-

下載億題庫APP

-

聯(lián)系電話:400-660-1360

下載億題庫APP

聯(lián)系電話:400-660-1360

請謹慎保管和記憶你的密碼,以免泄露和丟失

請謹慎保管和記憶你的密碼,以免泄露和丟失

02:09

02:09

The Unemployment Rate:The Unemployment Rate:environment.measure the labor force in terms of the working-age population.constraints written into labor contracts that make layoffs expensive.

00:27

00:27

The Objectives of Monetary Policy:associated goal of controlling inflation.

02:16

02:16

The Neutral Rate:The neutral;underlying economy.:economyLong-runrates might make a bad situation worse.

03:05

03:05

The Money Creation Process:1 divided by the reserve requirement is the money multiplier.

02:14

02:14

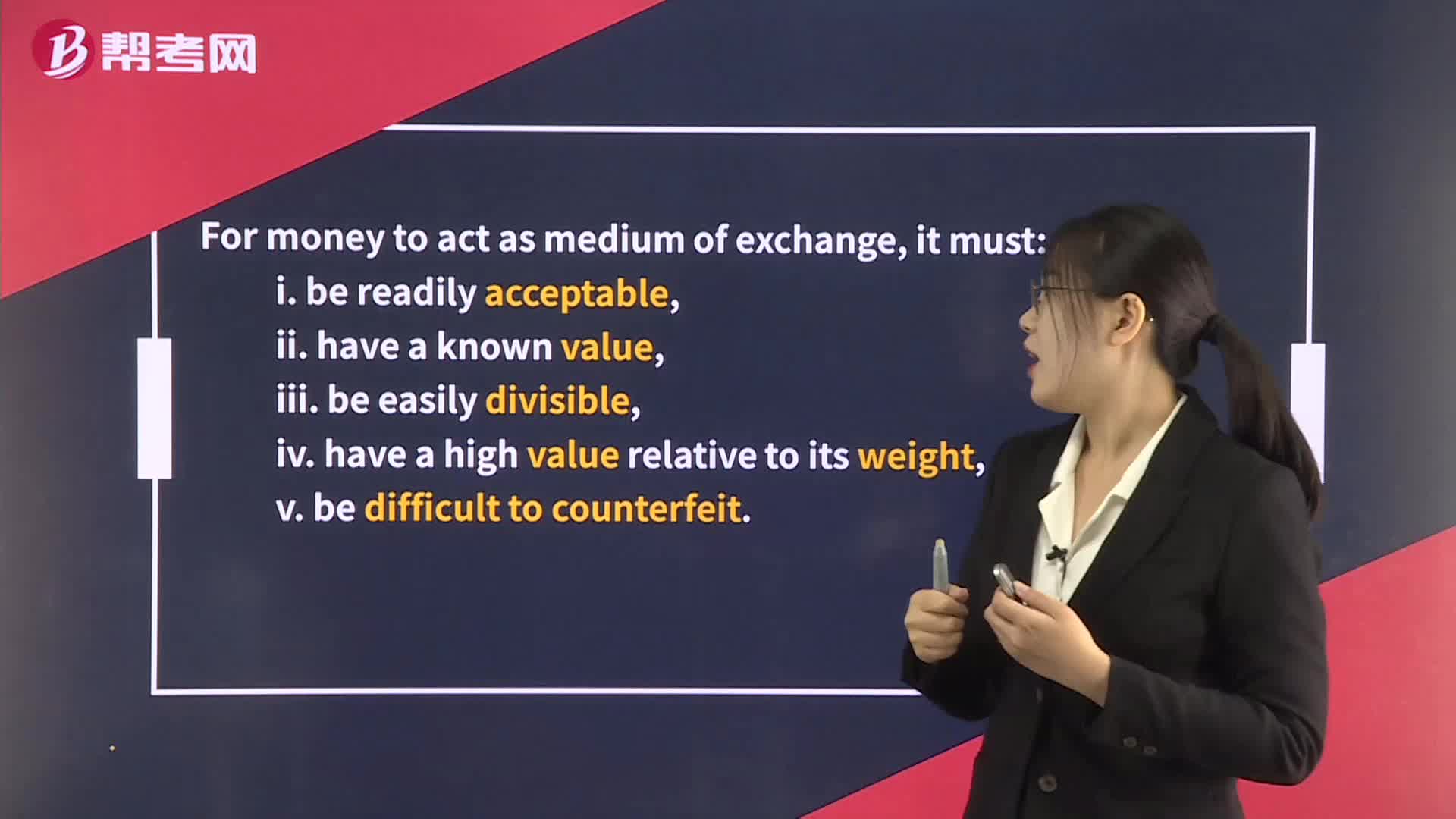

The Functions of Money:iii. be easily divisible;provides society with a convenient measure of value and unit of account.

01:30

01:30

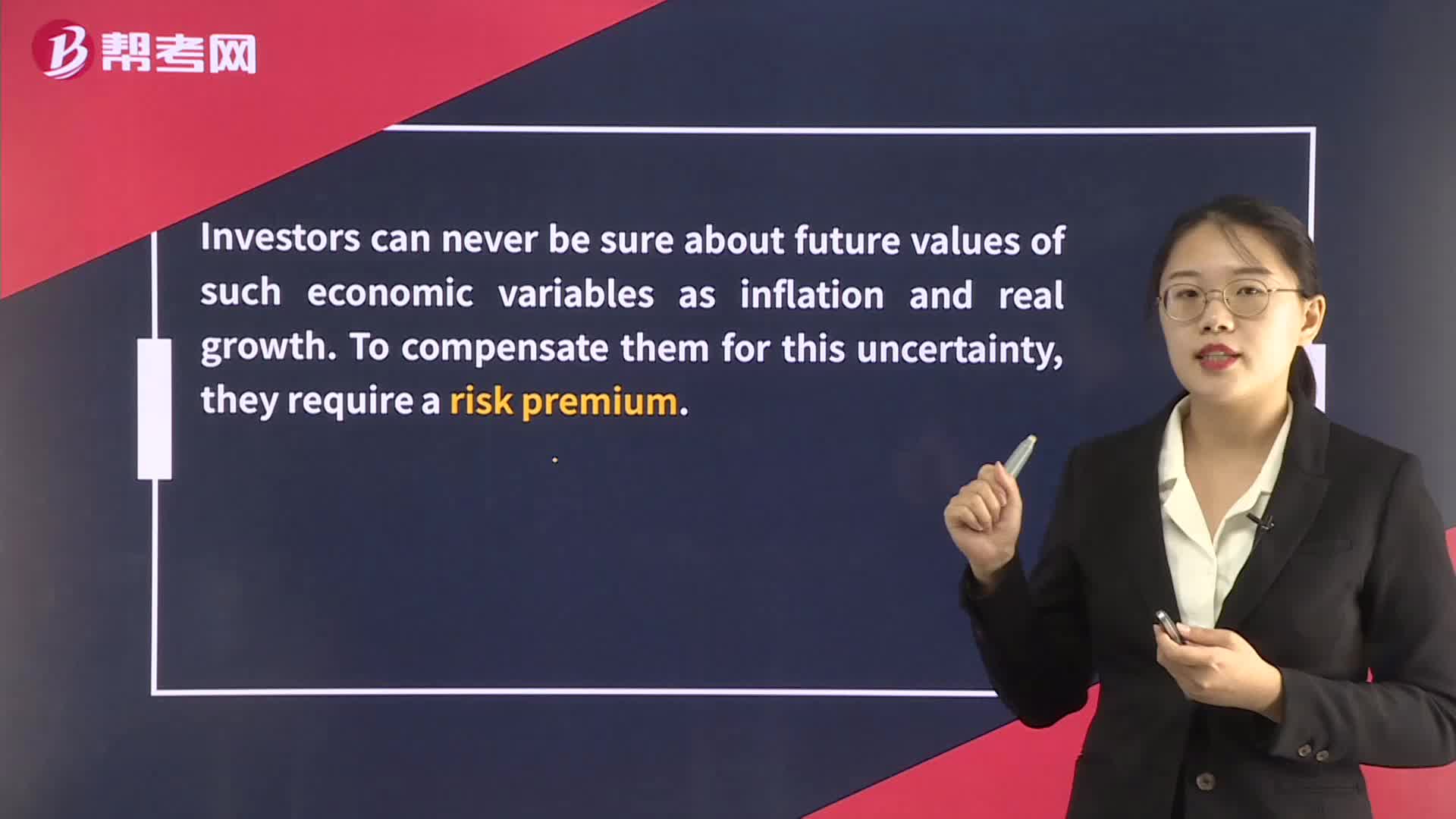

The Fisher Effect:The Fisher:interest in an economy is stable over time so that changes in nominal interest rates are the result;premium.premium to compensate them for uncertainty.

02:08

02:08

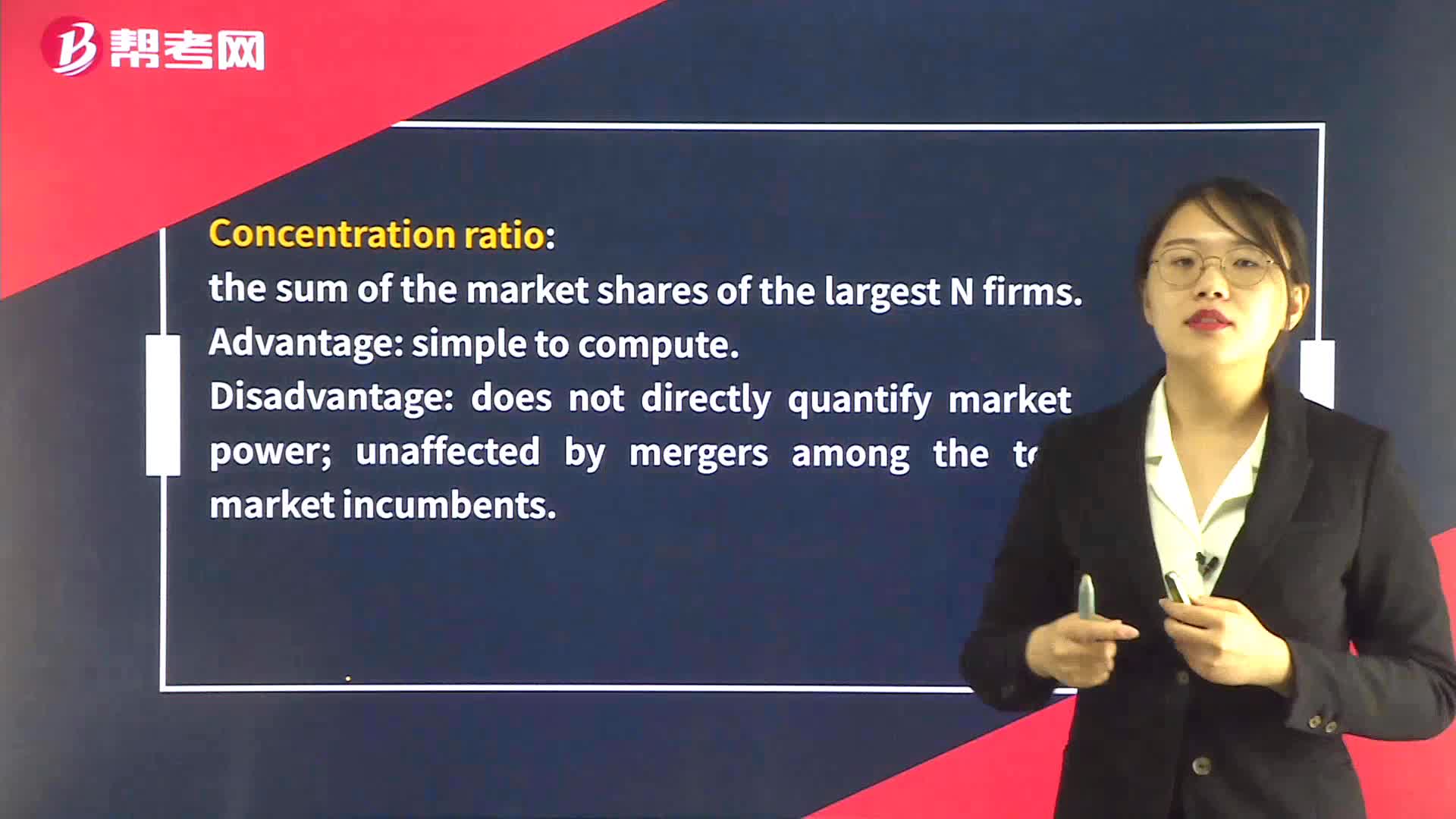

Identification of Market Structure – Concentration Ratio:the sum of the market;Advantage:simple to:The industry’sfour-companyconcentration ratiois closest to150300 + 250 + 200 + 150 + 100 + 50 = 9001050 = 86%.

03:24

03:24

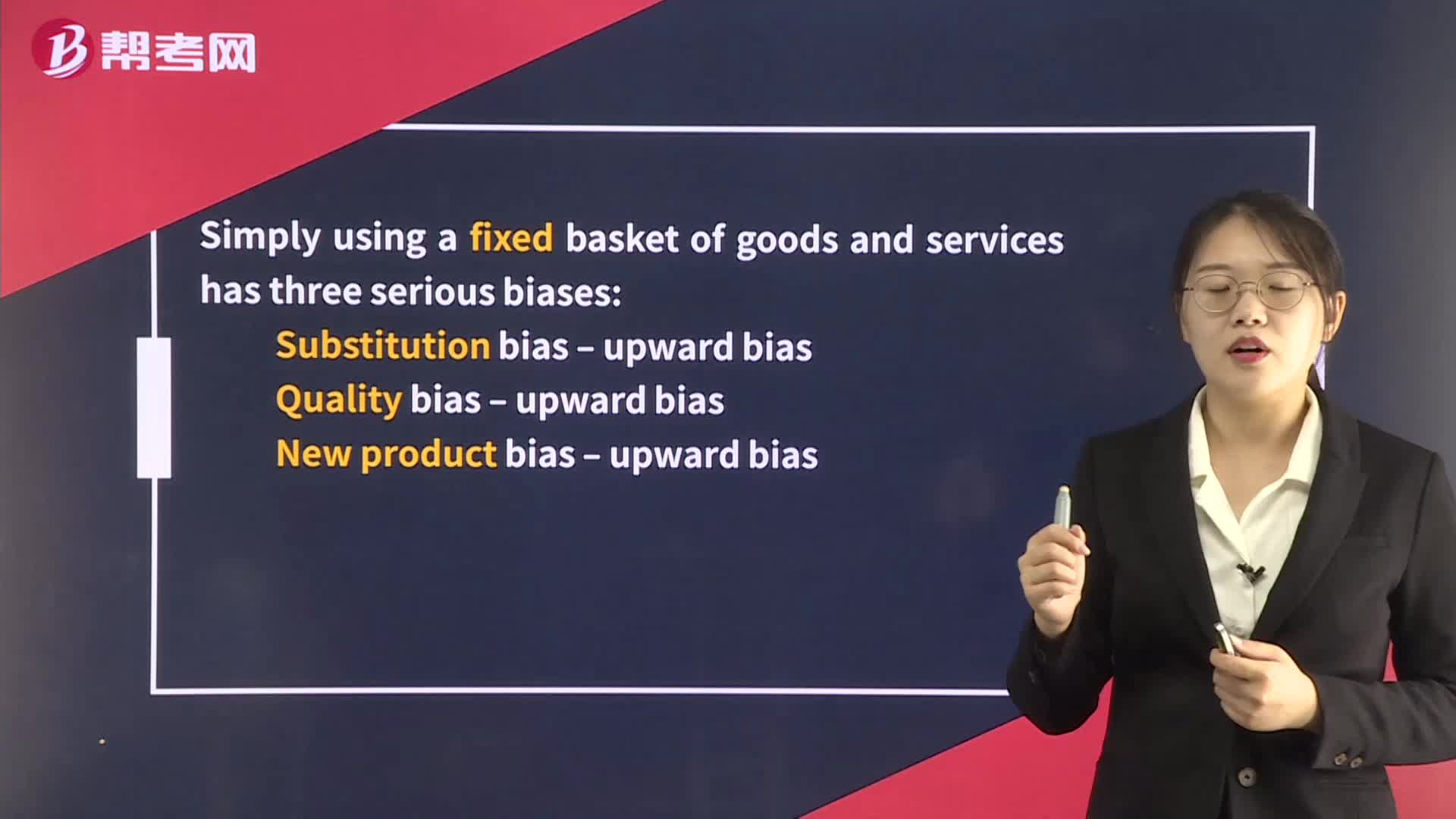

The Construction of Price Indexes:be used to average the different prices.:index.the basket.

04:31

04:31

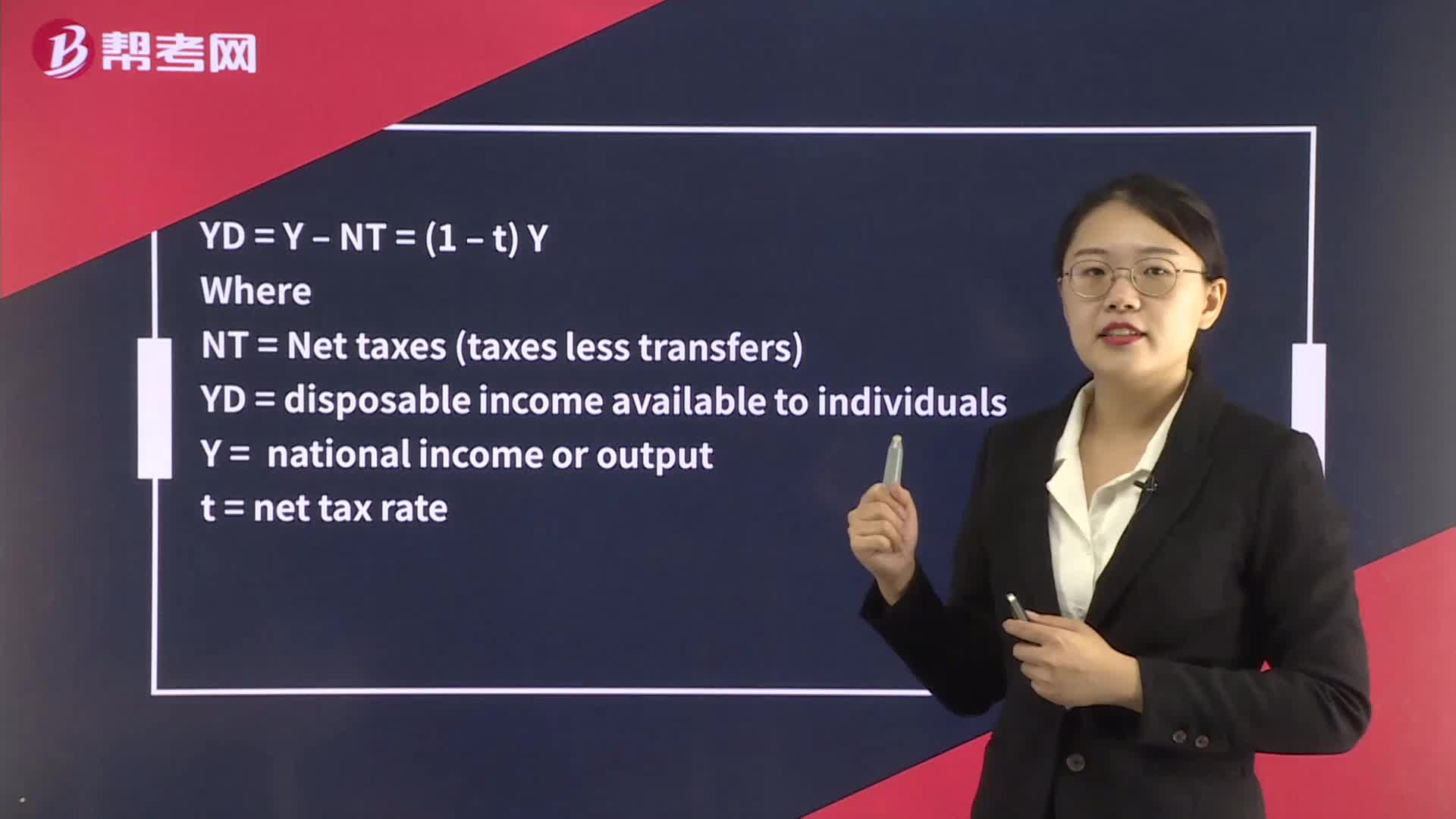

The Fiscal Multiplier:Wheret = tax rate

04:47

04:47

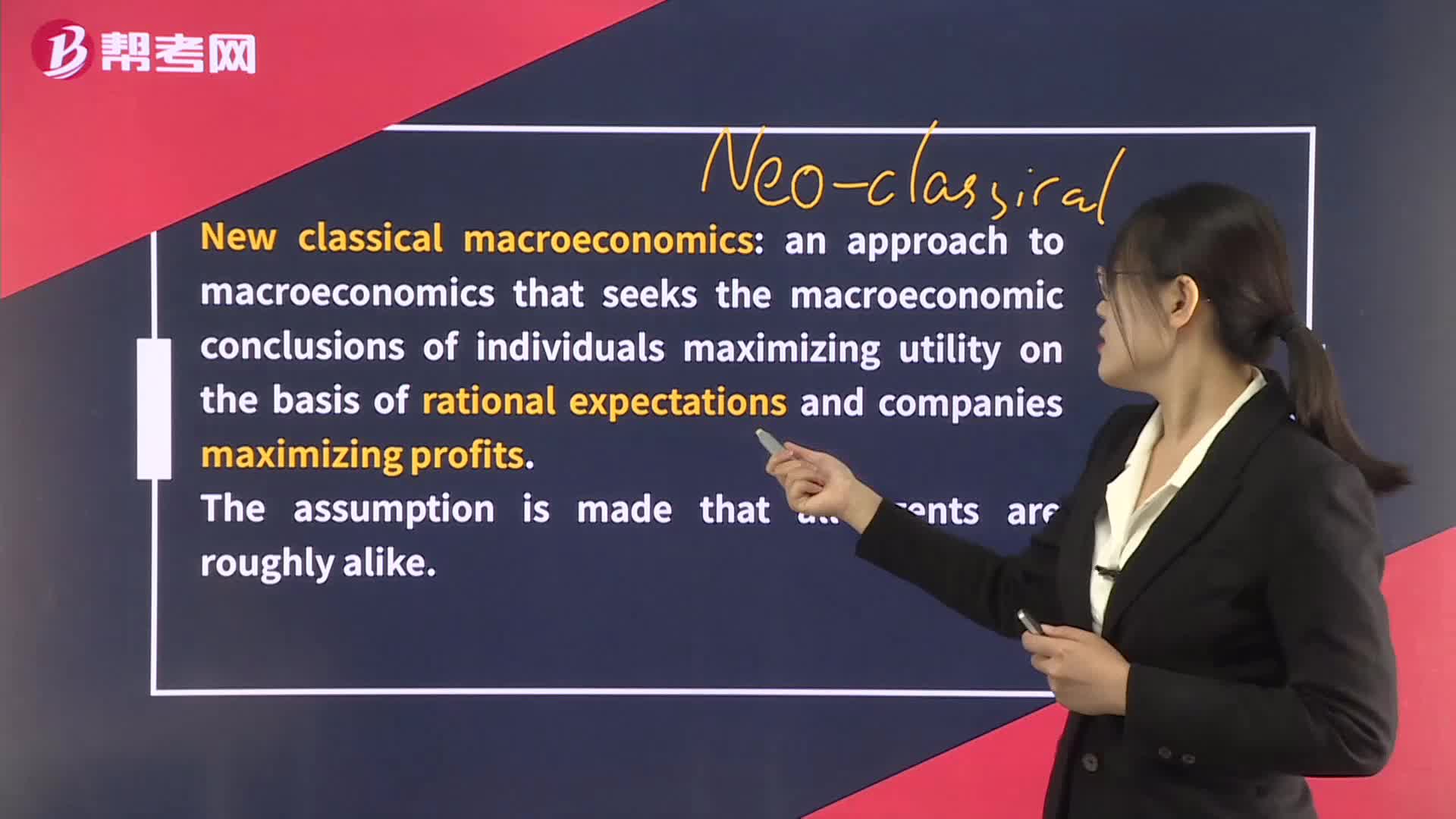

The New Classical School:an approach to macroeconomics that seeks the:Money,technologymodelslow-to-adjusteconomy is weak.

04:25

04:25

What are the responsibilities of the members in reference to the CFA Institute?:Once accepted as a member:每年交述職報告和年費but must not over promise the competency and future investment results.Case

06:50

06:50

What are the ethics and trust in the investment profession?:Global investment performance standards(GIPS)= 比例低,也并非所有的不道德都是違法君子有所不為的決策是更好的決策更符合stakeholder利益的決策