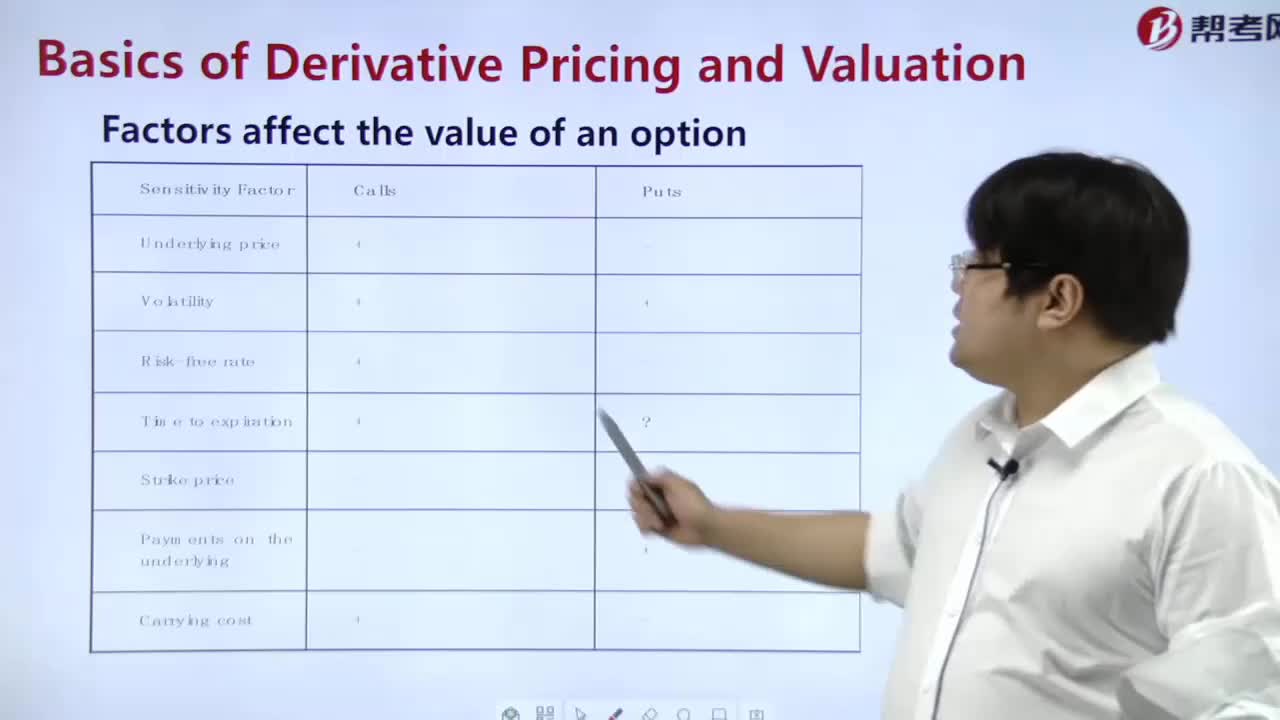

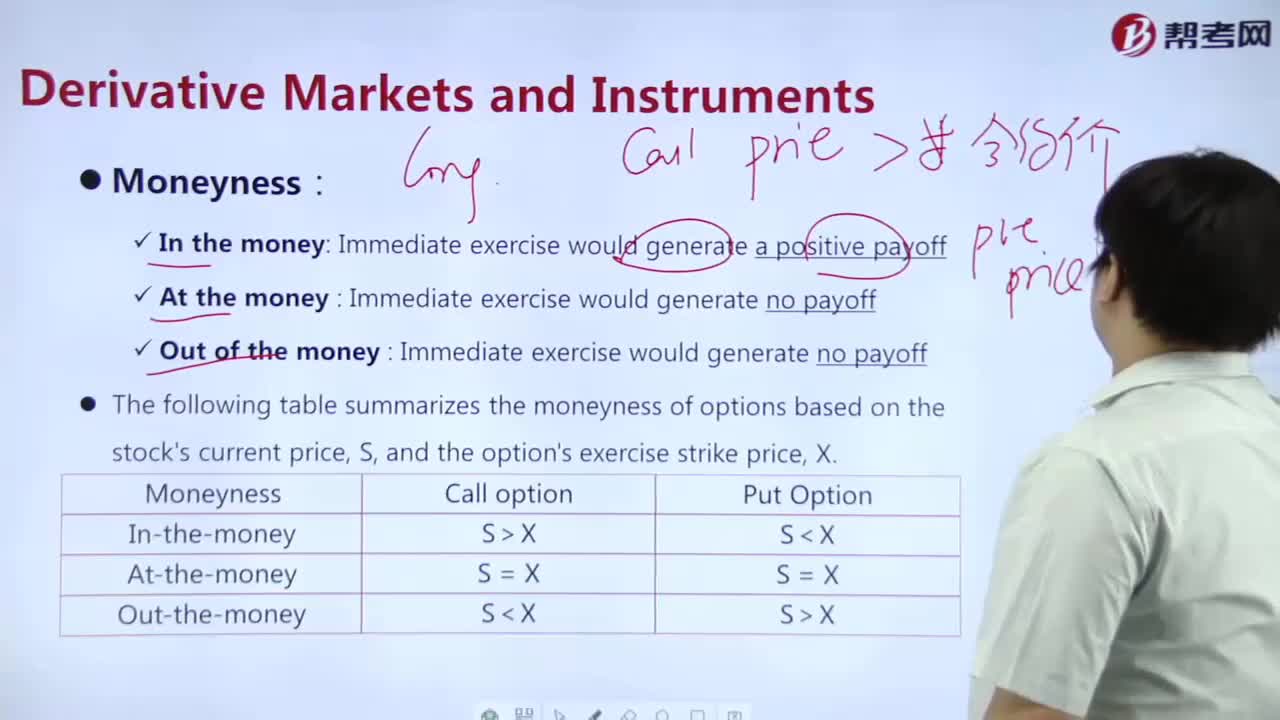

What are the factors that affect the value of options?

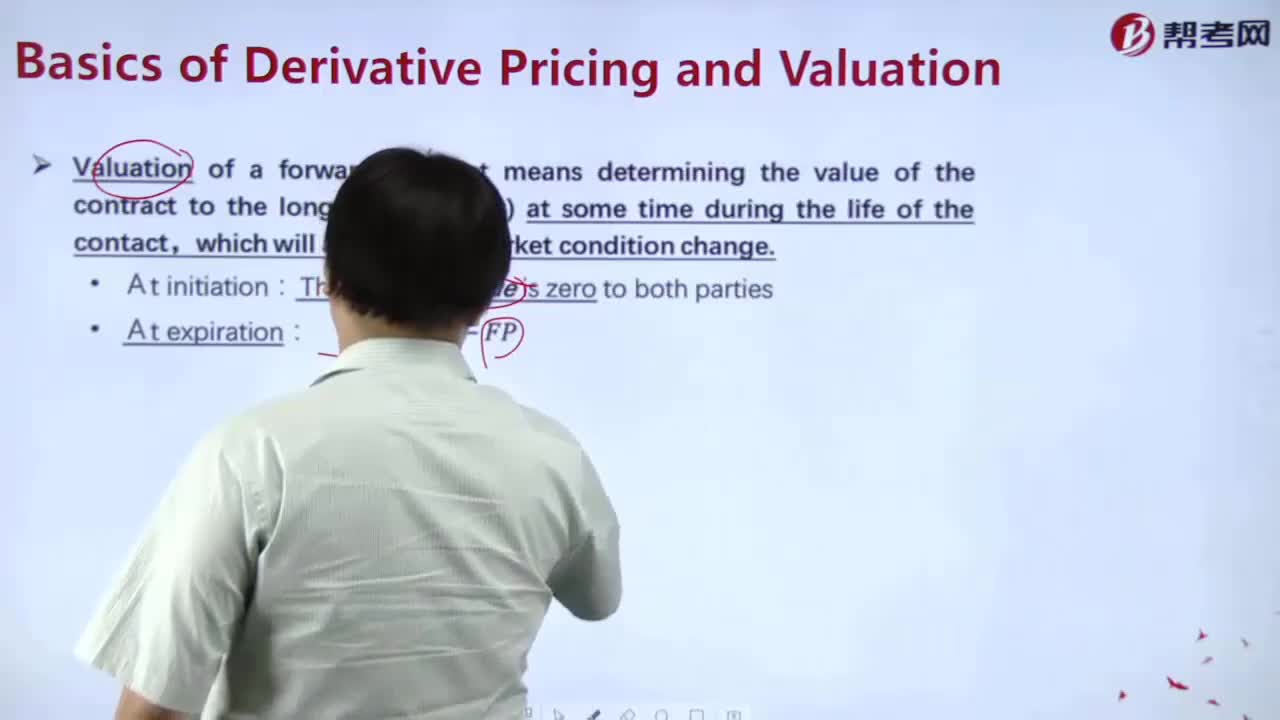

What's the value?

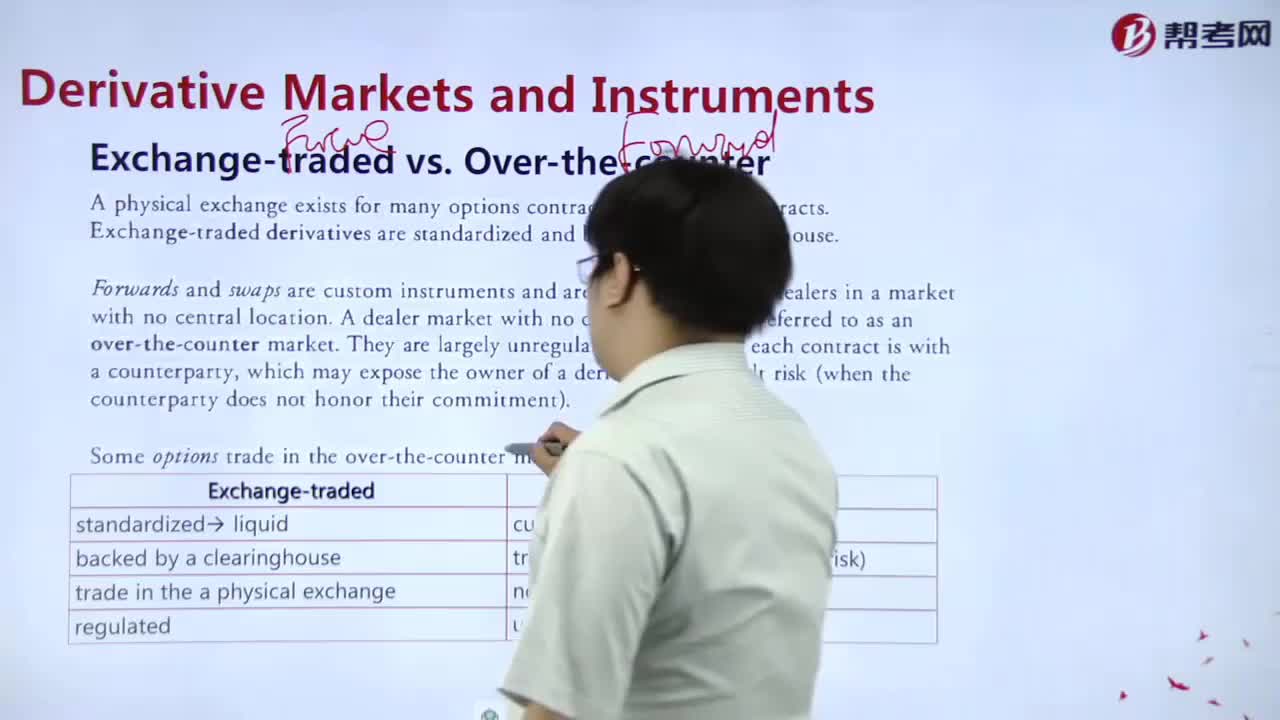

What's an over-the-counter deal?

How to determine the value of an option purchased?

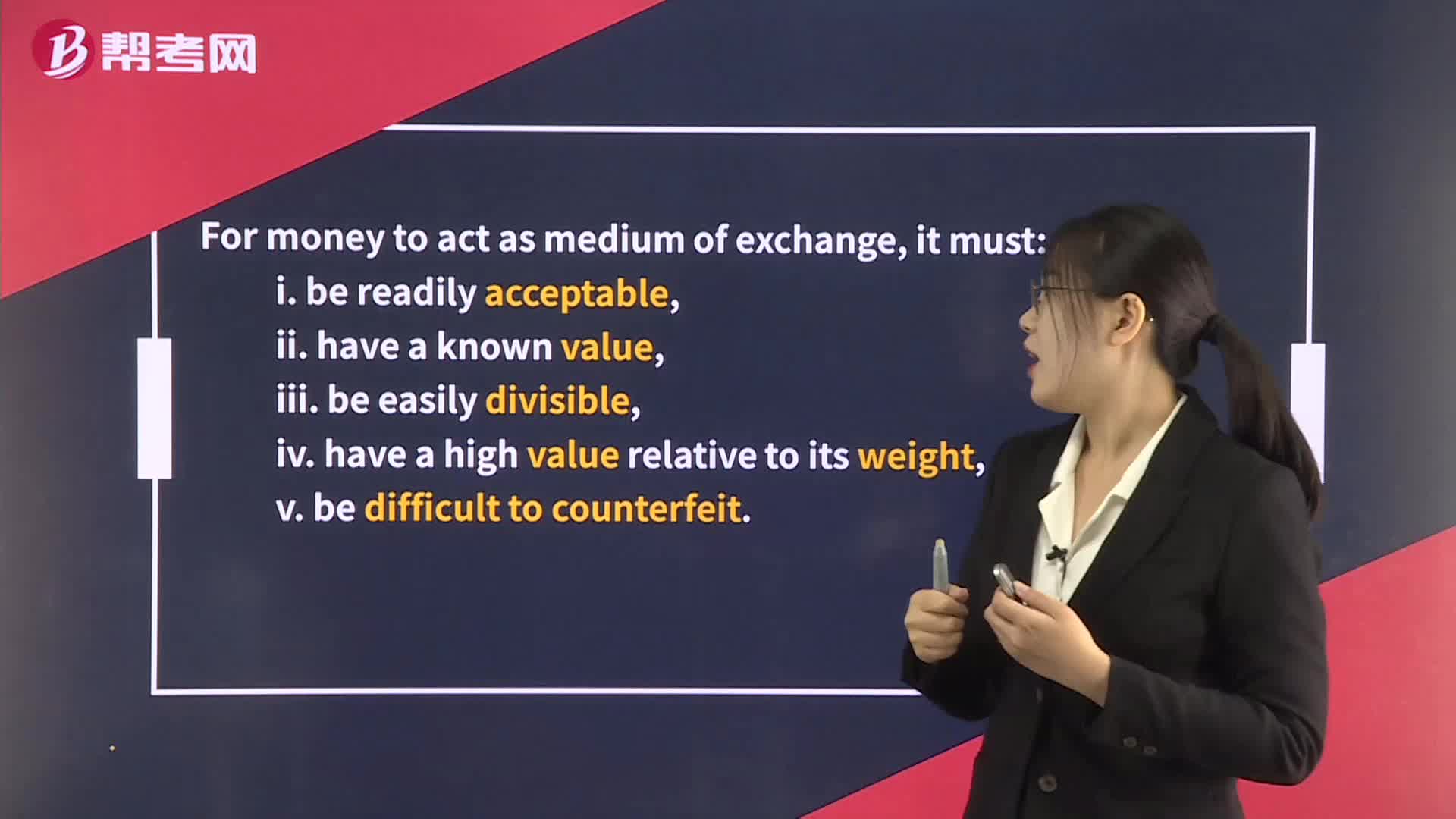

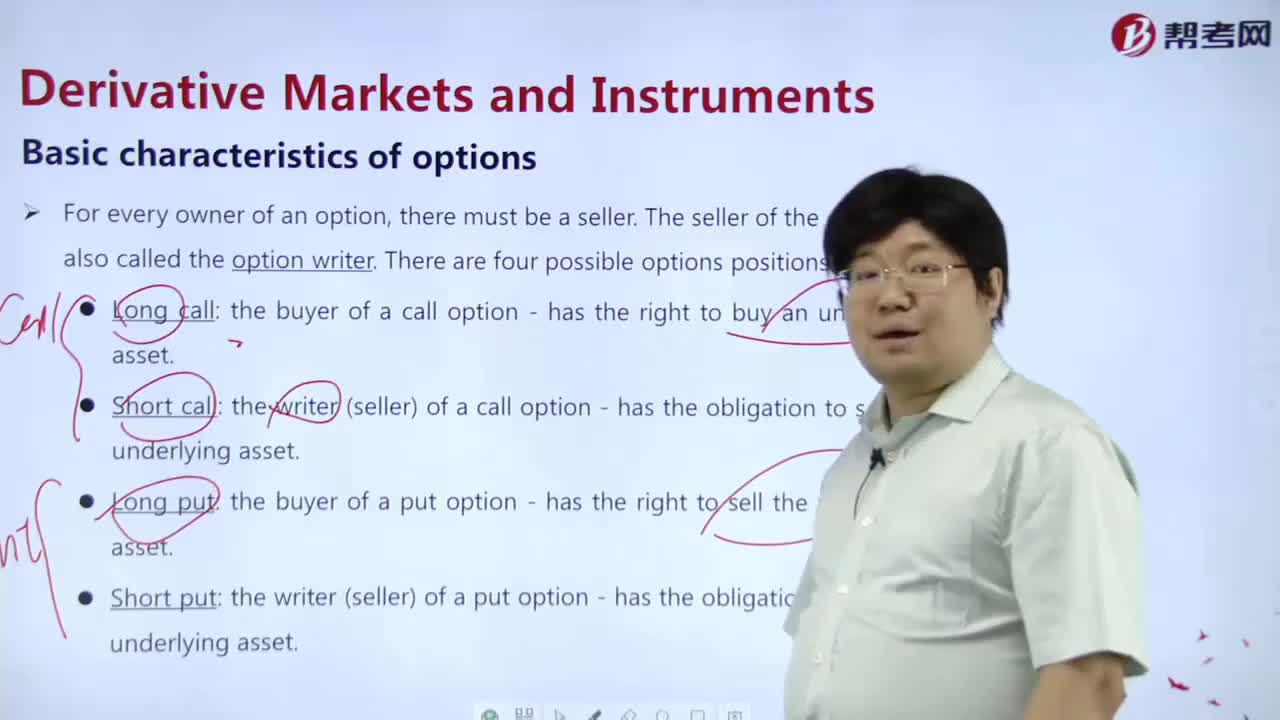

What are the basic characteristics of an option?

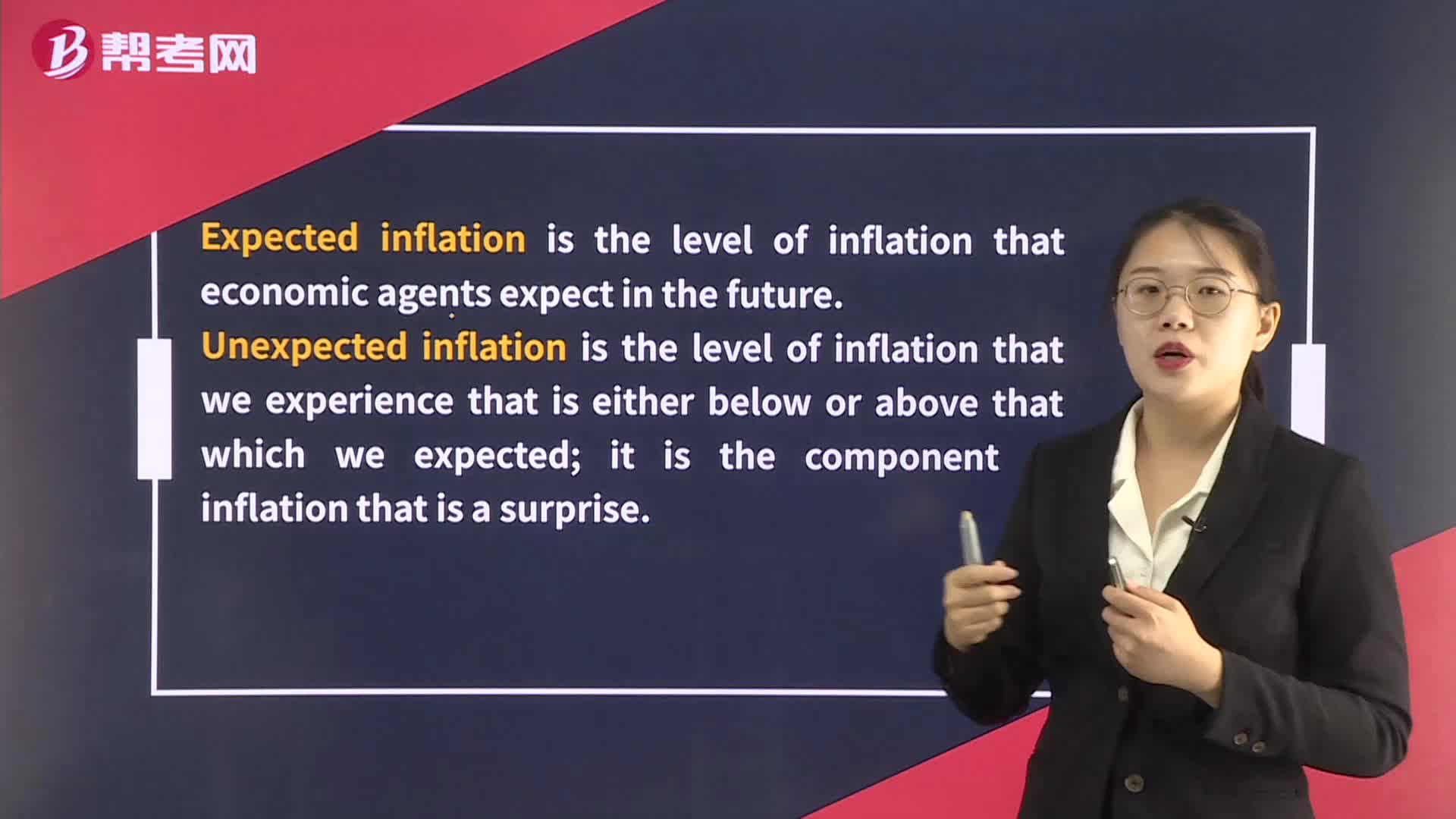

What is the definition of an option?

What is the definition of an interchange?

What are the other investments?

What are the types of alternative investments?

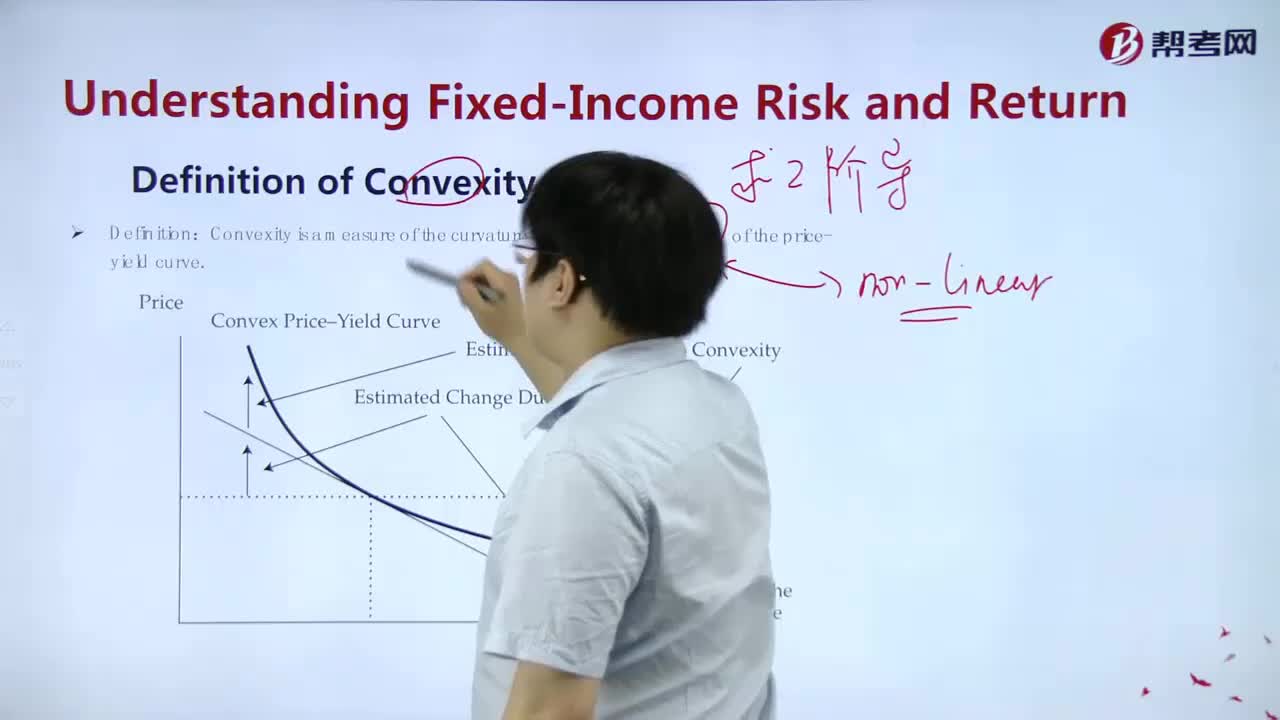

What's the meaning of?Definition of Convexity?

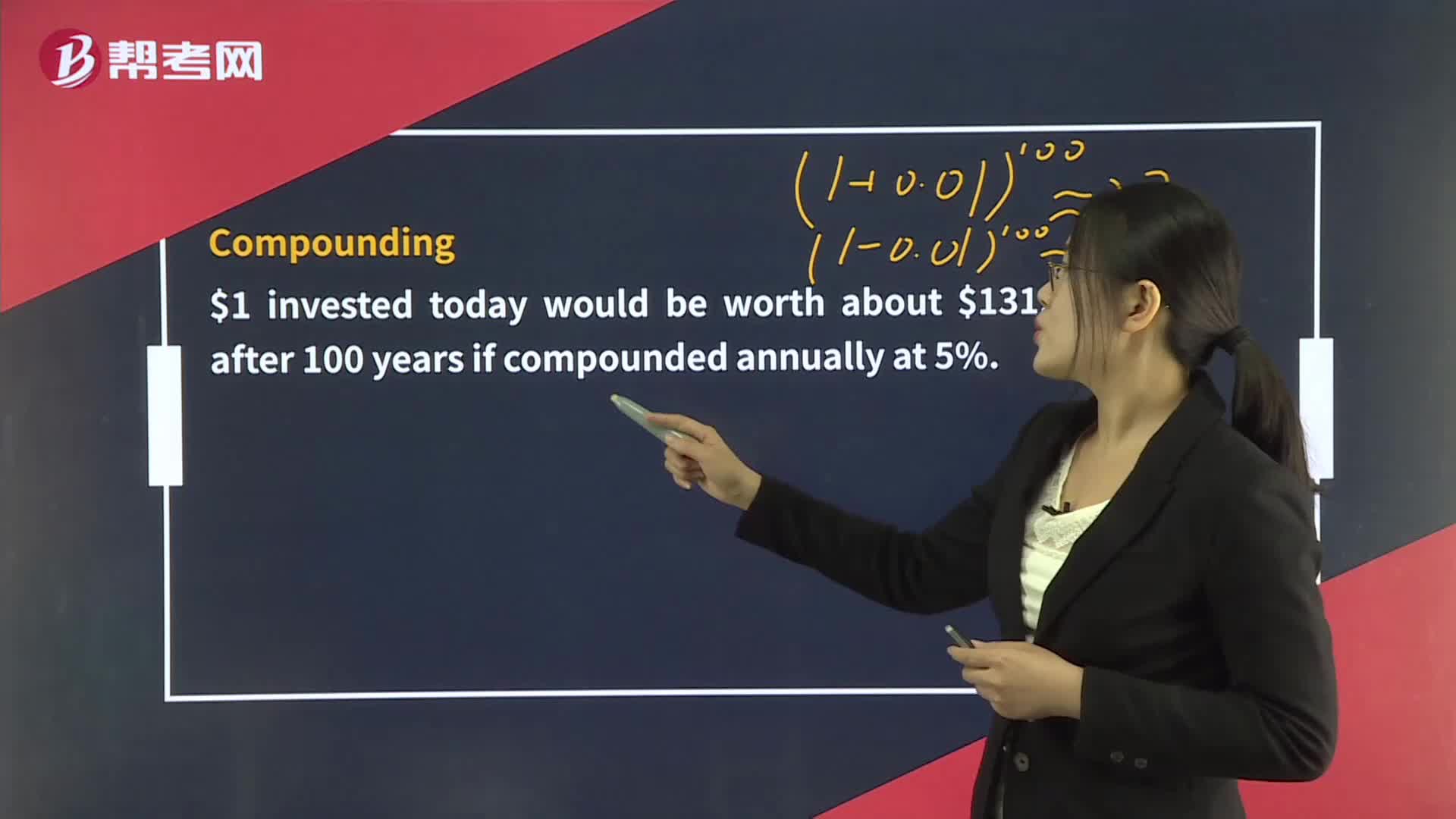

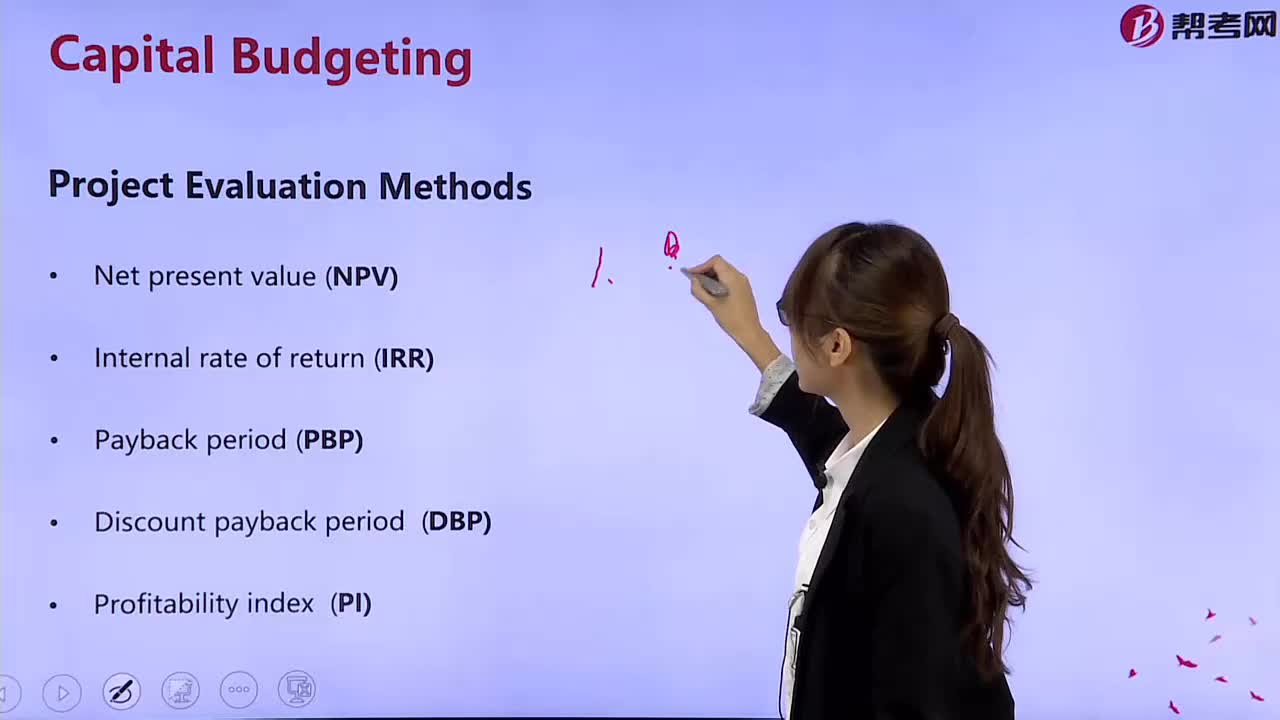

What is the net present value?

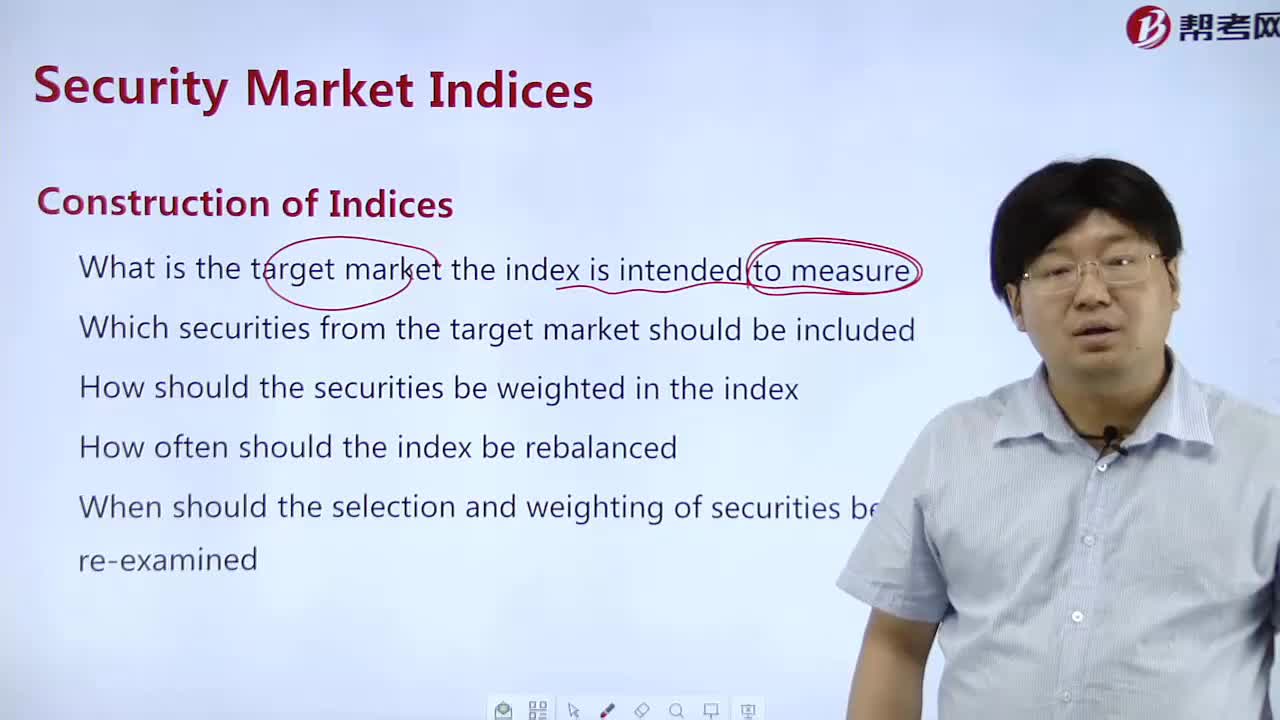

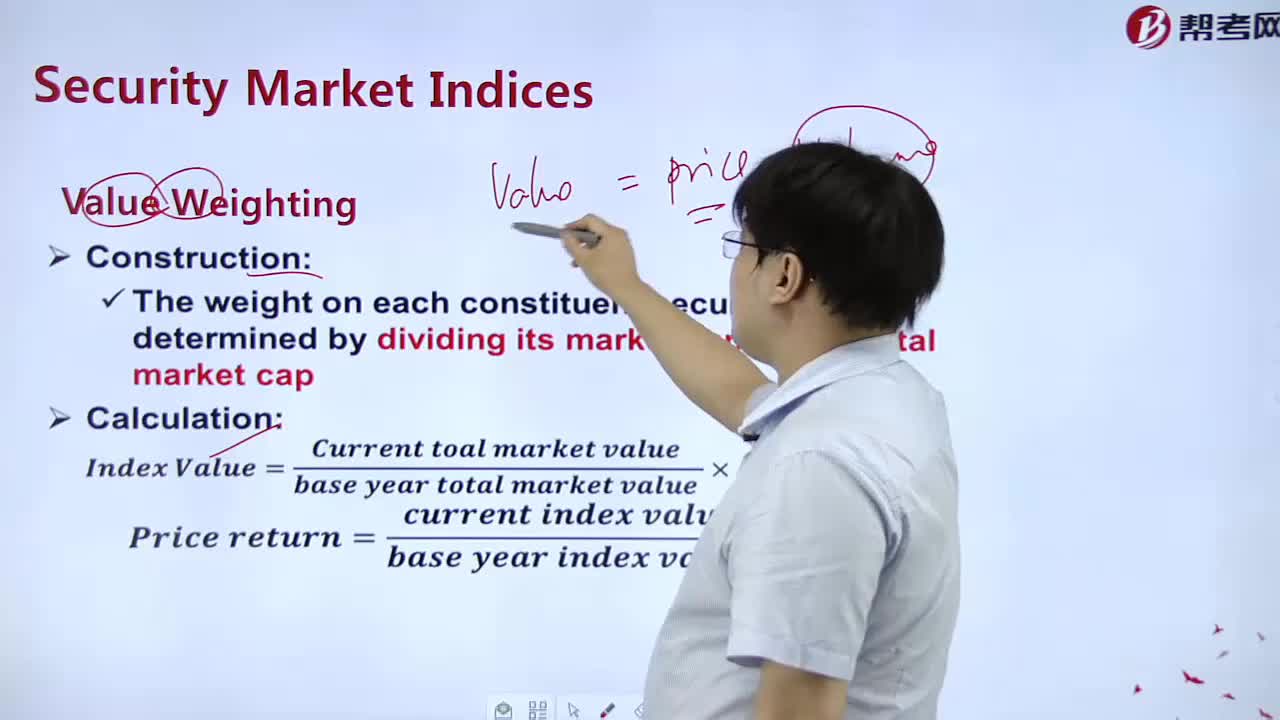

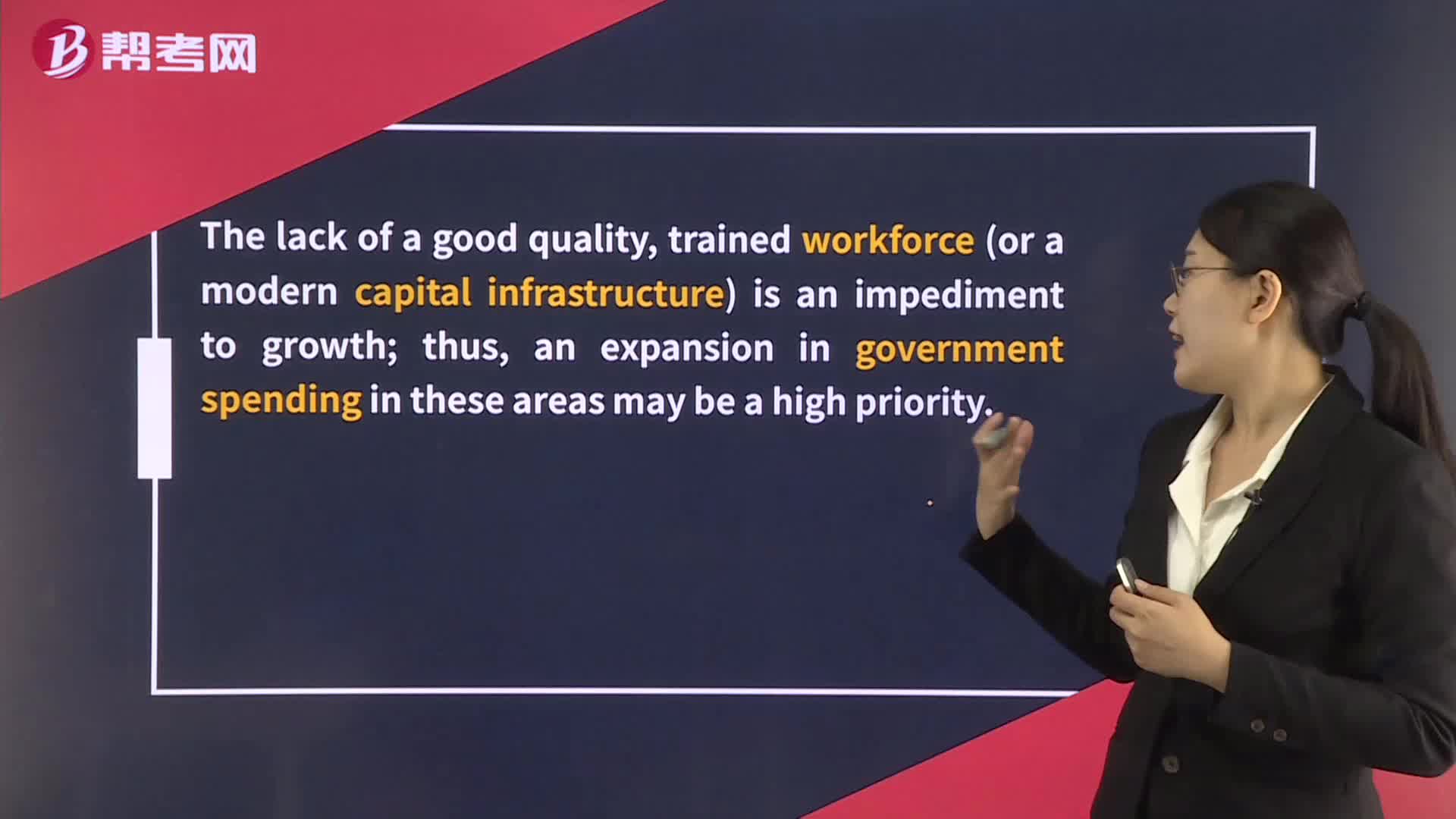

What are the factors that investors need to consider?

下載億題庫APP

聯(lián)系電話:400-660-1360