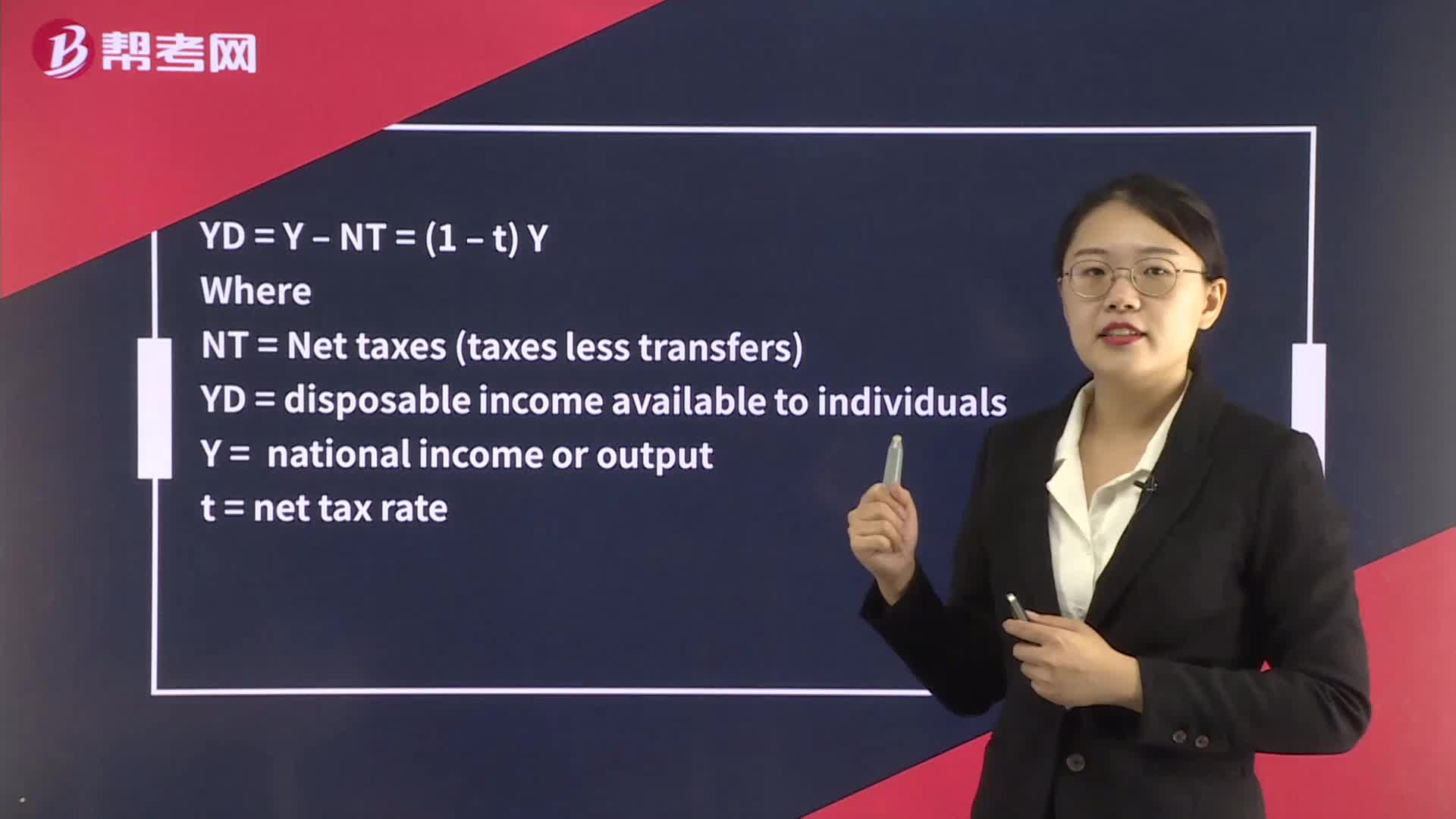

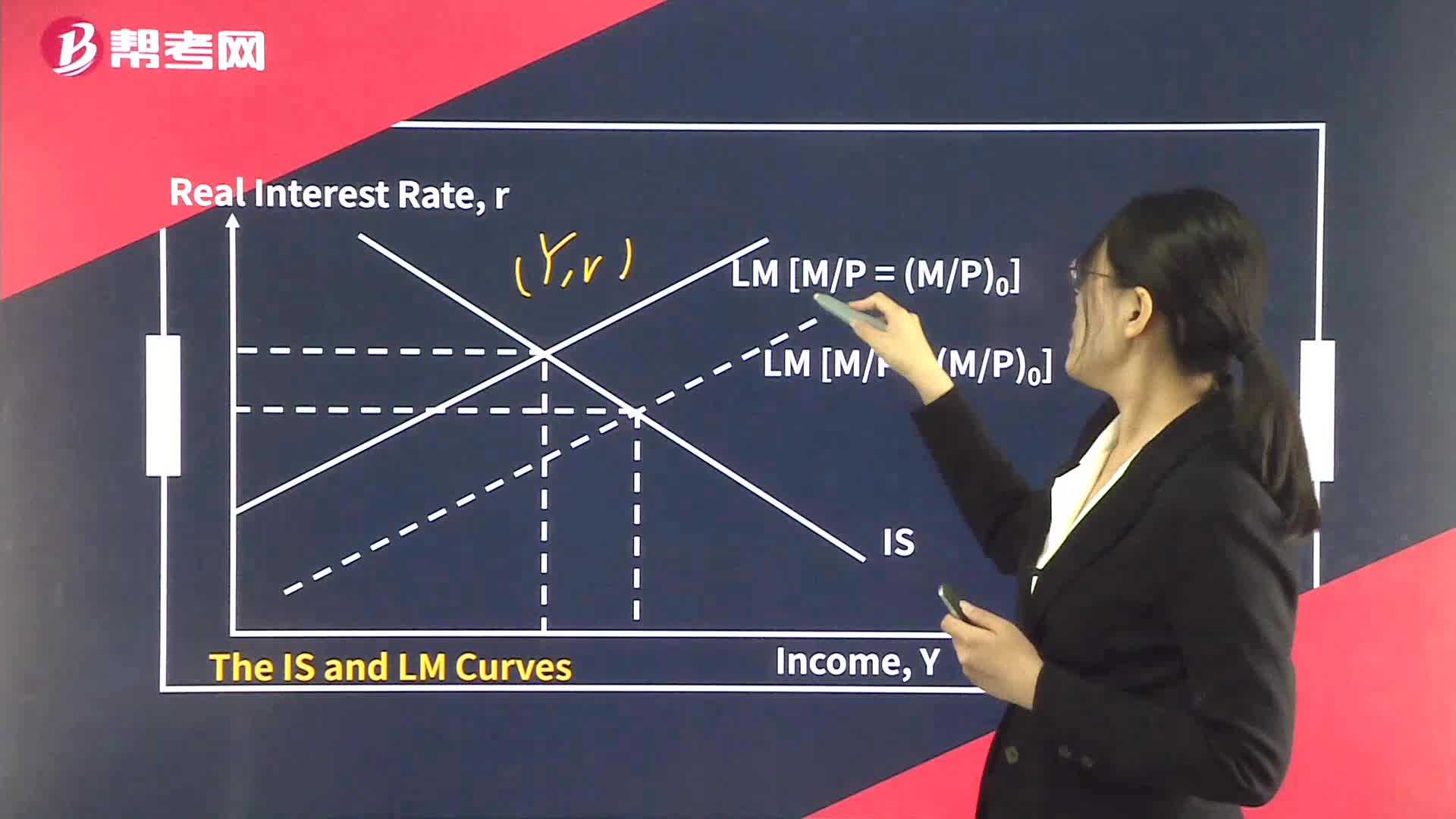

The IS Curve

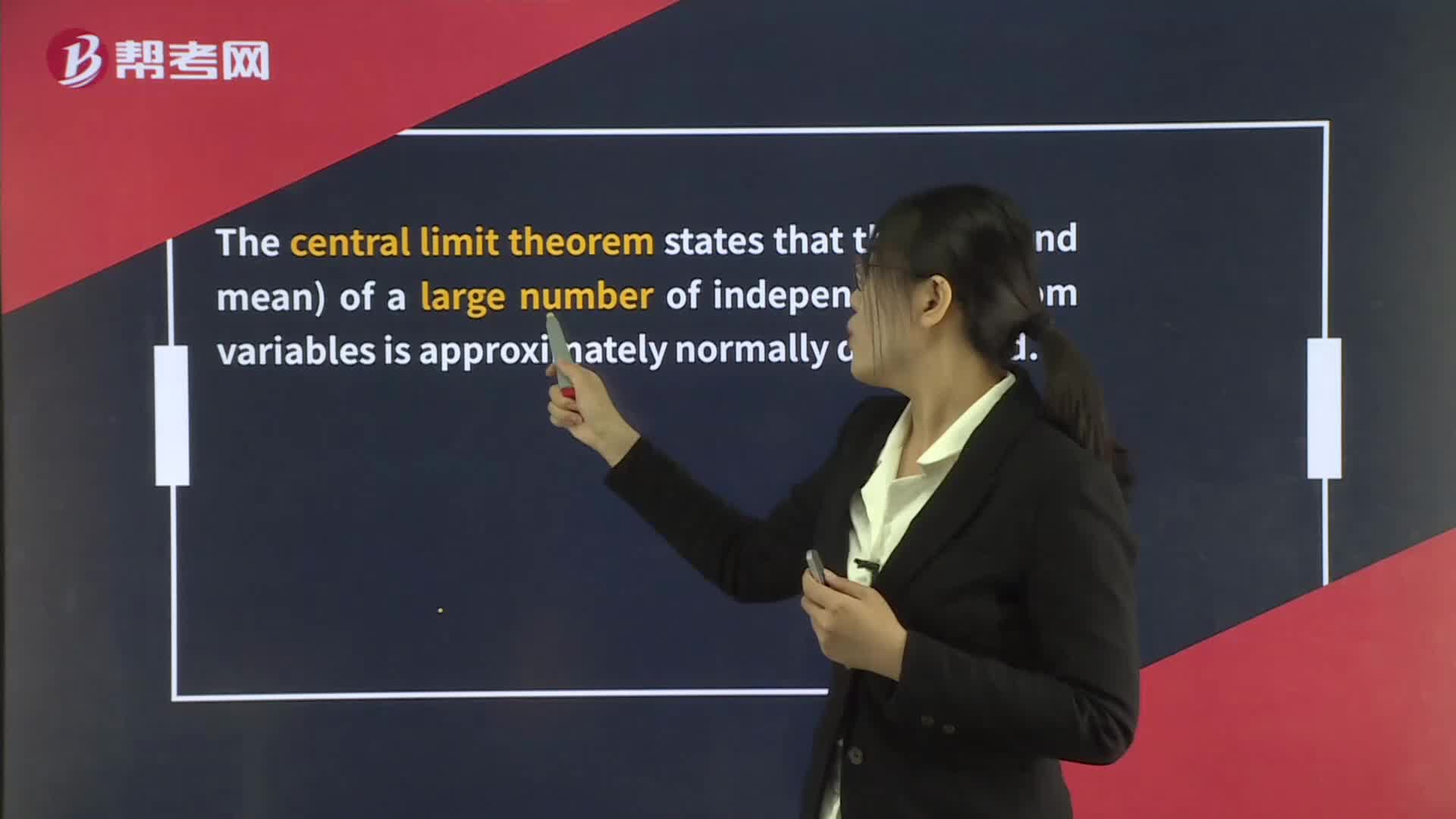

The Normal Distribution

The Lognormal Distribution

The Aggregate Demand Curve

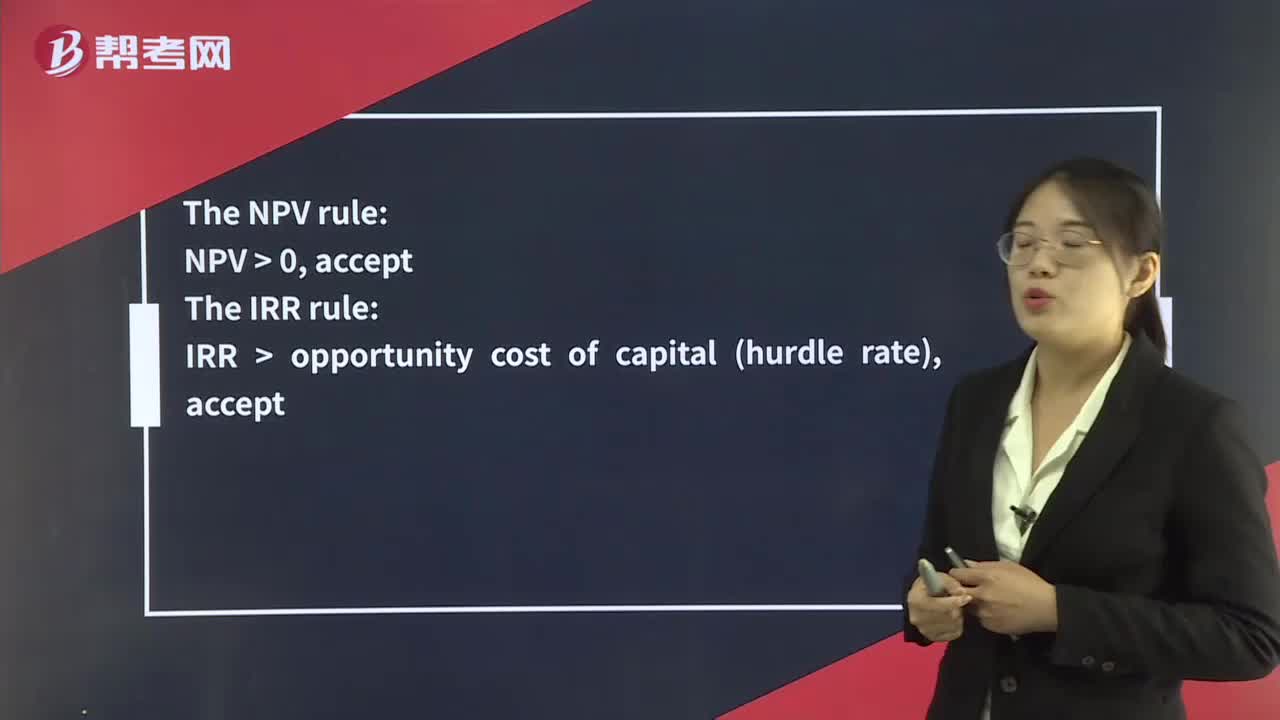

The NPV Rule & The IRR Rule

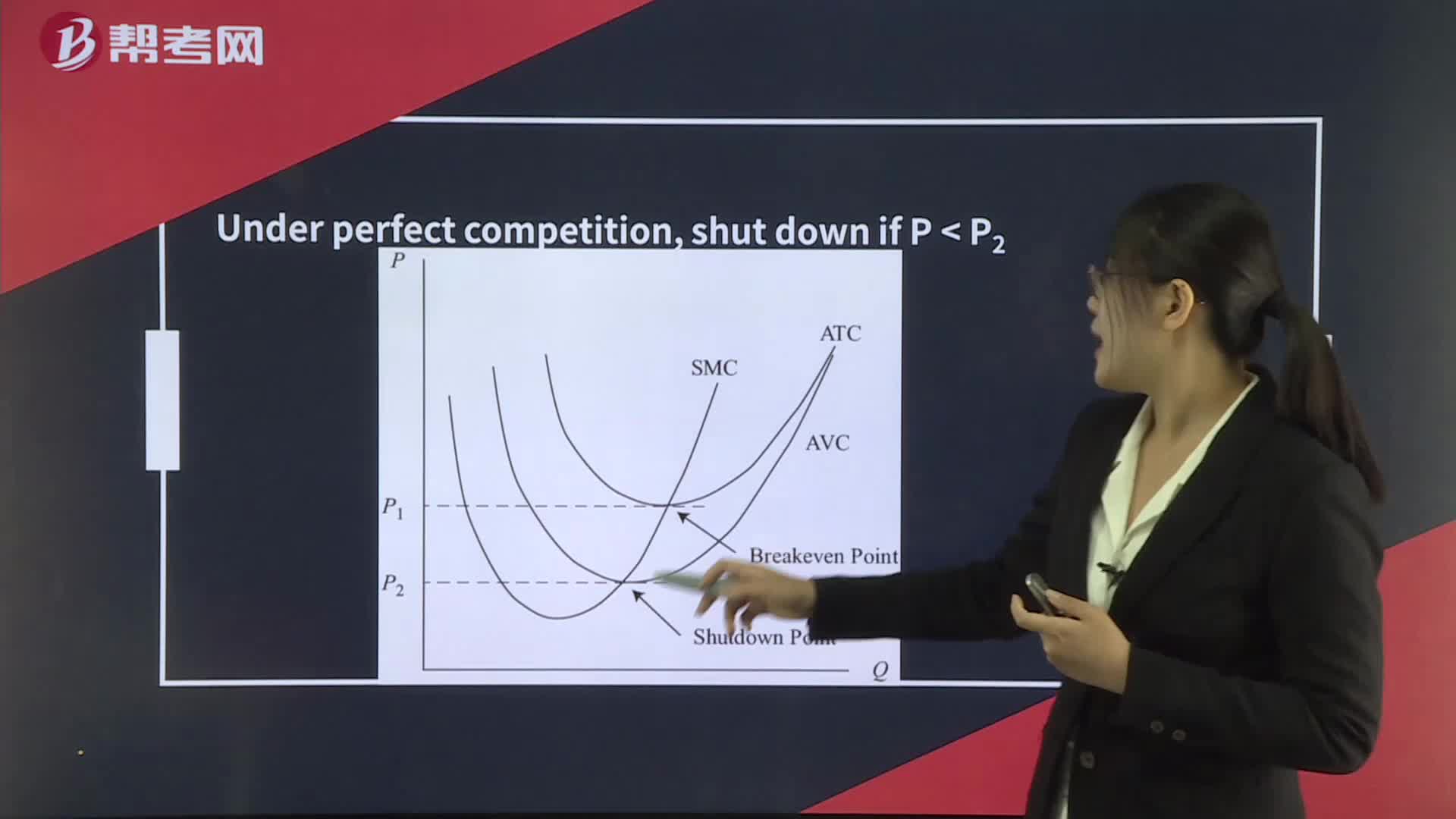

The Shutdown Decision

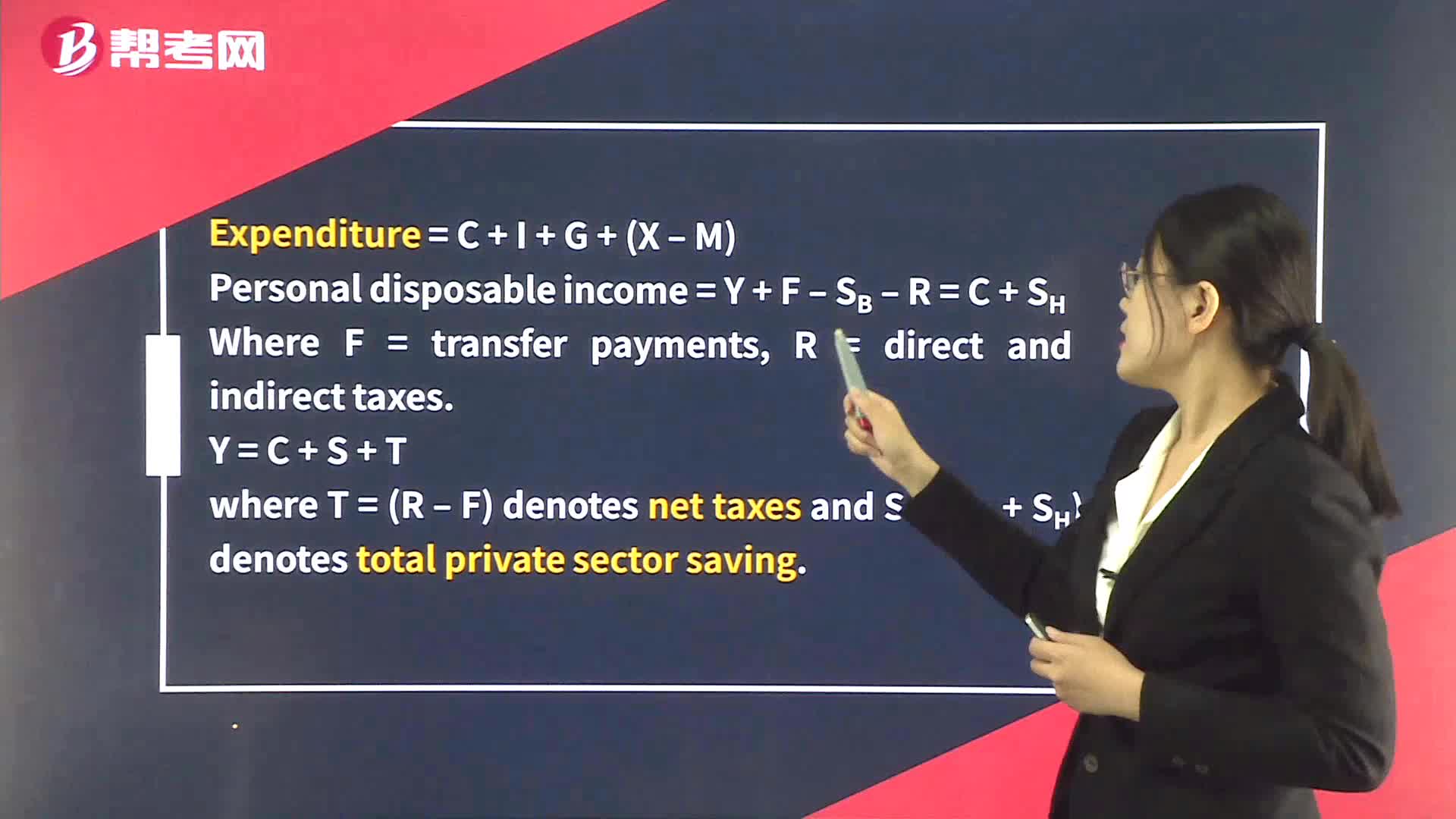

The AbsorptionApproach

The Ideal Currency Regime

Hypothesis Tests Concerning the Mean

The Unemployment Rate

The Quantity Theory of Money

The Objectives of Monetary Policy

下載億題庫APP

聯(lián)系電話:400-660-1360