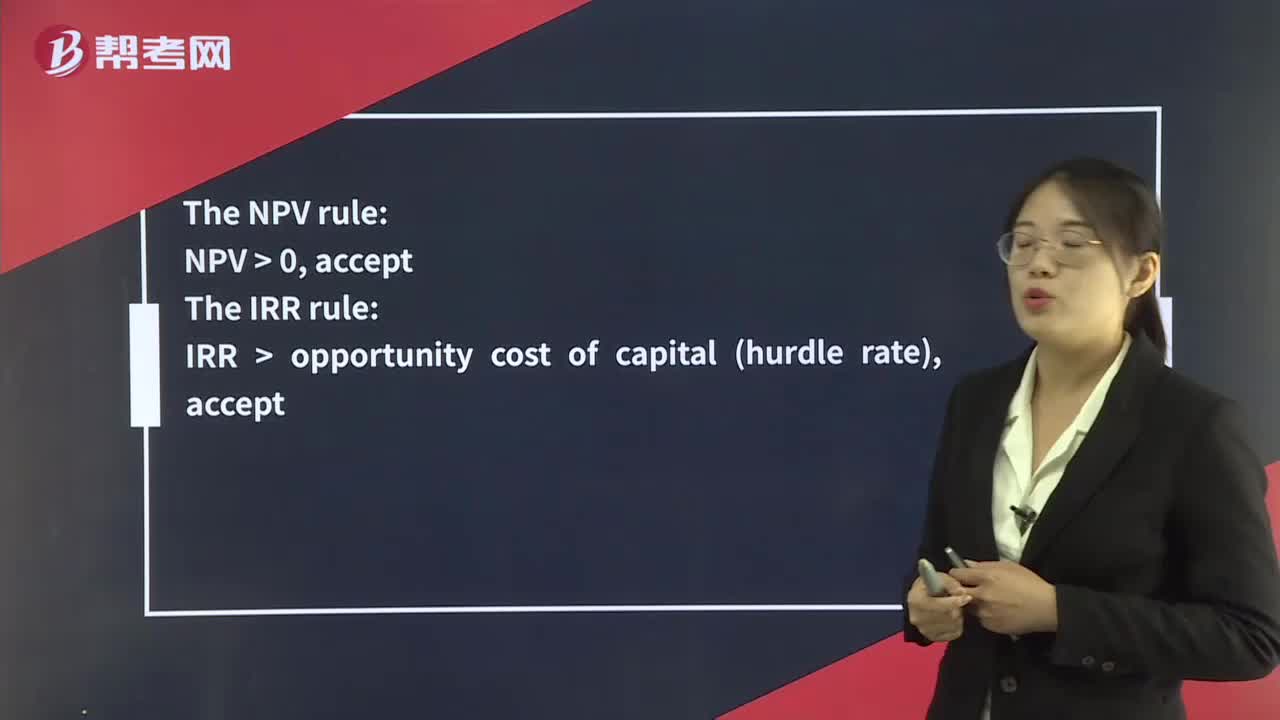

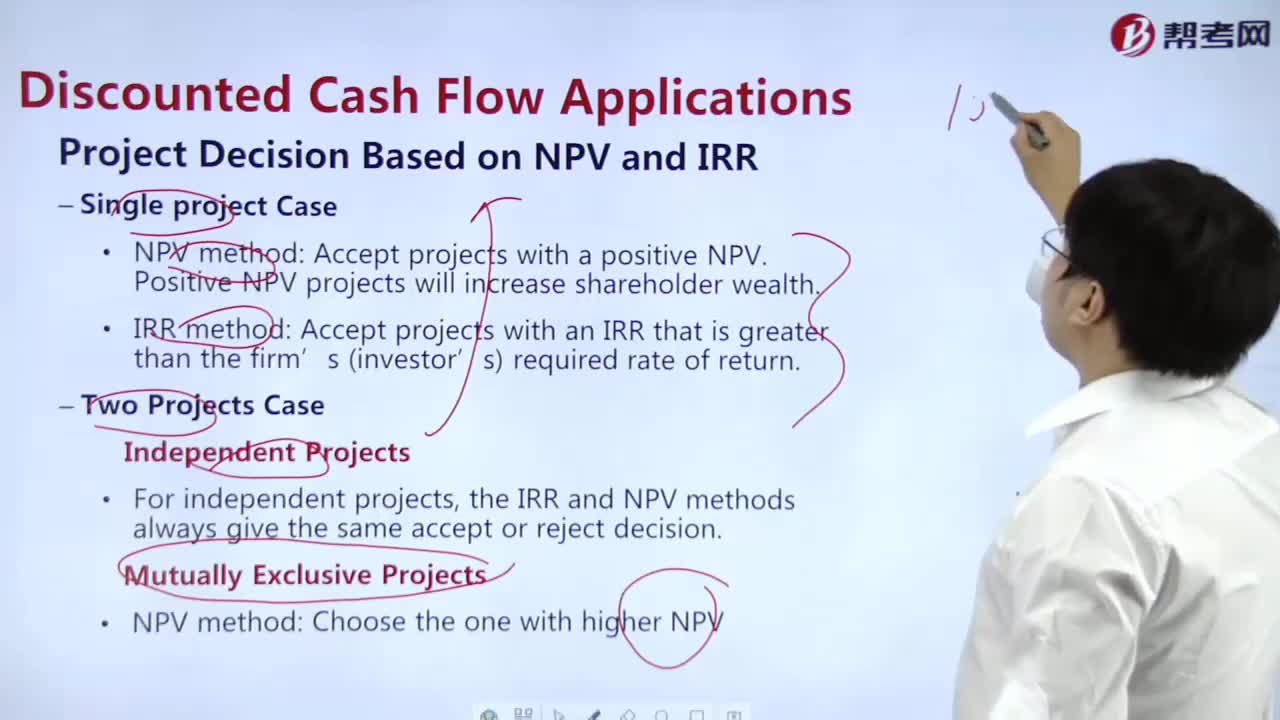

What are the project decision based on NPV and IRR?

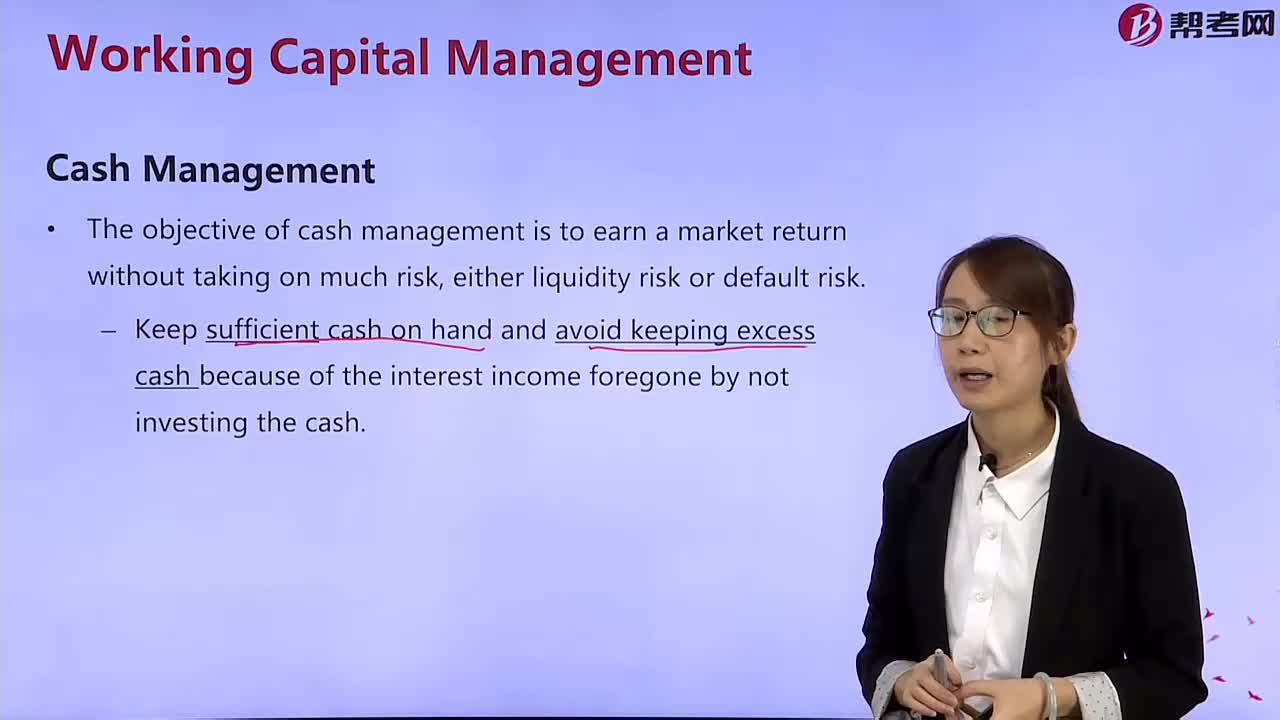

What is cash management?

How to manage the client in the project?

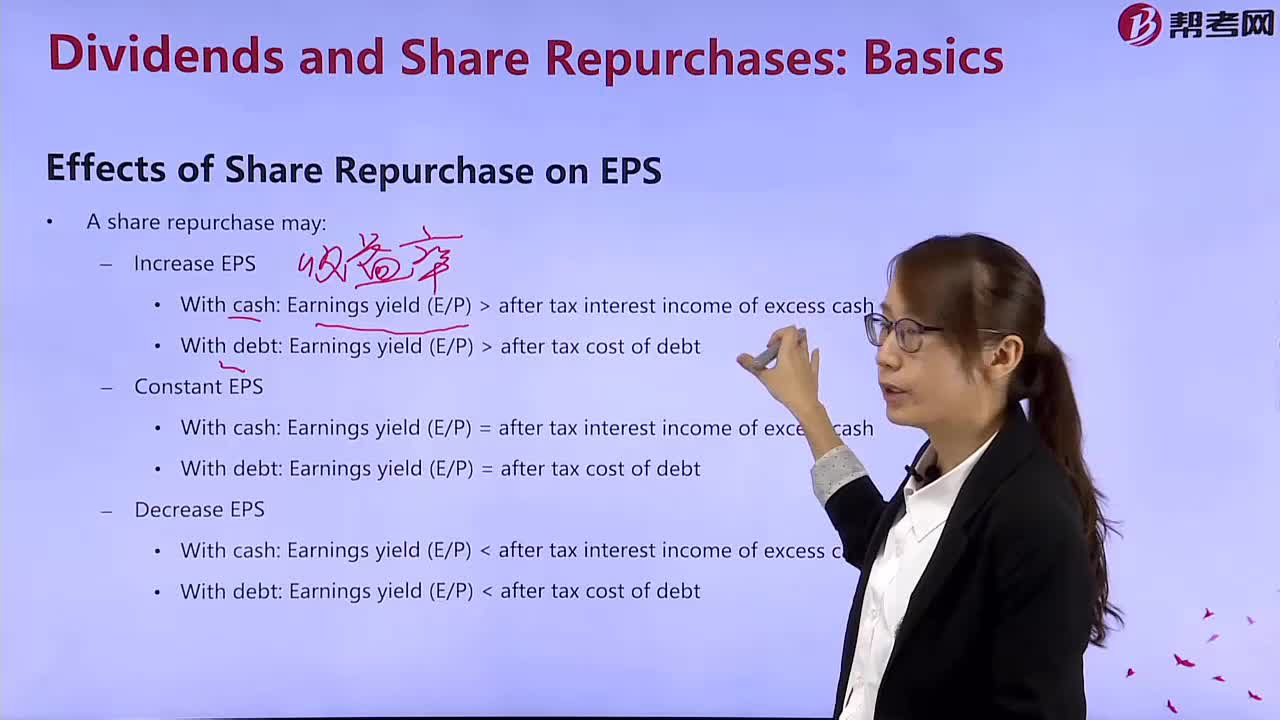

What effect does stock repurchase have on earnings per share?

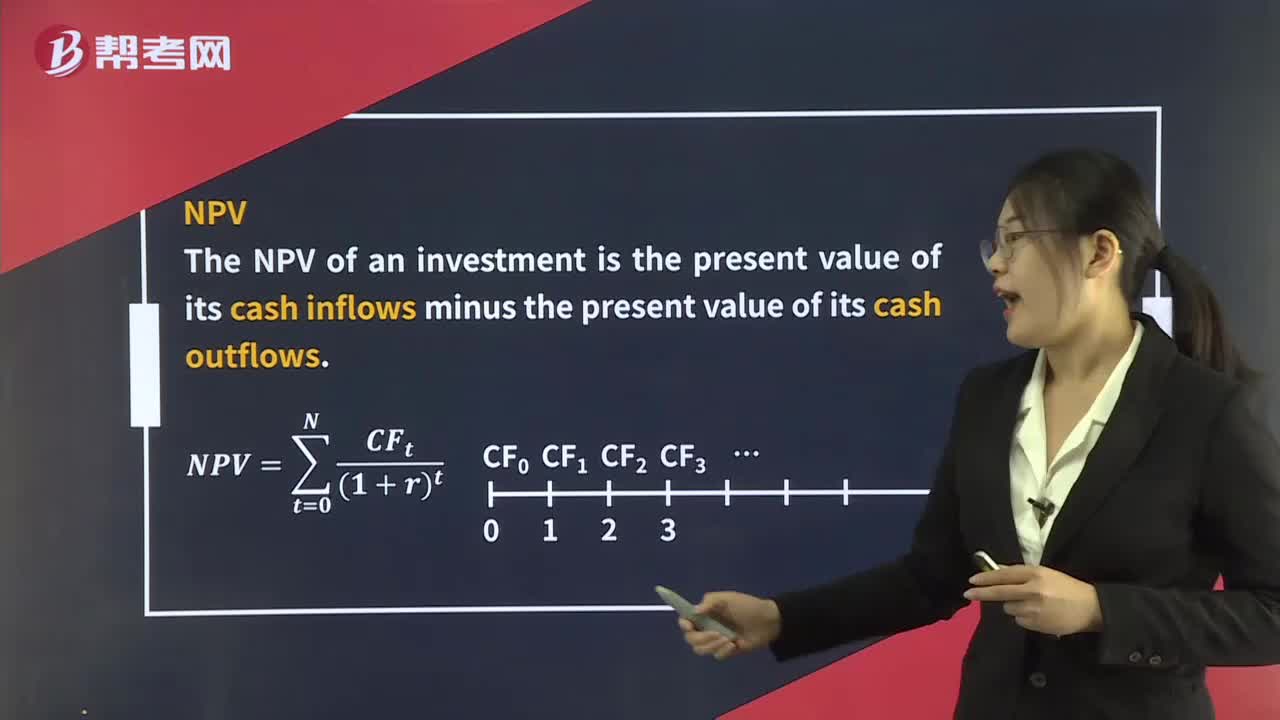

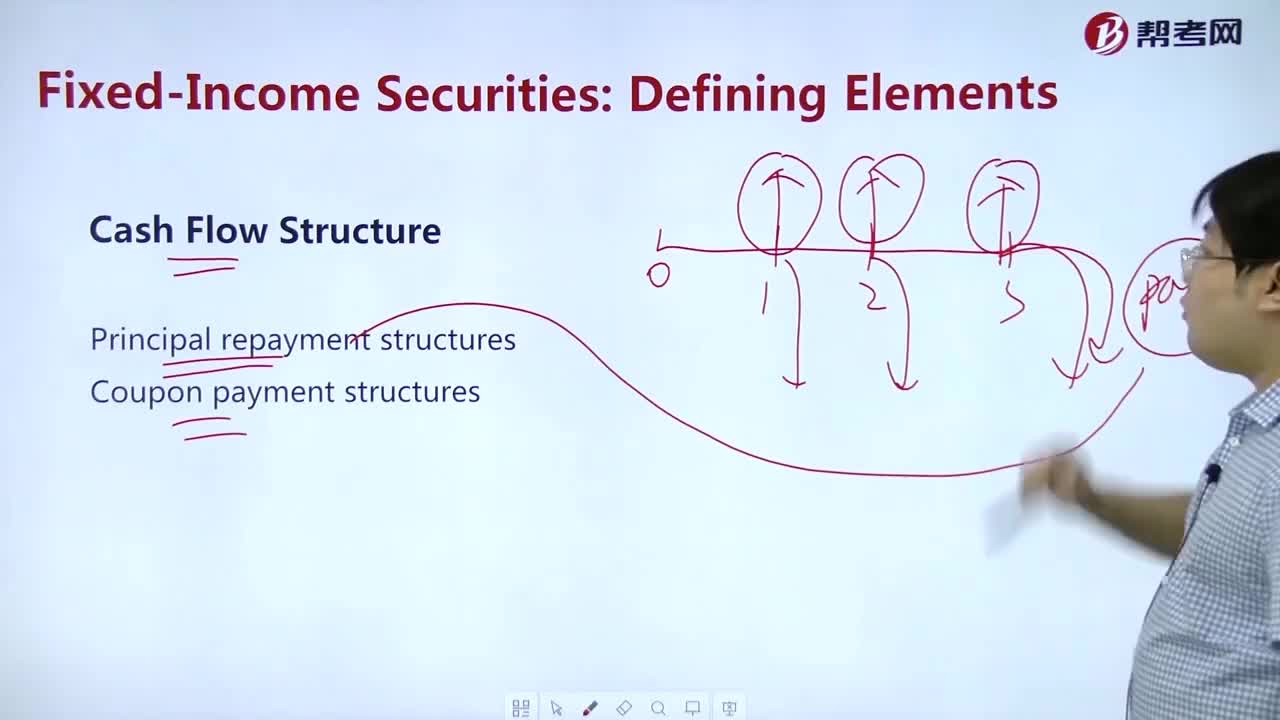

How to understand Cach Flow Structure?

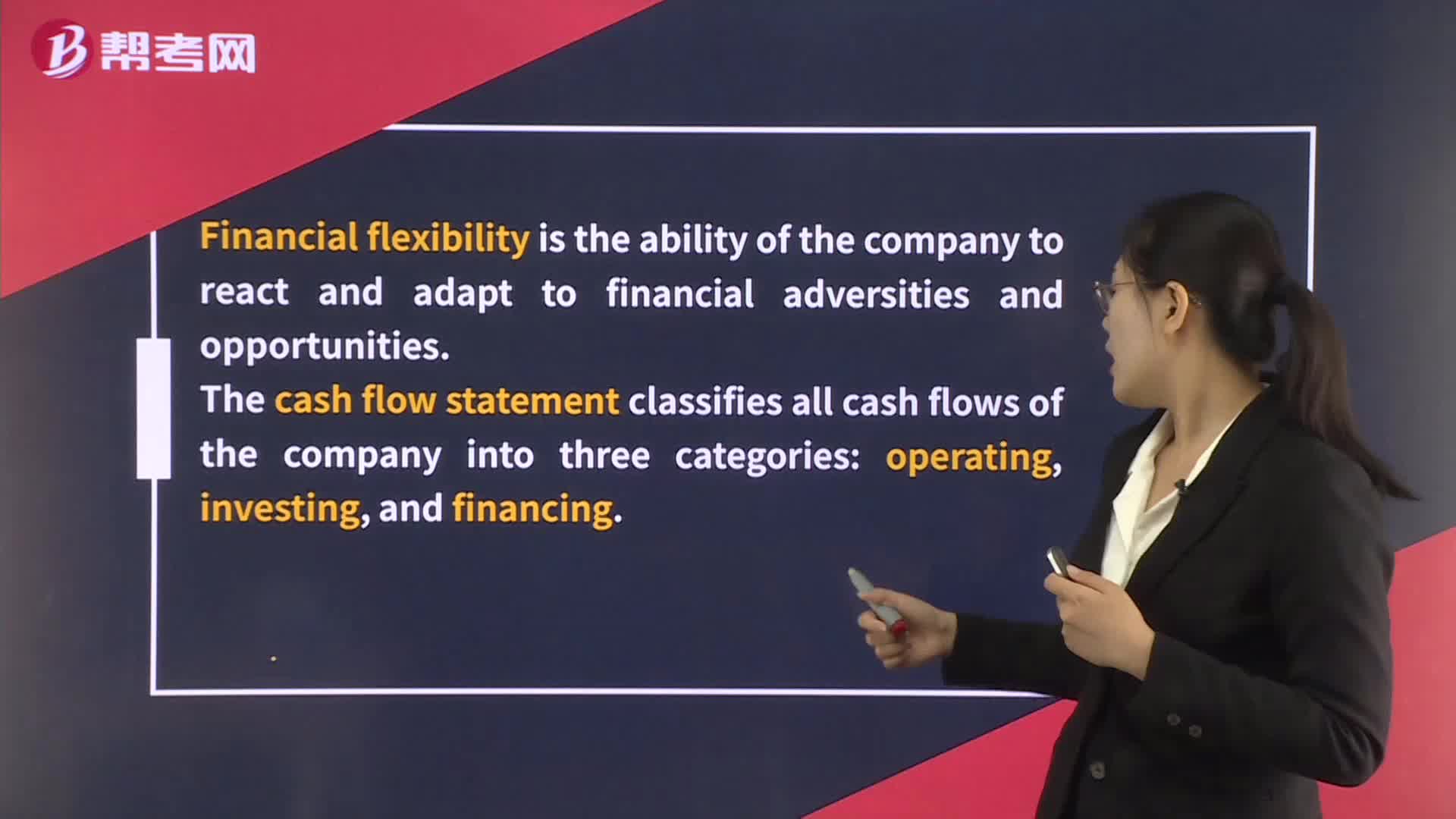

How to master Cash Flow Statement?

What are the methods of dividend discount model?

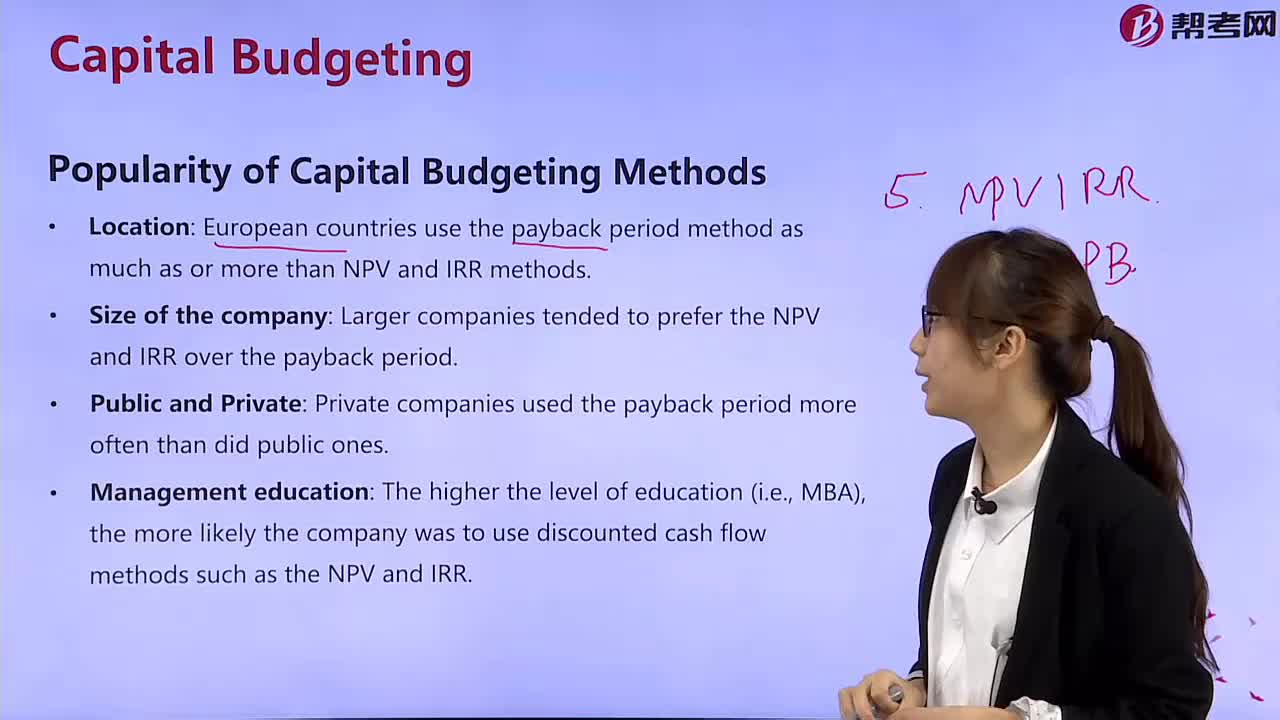

What are the popular capital budgeting methods?

What is the NPV profile?

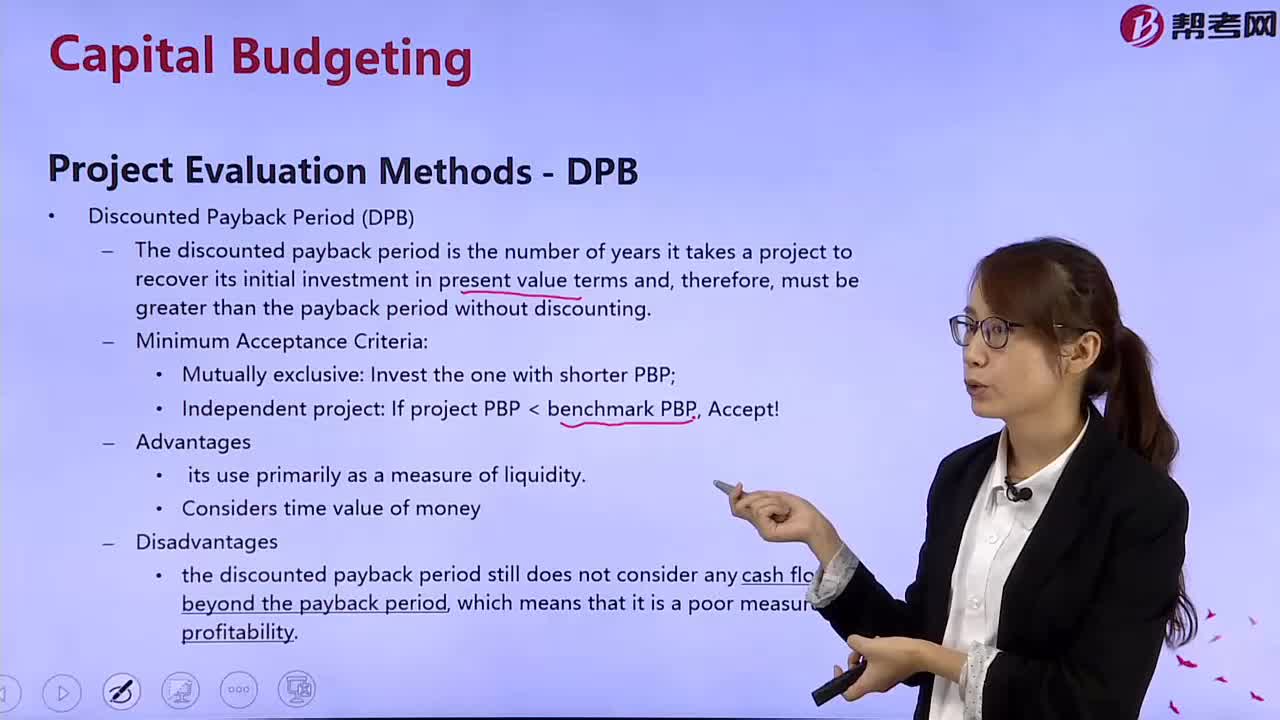

What is the discounted payback period?

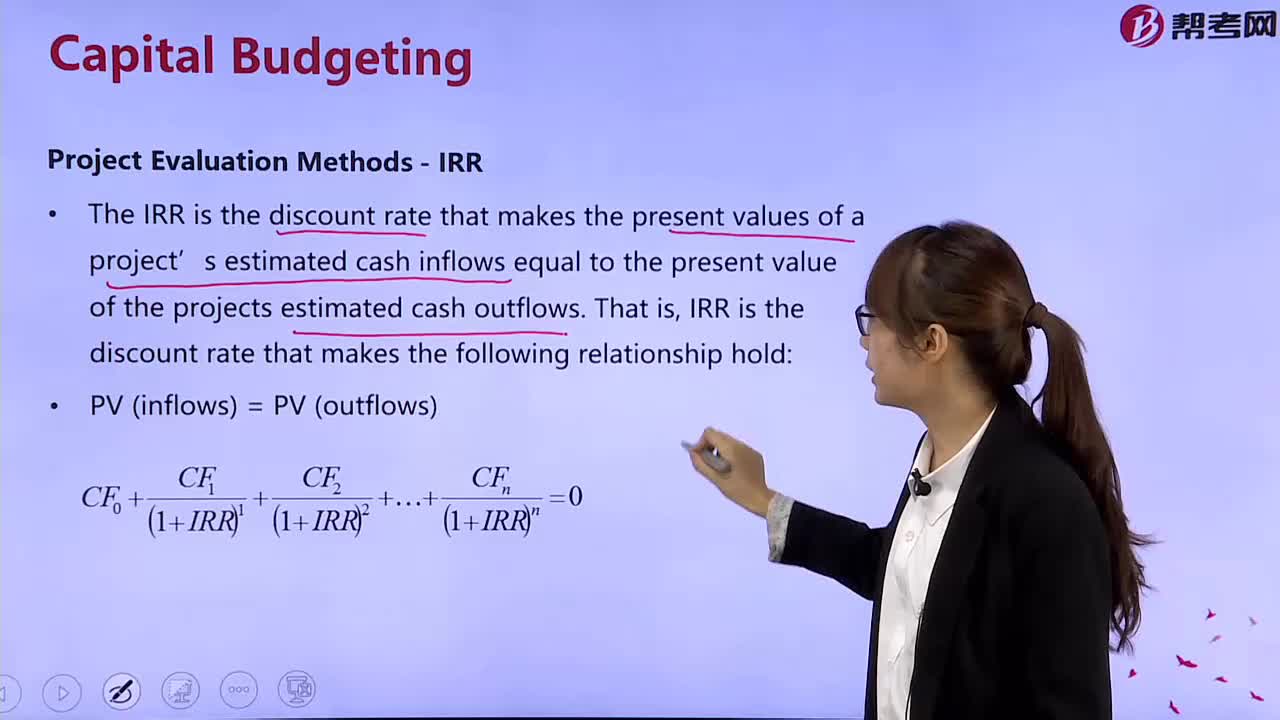

What is the IRR?

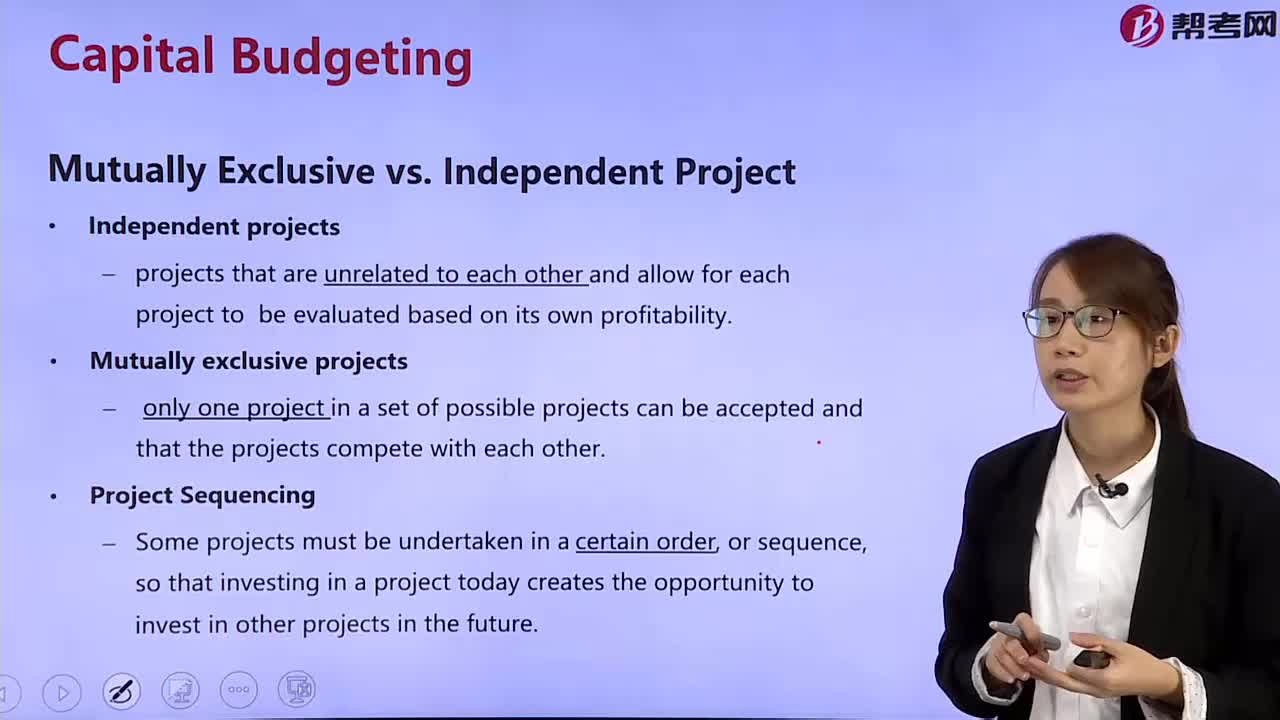

What's the difference between a mutually exclusive project and an independent project?

下載億題庫(kù)APP

聯(lián)系電話:400-660-1360