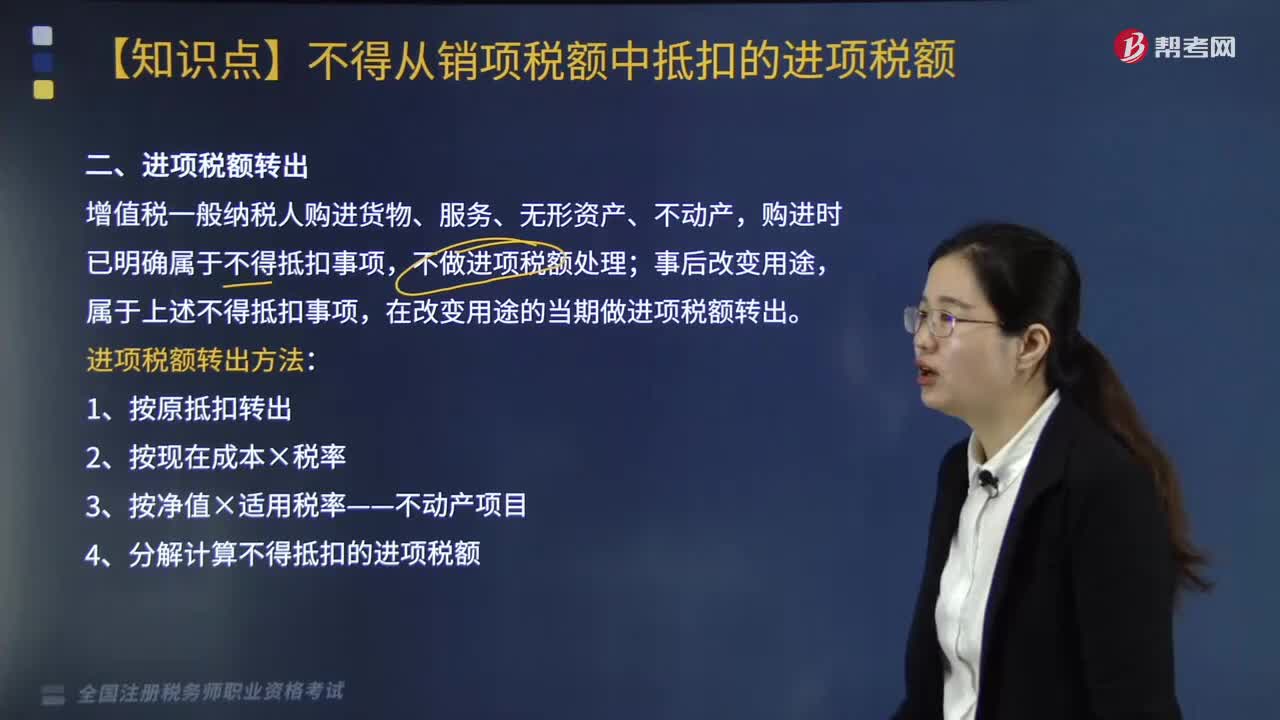

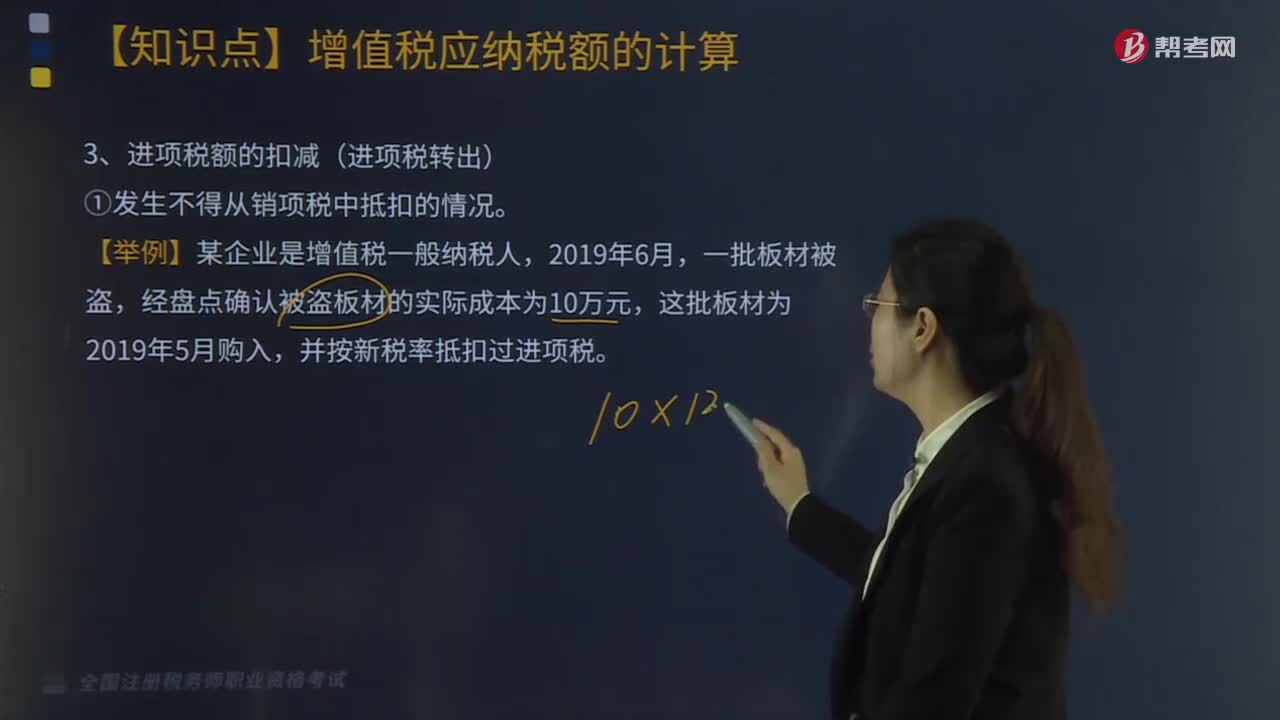

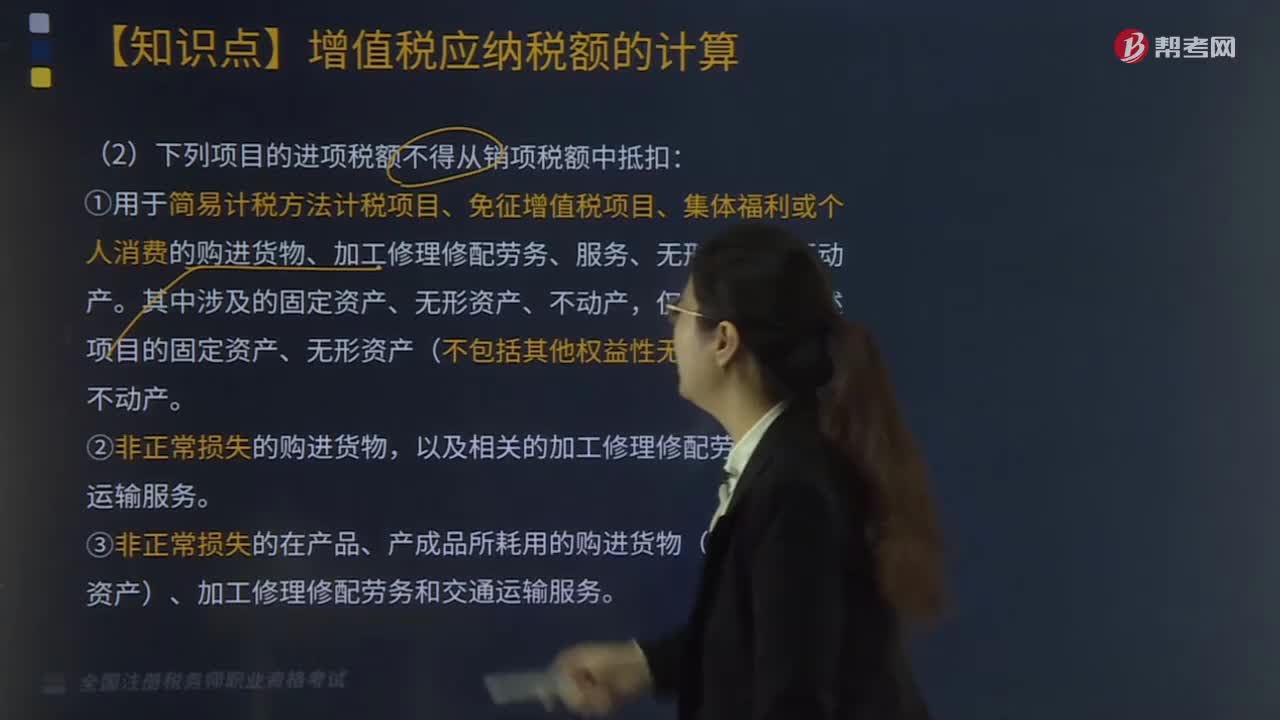

進(jìn)項(xiàng)稅額的扣減(進(jìn)項(xiàng)稅轉(zhuǎn)出)應(yīng)如何核算?

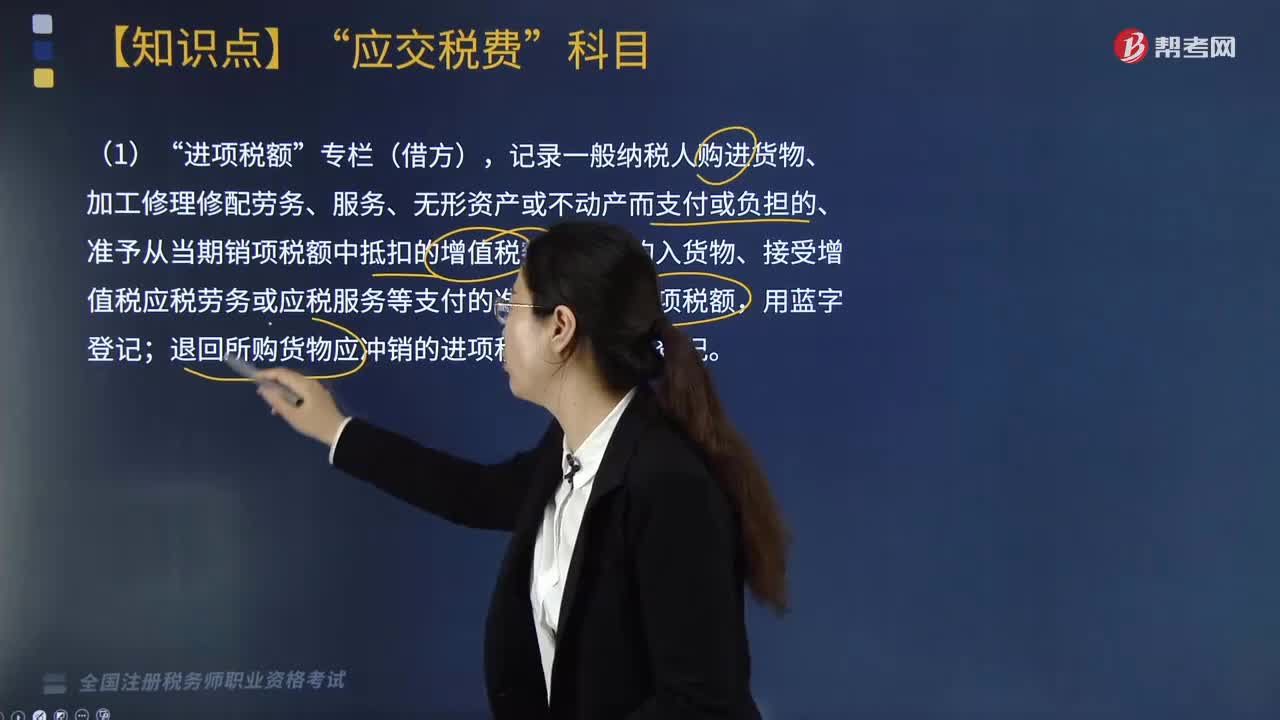

進(jìn)項(xiàng)稅額的會(huì)計(jì)如何核算?

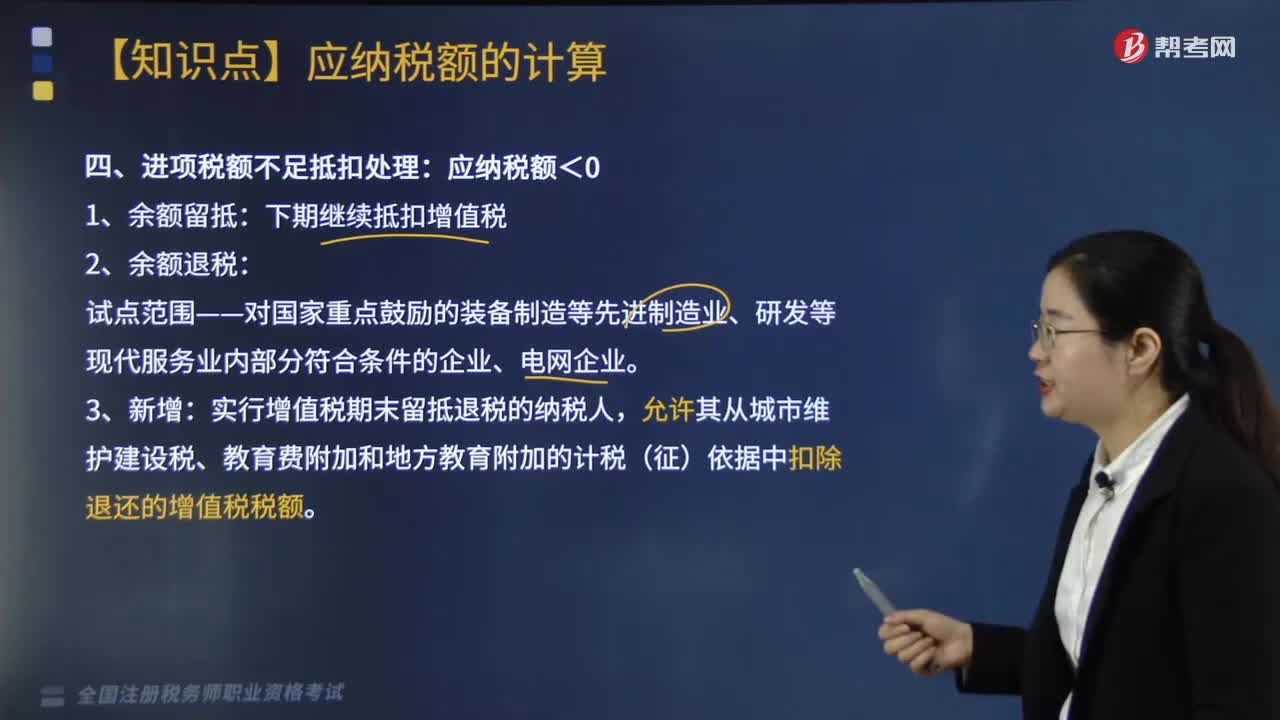

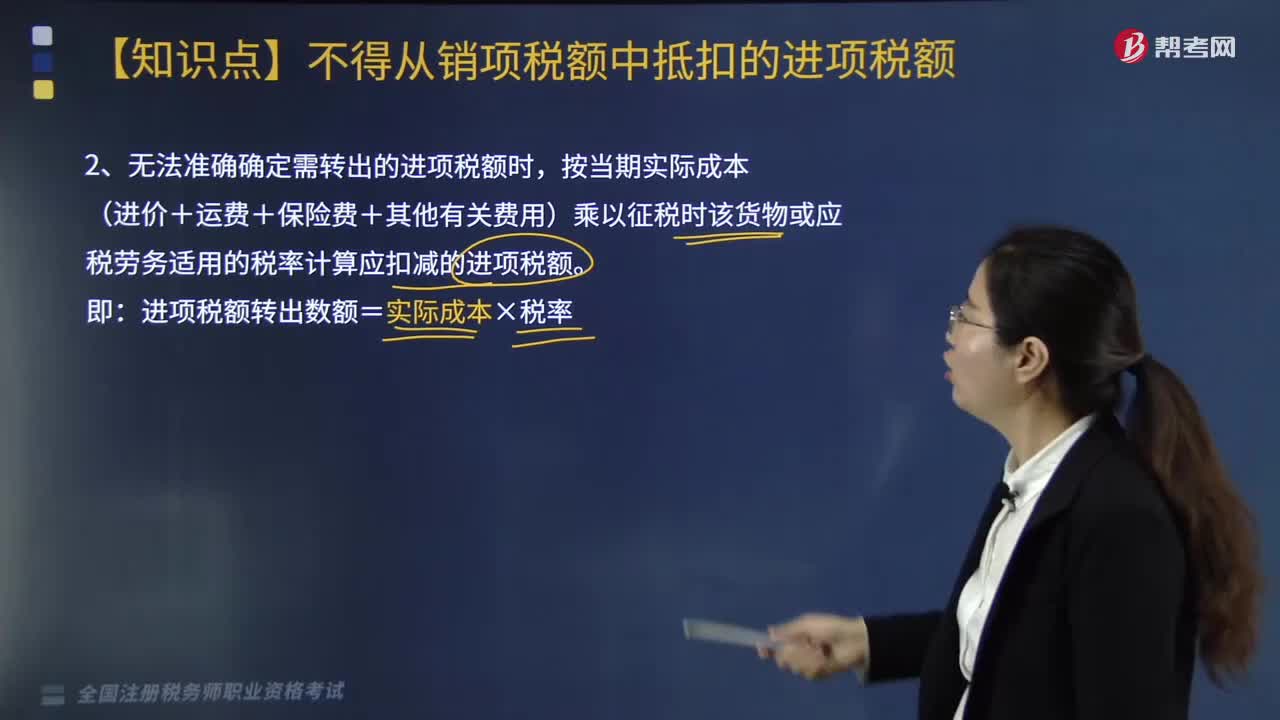

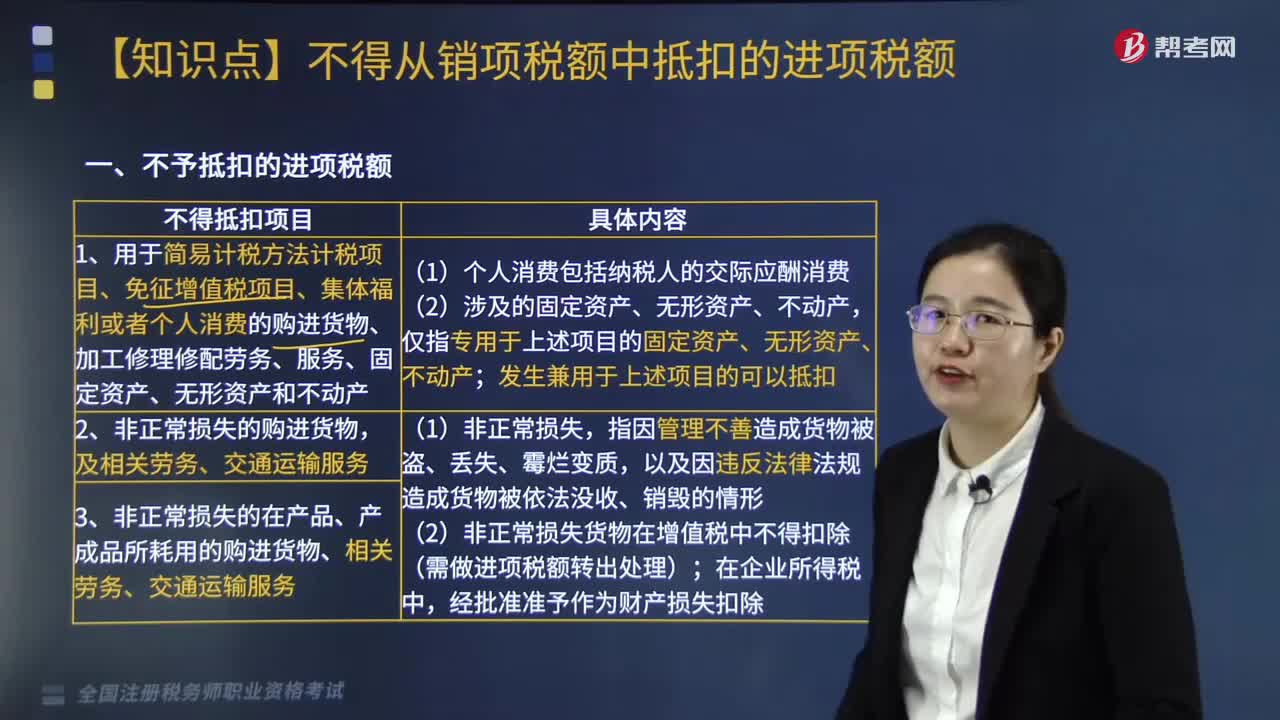

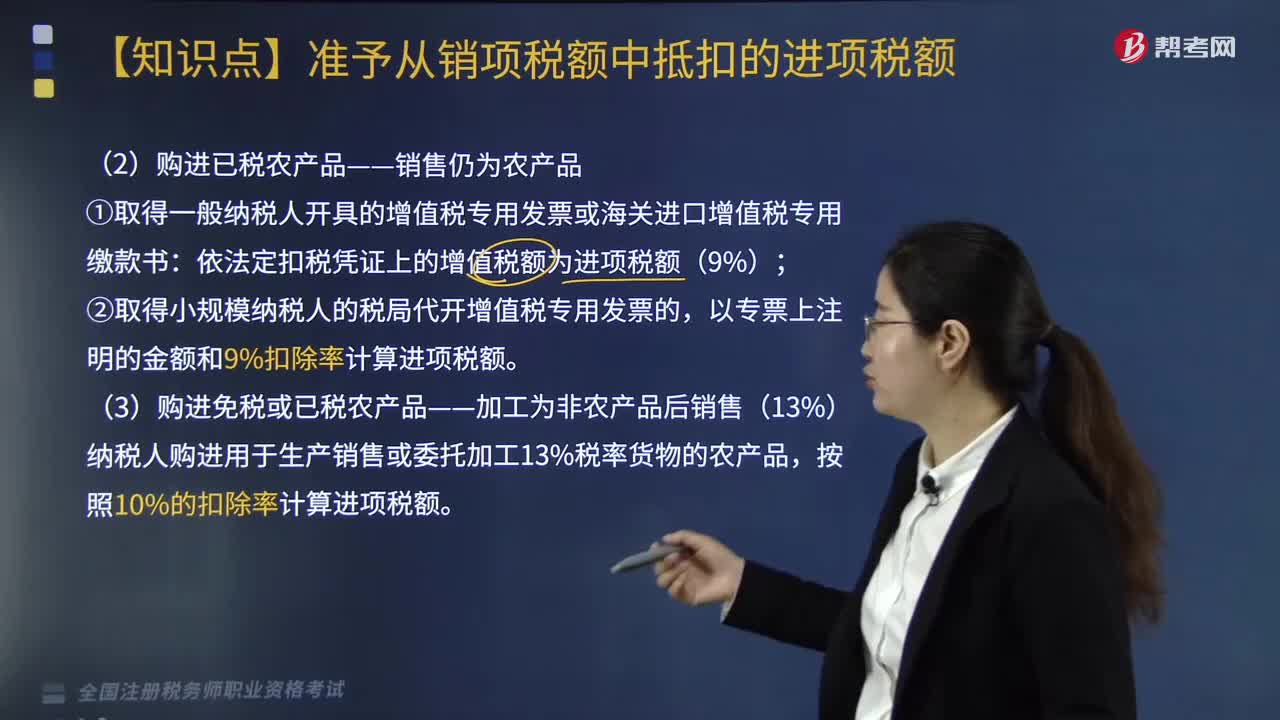

哪些項(xiàng)目中的進(jìn)項(xiàng)稅額不得從銷項(xiàng)稅額中抵扣?

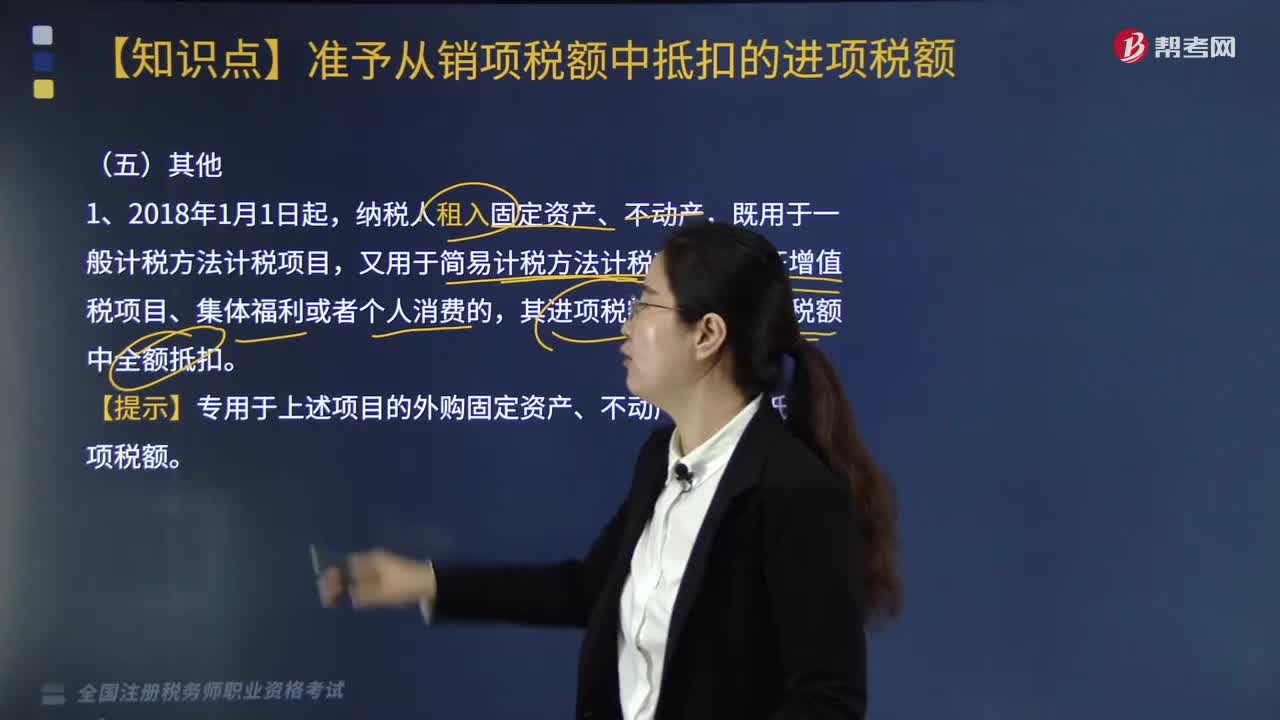

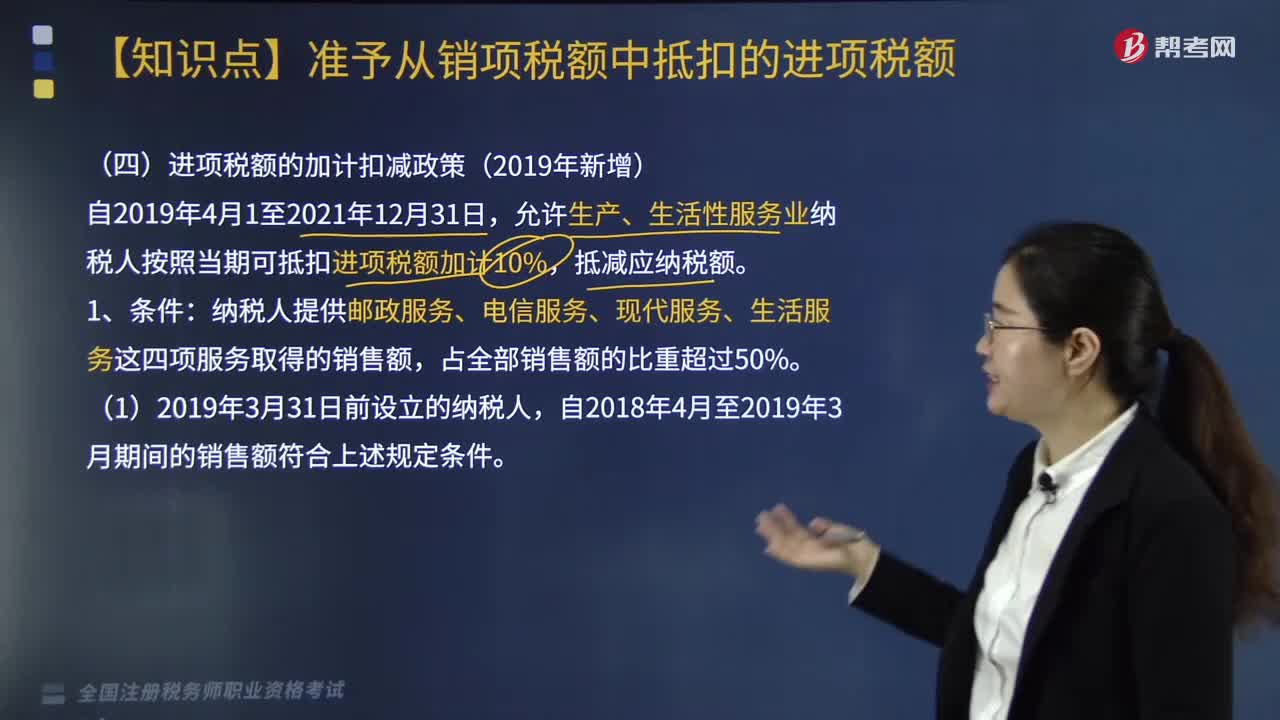

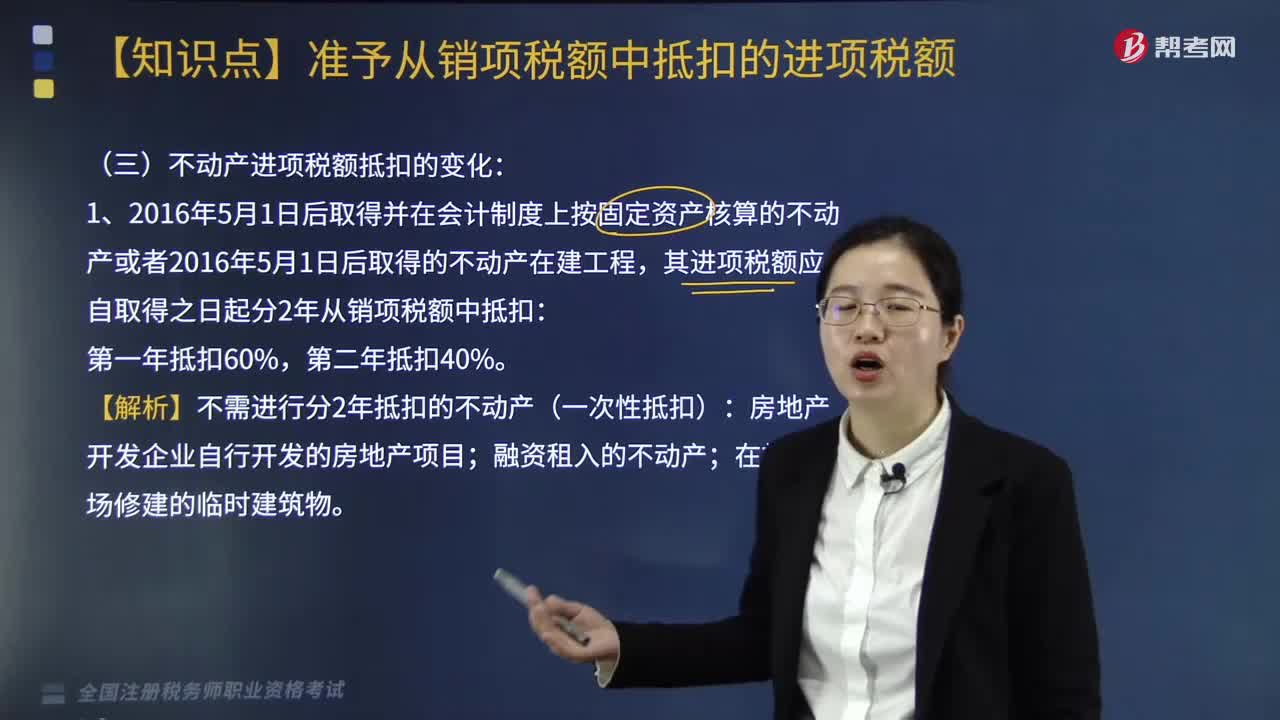

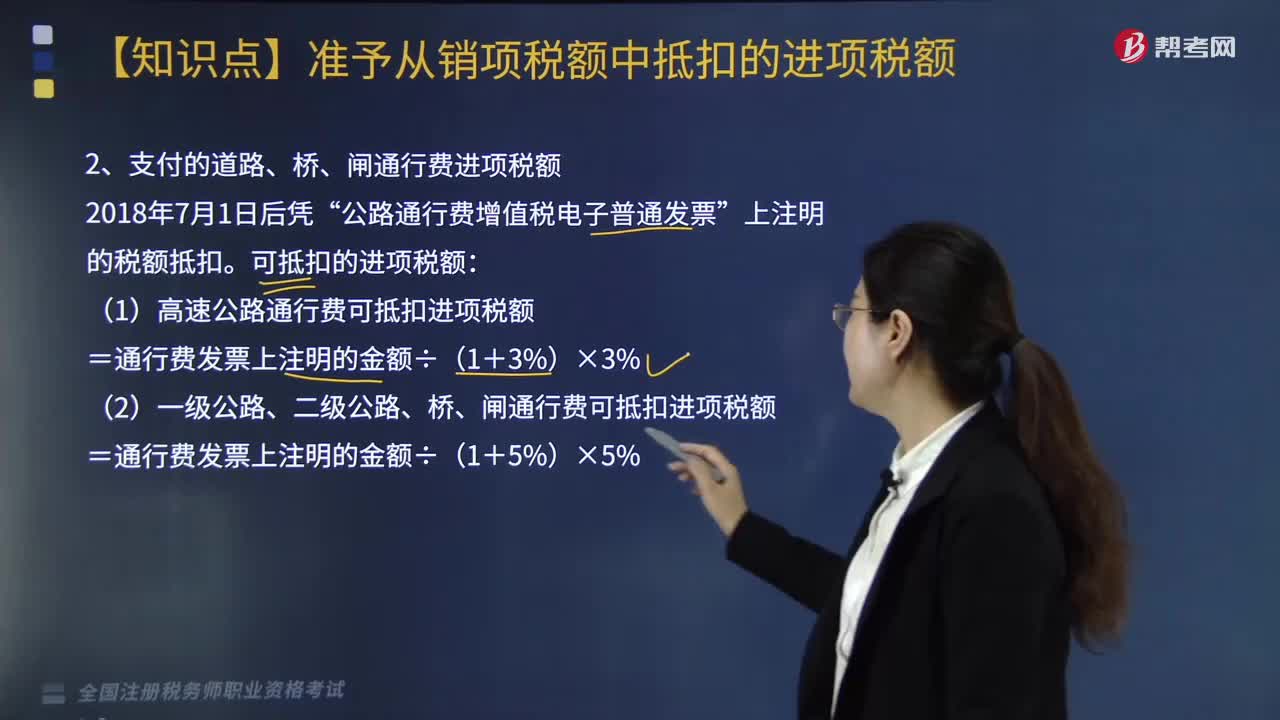

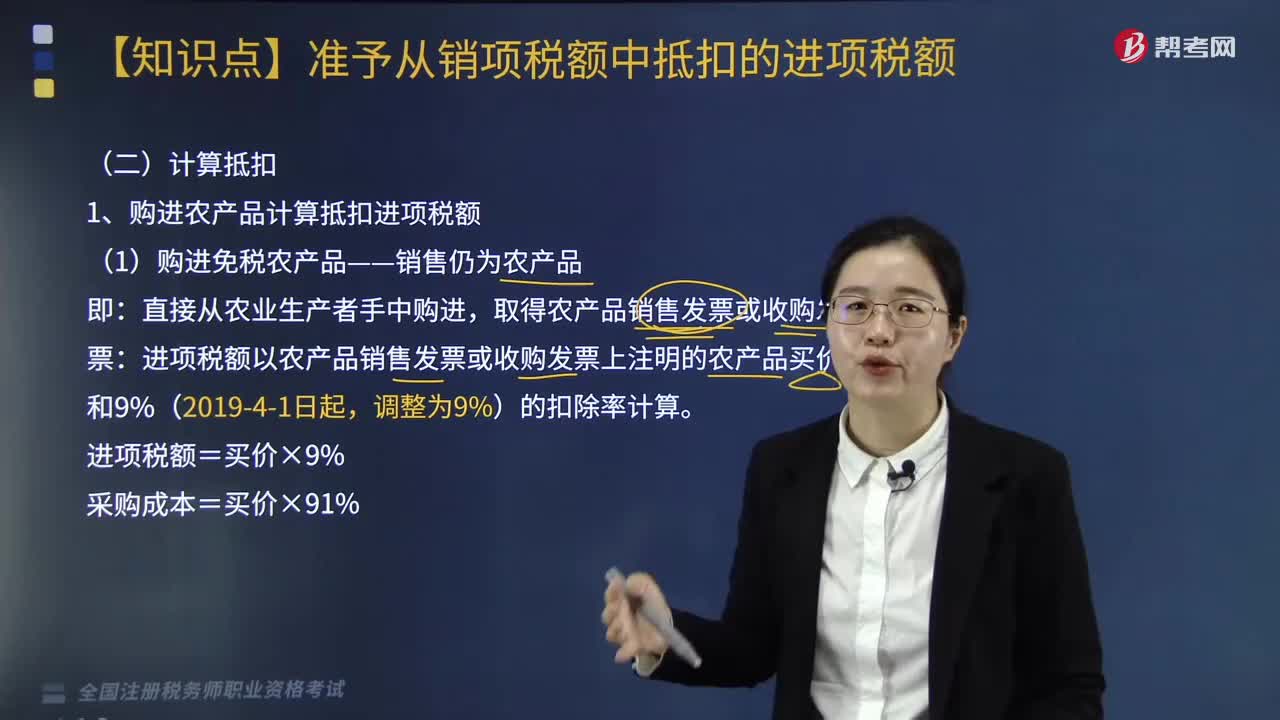

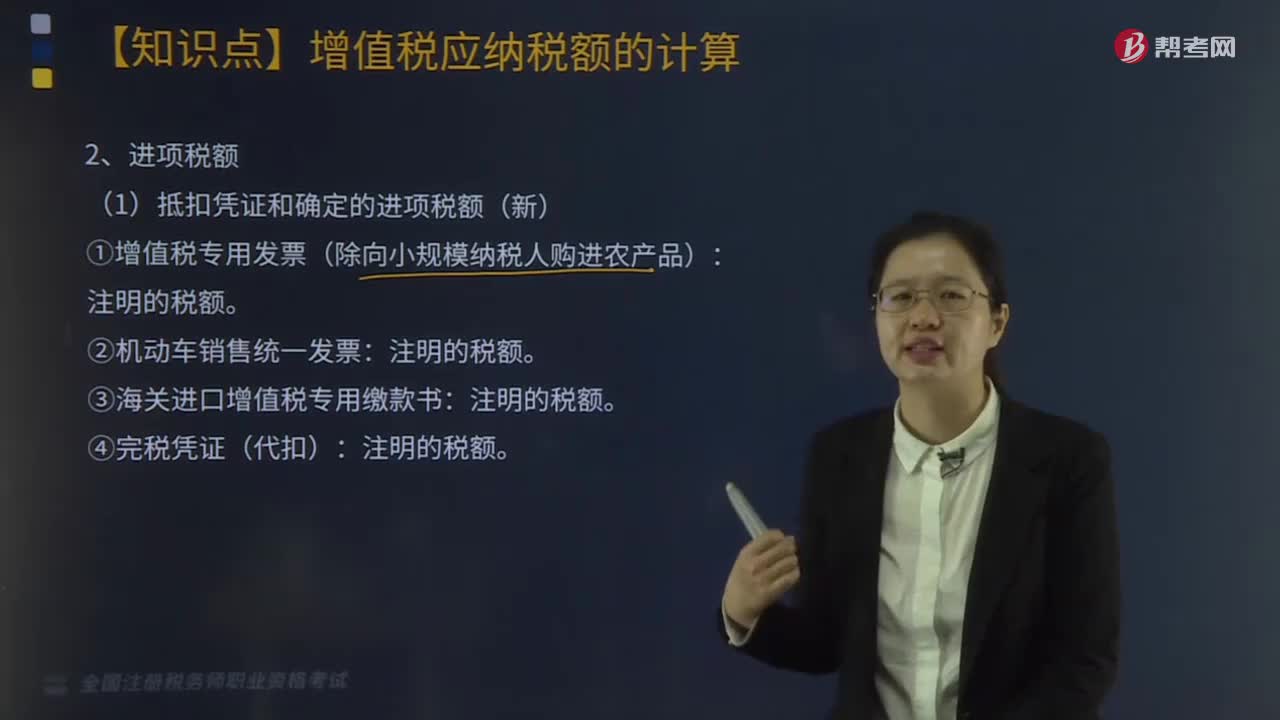

抵扣憑證和確定的進(jìn)項(xiàng)稅額應(yīng)如何計(jì)算?

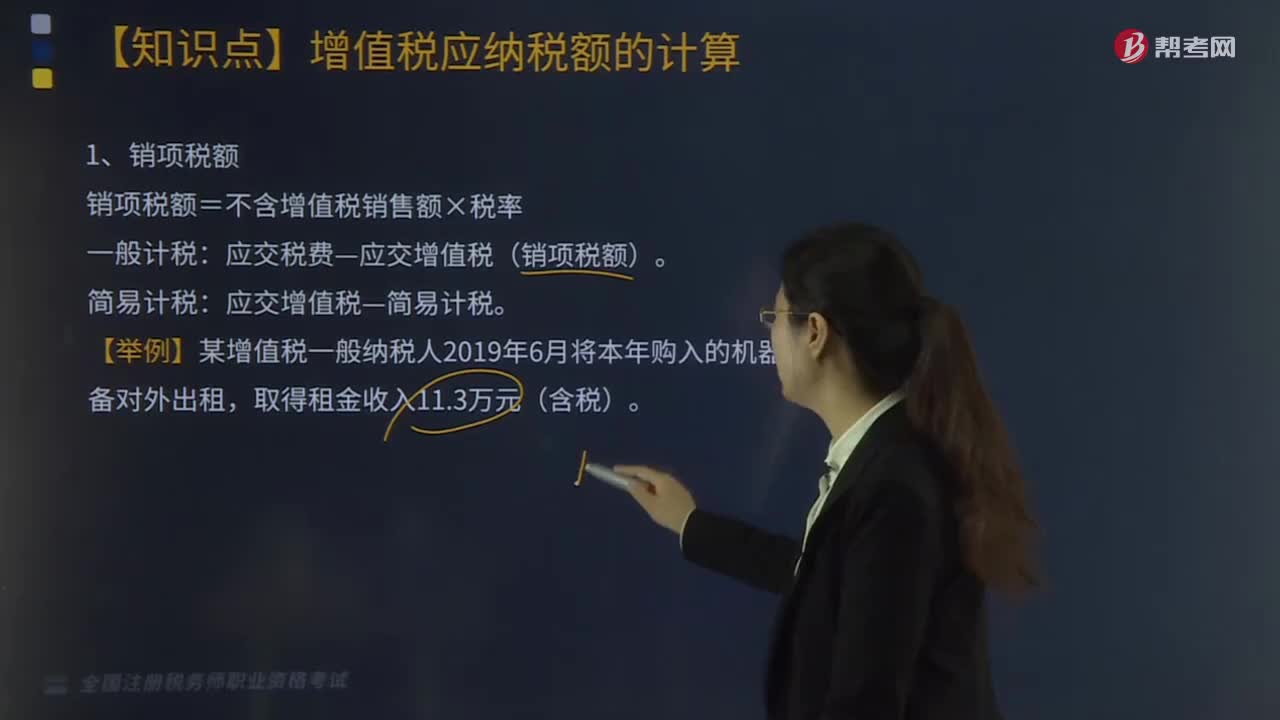

銷項(xiàng)稅額如何計(jì)算?

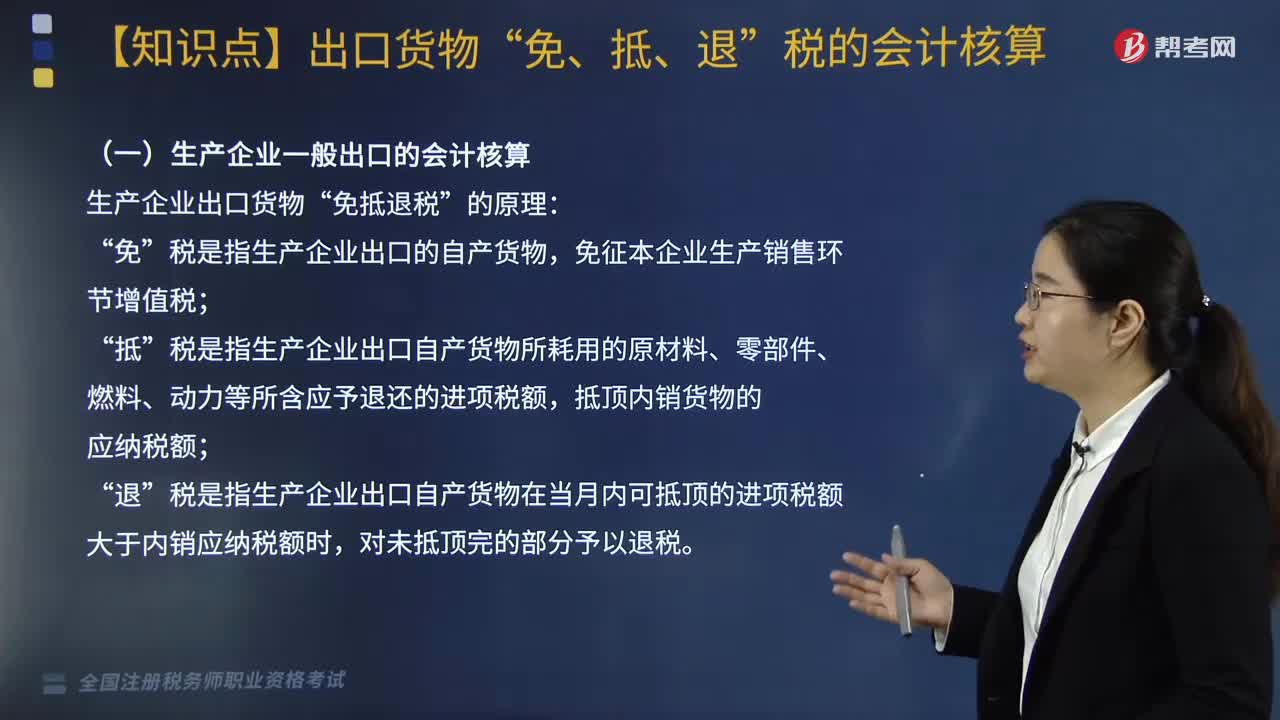

生產(chǎn)企業(yè)出口貨物“免抵退稅”原理是什么?應(yīng)如何進(jìn)行核算?

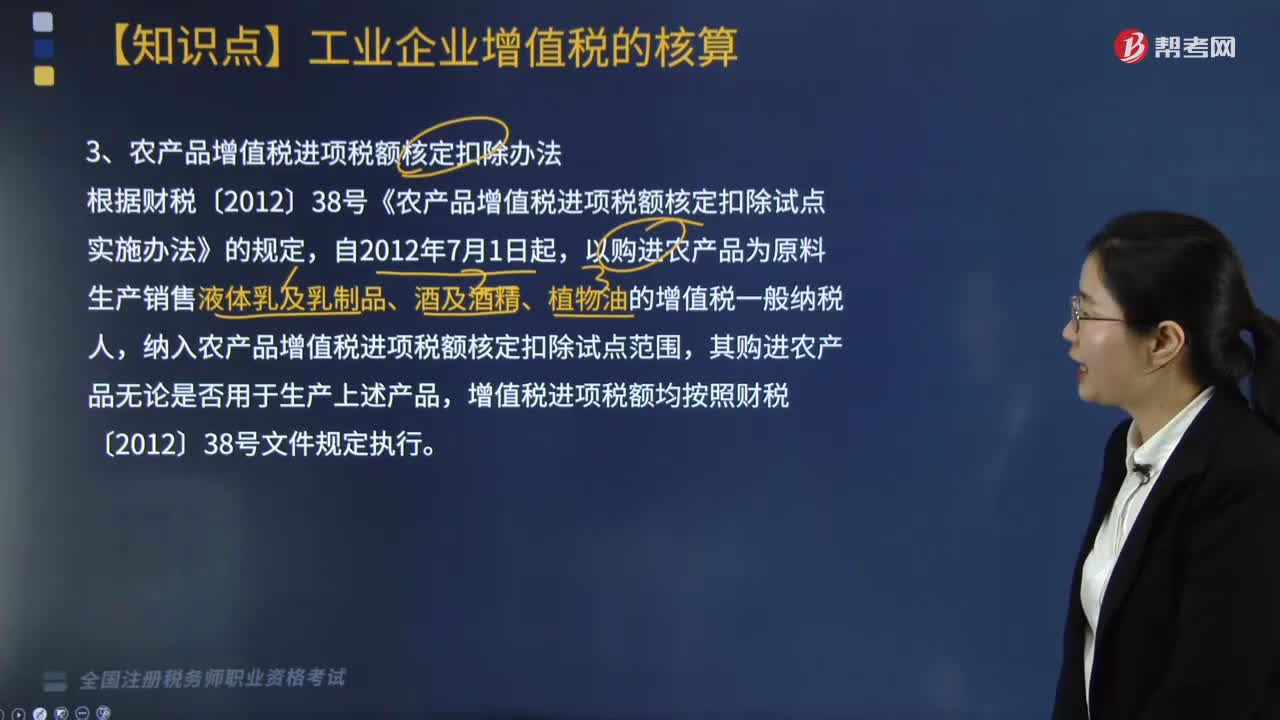

農(nóng)產(chǎn)品增值稅進(jìn)項(xiàng)稅額核定扣除辦法有哪些?外購貨物發(fā)生非正常損失賬務(wù)如何處理?

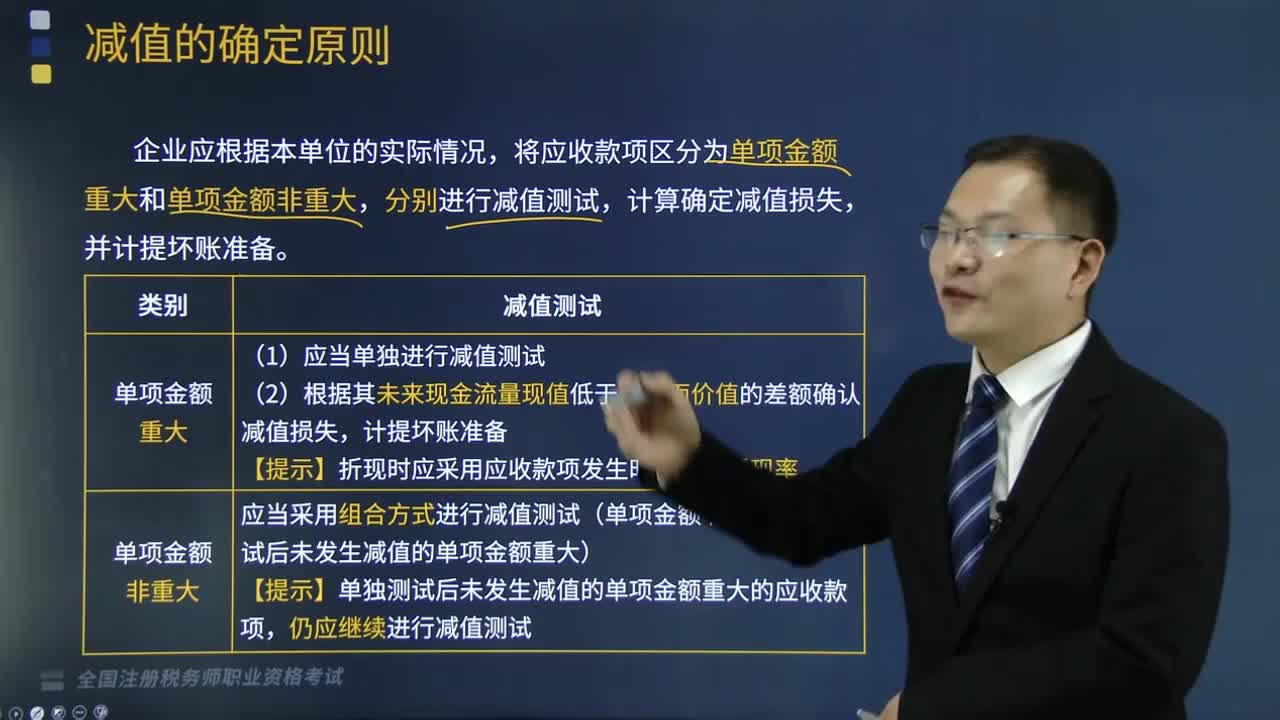

如何對(duì)應(yīng)收款項(xiàng)進(jìn)行減值測(cè)試?

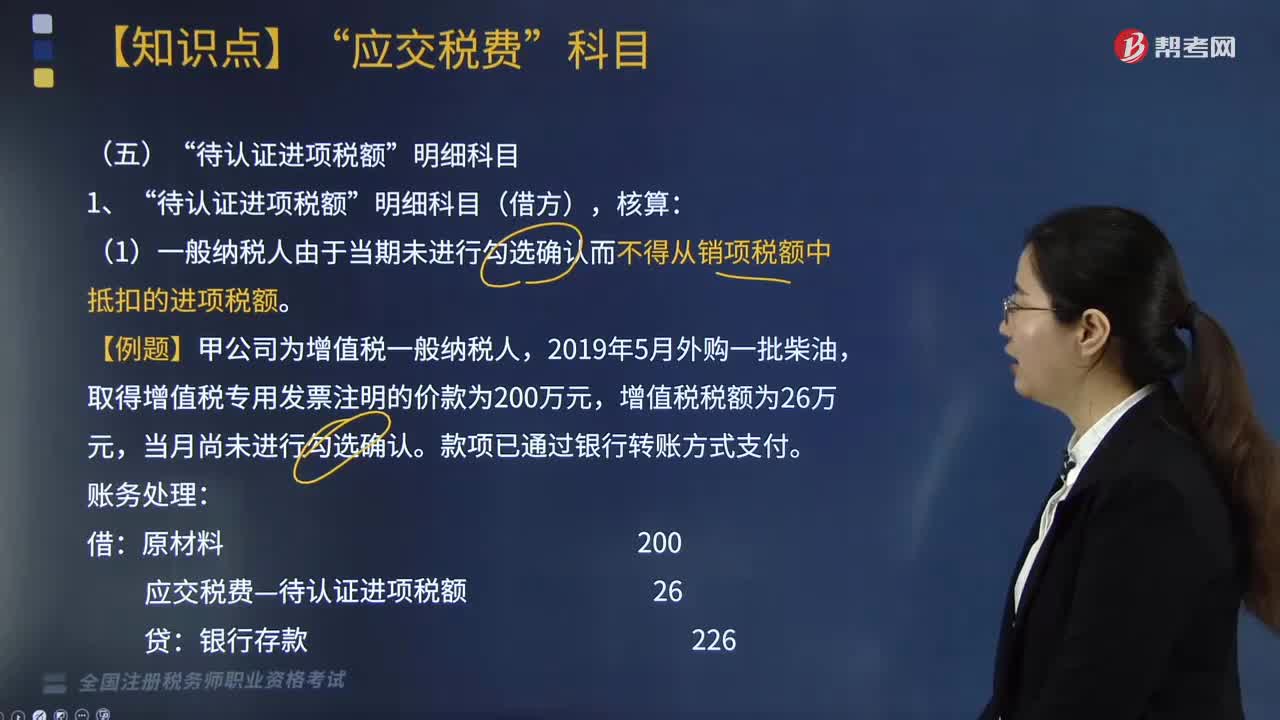

“待認(rèn)證進(jìn)項(xiàng)稅額”明細(xì)科目應(yīng)如何核算?

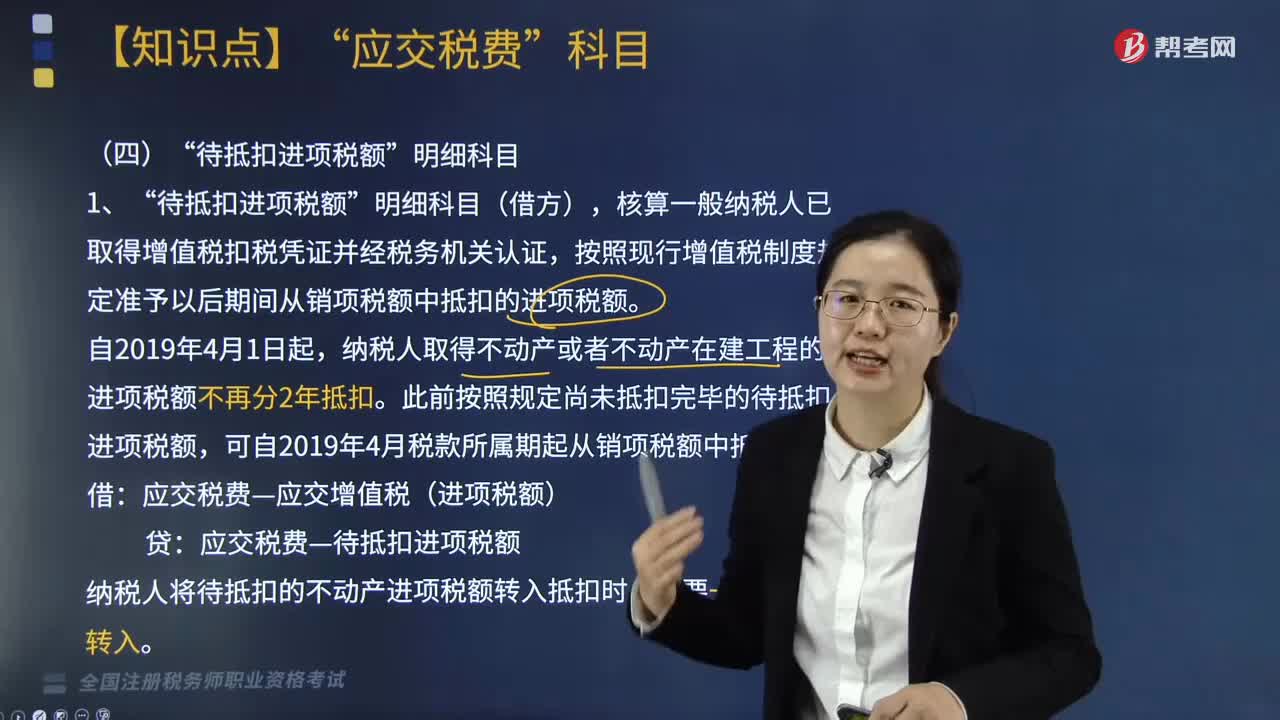

“待抵扣進(jìn)項(xiàng)稅額”明細(xì)科目如何進(jìn)行核算?

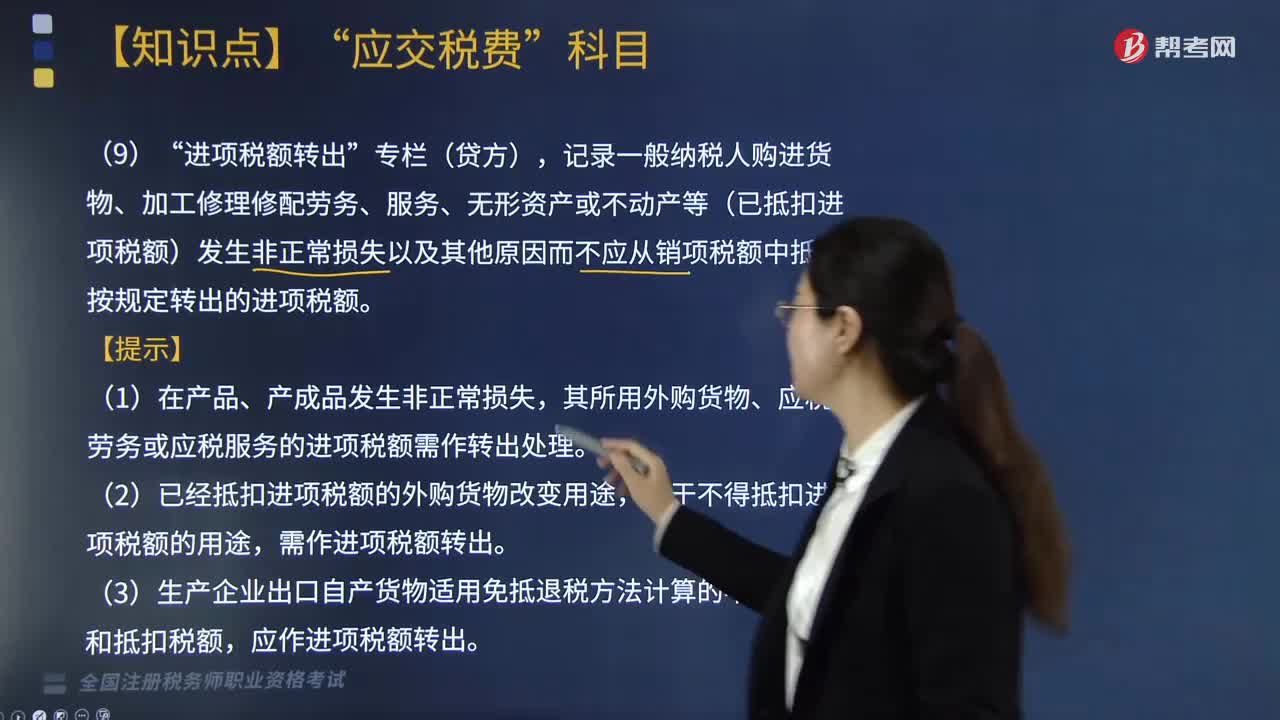

進(jìn)項(xiàng)稅額轉(zhuǎn)出” 專欄(貸方)如何記錄?

“進(jìn)項(xiàng)稅額”中,借方是如何記錄的?

下載億題庫APP

聯(lián)系電話:400-660-1360