下載億題庫APP

聯系電話:400-660-1360

下載億題庫APP

聯系電話:400-660-1360

請謹慎保管和記憶你的密碼,以免泄露和丟失

請謹慎保管和記憶你的密碼,以免泄露和丟失

Expected Value & Variance

微信截圖_1596612583754820200805153304781.png)

微信截圖_1596612807724620200805153354543.png)

微信截圖_1596612909154020200805153529295.png)

A. $9.81 million.

B. $12.20 million.

C. $32.40 million.

微信截圖_1596613002237120200805153659867.png)

微信截圖_1596613038936020200805153743369.png)

微信截圖_1596613084339220200805153821458.png)

微信截圖_1596613127959220200805153906873.png)

The amount of the expected recovery is closest to:

A $36,400.

B $63,600.

C $81,600.

[Solutions] B

If Scenario 1 occurs, the expected recovery is 60%($50,000) + 40%($30,000) = $42,000, and if Scenario 2 occurs, the expected recovery is 90%($80,000) + 10%($60,000) = $78,000. Weighting by the probability of each scenario, the expected recovery is 40%($42,000) + 60%($78,000) = $63,600.

85

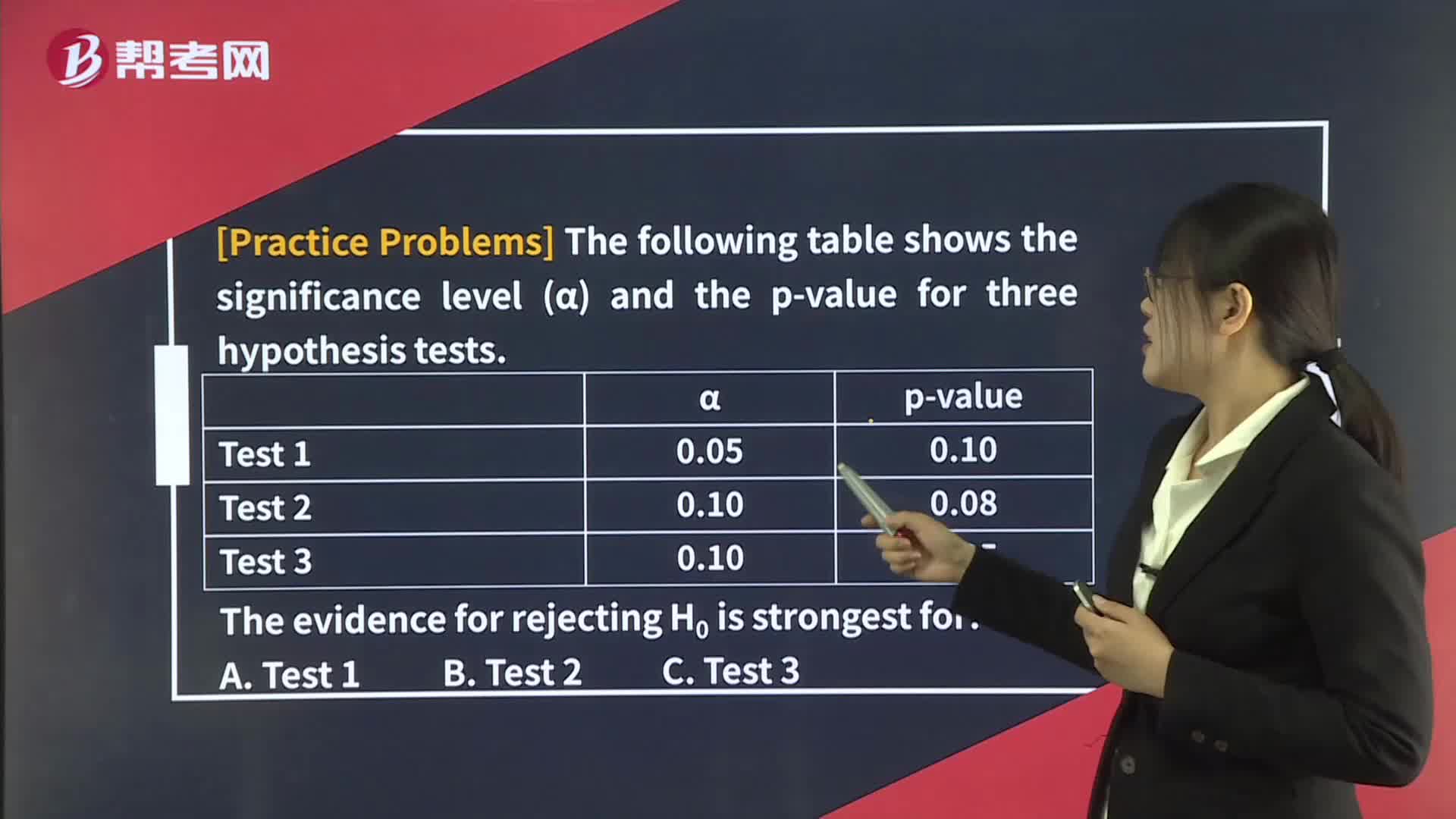

85p-Value:for rejecting the null is strongest for Test 3.

300

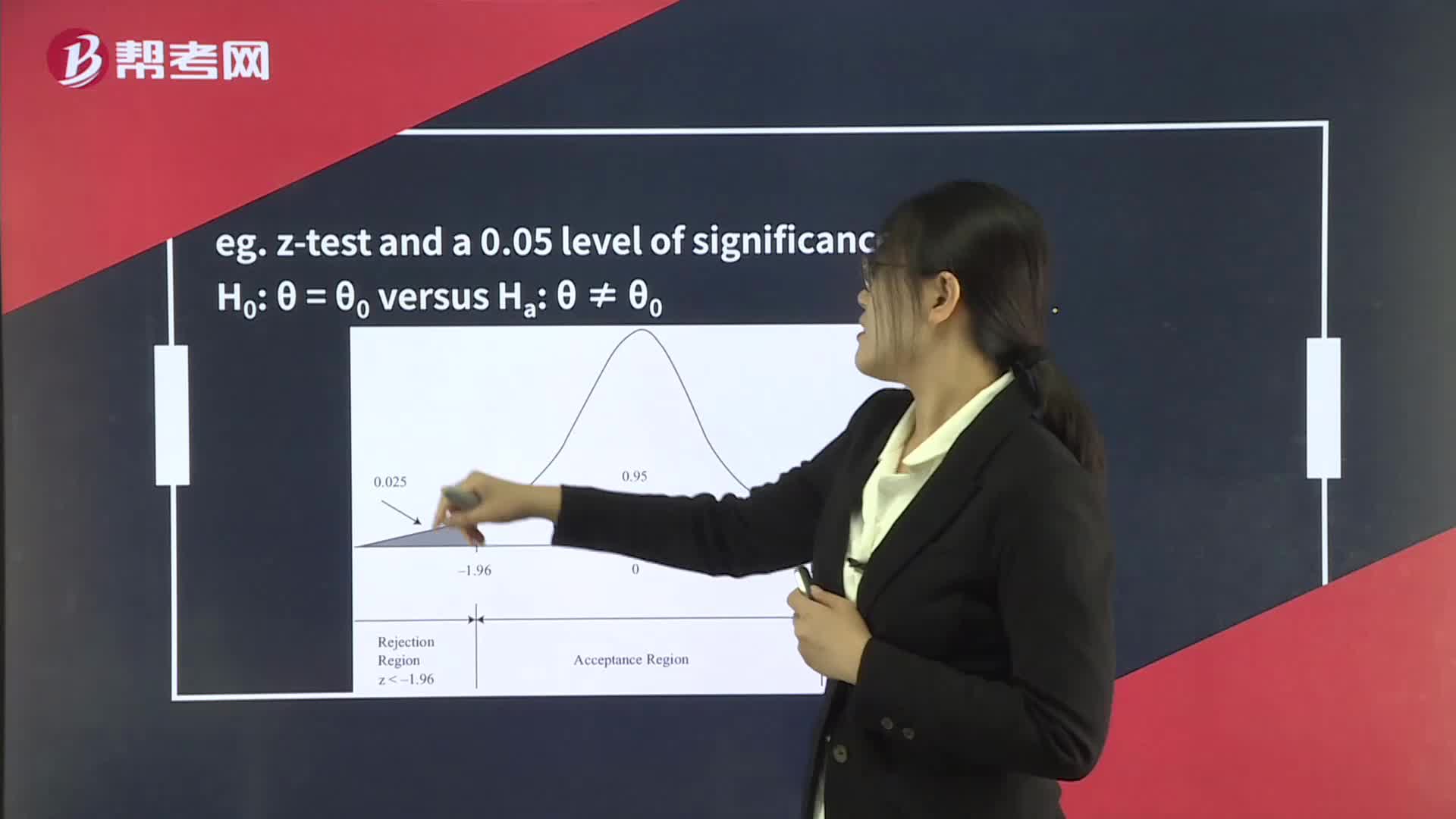

300Rejection Point (Critical Value) for the Test Statistic:the result is not statistically significant at the 0.05 level.

900

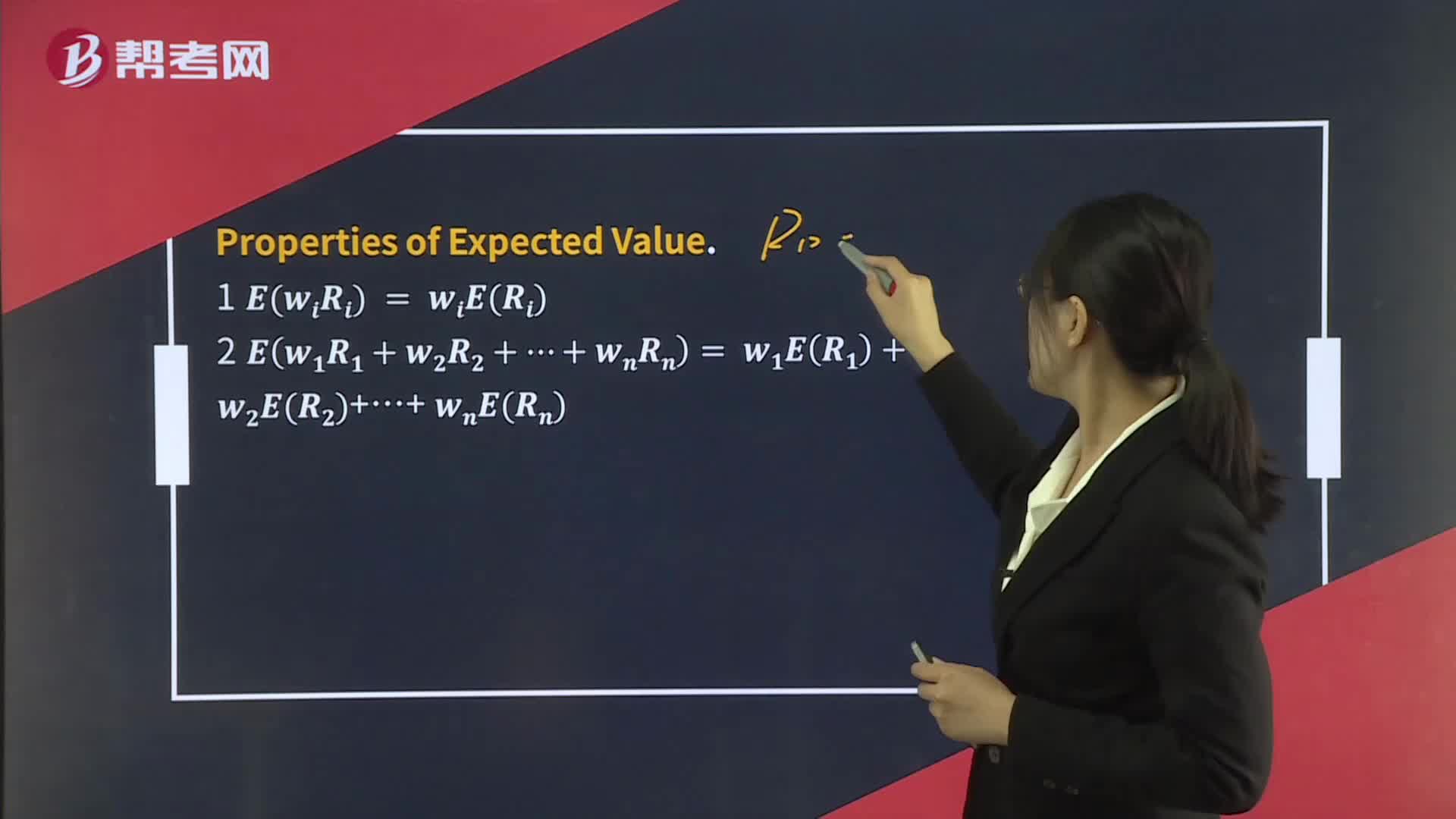

900Portfolio Expected Return and Variance of Return:Return,RjFirst= 7.50 + 12.50 + 3.75 = 23.75.

微信掃碼關注公眾號

獲取更多考試熱門資料