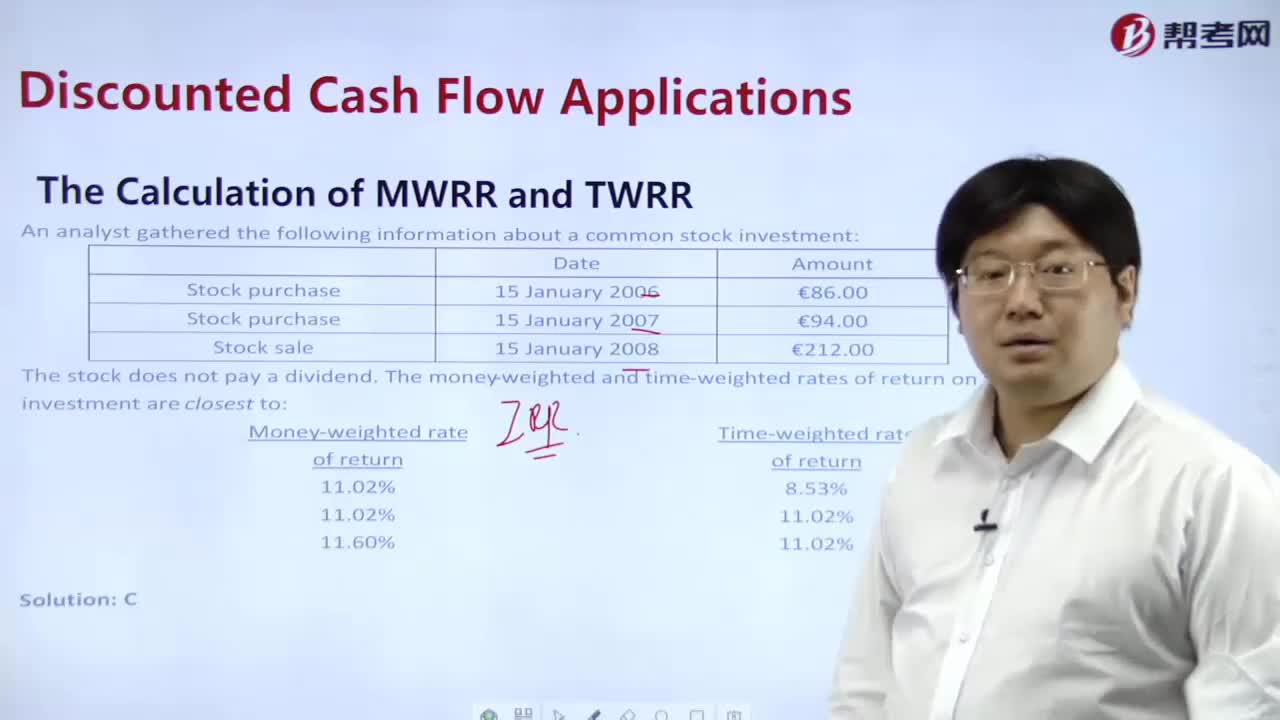

How to calculate MWRR and TWRR?

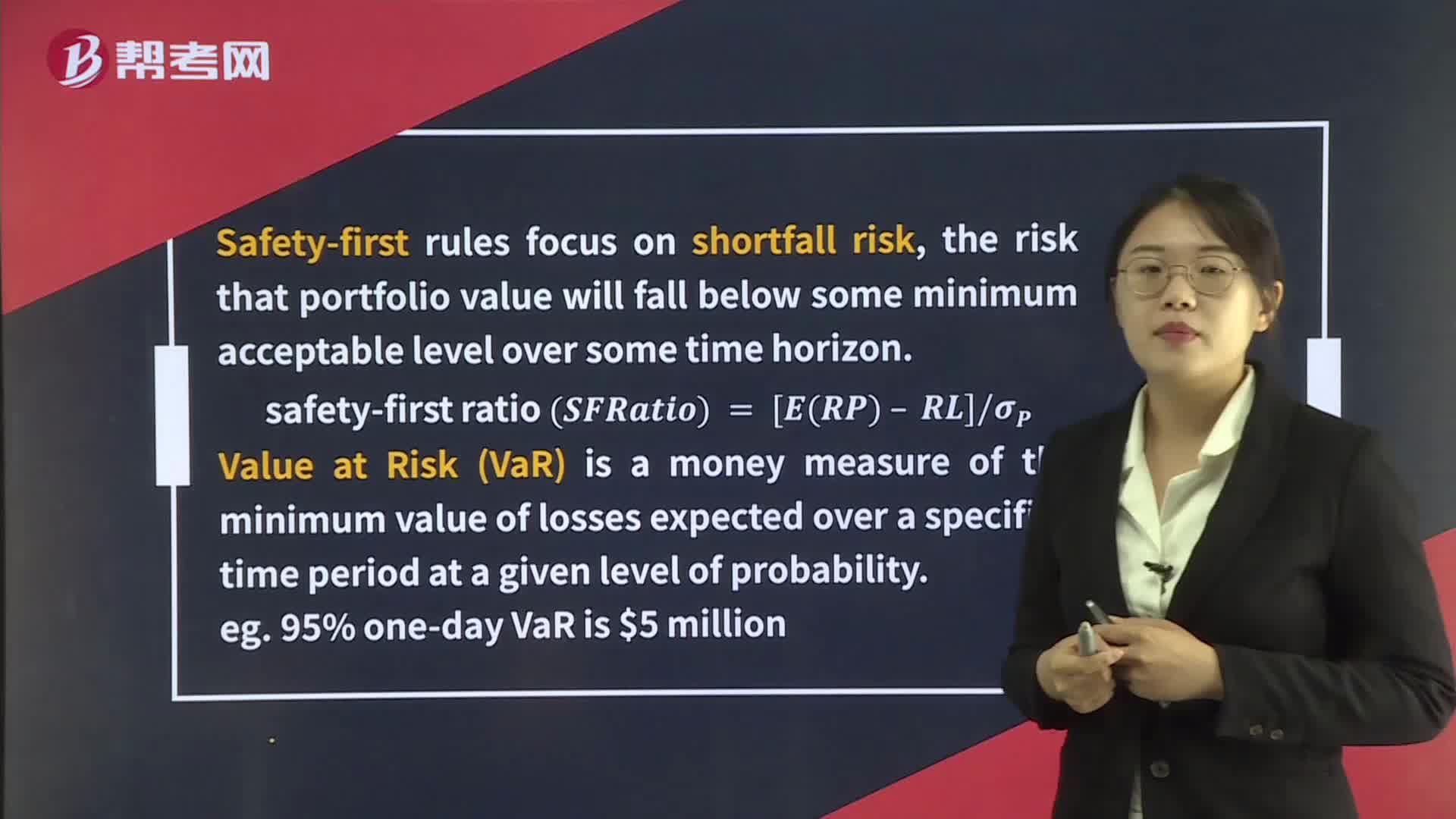

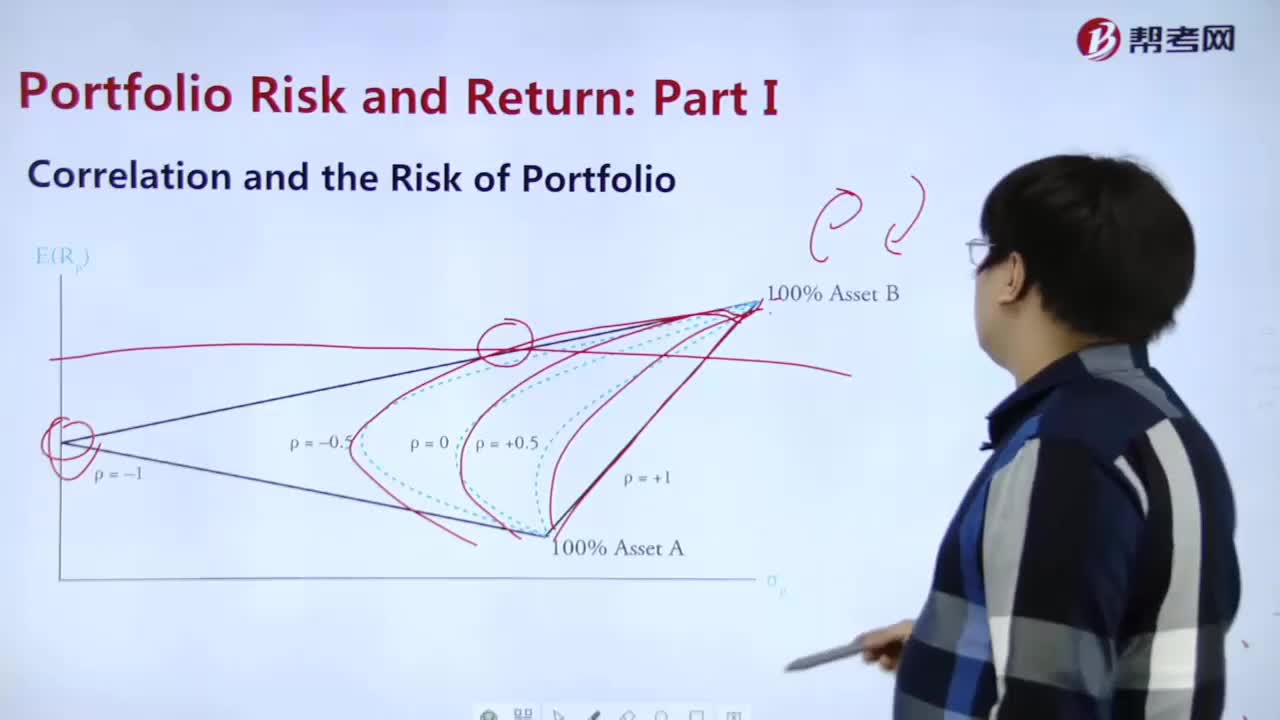

What are the correlations and risks of portfolio?

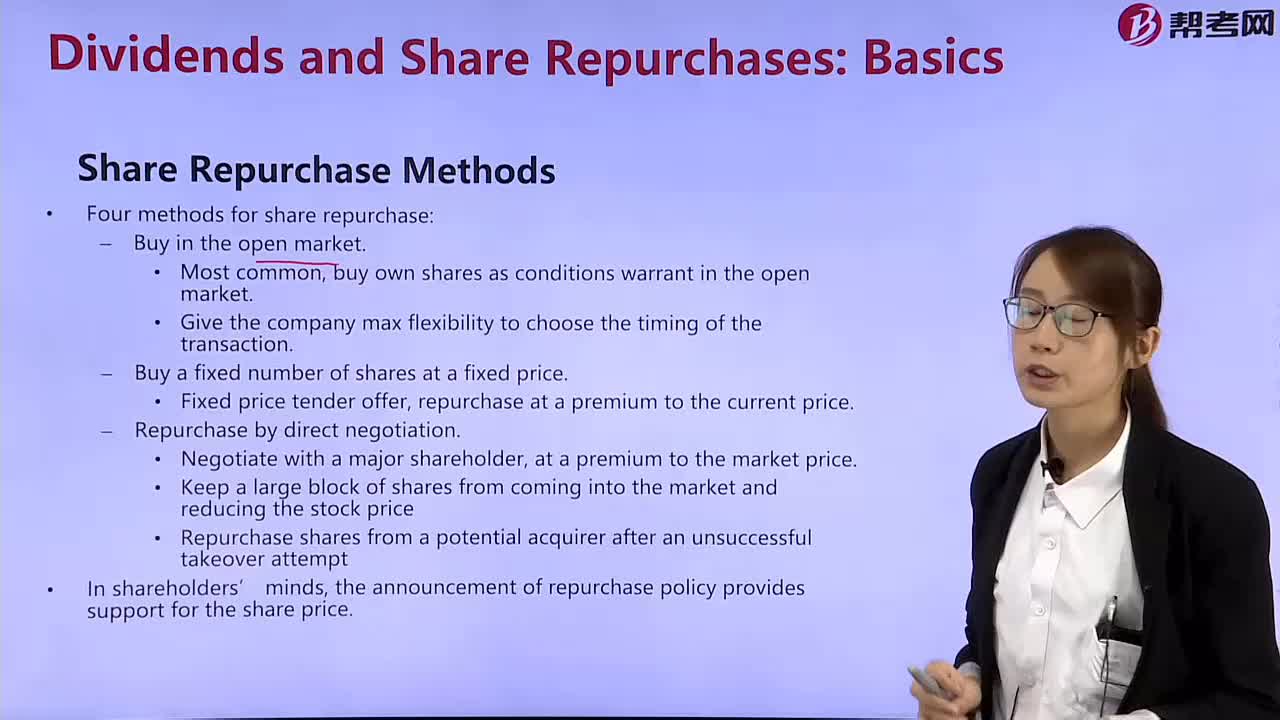

What are the methods of share repurchase?

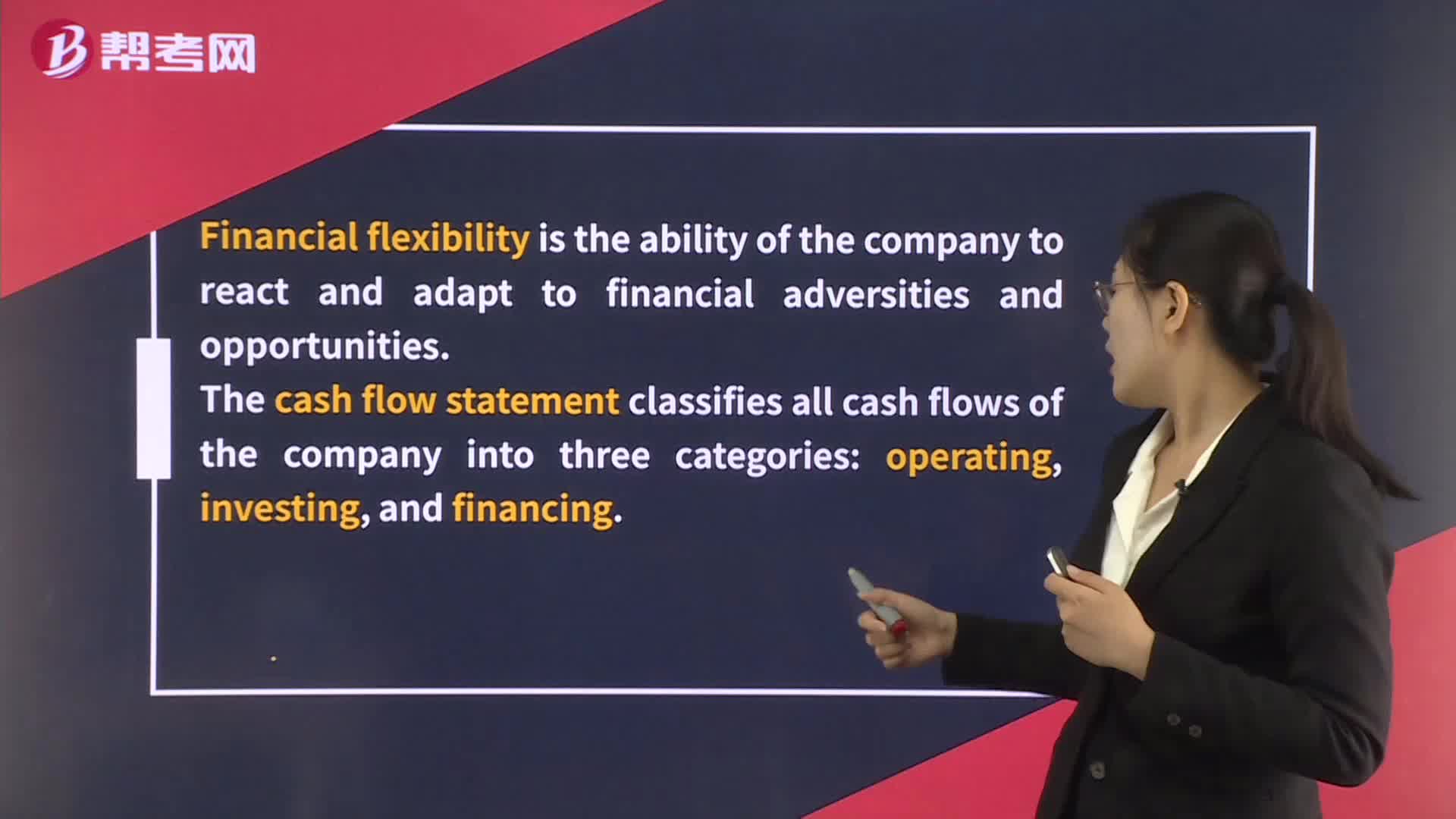

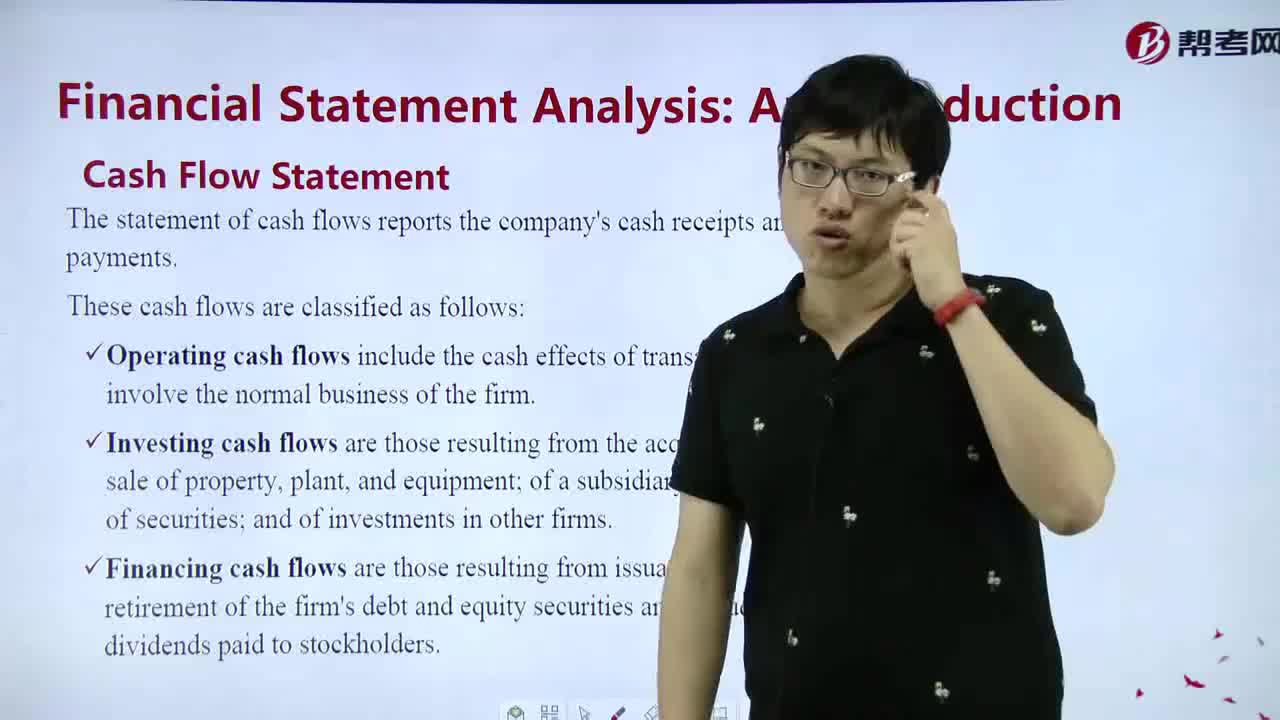

How to master Cash Flow Statement?

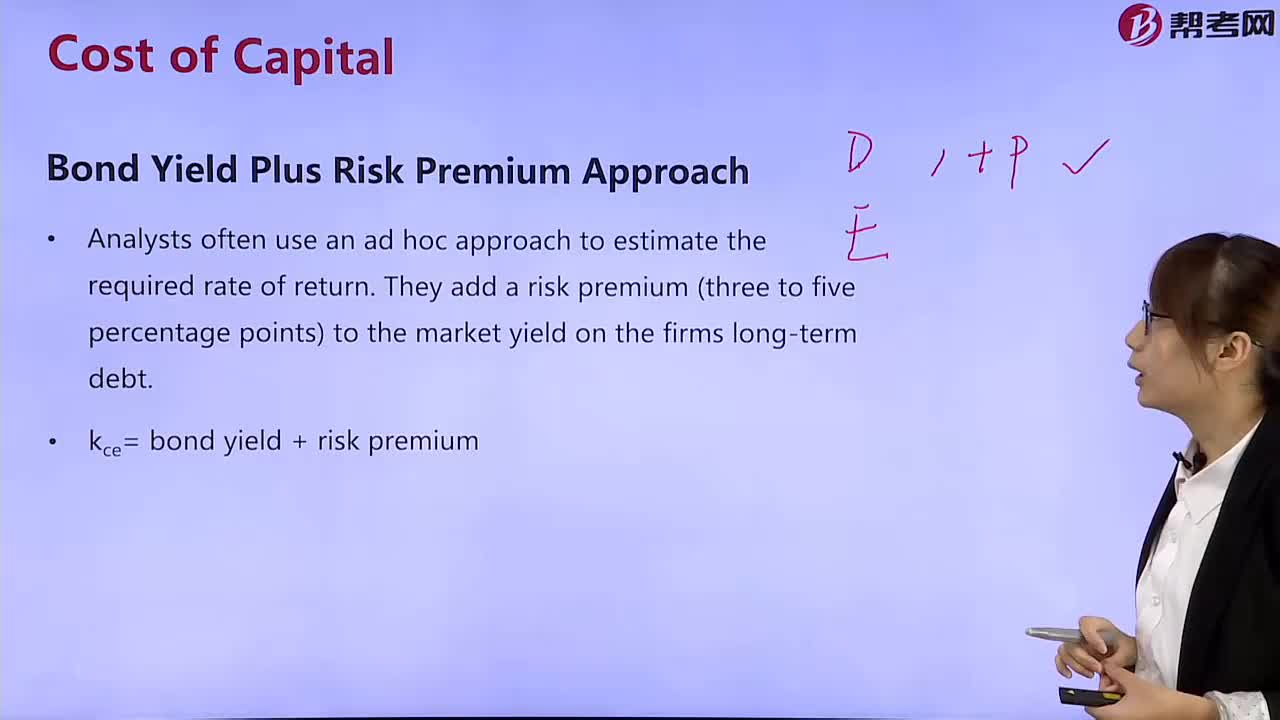

What are the methods of bond yield plus risk premium?

What are the methods of dividend discount model?

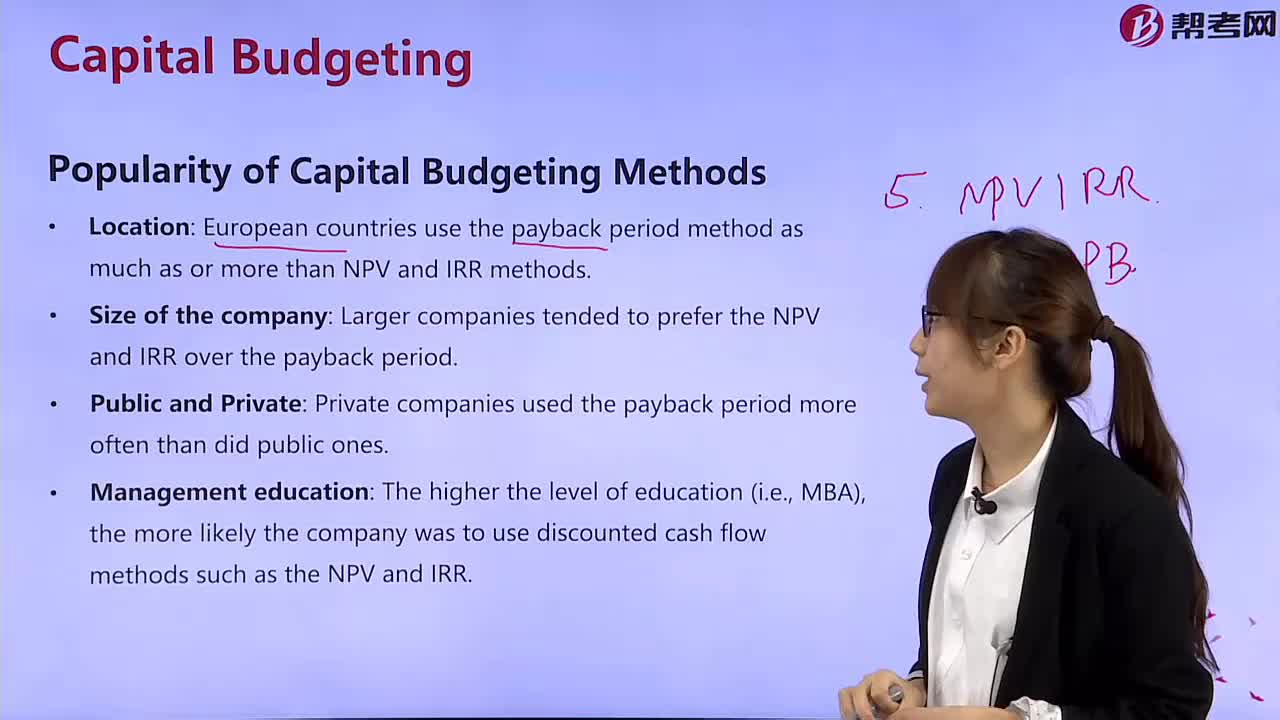

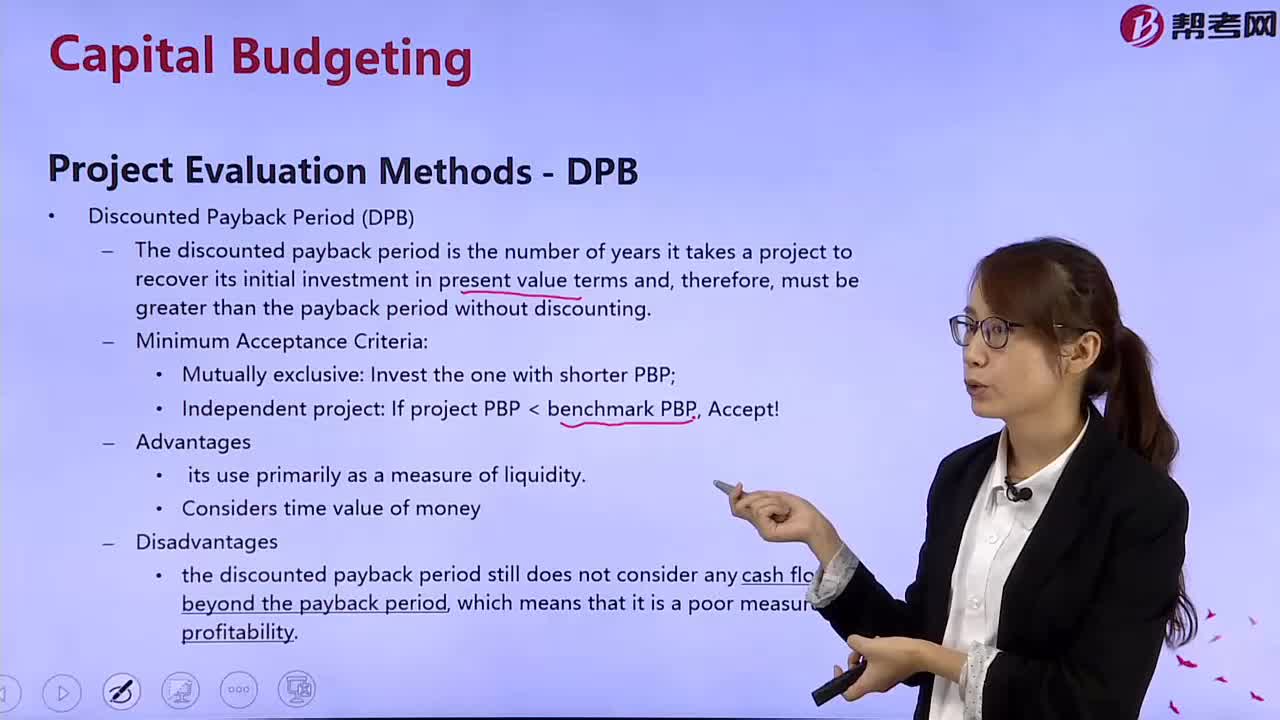

What are the popular capital budgeting methods?

What is the discounted payback period?

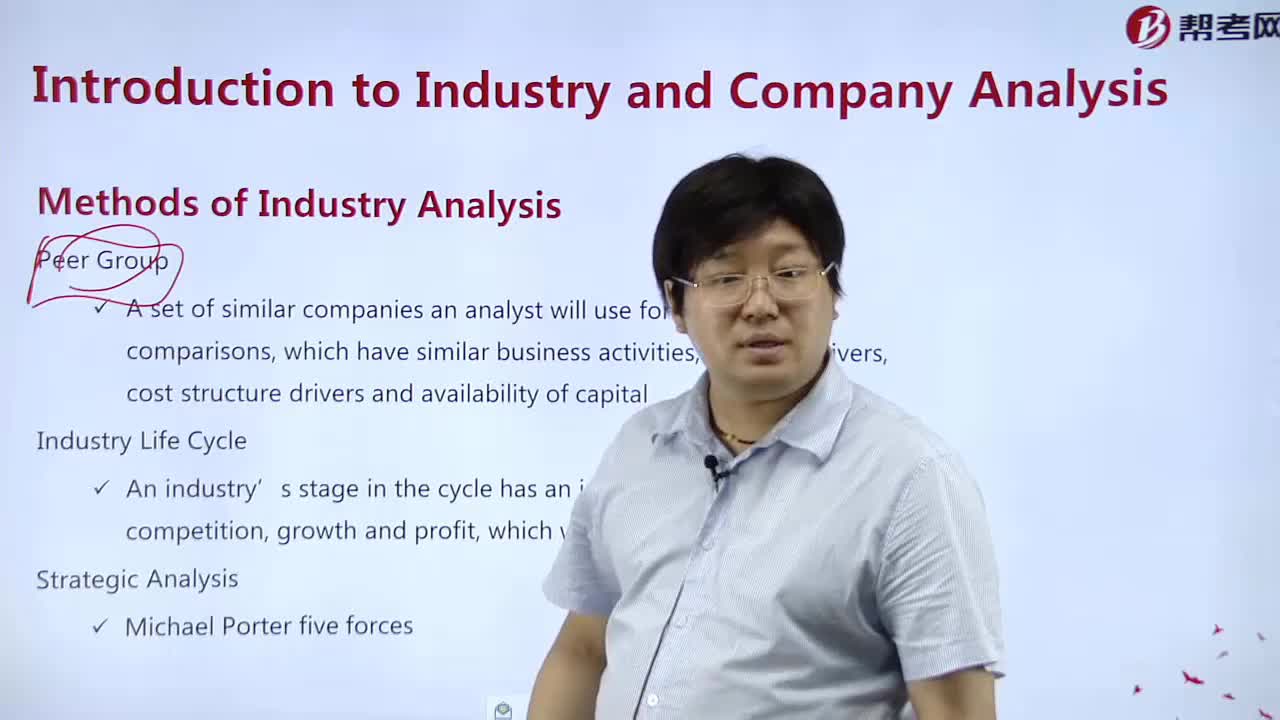

What are the methods of industrial analysis?

What are the weighting methods?

Point and Interval Estimates of the Population Mean

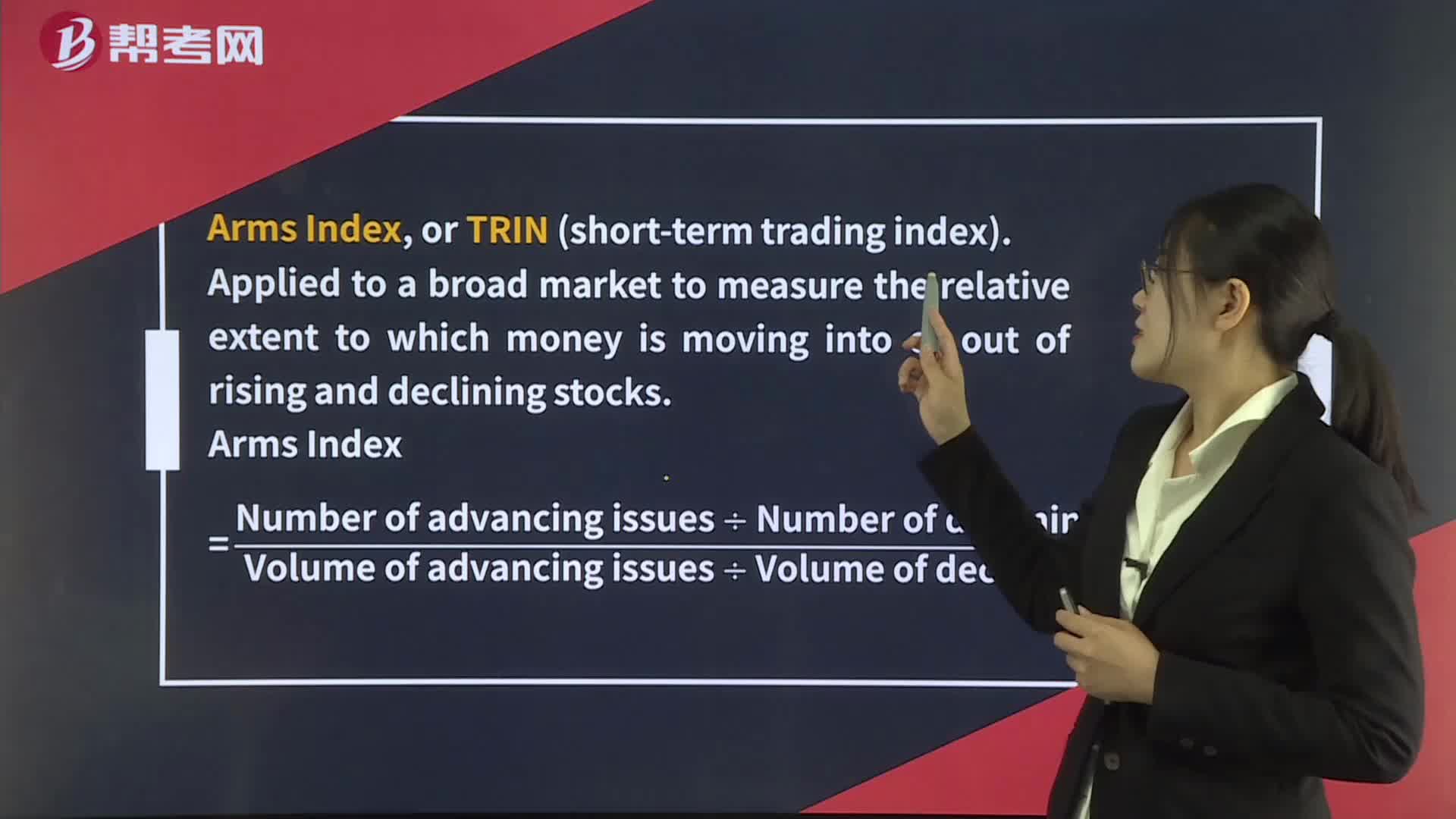

Technical Indicators— Flow-of-Funds Indicators

下載億題庫APP

聯(lián)系電話:400-660-1360