下載億題庫APP

聯(lián)系電話:400-660-1360

下載億題庫APP

聯(lián)系電話:400-660-1360

請(qǐng)謹(jǐn)慎保管和記憶你的密碼,以免泄露和丟失

請(qǐng)謹(jǐn)慎保管和記憶你的密碼,以免泄露和丟失

待轉(zhuǎn)銷項(xiàng)稅額會(huì)計(jì)分錄怎么做?

結(jié)轉(zhuǎn)銷項(xiàng)稅額

借:應(yīng)交稅金——待轉(zhuǎn)銷項(xiàng)稅額

貸:應(yīng)交稅金——應(yīng)交增值稅——未交增值稅

結(jié)轉(zhuǎn)進(jìn)項(xiàng)稅額

借:應(yīng)交稅金——應(yīng)交增值稅——未交增值稅

貸:應(yīng)交稅金——應(yīng)交增值稅——銷項(xiàng)稅

微信截圖_1594106161755420200707151645838.png)

60

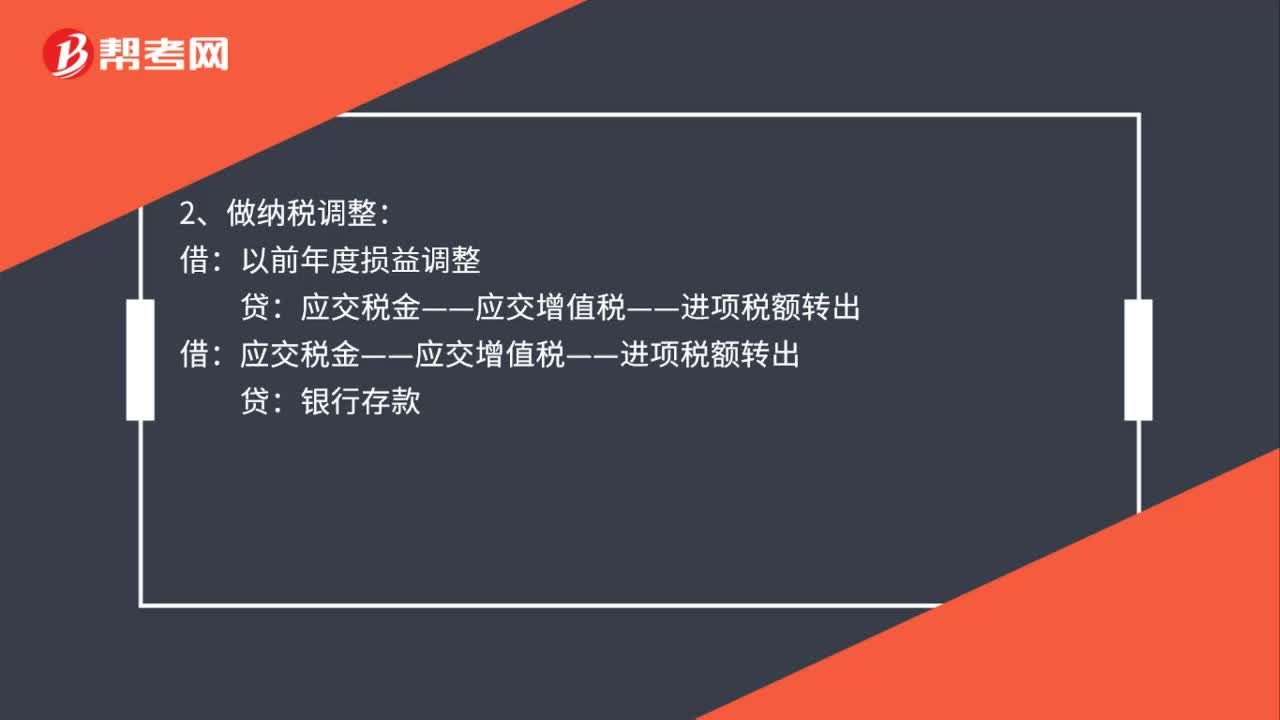

60進(jìn)項(xiàng)稅額轉(zhuǎn)出會(huì)計(jì)分錄怎么做?:進(jìn)項(xiàng)稅額轉(zhuǎn)出會(huì)計(jì)分錄怎么做?1、不做納稅調(diào)整:應(yīng)交稅金——應(yīng)交增值稅——已交稅金:補(bǔ)繳稅金:貸:2、做納稅調(diào)整:應(yīng)交稅金——應(yīng)交增值稅——進(jìn)項(xiàng)稅額轉(zhuǎn)出銀行存款應(yīng)交稅金——應(yīng)交所得稅借利潤分配——未分配利潤貸以前年度損益調(diào)整

55

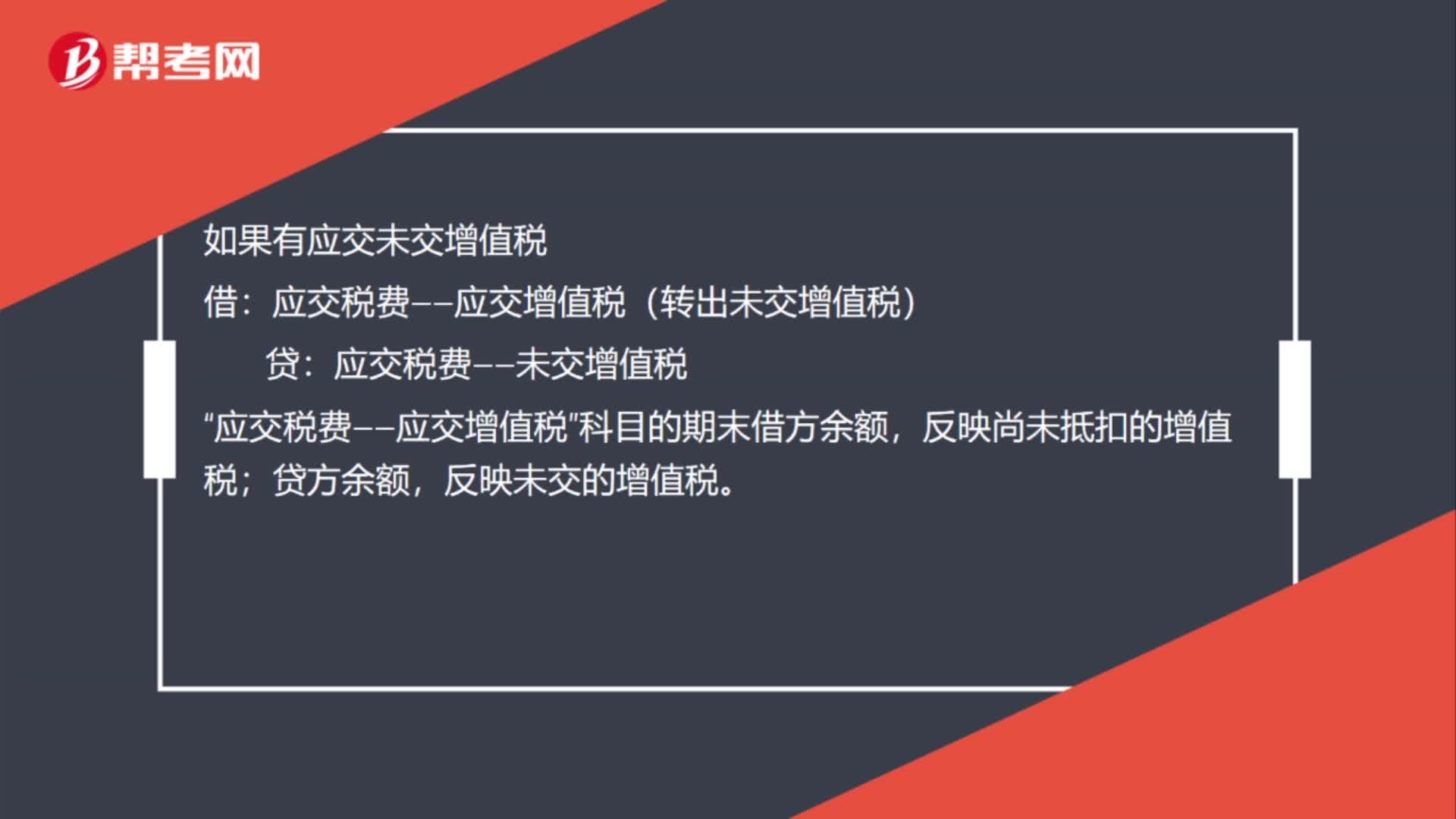

55進(jìn)項(xiàng)稅額大于銷項(xiàng)稅額會(huì)計(jì)分錄怎么做?:進(jìn)項(xiàng)稅額大于銷項(xiàng)稅額會(huì)計(jì)分錄怎么做?進(jìn)項(xiàng)稅額大于銷項(xiàng)稅額會(huì)計(jì)分錄:月末,如果有留抵稅額,企業(yè)應(yīng)將本月多交的增值稅。應(yīng)交稅費(fèi)——未交增值稅:應(yīng)交稅費(fèi)——應(yīng)交增值稅(轉(zhuǎn)出多交增值稅):如果有應(yīng)交未交增值稅“借”應(yīng)交稅費(fèi)——應(yīng)交增值稅(轉(zhuǎn)出未交增值稅),貸;應(yīng)交稅費(fèi)——未交增值稅,應(yīng)交稅費(fèi)——應(yīng)交增值稅。科目的期末借方余額反映尚未抵扣的增值稅貸方余額反映未交的增值稅

67

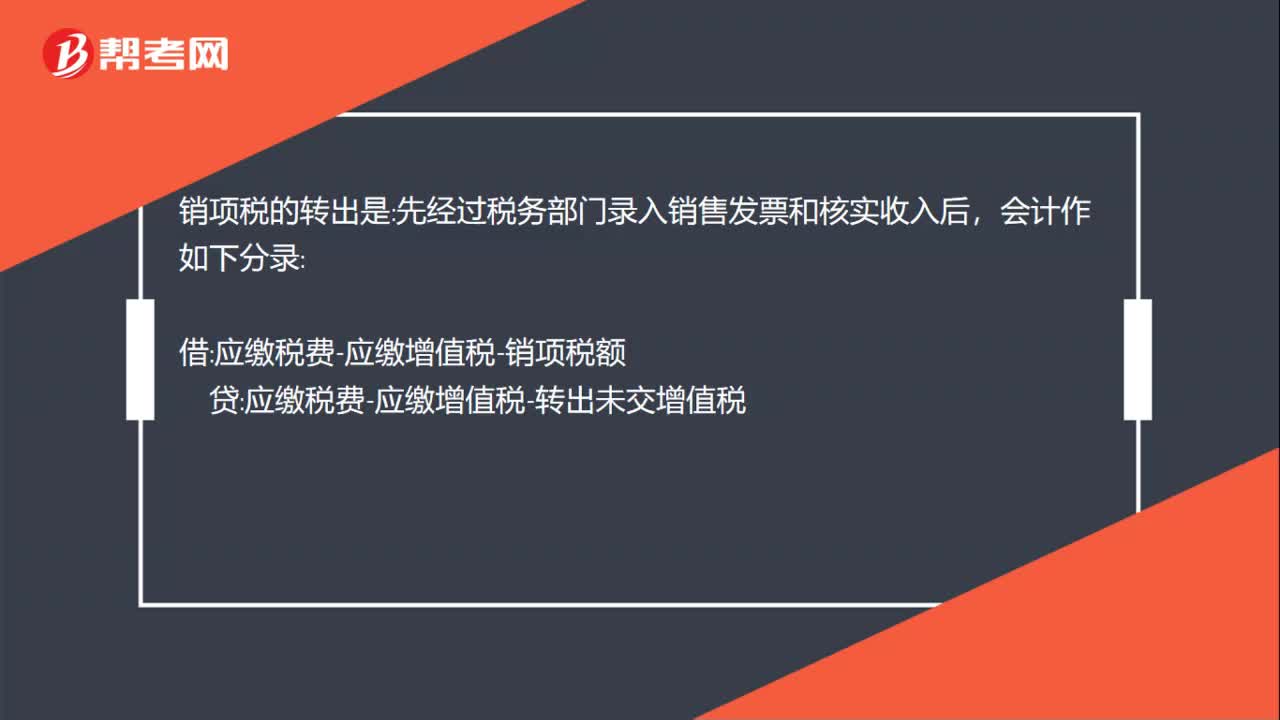

67銷項(xiàng)稅額轉(zhuǎn)出會(huì)計(jì)分錄怎么做?:銷項(xiàng)稅額轉(zhuǎn)出會(huì)計(jì)分錄怎么做?銷項(xiàng)稅額轉(zhuǎn)出會(huì)計(jì)分錄:進(jìn)項(xiàng)稅的轉(zhuǎn)出是,經(jīng)過稅務(wù)部門核實(shí)進(jìn)項(xiàng)稅發(fā)票后:會(huì)計(jì)作如下分錄:應(yīng)繳稅費(fèi)-應(yīng)繳增值稅-轉(zhuǎn)出未交增值稅:應(yīng)繳稅費(fèi)-應(yīng)繳增值稅-進(jìn)項(xiàng)稅額:銷項(xiàng)稅的轉(zhuǎn)出是:先經(jīng)過稅務(wù)部門錄入銷售發(fā)票和核實(shí)收入后:會(huì)計(jì)作如下分錄:應(yīng)繳稅費(fèi)-應(yīng)繳增值稅-銷項(xiàng)稅額:應(yīng)繳稅費(fèi)-應(yīng)繳增值稅-轉(zhuǎn)出未交增值稅月末結(jié)轉(zhuǎn)應(yīng)繳稅費(fèi)-應(yīng)繳增值稅-轉(zhuǎn)出未交增值稅若進(jìn)項(xiàng)稅大于銷項(xiàng)稅為紅數(shù)貸

00:51

00:512020-06-11

01:20

01:202020-06-11

02:28

02:282020-06-02

01:23

01:232020-06-02

00:30

00:302020-05-30

微信掃碼關(guān)注公眾號(hào)

獲取更多考試熱門資料