下載億題庫APP

聯(lián)系電話:400-660-1360

下載億題庫APP

聯(lián)系電話:400-660-1360

請謹(jǐn)慎保管和記憶你的密碼,以免泄露和丟失

請謹(jǐn)慎保管和記憶你的密碼,以免泄露和丟失

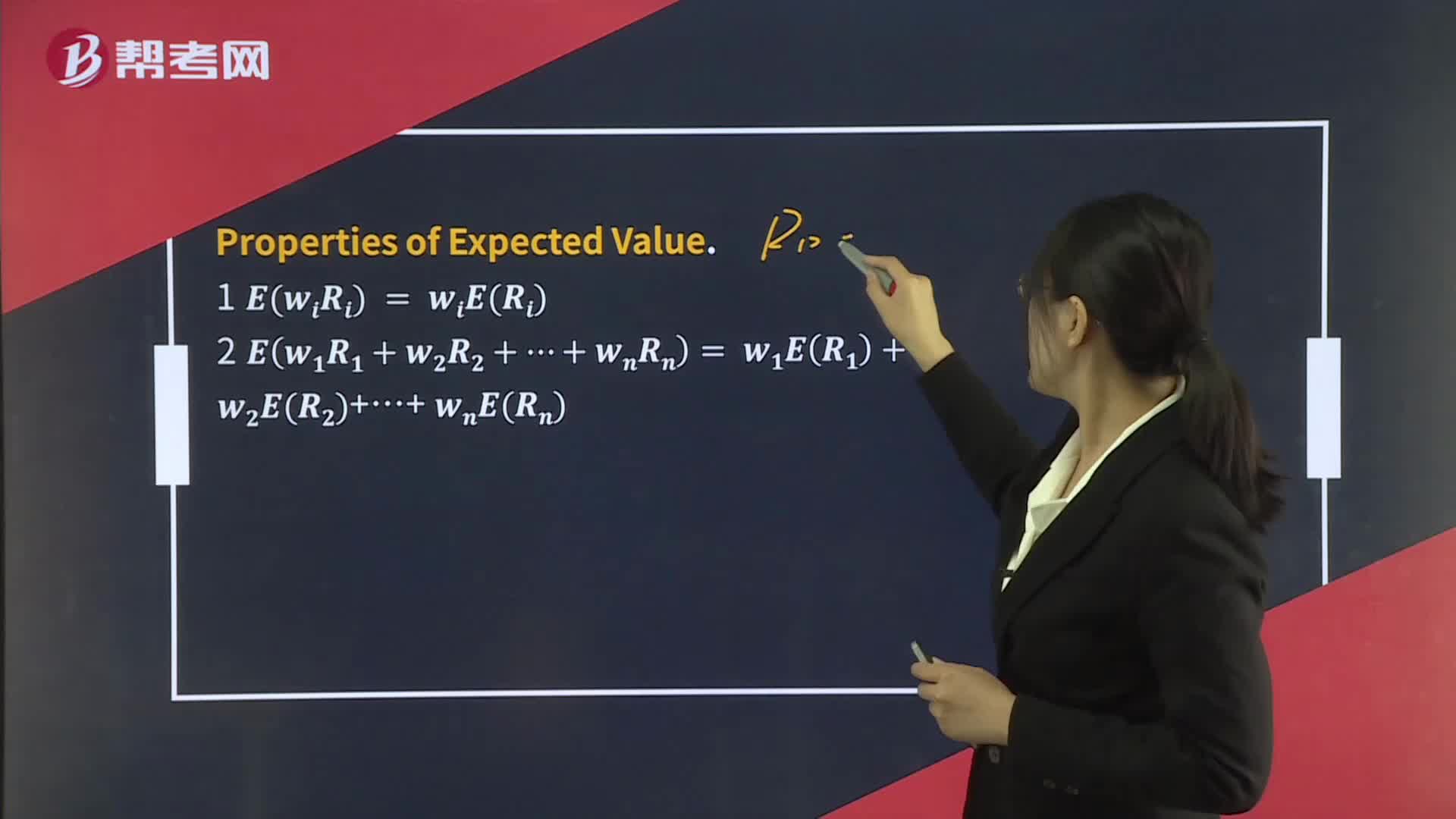

Portfolio Expected Return and Variance of Return

微信截圖_1596615516354320200805161854891.png)

微信截圖_1596615553845720200805161935286.png)

微信截圖_1596615032125720200805161813506.png)

微信截圖_1596615817108620200805162353540.png)

微信截圖_1596615869115520200805162443578.png)

微信截圖_1596615907333920200805162531315.png)

微信截圖_159661597863120200805162642438.png)

微信截圖_1596616040251820200805162742978.png)

[Solutions] C

The correlation between two random variables Ri and Rj is defined as ρ(Ri,Rj) = Cov(Ri,Rj)/σ(Ri)σ(Rj). Using the subscript i to represent hedge funds and the subscript j to represent the market index, the standard deviations are σ(Ri) = 2561/2 = 16 and σ(Rj) = 811/2 = 9. Thus, ρ(Ri,Rj) = Cov(Ri,Rj)/σ(Ri)σ(Rj) = 110/(16 × 9) = 0.764.

微信截圖_1596616087599220200805162840345.png)

微信截圖_1596616155430920200805162929517.png)

A. 26.39.

B. 26.56.

C. 28.12.

[Solutions] B

First, expected returns are

E(RFI) = (0.25 × 25) + (0.50 × 15) + (0.25 × 10)

= 6.25 + 7.50 + 2.50 = 16.25 and

E(RDI) = (0.25 × 30) + (0.50 × 25) + (0.25 × 15)

= 7.50 + 12.50 + 3.75 = 23.75.

微信截圖_1596616215947420200805163029140.png)

Independence for Random Variables:

Two random variables X and Y are independent if and only if P(X, Y) = P(X)P(Y).

Independence is a stronger property than uncorrelatedness because correlation addresses only linear relationships.

Multiplication Rule for expected value of the product of uncorrelated random variables.

If X and Y are uncorrelated: E(XY) = E(X)E(Y)

900

900Portfolio Expected Return and Variance of Return:Return,RjFirst= 7.50 + 12.50 + 3.75 = 23.75.

446

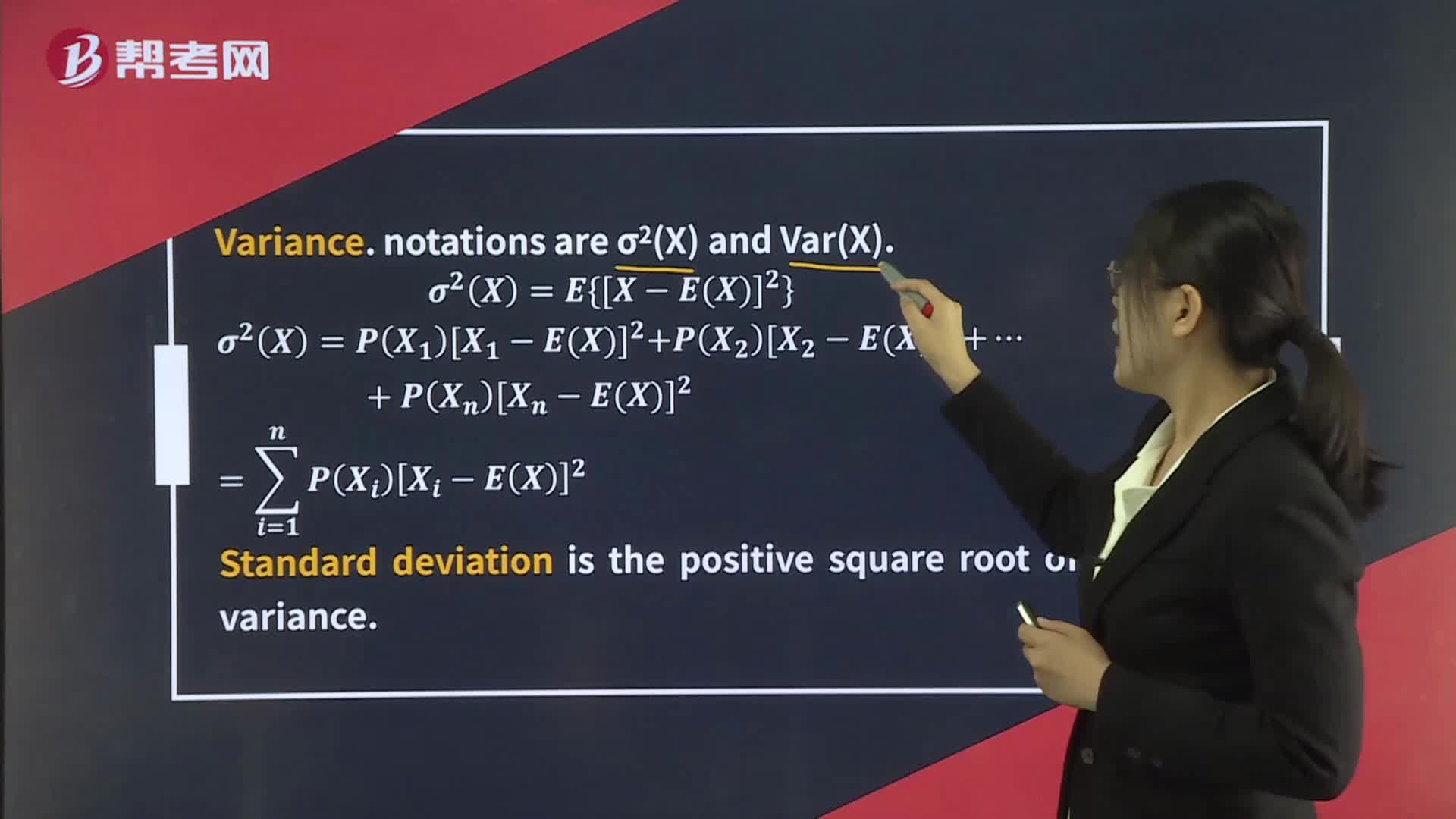

446Expected Value and Variance:A. $9.81:million.,0.05$70 – 37.752 + 0.70$40 – 37.752 + 0.25$25 – 37.752 = $96.18 million. The standard deviation is thus σ = $96.1812 = $9.81 million.,$63600.

583

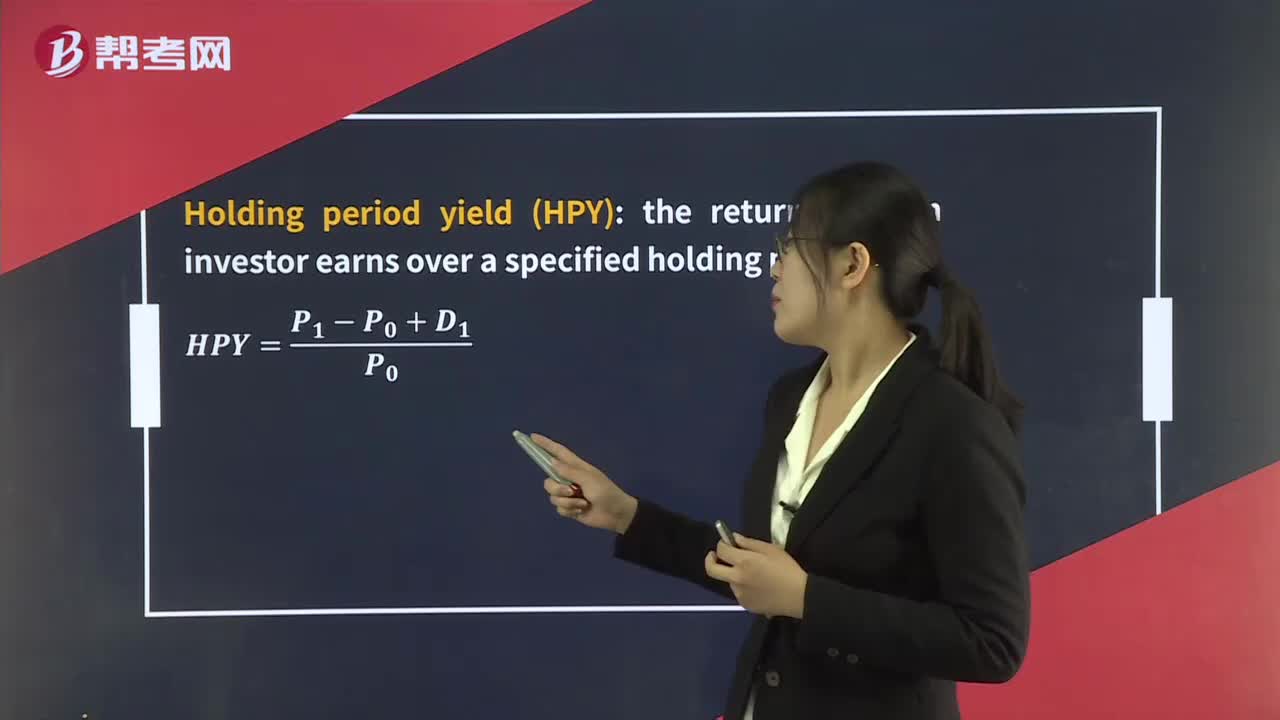

583Money-Weighted Rate of Return & Time-Weighted Rate of Return:[Solutions] C

微信掃碼關(guān)注公眾號

獲取更多考試熱門資料