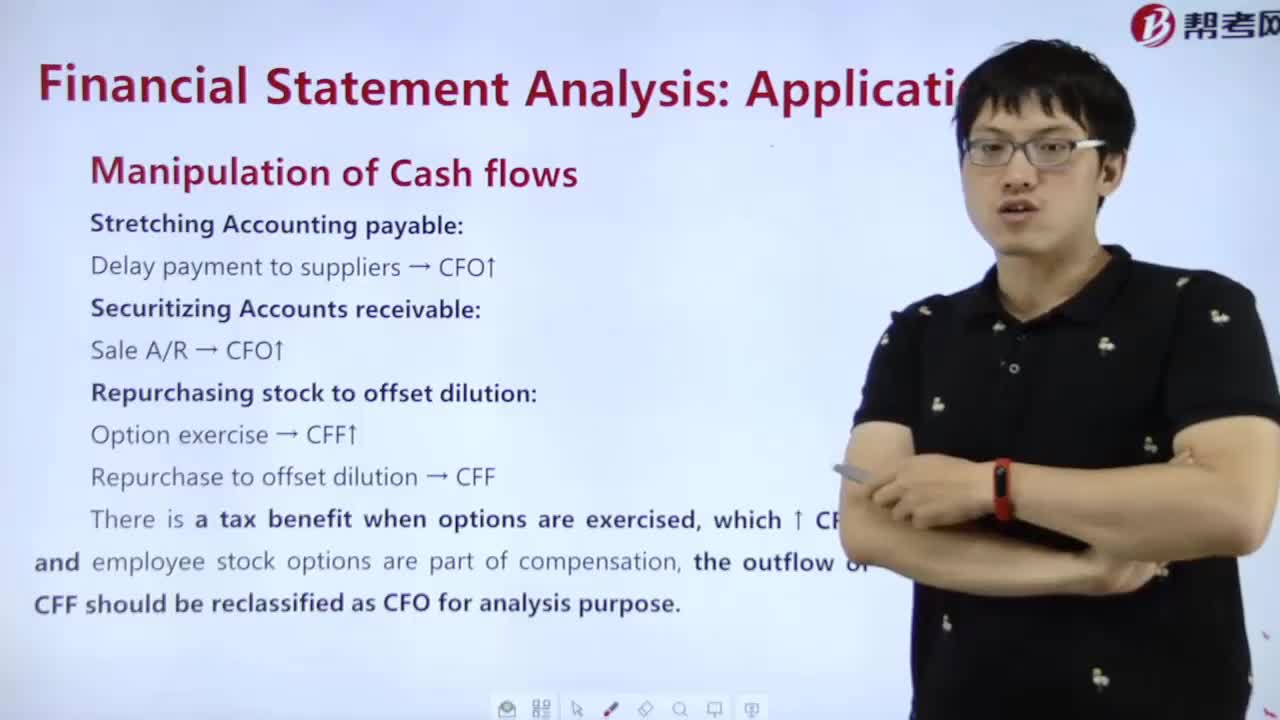

How to explain Manipulation of Cash flows?

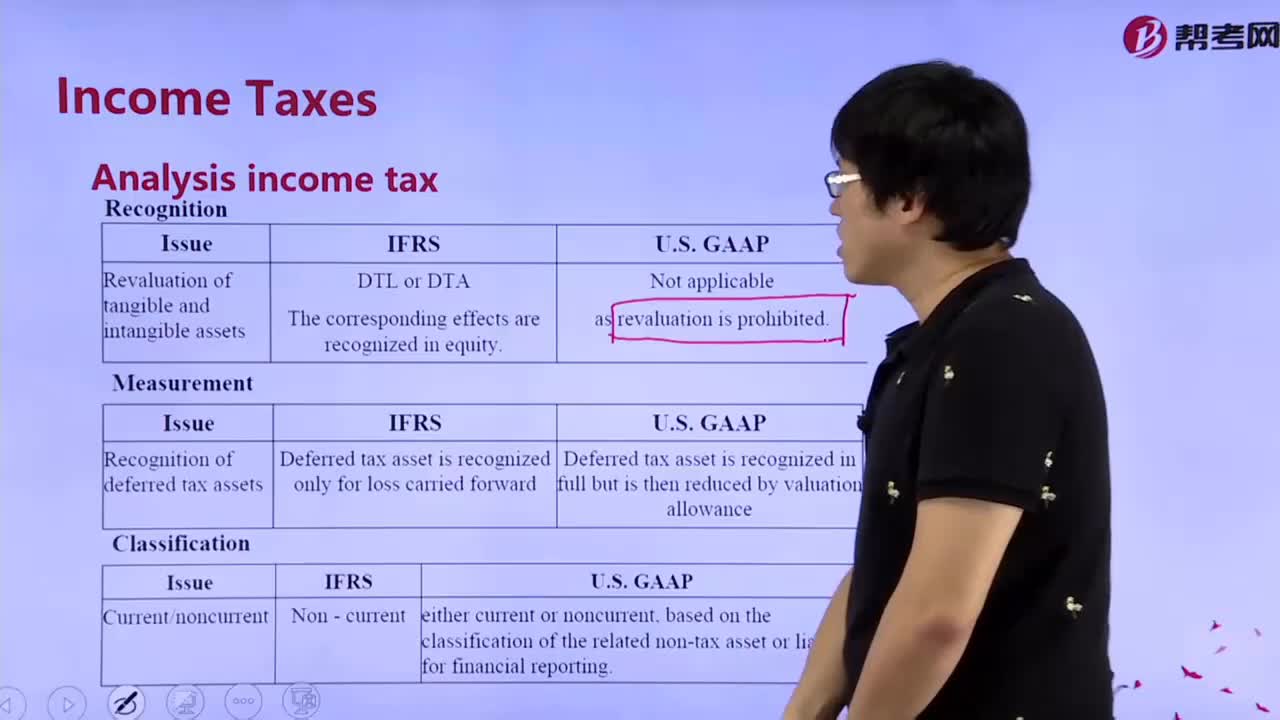

What's the meaning of Analysis income tax?

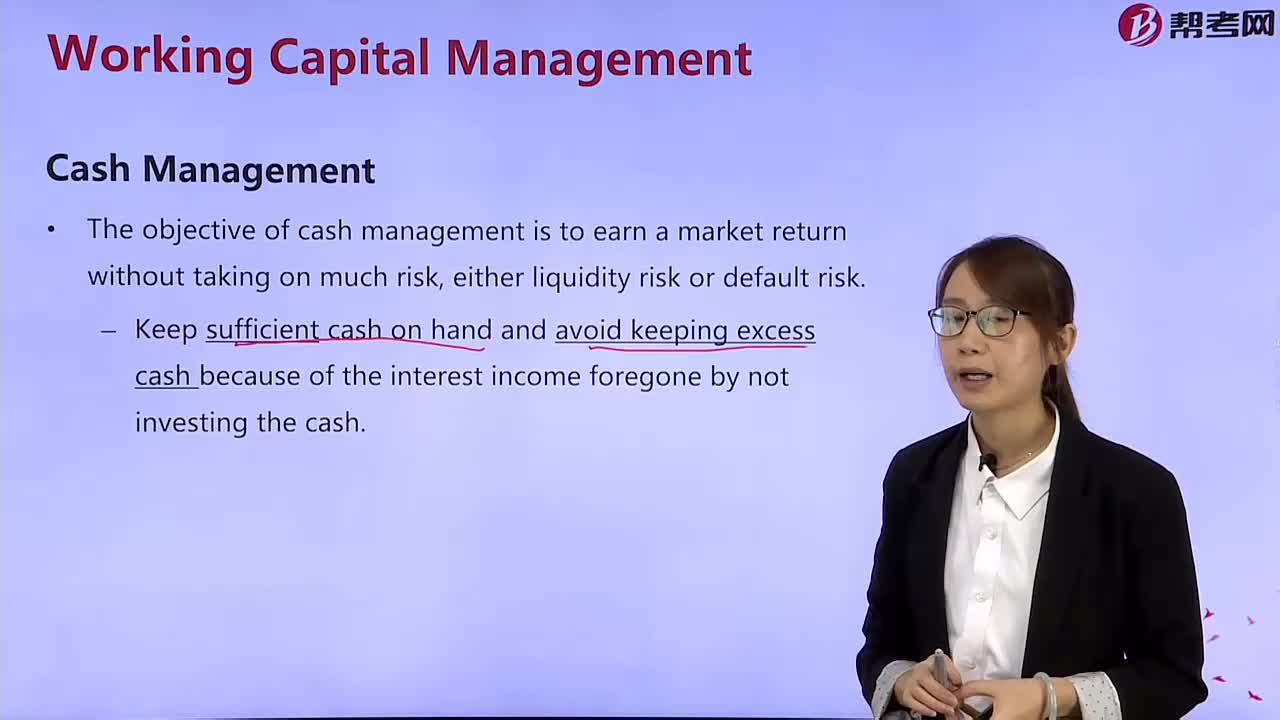

What is cash management?

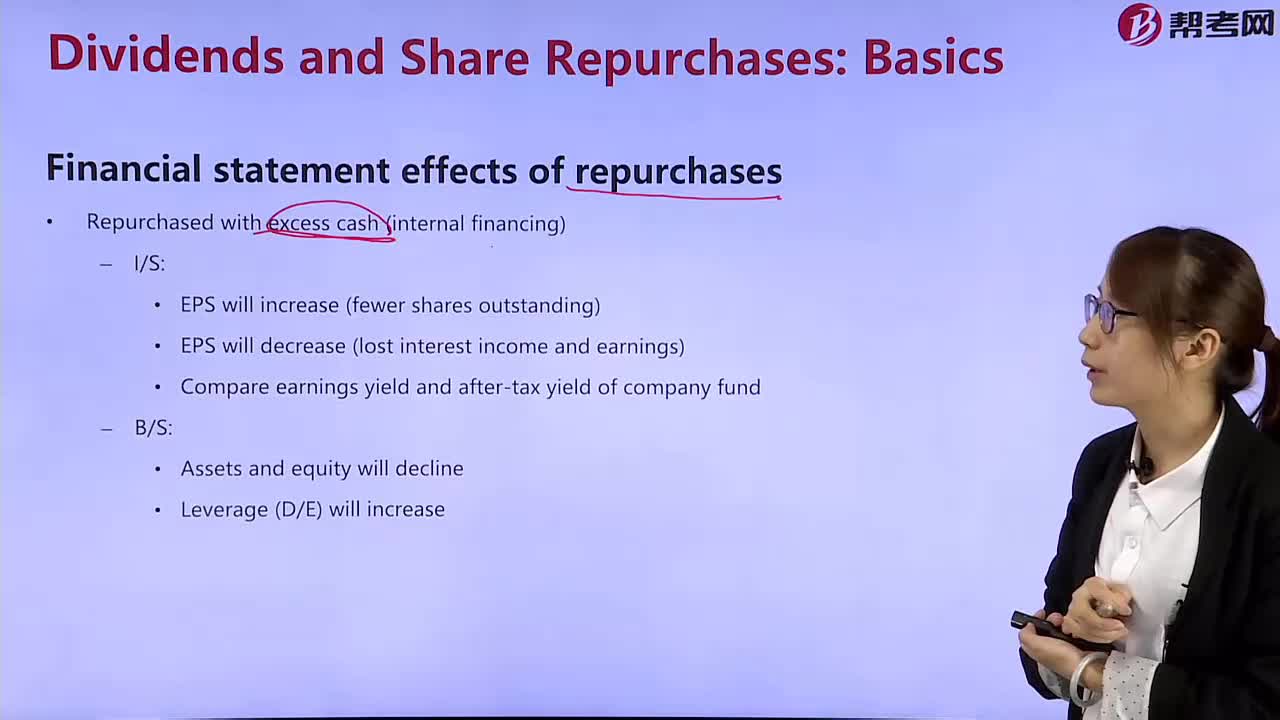

What is the effect of the repurchase on the financial statements?

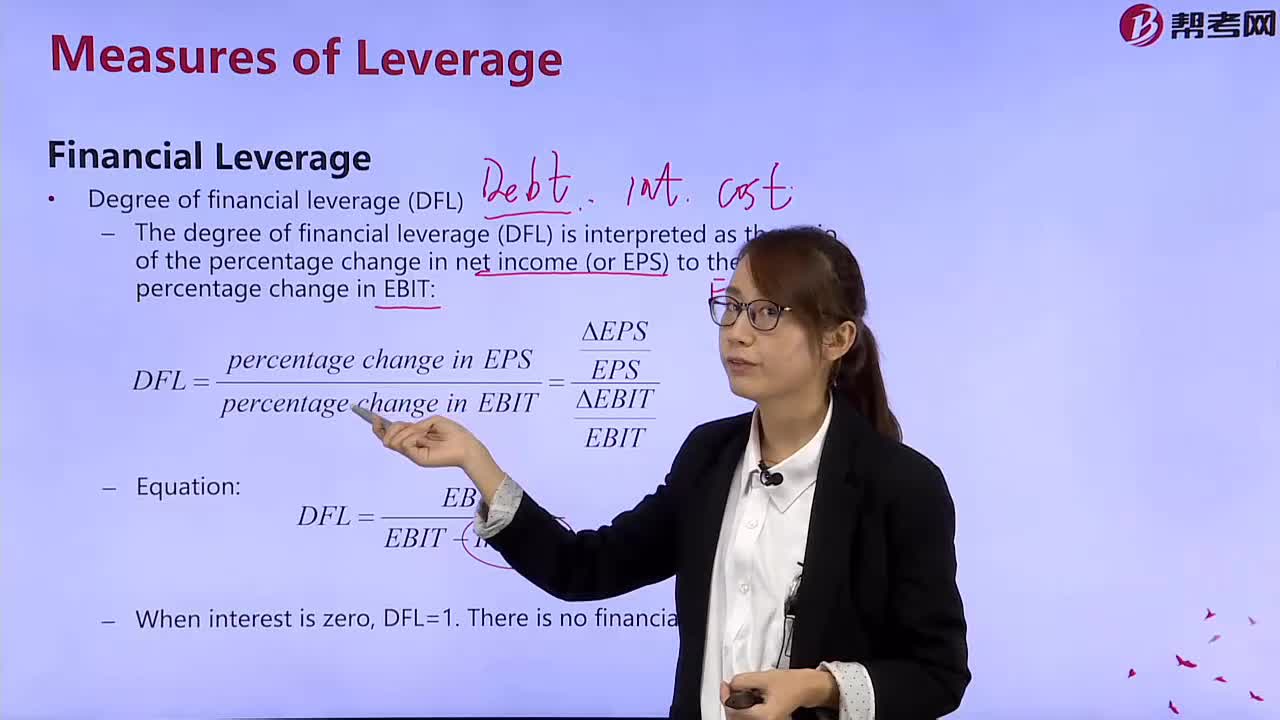

How to calculate the degree of financial leverage?

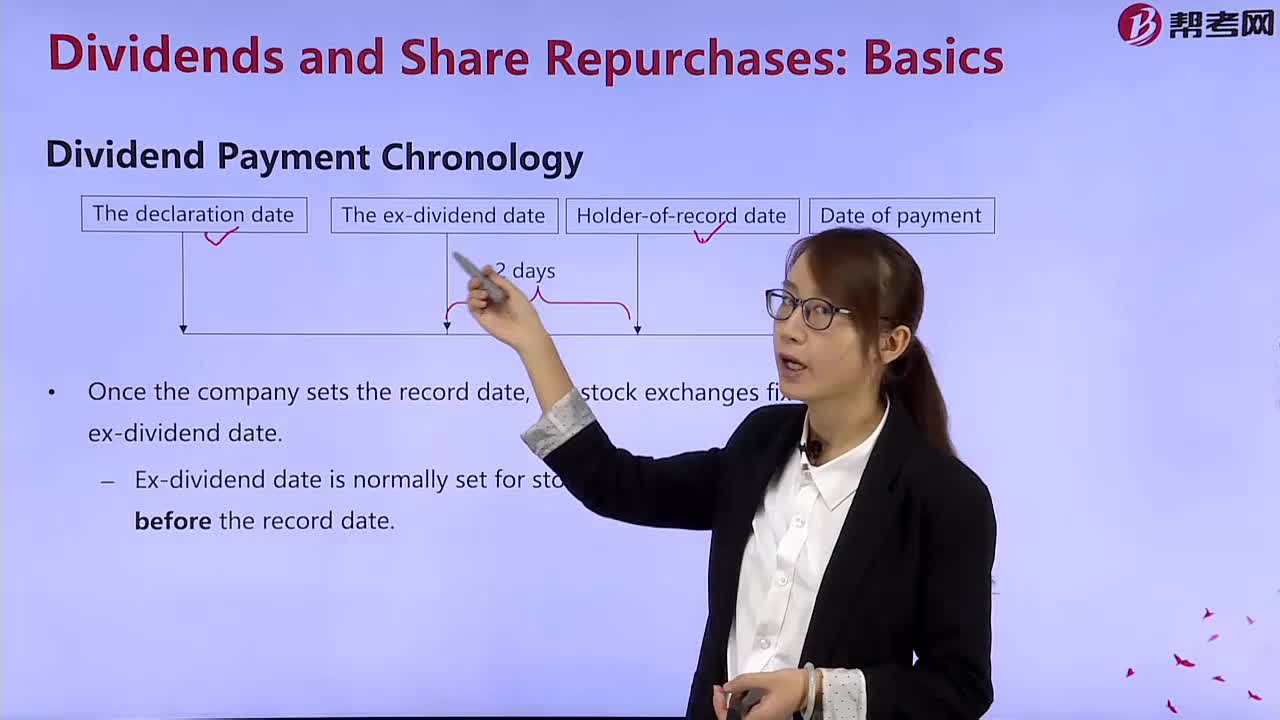

What is included in the annual statement of dividend payment?

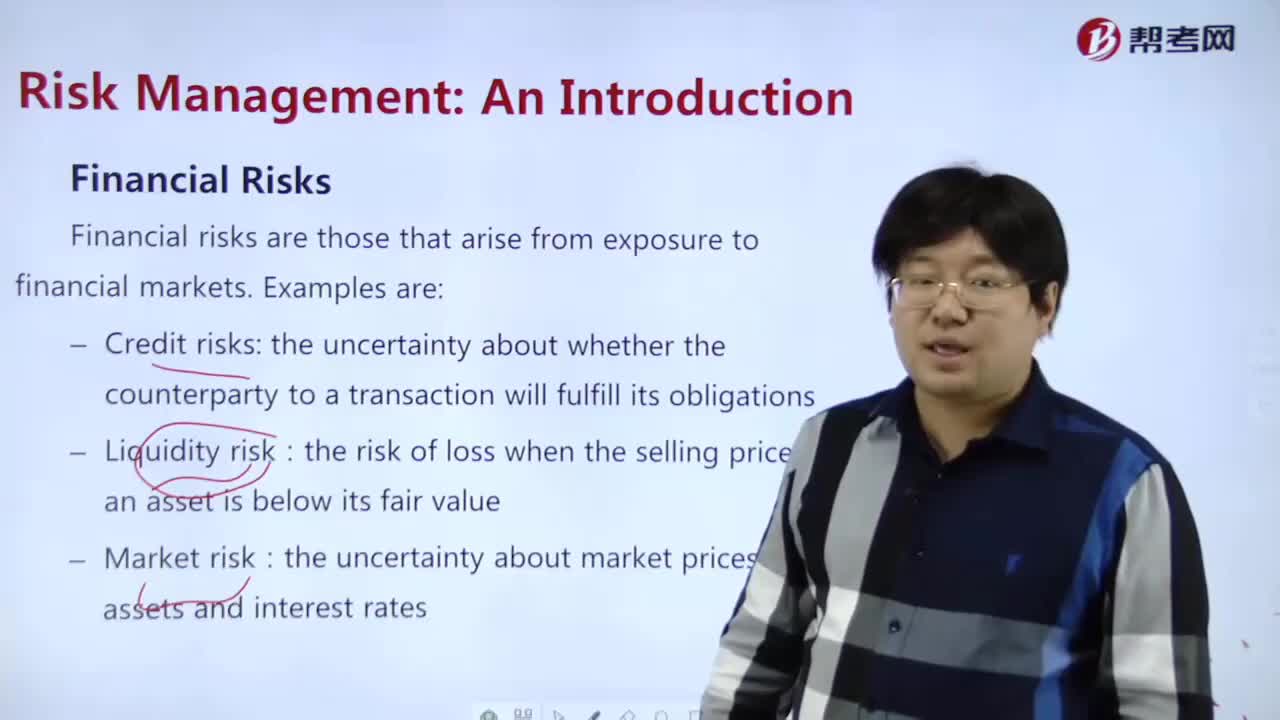

What are the types of financial risks?

How to master Cash Flow Statement?

How to master Measurement of financial elements?

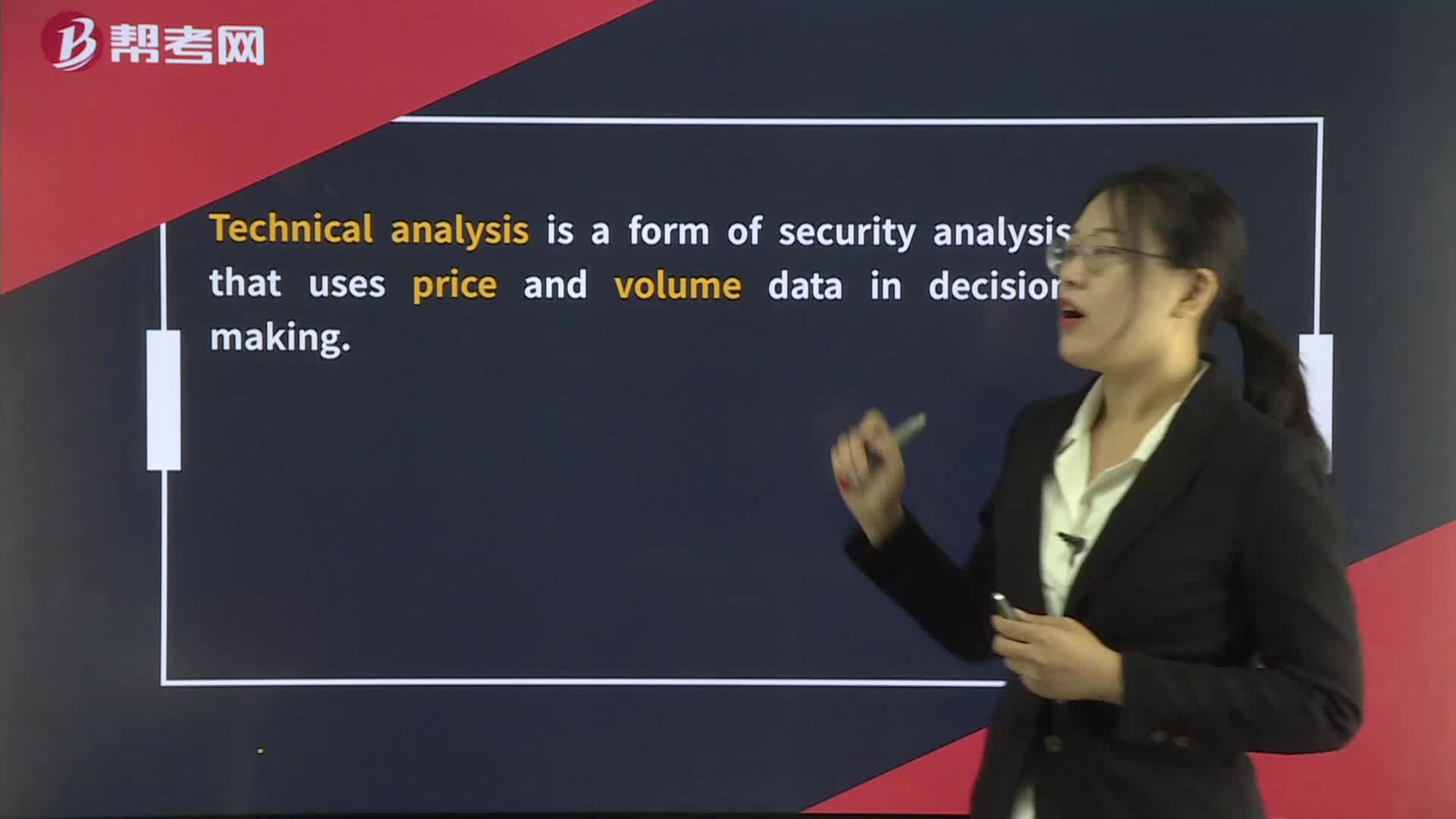

What are the methods of industrial analysis?

The steps of strategic analysis?

What is the job of industrial analysis?

下載億題庫APP

聯(lián)系電話:400-660-1360