Currency Regimes– Fixed Parity and Target Zone

Absolute and Comparative Advantage

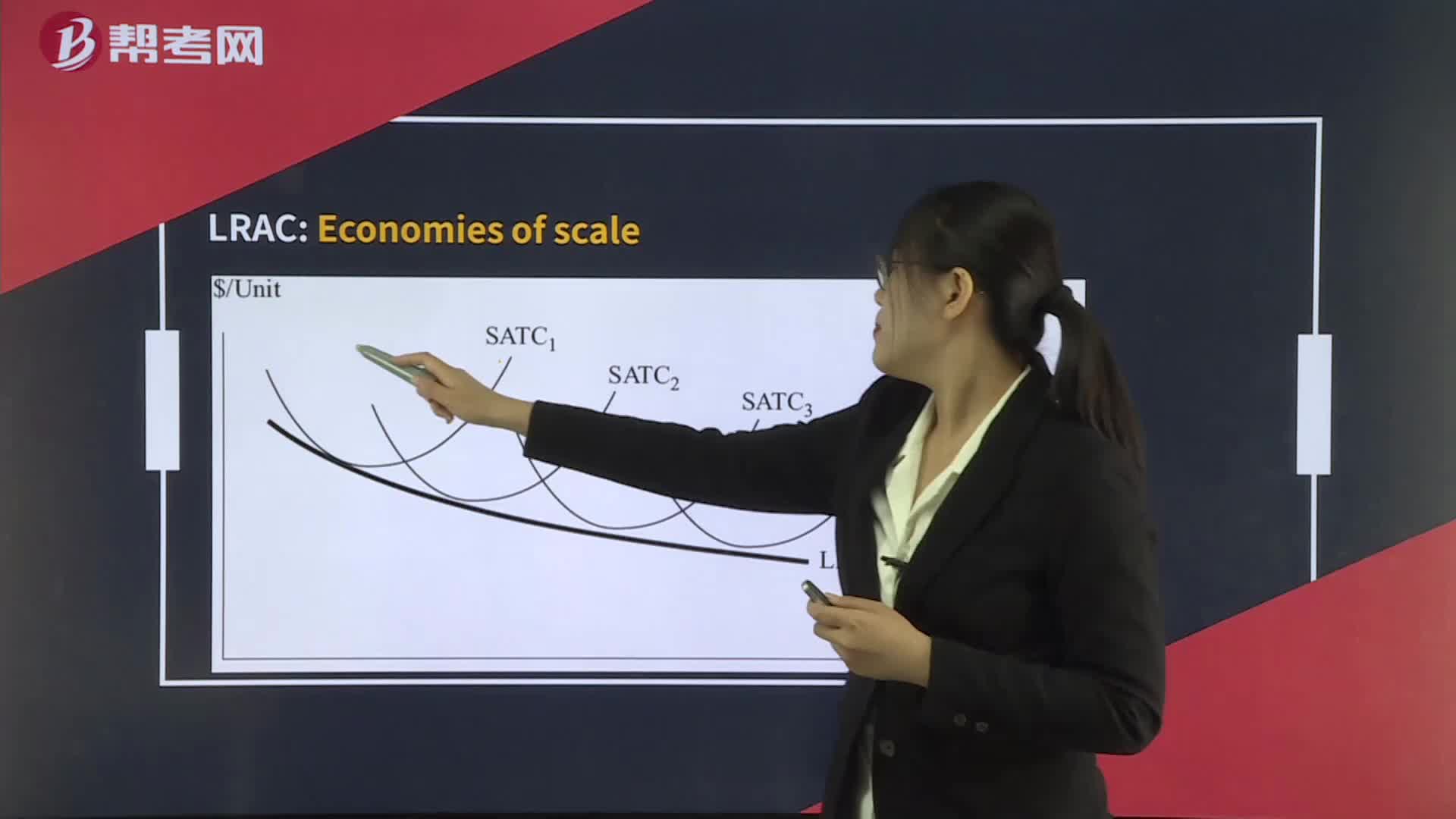

Economies of Scale and Diseconomies of Scale

Benefits and Costs of International Trade

Historical Perspective on Currency Regimes

Shifts in the AD and AS curves and Equilibriums

Financial Statements and Supplementary Information

Currency Regimes - Dollarization and Monetary Union

Currency Regimes - Currency Board System

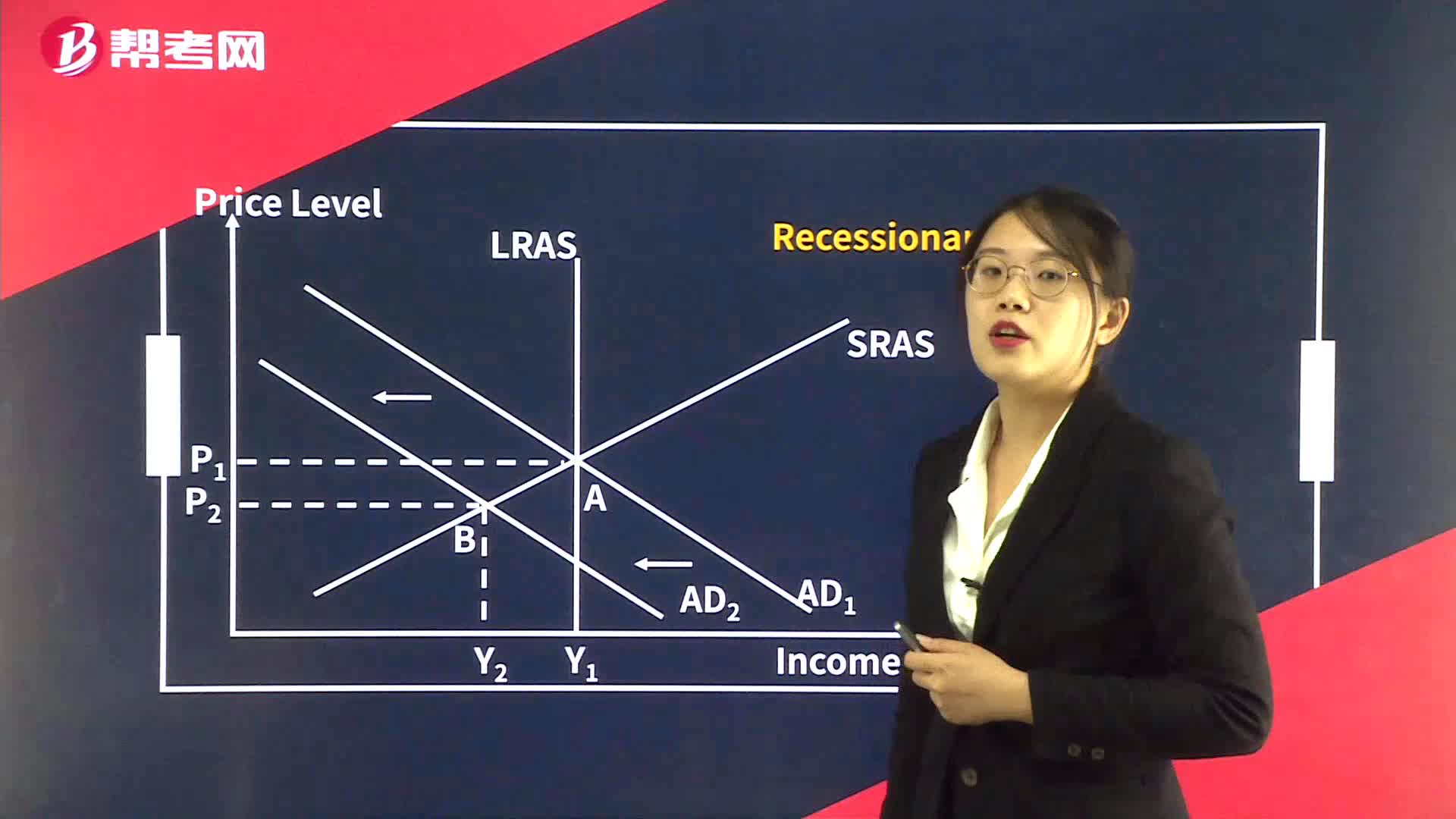

Equilibrium GDP and Prices

The Relationship Between Fiscal and Monetary Policy

Equilibrium GDP and Prices - Recessionary Gap

下載億題庫APP

聯(lián)系電話:400-660-1360