How to master I、S:common size analysis?

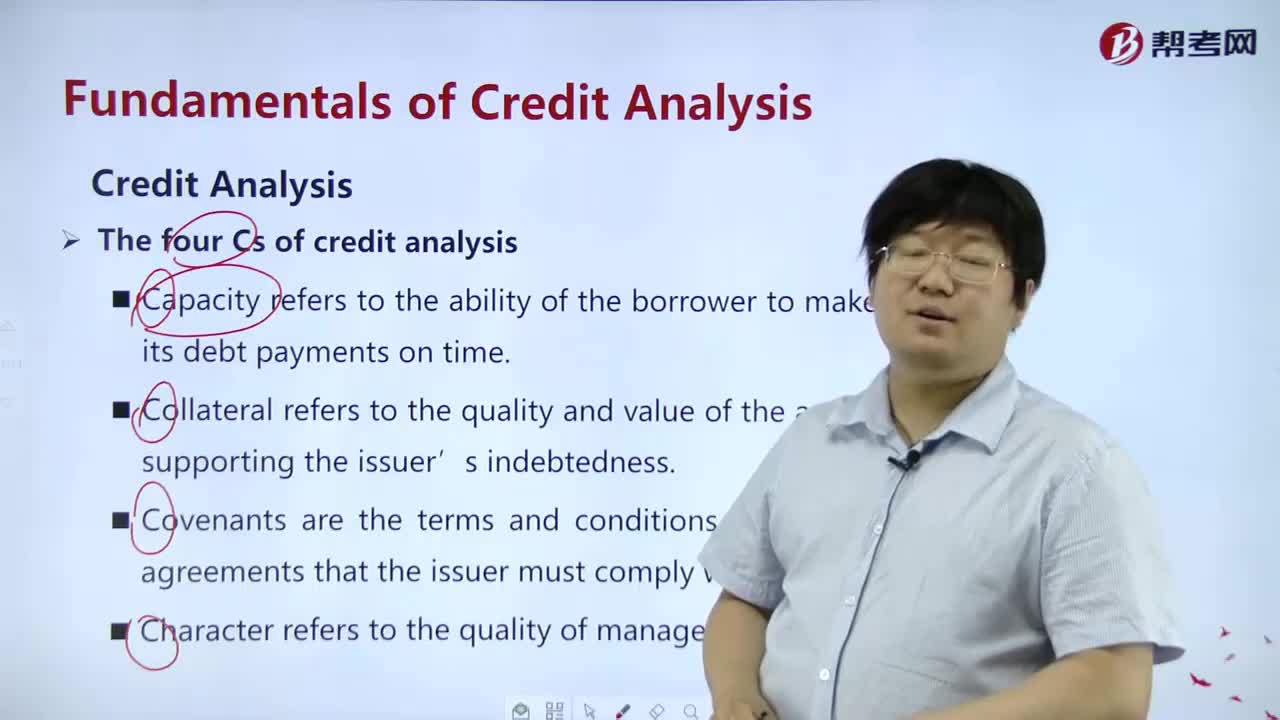

How to master Credit Analysis?

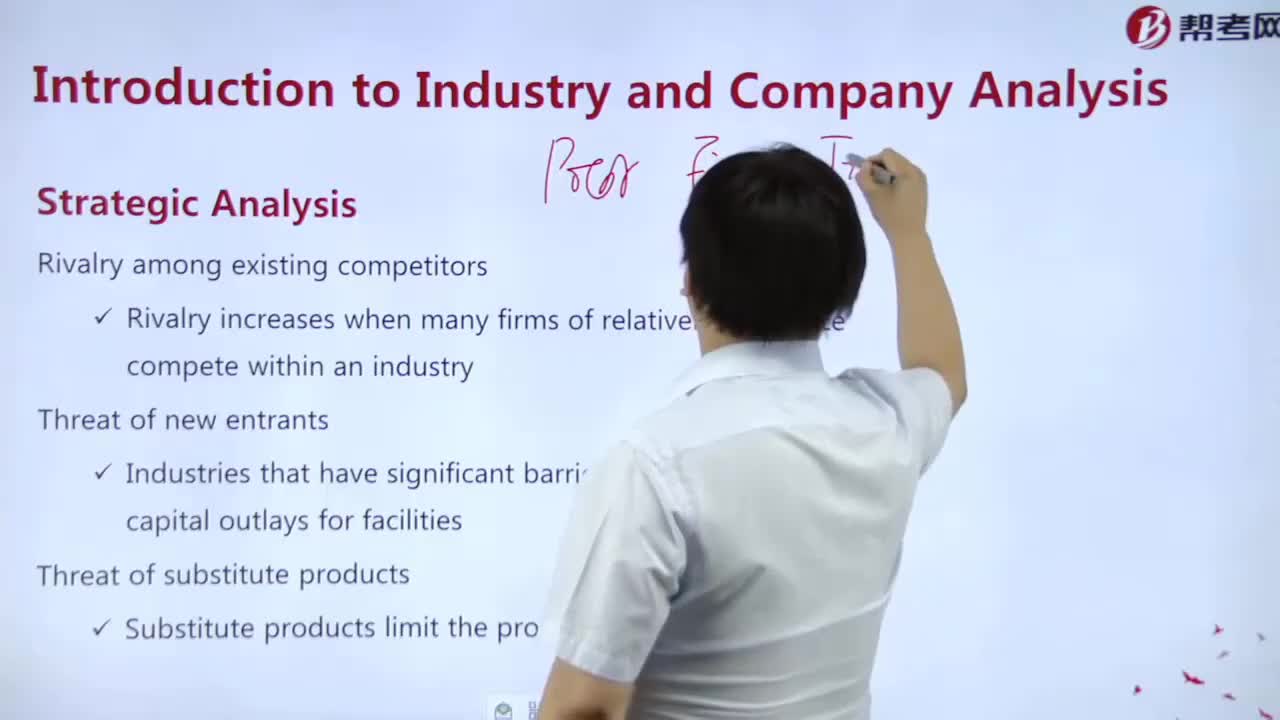

The steps of strategic analysis?

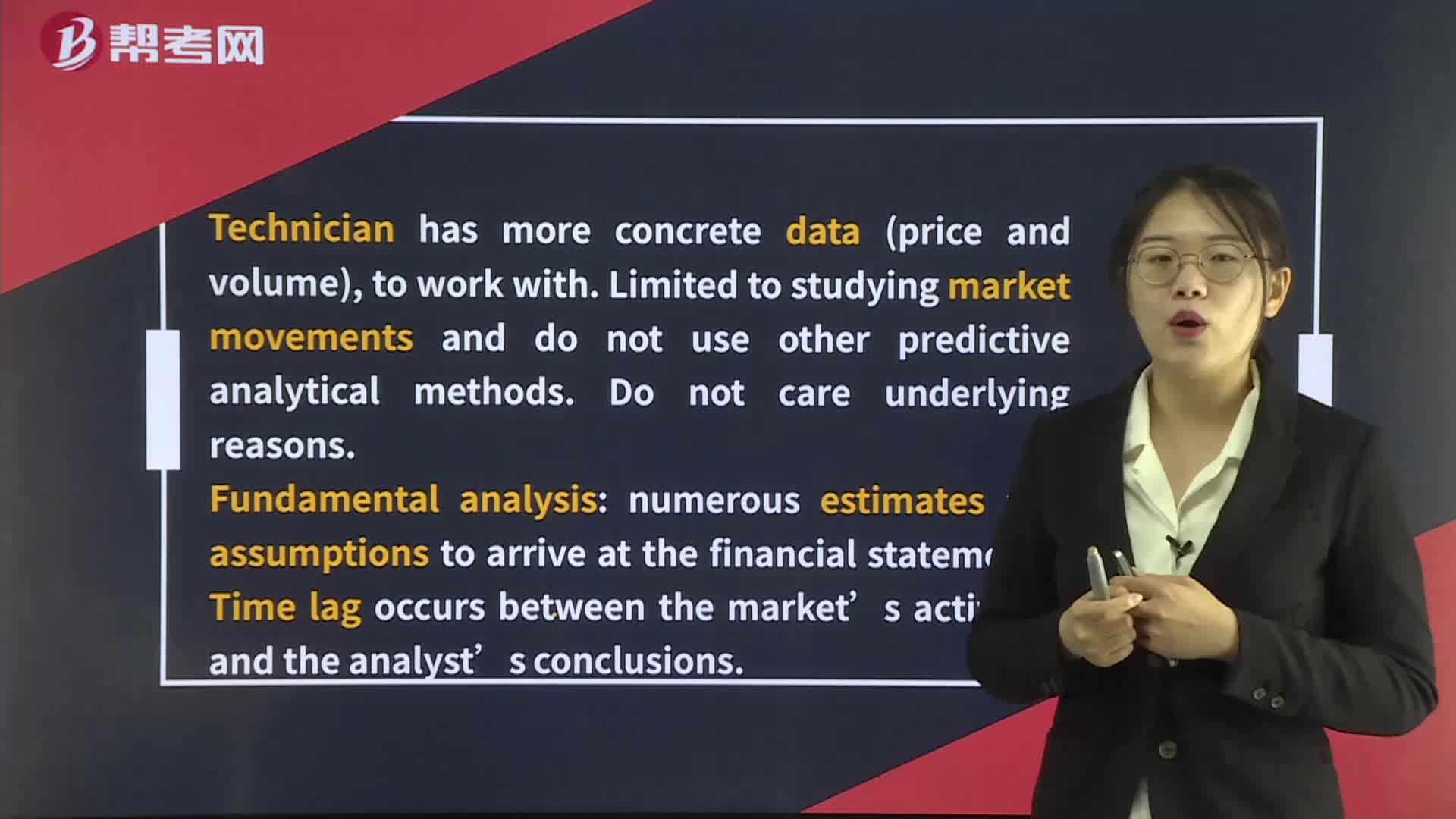

Technical and Fundamental Analysis

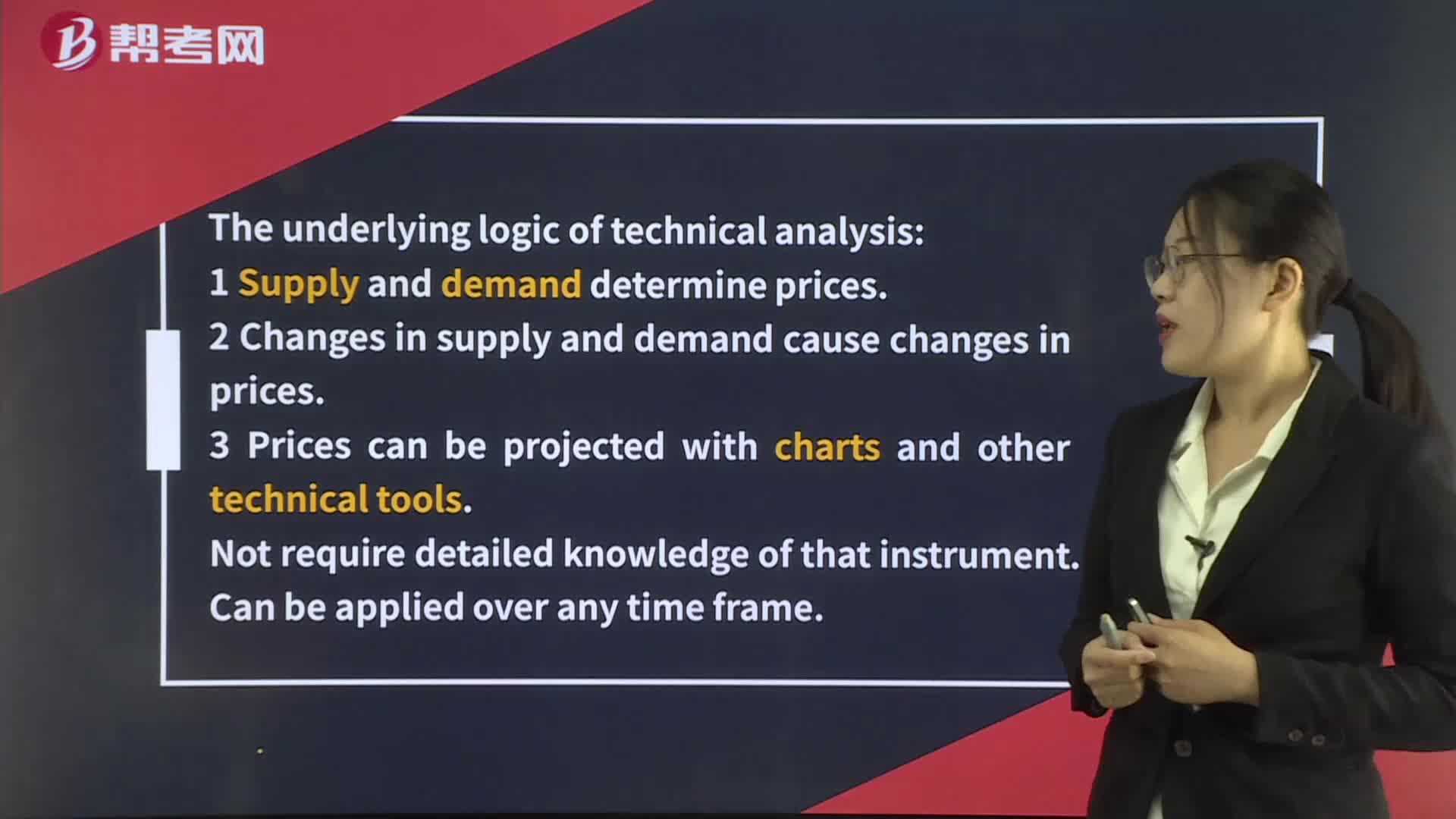

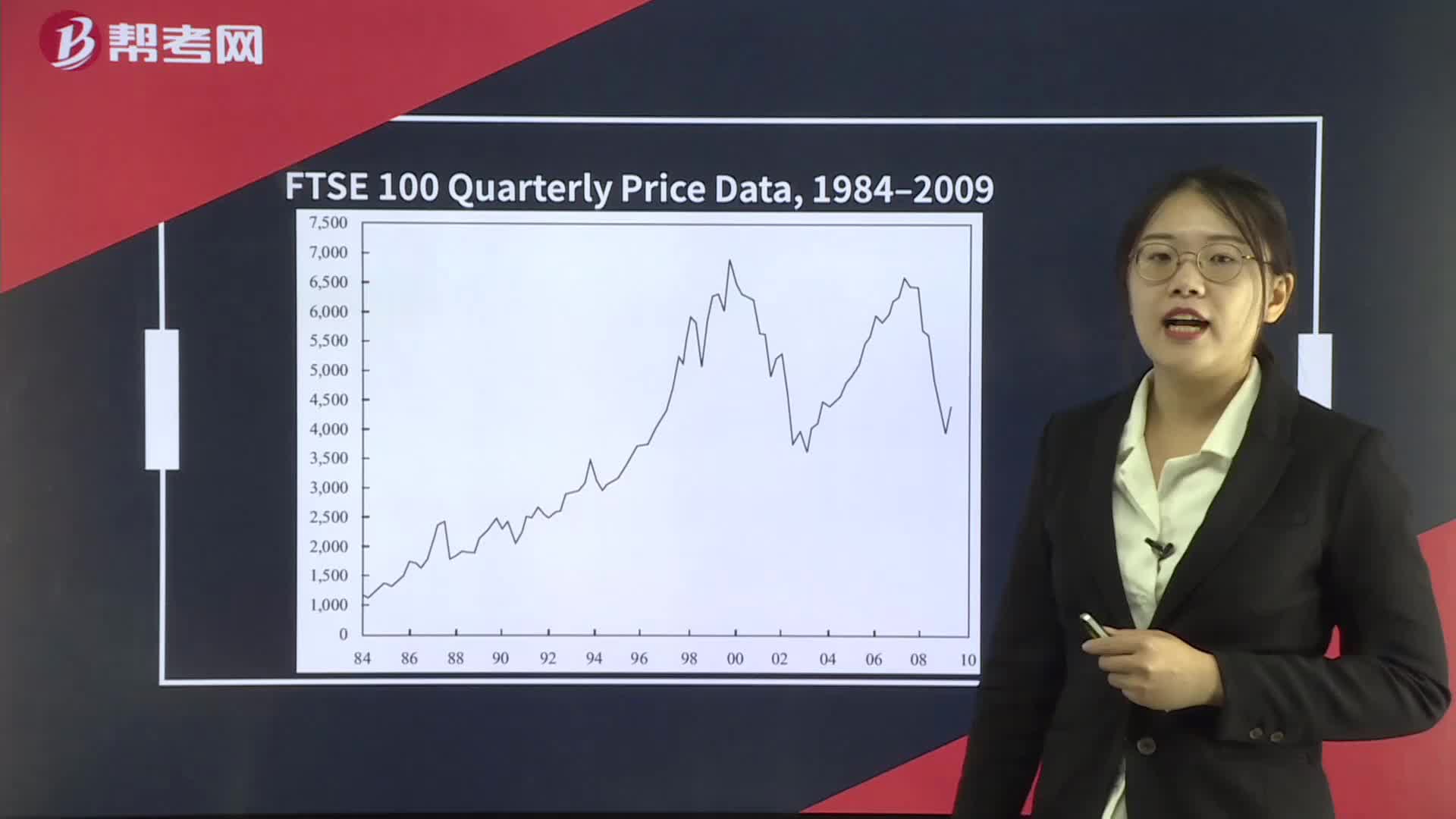

Technical Analysis

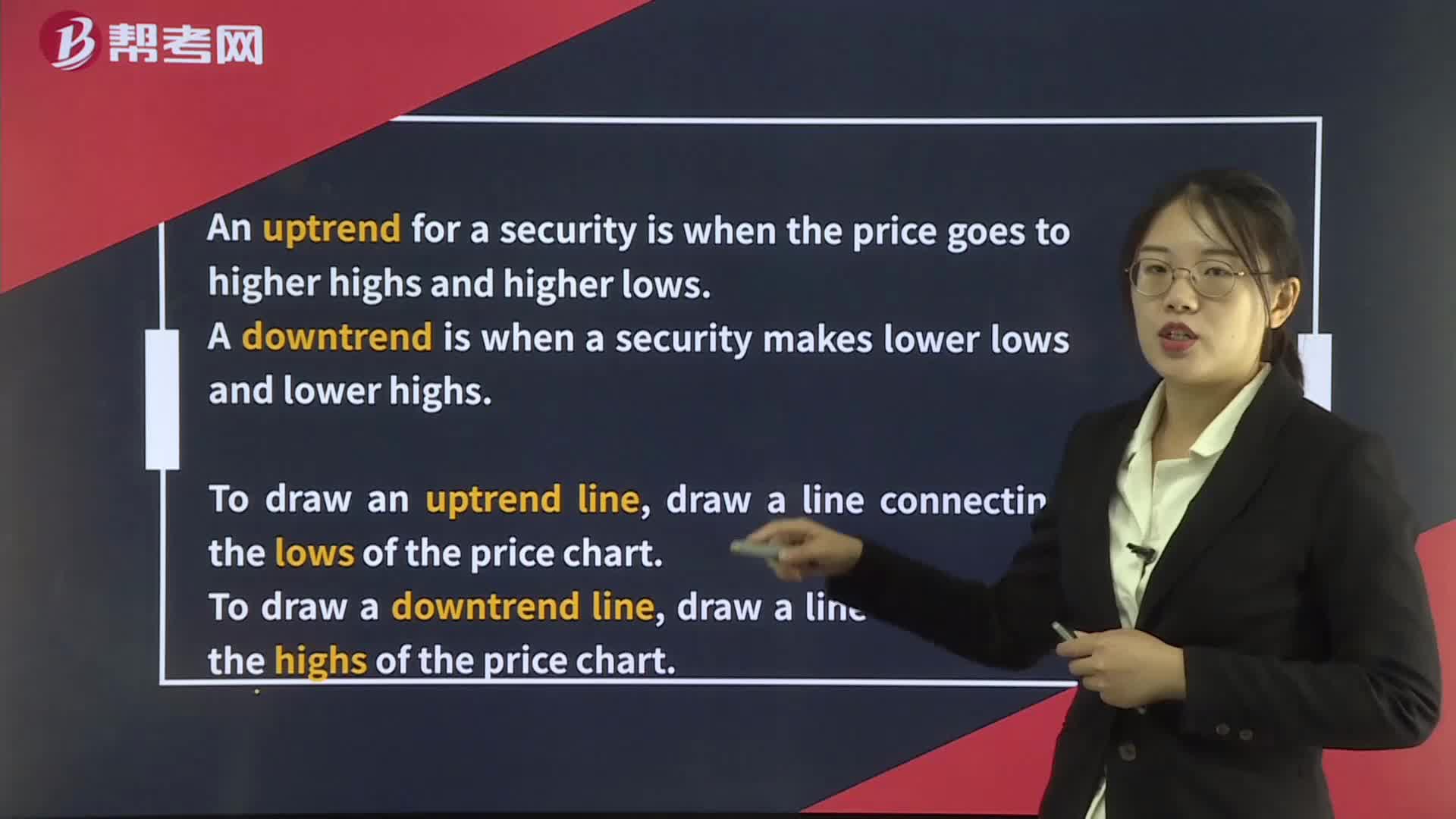

Technical Analysis Tools— Trend

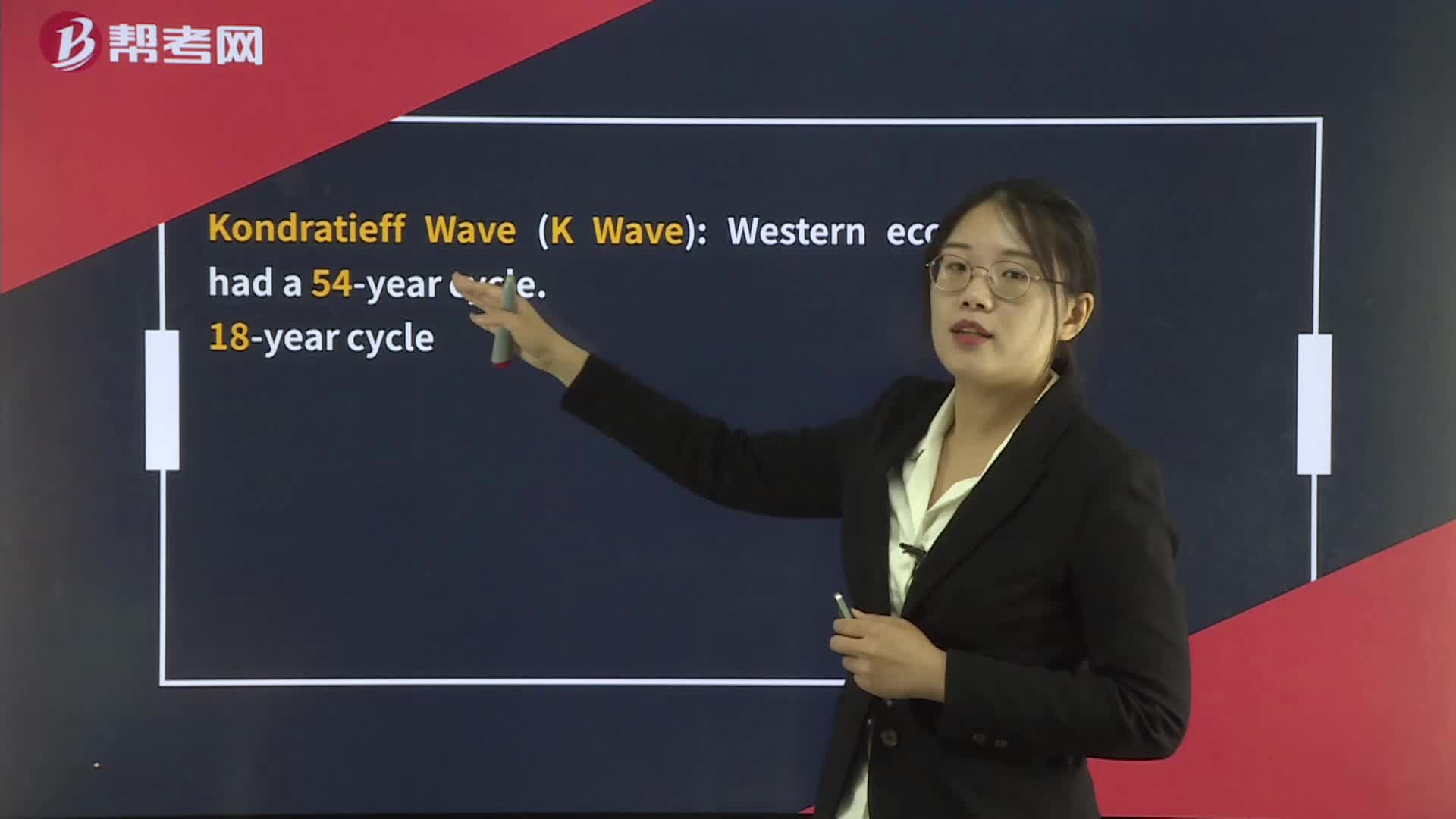

Technical Analysis Tools— Cycles

Technical Analysis Tools— Technical Indicators

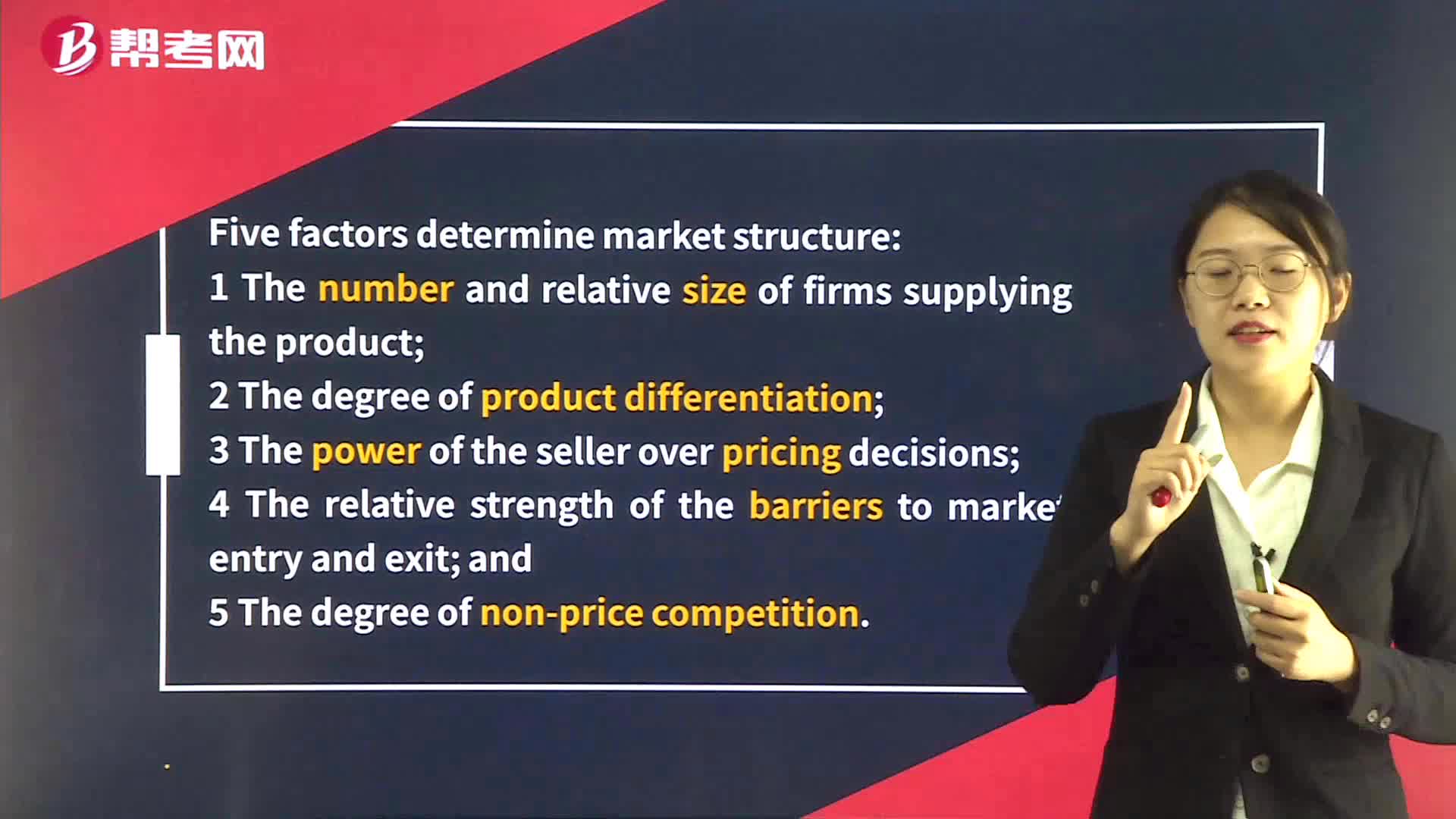

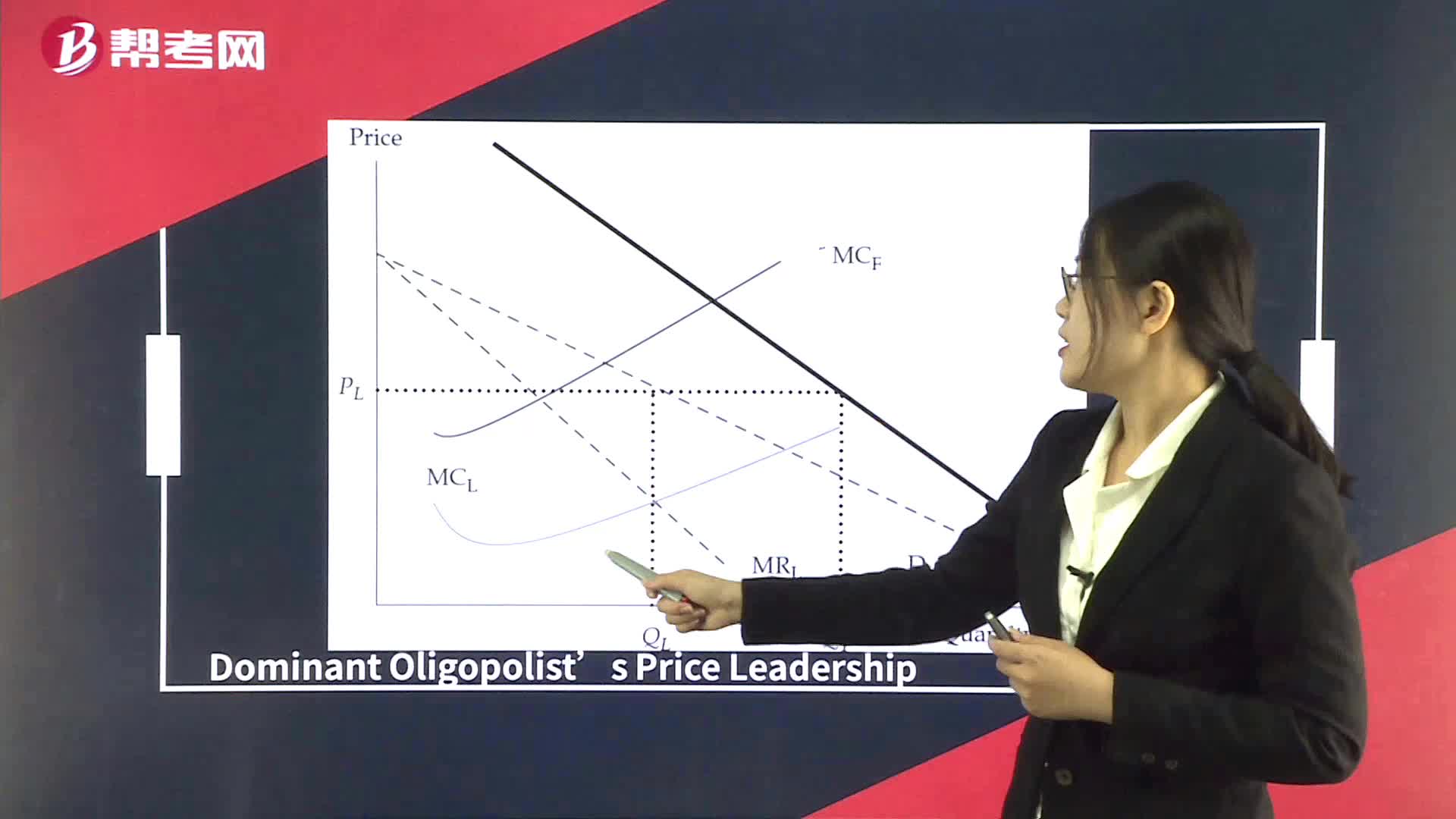

Supply Analysis in Oligopoly Market

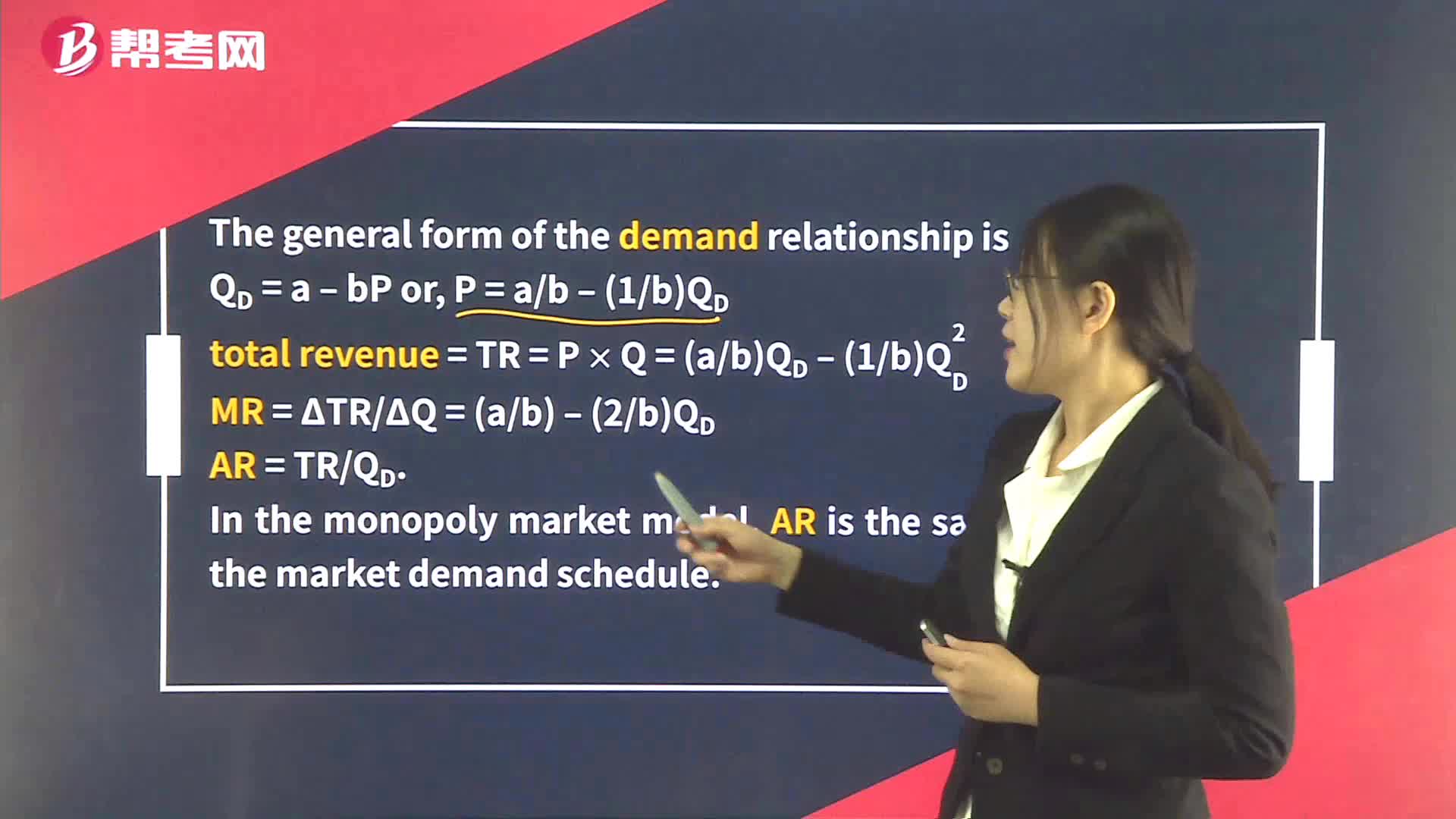

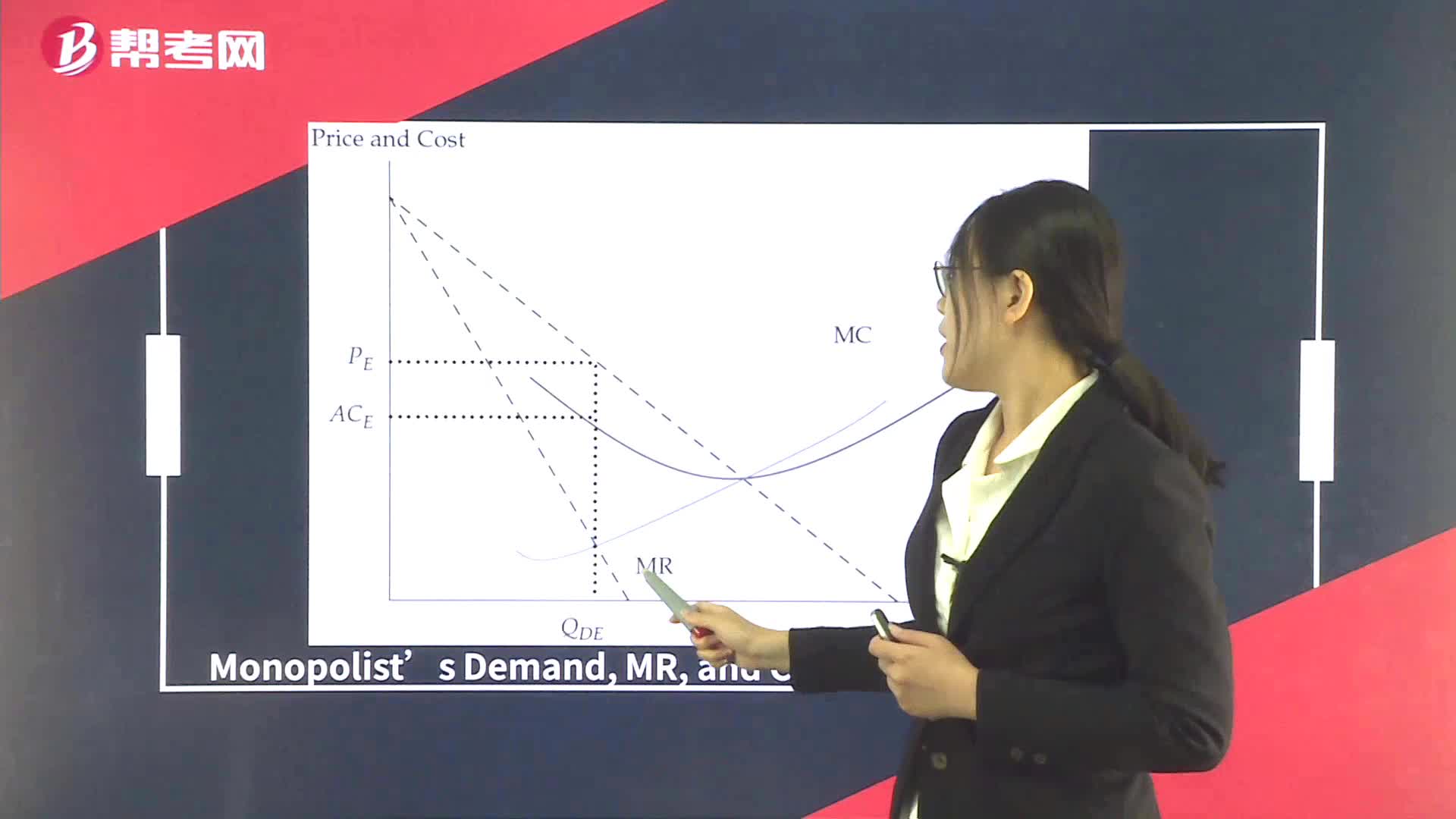

Supply Analysis in Monopoly

Technical Analysis Tools— Charts

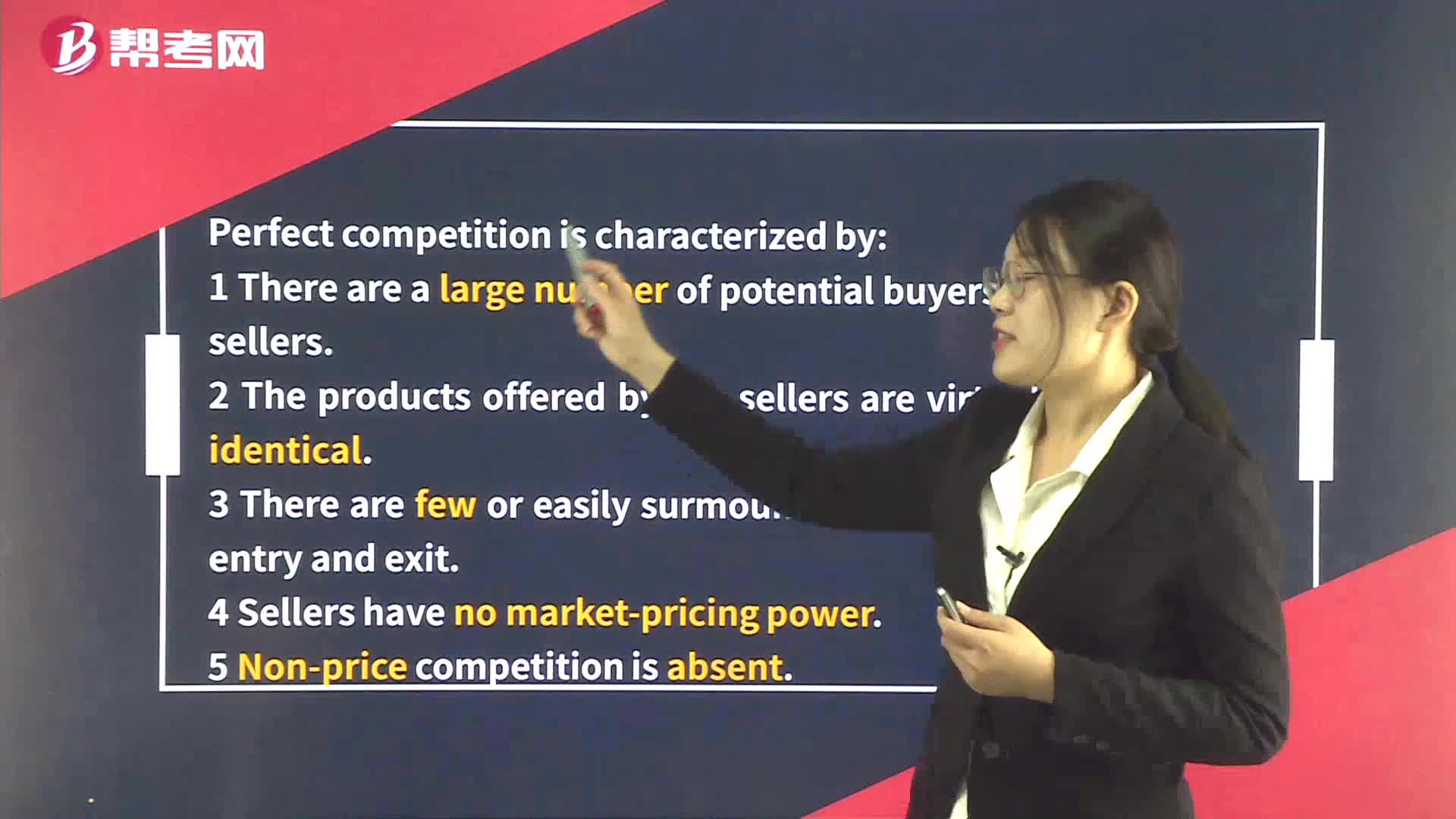

Supply Analysis in Monopolistic Competition

下載億題庫APP

聯(lián)系電話:400-660-1360