下載億題庫(kù)APP

聯(lián)系電話(huà):400-660-1360

下載億題庫(kù)APP

聯(lián)系電話(huà):400-660-1360

請(qǐng)謹(jǐn)慎保管和記憶你的密碼,以免泄露和丟失

請(qǐng)謹(jǐn)慎保管和記憶你的密碼,以免泄露和丟失

進(jìn)項(xiàng)稅額轉(zhuǎn)出月底怎么做分錄?

發(fā)生需要轉(zhuǎn)出時(shí):

借:庫(kù)存商品(在建工程、原材料、銷(xiāo)售費(fèi)用)

貸:應(yīng)交稅金——應(yīng)交增值稅(進(jìn)項(xiàng)稅轉(zhuǎn)出)

微信截圖_1592810421612520200622152124291.png)

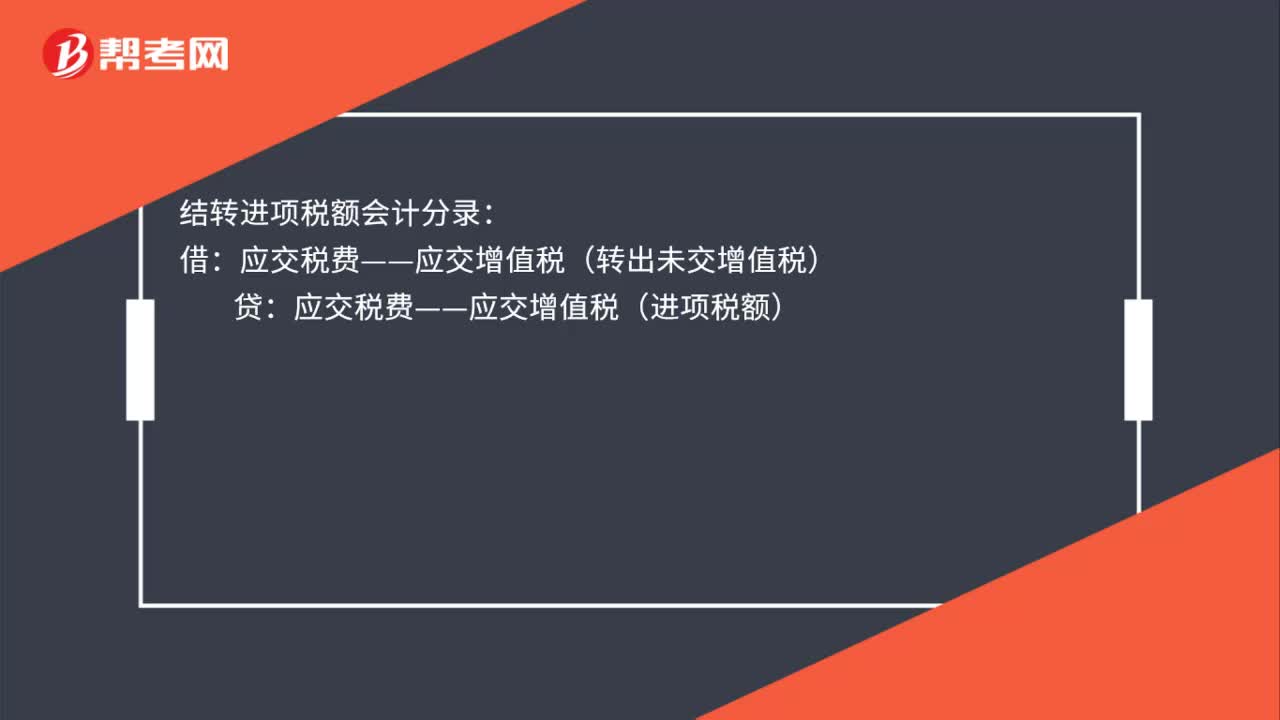

月底進(jìn)行結(jié)轉(zhuǎn)時(shí):

借:應(yīng)交稅法——應(yīng)交增值稅(進(jìn)項(xiàng)稅轉(zhuǎn)出)

貸:應(yīng)交稅費(fèi)——應(yīng)交增值稅(未交增值稅)

21

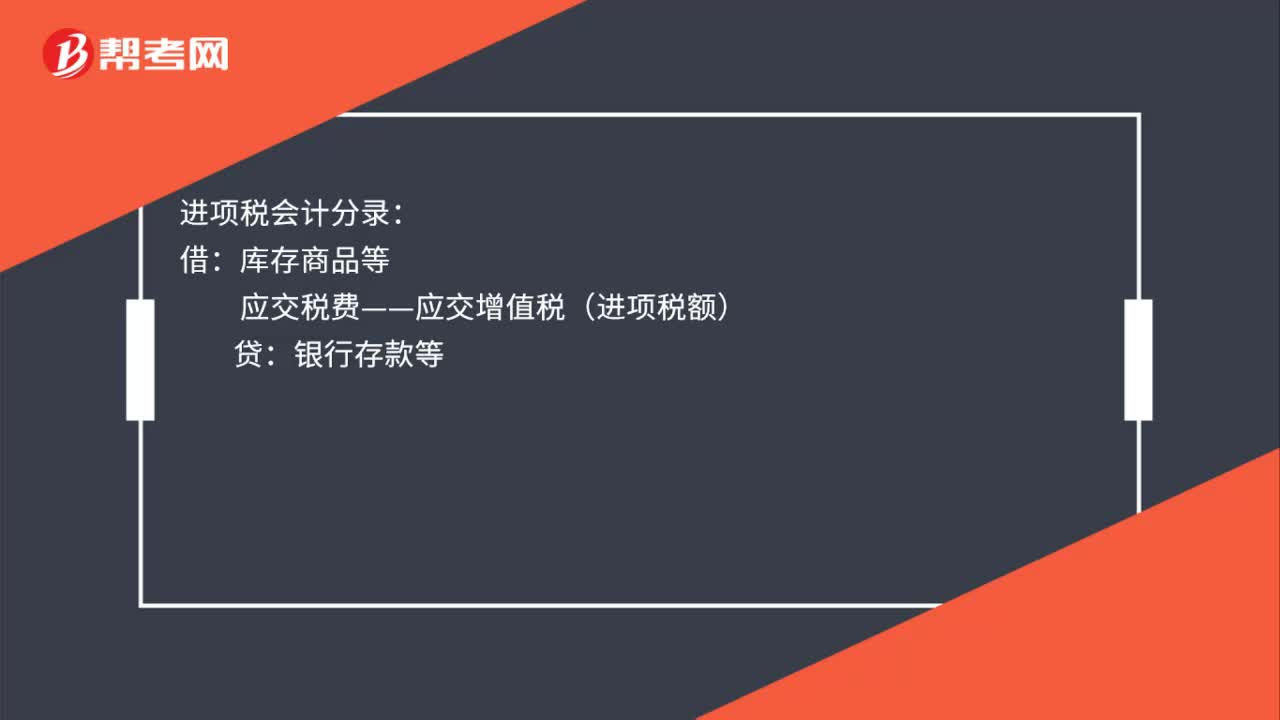

21進(jìn)項(xiàng)稅會(huì)計(jì)分錄是什么?:進(jìn)項(xiàng)稅會(huì)計(jì)分錄:借:庫(kù)存商品等:應(yīng)交稅費(fèi)——應(yīng)交增值稅(進(jìn)項(xiàng)稅額)貸銀行存款等

28

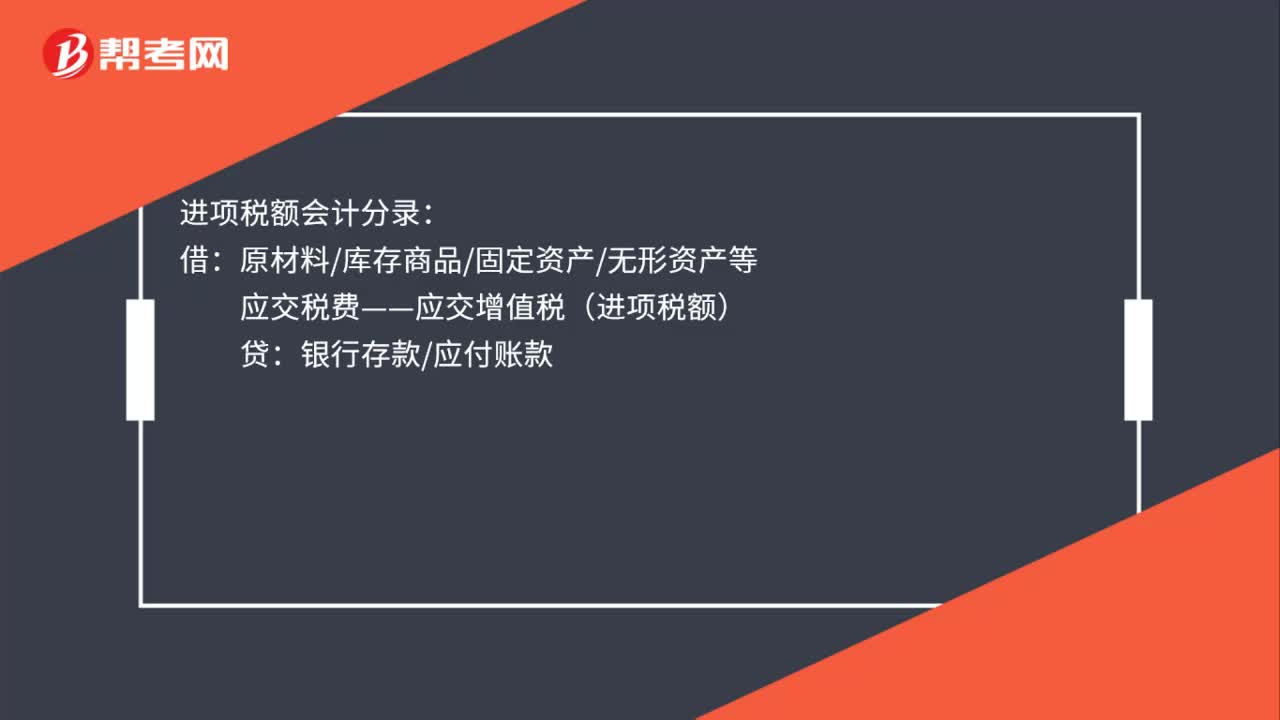

28進(jìn)項(xiàng)稅額會(huì)計(jì)分錄是什么?:進(jìn)項(xiàng)稅額會(huì)計(jì)分錄:借:原材料庫(kù)存商品固定資產(chǎn)無(wú)形資產(chǎn)等:應(yīng)交稅費(fèi)——應(yīng)交增值稅(進(jìn)項(xiàng)稅額)貸銀行存款應(yīng)付賬款

79

79結(jié)轉(zhuǎn)銷(xiāo)項(xiàng)稅額的會(huì)計(jì)分錄怎么做?:結(jié)轉(zhuǎn)銷(xiāo)項(xiàng)稅額的會(huì)計(jì)分錄怎么做?結(jié)轉(zhuǎn)銷(xiāo)項(xiàng)稅額會(huì)計(jì)分錄:應(yīng)交稅費(fèi)——應(yīng)交增值稅(銷(xiāo)項(xiàng)稅額):結(jié)轉(zhuǎn)進(jìn)項(xiàng)稅額會(huì)計(jì)分錄:應(yīng)交稅費(fèi)——應(yīng)交增值稅(進(jìn)項(xiàng)稅額):結(jié)轉(zhuǎn)應(yīng)繳納增值稅(即進(jìn)、銷(xiāo)差額):應(yīng)交稅費(fèi)——應(yīng)交增值稅(轉(zhuǎn)出未交增值稅)貸應(yīng)交稅費(fèi)——未交增值稅下期交納時(shí)借應(yīng)交稅費(fèi)——未交增值稅貸銀行存款

00:51

00:51 00:35

00:352020-05-29

00:59

00:592020-05-29

00:46

00:462020-05-29

01:19

01:192020-05-29

微信掃碼關(guān)注公眾號(hào)

獲取更多考試熱門(mén)資料