下載億題庫APP

聯(lián)系電話:400-660-1360

下載億題庫APP

聯(lián)系電話:400-660-1360

請謹慎保管和記憶你的密碼,以免泄露和丟失

請謹慎保管和記憶你的密碼,以免泄露和丟失

2020年CFA考試《CFA一級》考試共240題,分為單選題。小編每天為您準備了5道每日一練題目(附答案解析),一步一步陪你備考,每一次練習的成功,都會淋漓盡致的反映在分數(shù)上。一起加油前行。

1、Equity return series are best described as, for the most part:【單選題】

A.platykurtotic (less peaked than a normal distribution).

B.leptokurtotic (more peaked than a normal distribution).

C.mesokurtotic (identical to the normal distribution in peakedness).

正確答案:B

答案解析:“Statistical Concepts and Market Returns,” Richard A. DeFusco, CFA, Dennis W. McLeavey, CFA, Jerald E. Pinto, CFA, and David E. Runkle, CFA

2013 Modular Level I, Vol. 1, Reading 7, Section 9

Study Session 2–7–l

Explain measures of sample skewness and kurtosis.

B is correct. Most equity return series have been found to be leptokurtotic.

2、An analyst does research about risk management applications of option strategies.With respect to option strategies, the shape of the graph that illustrates both thevalue at expiration and profit for buying a call is most similar in shape to thegraph for:【單選題】

A.selling a put.

B.a covered call position.

C.a protective put position.

正確答案:C

答案解析:有保護的看跌期權(protective put position)是購買一股股票的同時再買人針對該股票的一個看跌期權,當股票價格上漲時股票可以獲利,看跌期權沒有價值;而如果股票價格下跌股票損失時,看跌期權則可以獲利,所以從圖形上來看其收益類似于購買了一個看漲期權。

3、The probability of Event A is 40%. The probability of Event B is 60%. The joint probability of AB is40%. The probability (P) that A or B occurs, or both occur, is closest to:【單選題】

A.60%.

B.40%.

C.84%.

正確答案:A

答案解析:P(A or B)=P(A)+P(B)-P(AB)=0.40+0.60-0.40=0.60 or 60%.

CFA Level I

"Probability Concepts," Richard A. DeFusco, Dennis W. McLeavey, Jerald E. Pinto, and David E.Runkle

Section 2

4、The price of a good falls from $15 to $13. Given this decline in price, the quantity demanded of the good rises from 100 units to 120 units. The price elasticity of demand for the good is closest to:【單選題】

A.1.3.

B.1.5.

C.10.0.

正確答案:A

答案解析:“Elasticity,” Michael Parkin

2011 Modular Level I, Vol. 2, pp. 10-11

Study Session 4-13-a

Calculate and interpret the elasticities of demand (price elasticity, cross elasticity, and income elasticity) and the elasticity of supply and discuss the factors that influence each measure.

Price elasticity of demand is calculated as:

Price elasticity of demand = %ΔQ / %ΔP = (ΔQ / Qave) / (ΔP / Pave)

In this case, (20 / 110) / (2 / 14) = 1.27 rounded to 1.3

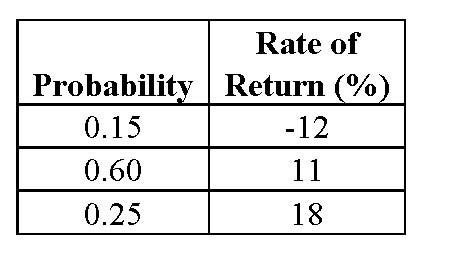

5、The table below provides a probability distribution of stock returns for shares of Orion Corporation:

The variance of returns for Orion Corporation stock is closest to:【單選題】

A.44.36

B.50.94

C.88.71

正確答案:C

答案解析:“An Introduction to Portfolio Management,” Frank K. Reilly and Keith C. Brown

2010 Modular Level I, Vol. 4, pp.242-244

Study Session 12-50-c

Compute and interpret the expected return, variance, and standard deviation for an

individual investment and the expected return and standard deviation for a portfolio.

C is correct. The table below provides the calculation of the variance

Expected return E( R) = 9.3%

Variance of returns = 88.71

459

459What are the indices for a skewed distribution?:What are the indices for a skewed distribution?

265

265What are the responsibilities of the members in reference to the CFA Institute?:Once accepted as a member:每年交述職報告和年費but must not over promise the competency and future investment results.Case

640

640What members and candidates should notice in CFA examinations?:or security of the CFA examinations.(不能惡心CFA),考試不能作弊:考試內(nèi)容要保密:A. No.:Responsibilities as a CFA Institute Member.right④Case

微信掃碼關注公眾號

獲取更多考試熱門資料