitution What's the difference?

05:11

05:11

What is the meaning of a Fixed Income Index?:What is the meaning of a Fixed Income Index?

07:02

07:02

What is a The well-functioning market ?:What is a The well-functioning market?

02:56

02:56

The Relationship Between Fiscal and Monetary Policy:Policyassumption is made that wages and prices are rigid

06:50

06:50

What are the ethics and trust in the investment profession?:Global investment performance standards(GIPS)= 比例低,也并非所有的不道德都是違法君子有所不為的決策是更好的決策更符合stakeholder利益的決策