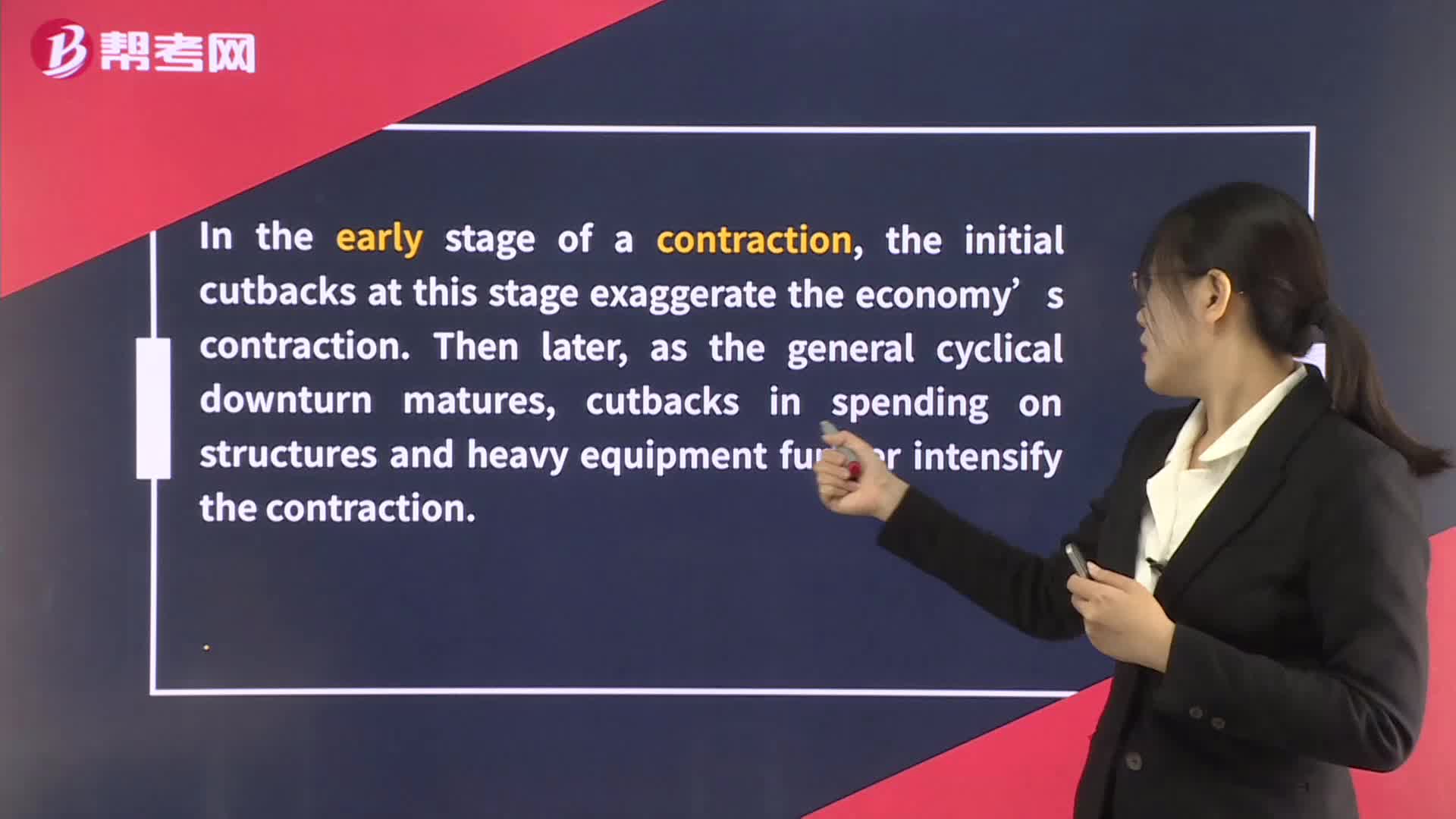

Resource Use through the Business Cycle - Capital Spending

Phases Of the Business Cycle

Housing Sector Behavior through the Business Cycle

External Trade Sector Behavior through the Business Cycle

Deficits and the National Debt

What are the responsibilities of the members in reference to the CFA Institute?

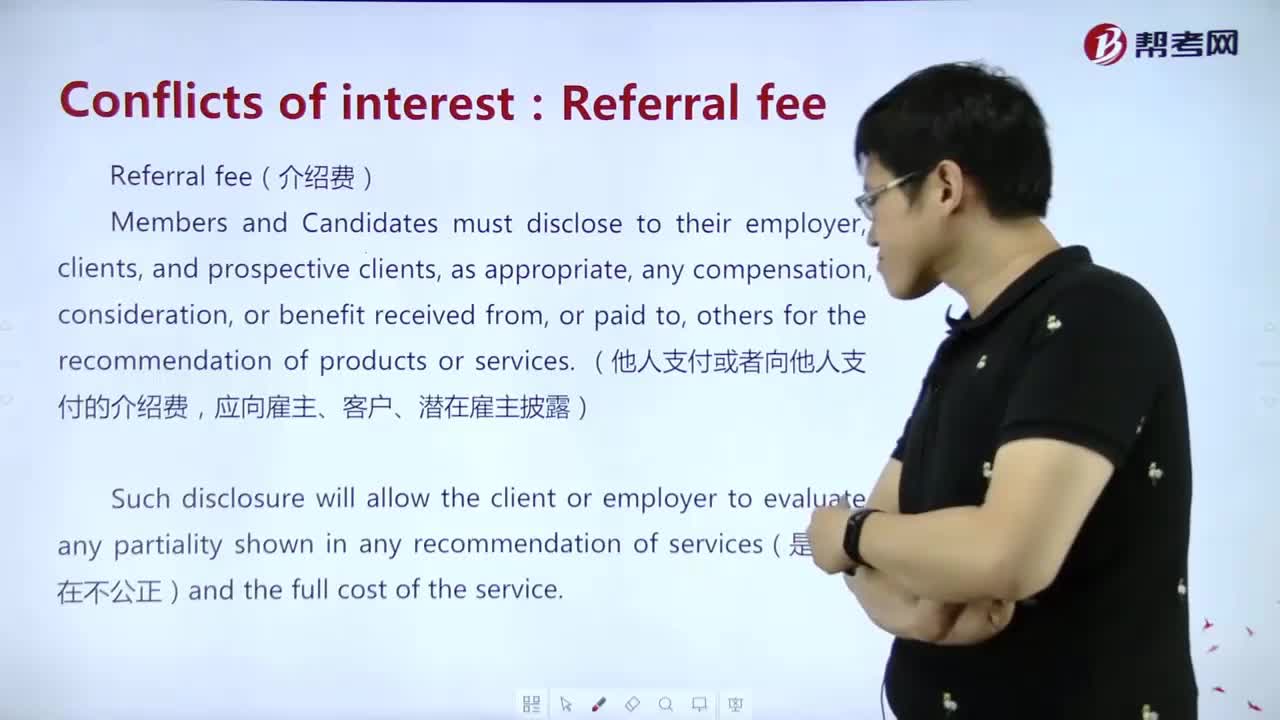

What’s the main idea of referral fee?

How to identifying the actual investment client and voting proxy policies?

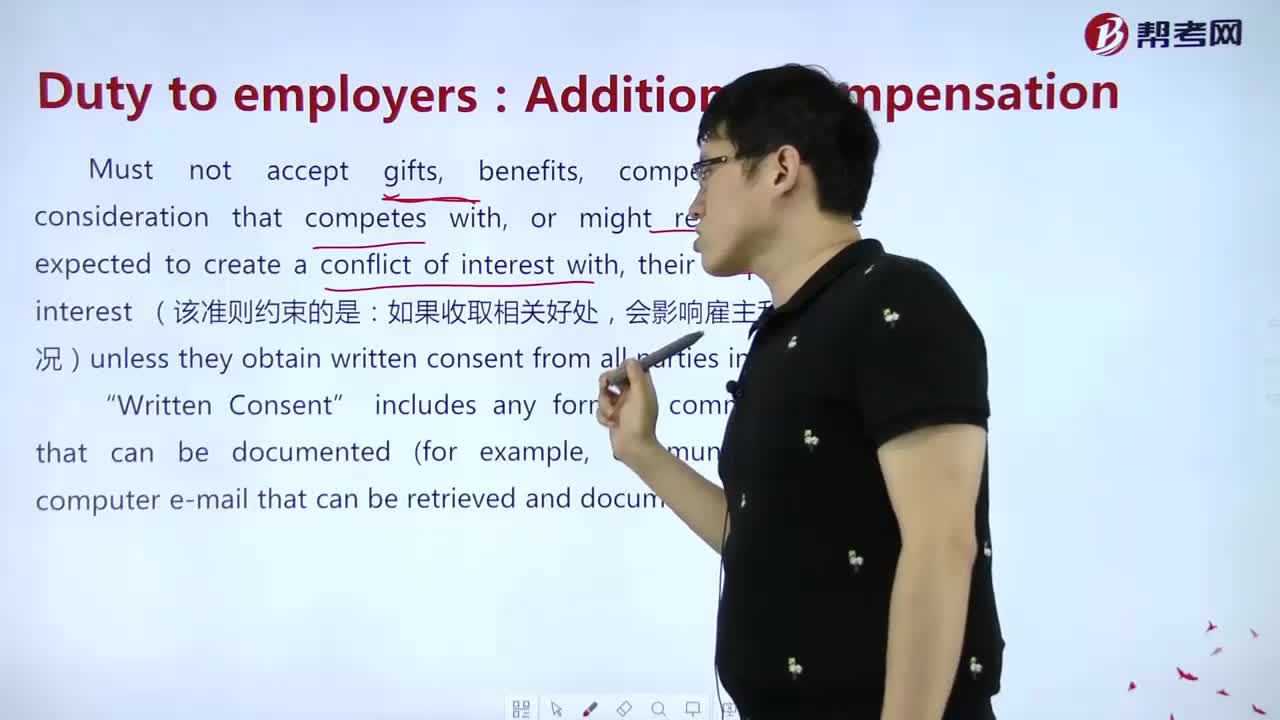

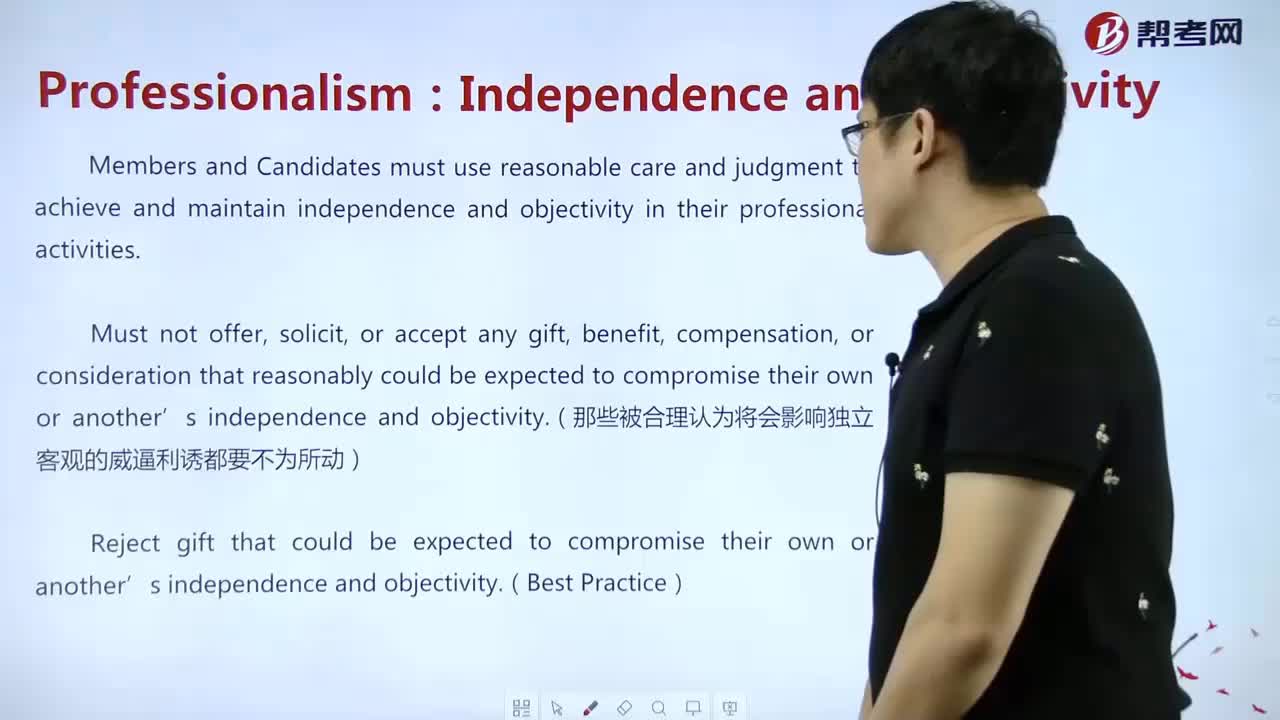

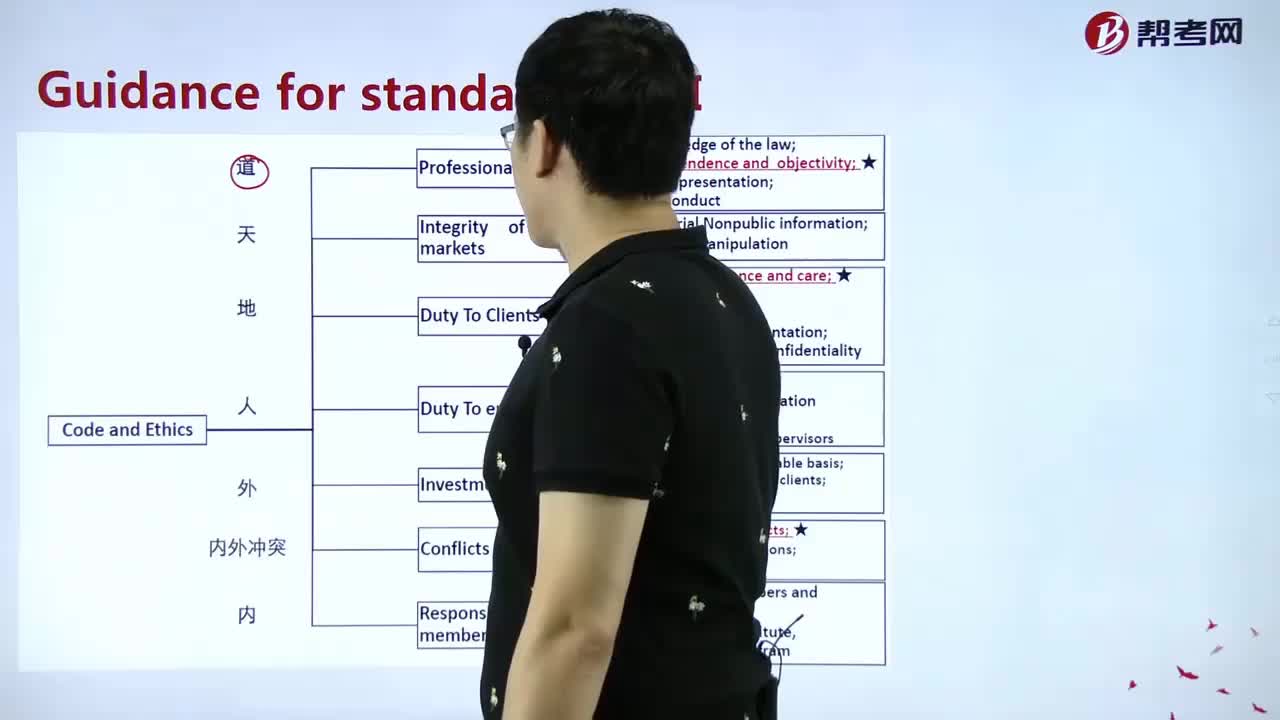

How to understand the guidance for Standards I–VII?

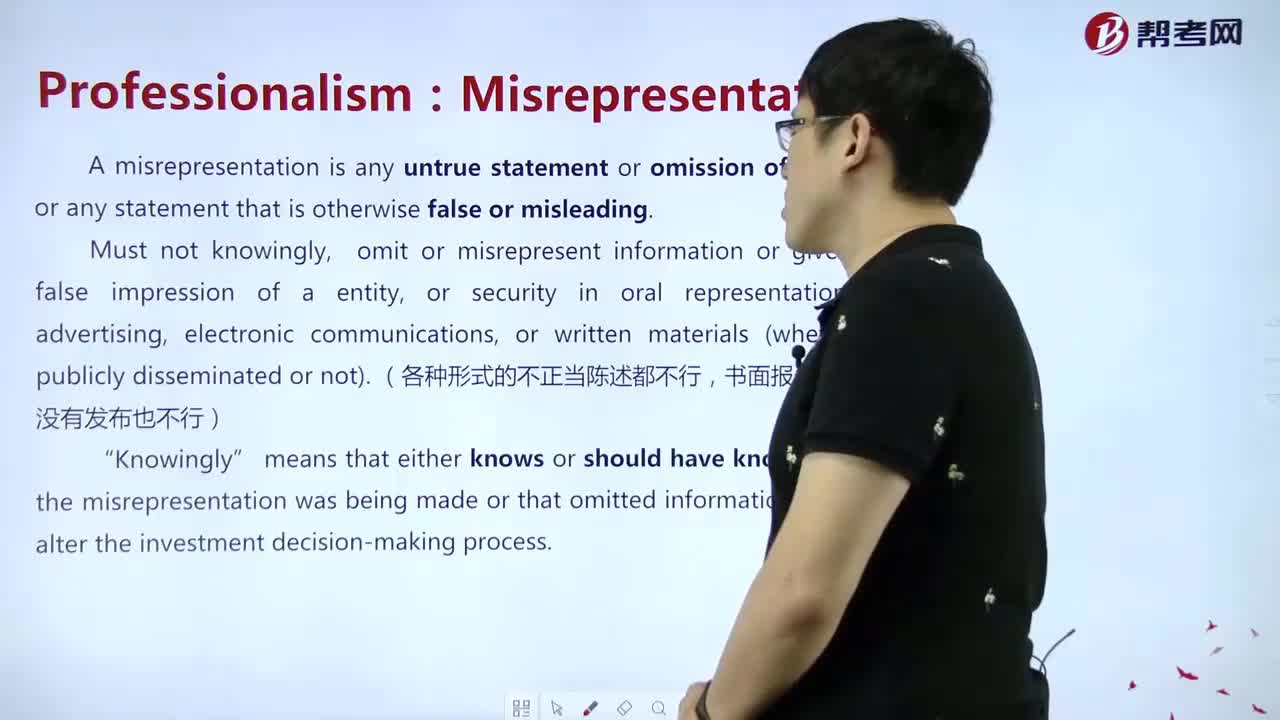

How to understand the meaning of misrepresentation?

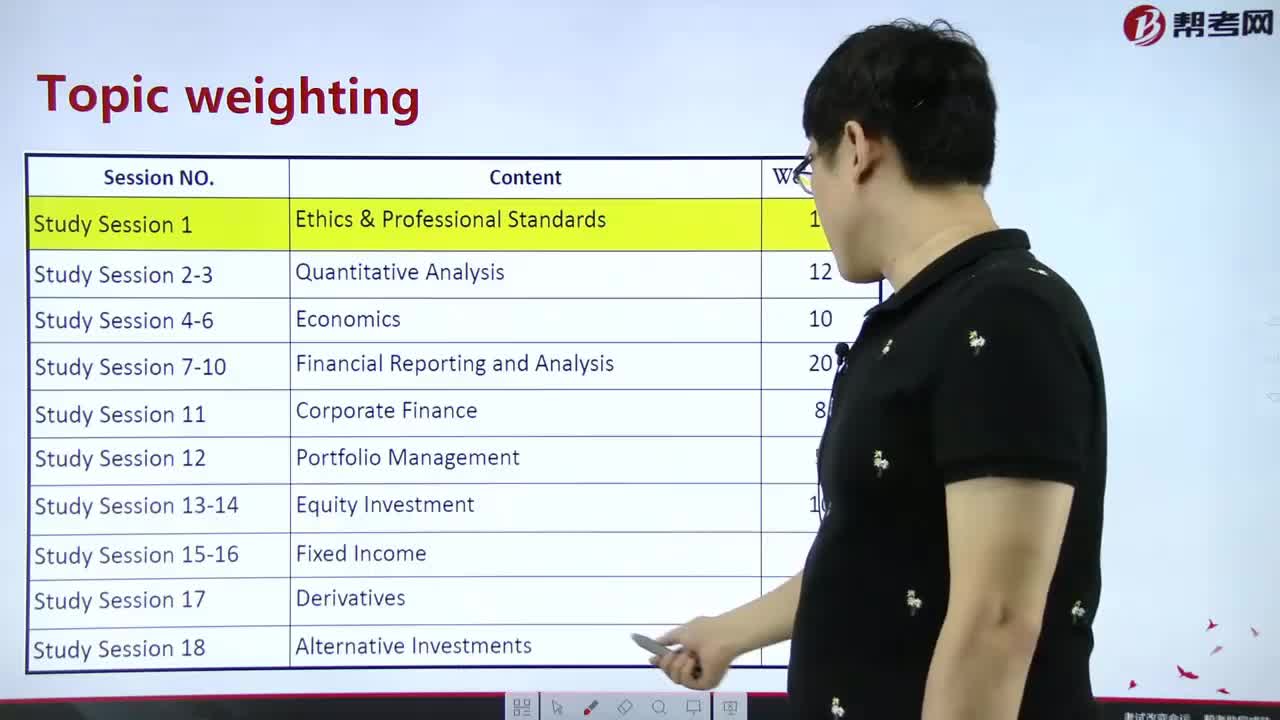

What are the ethics and trust in the investment profession?

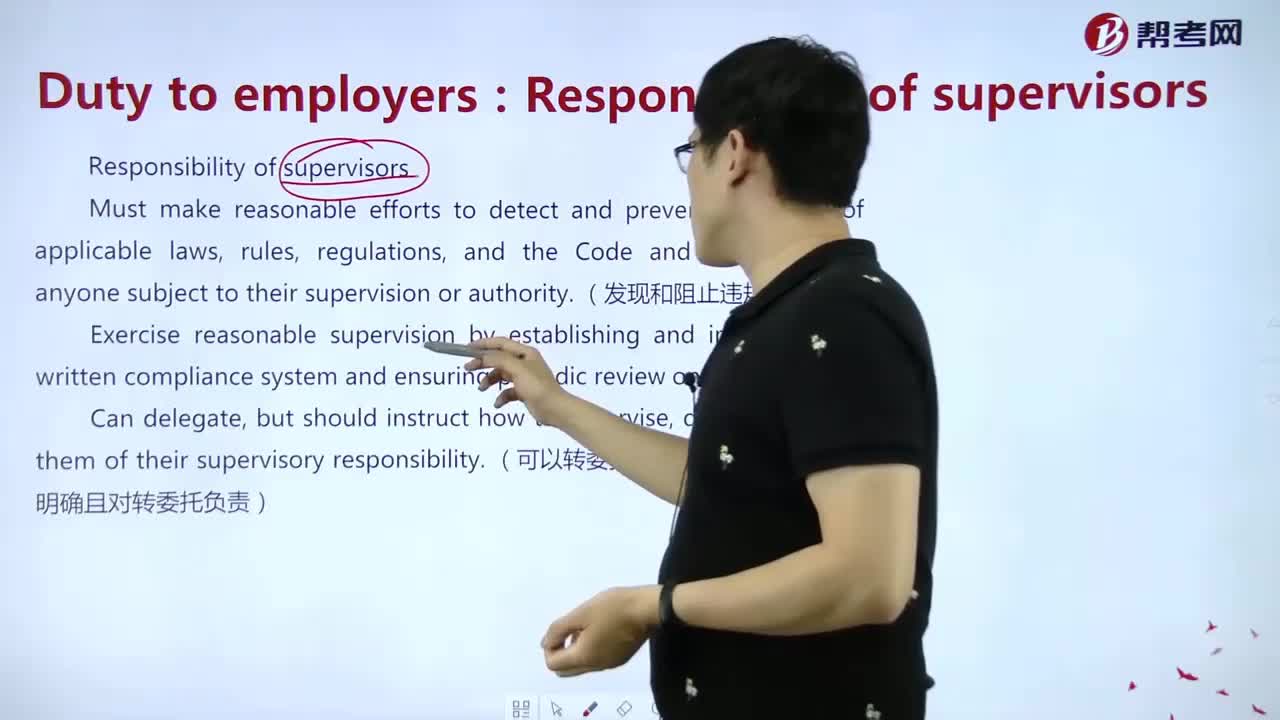

What’s the responsibility of supervisors?

下載億題庫APP

聯(lián)系電話:400-660-1360