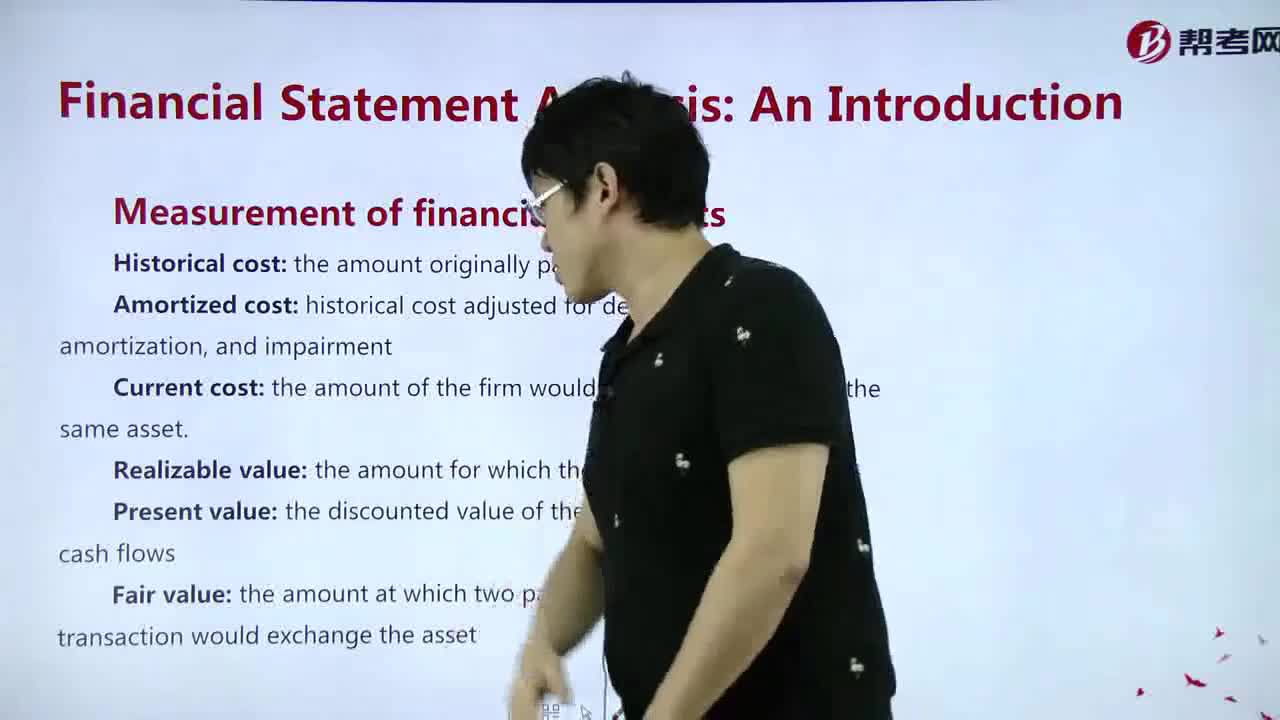

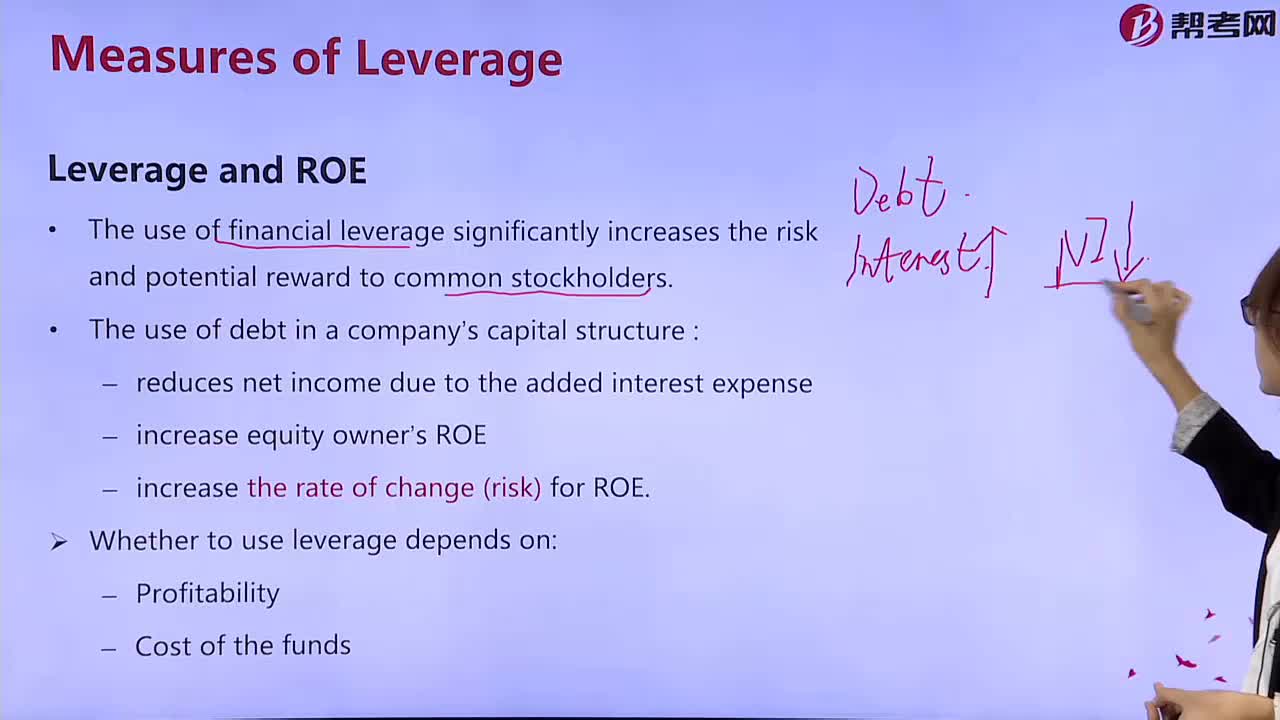

What does financial leverage have to do with return on assets?

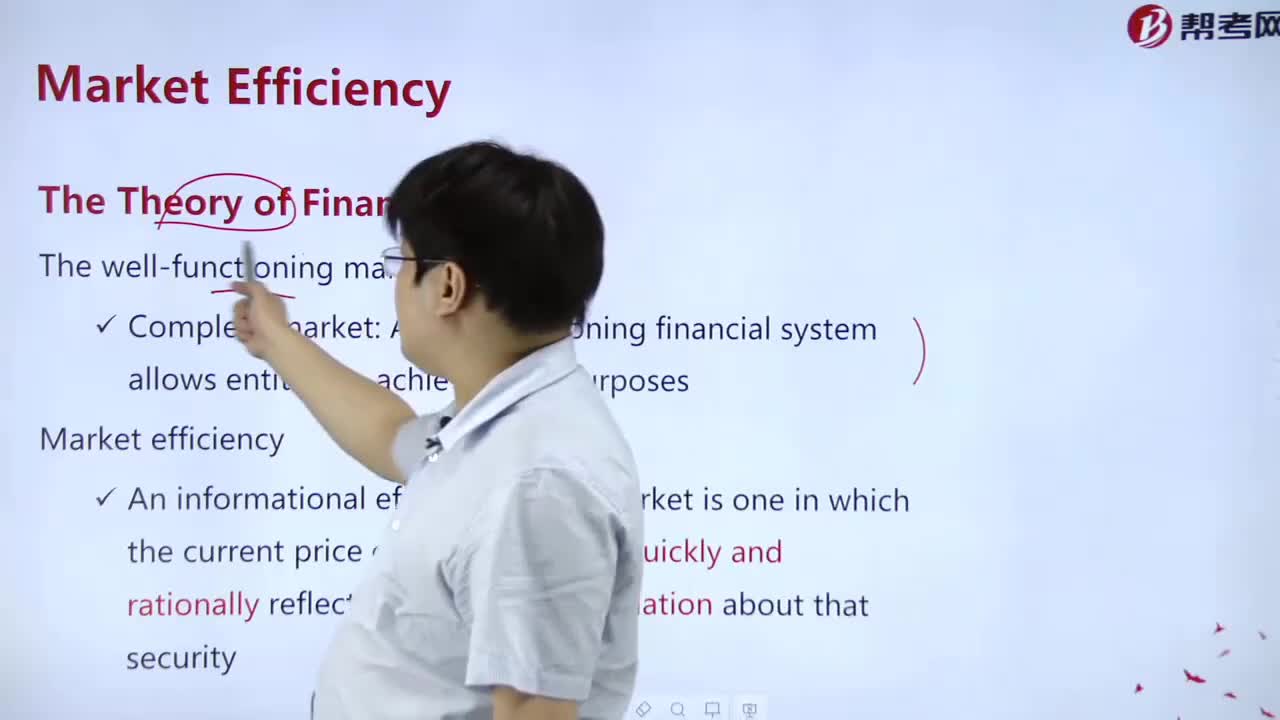

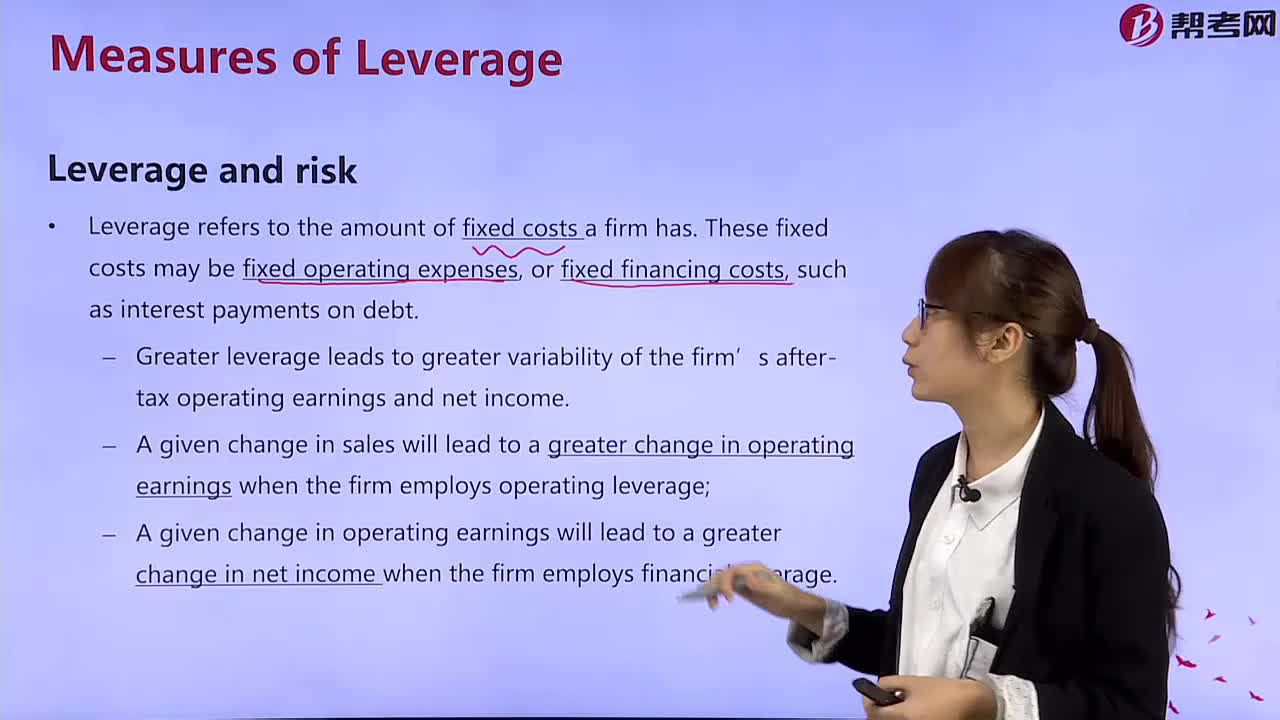

What does leverage and risk mean?

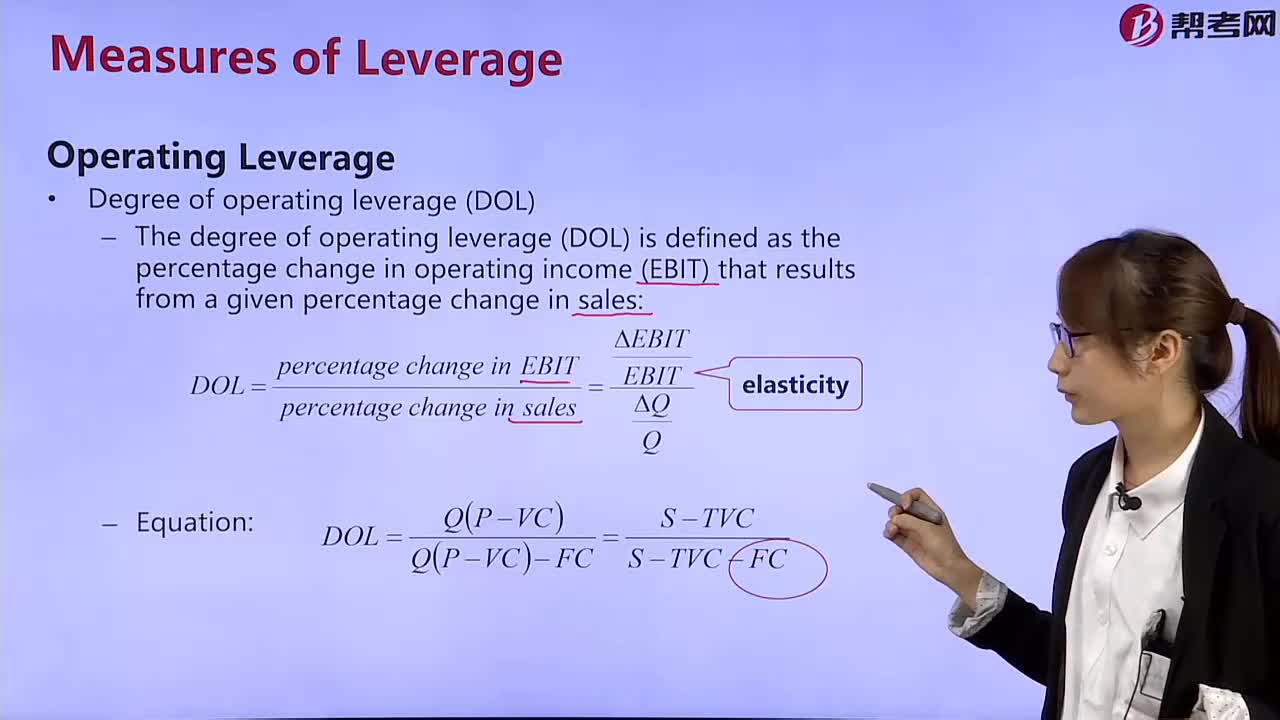

How to calculate the degree of operating leverage?

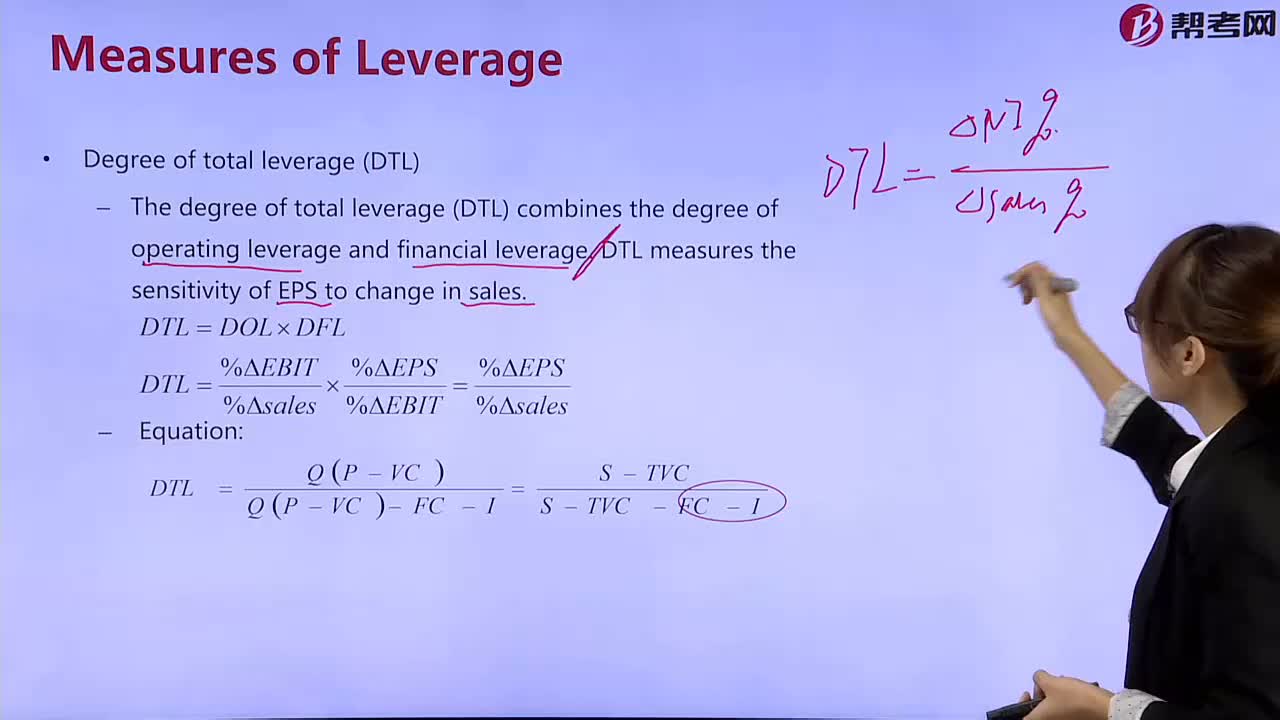

How To calculate total leverage?

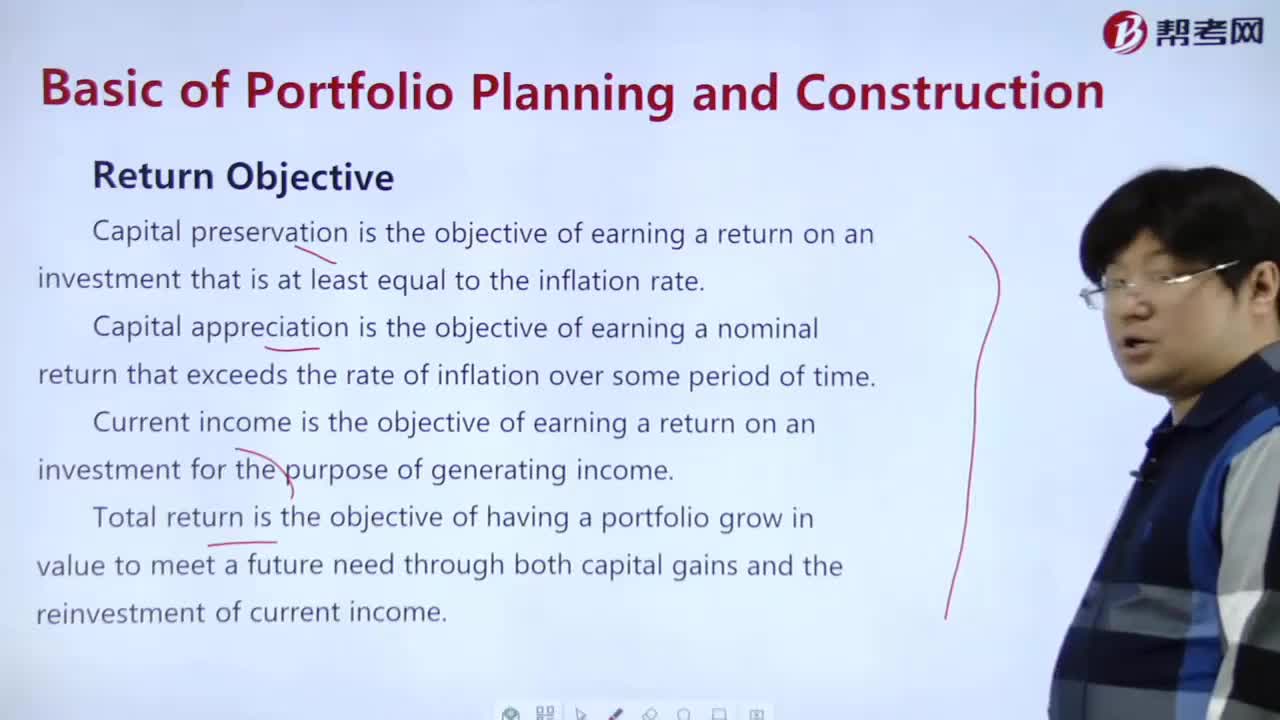

How to control risk and return?

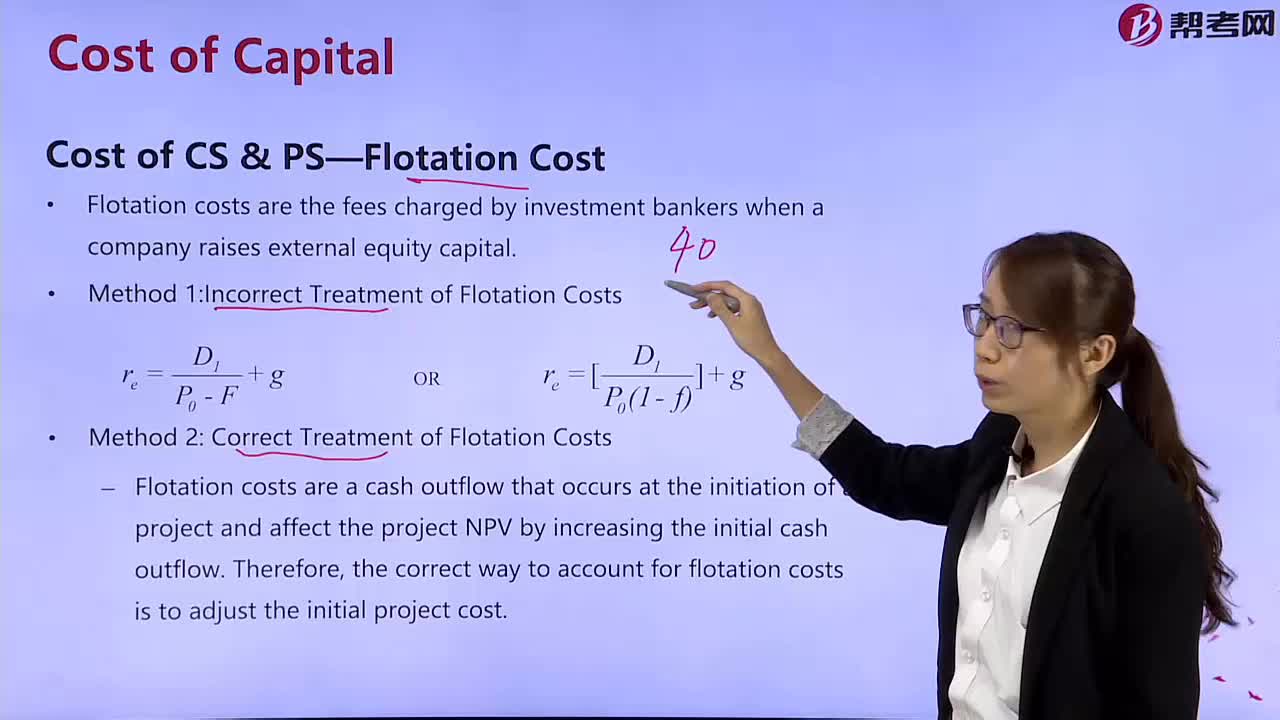

How To deal with flotation cost?

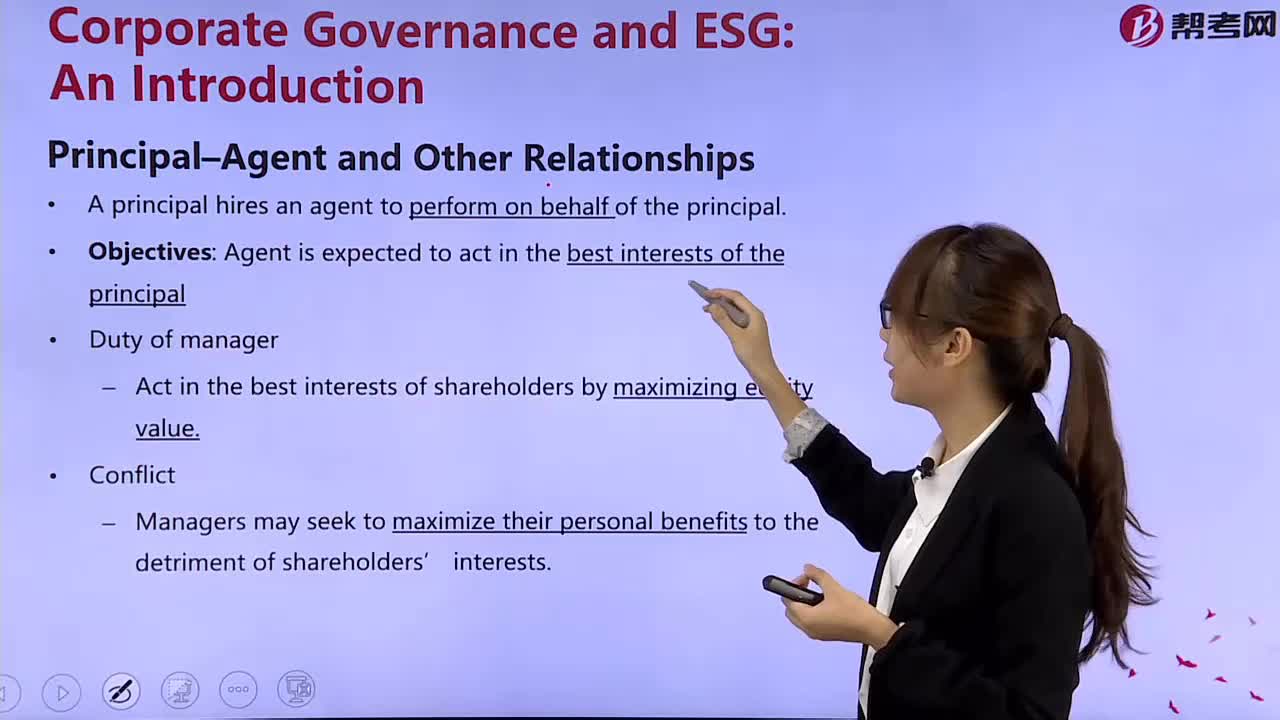

What are the non-financial risks?

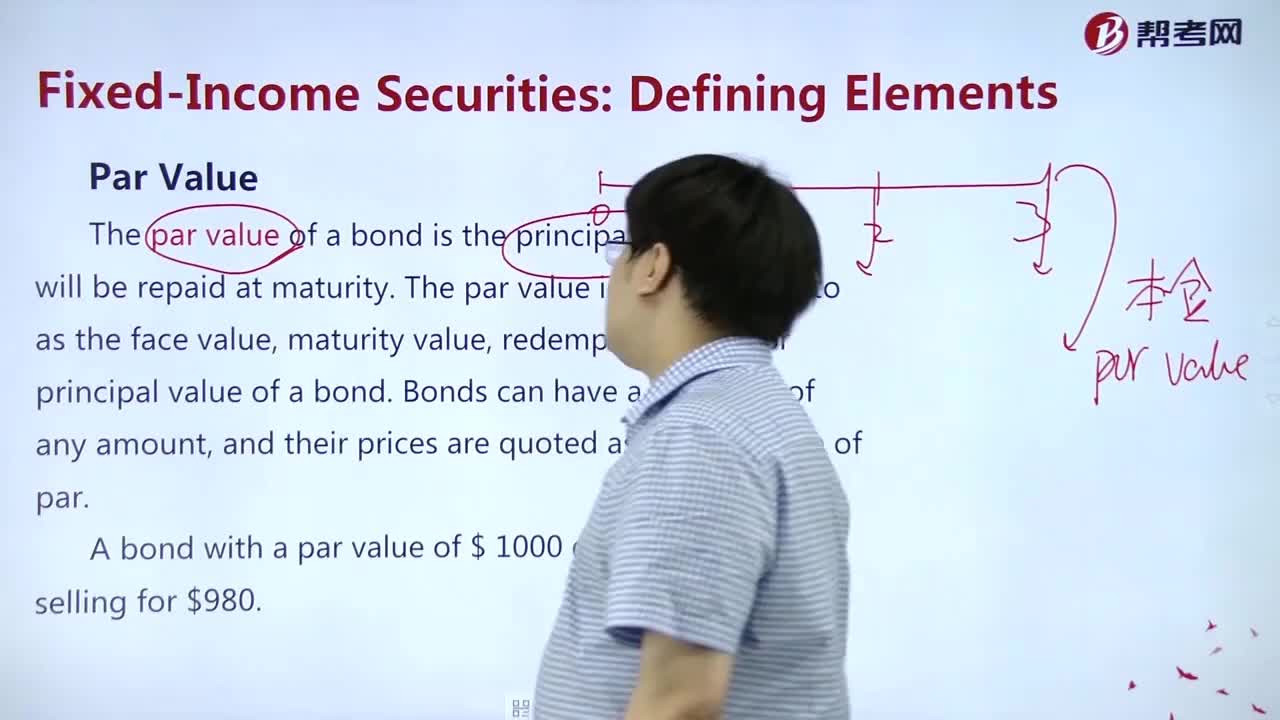

What does Par Value mean?

What does Tax Considerations mean?

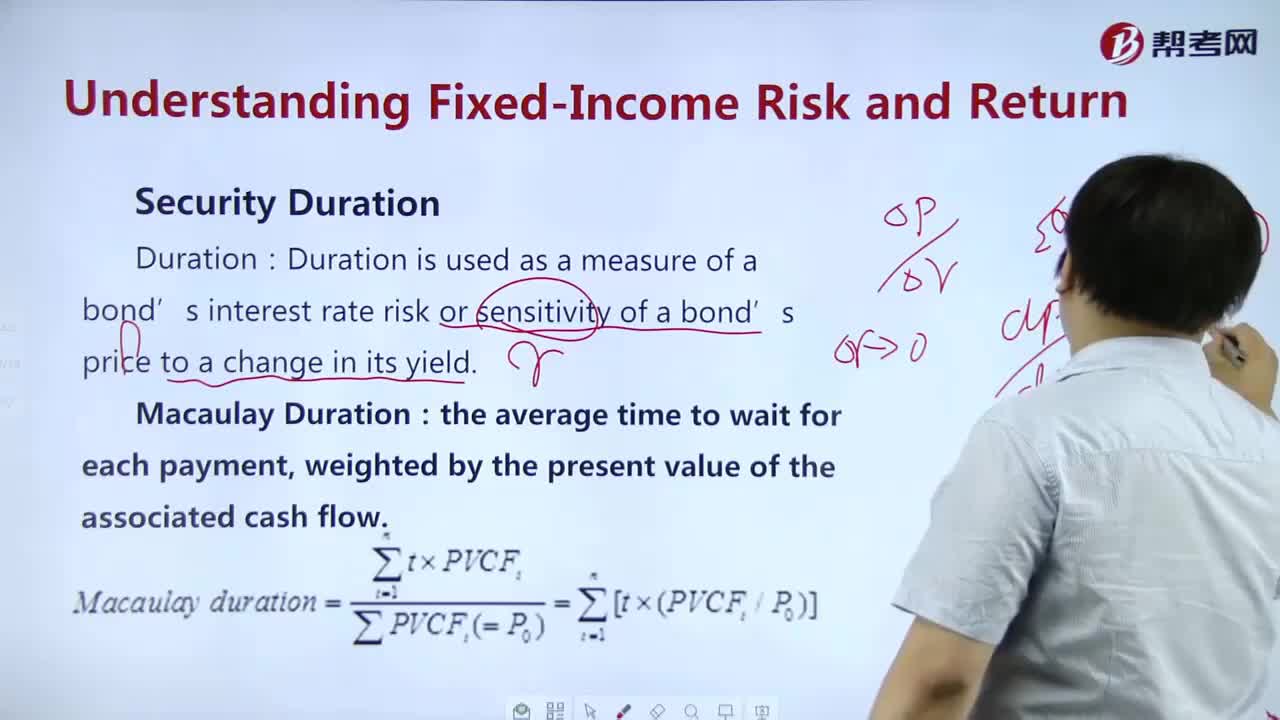

How to master Bonds with Embedded Options?

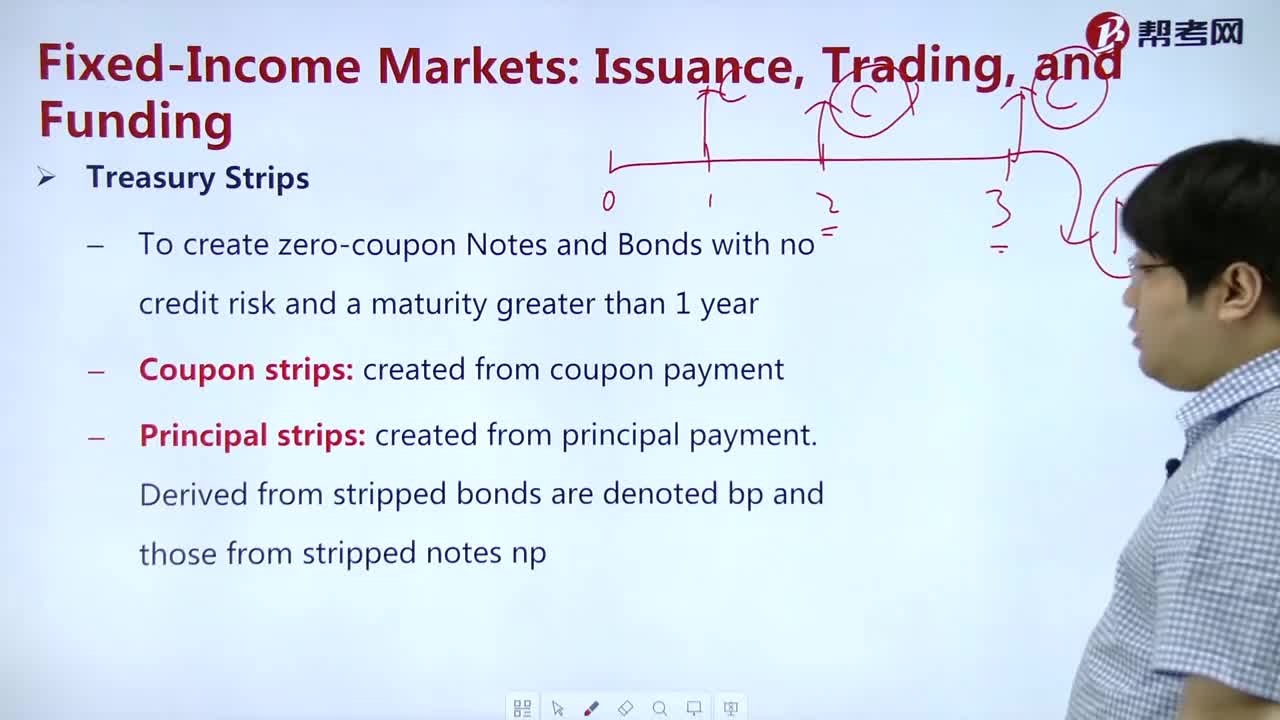

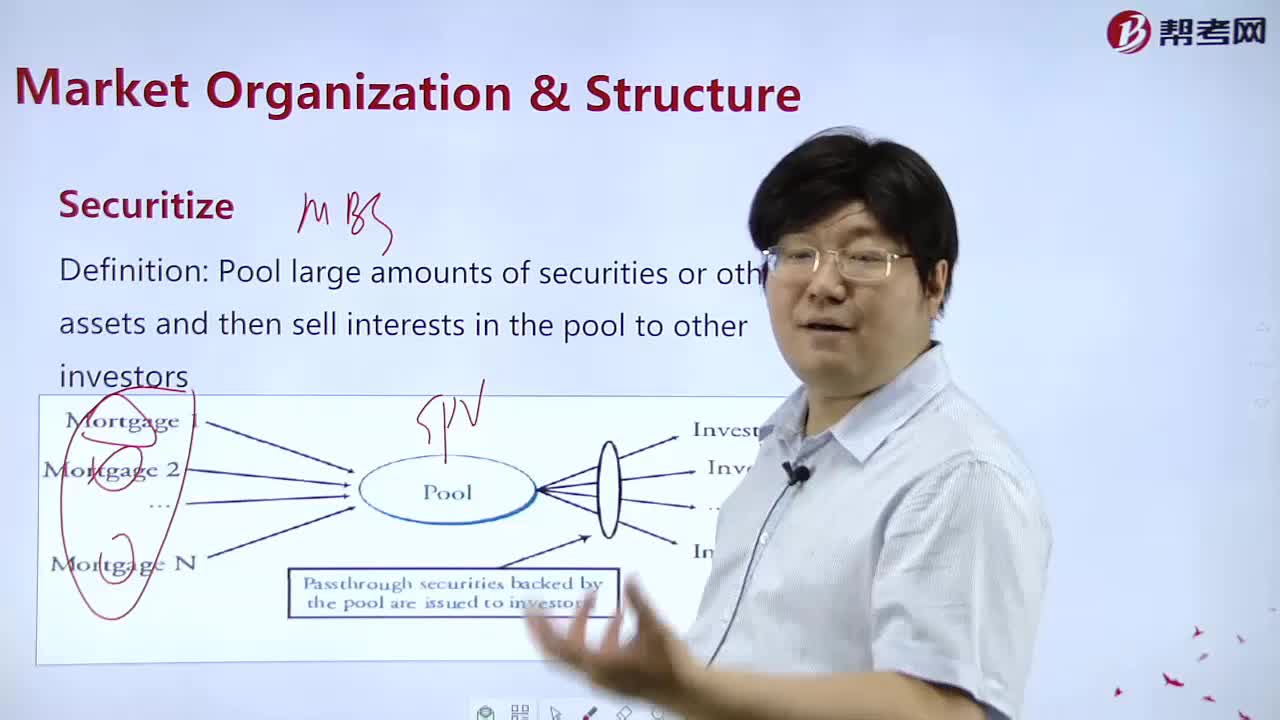

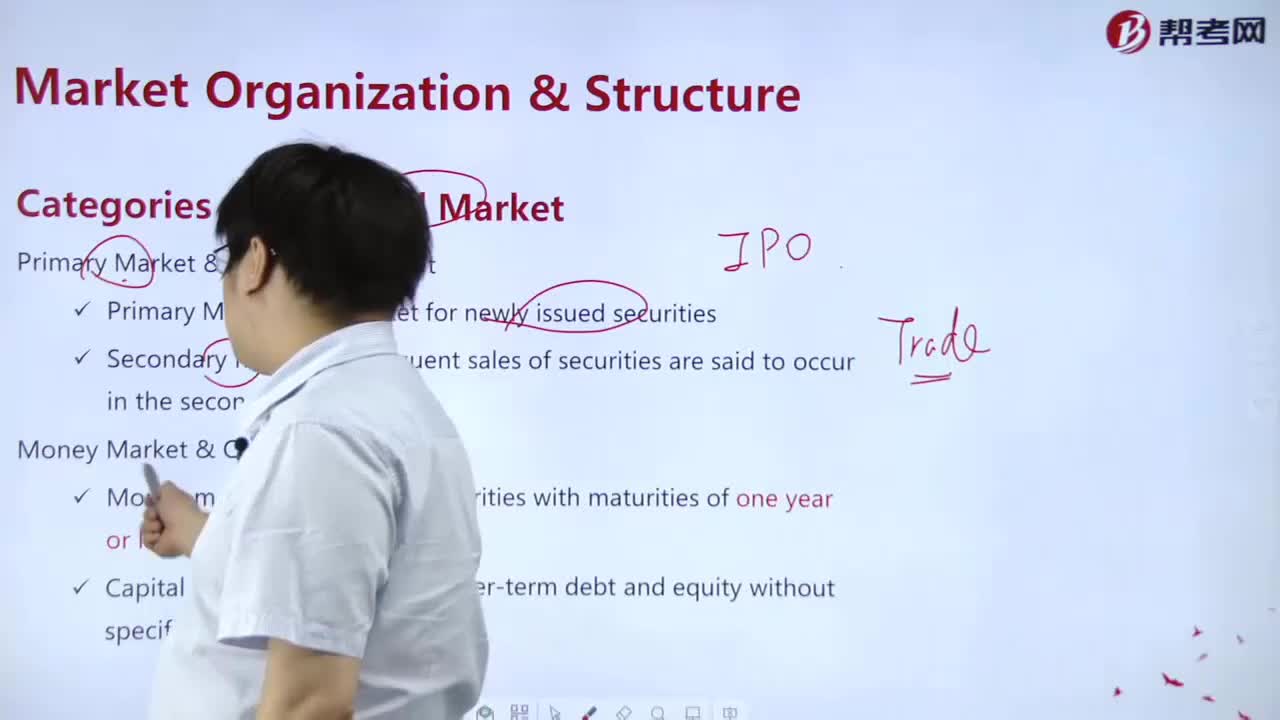

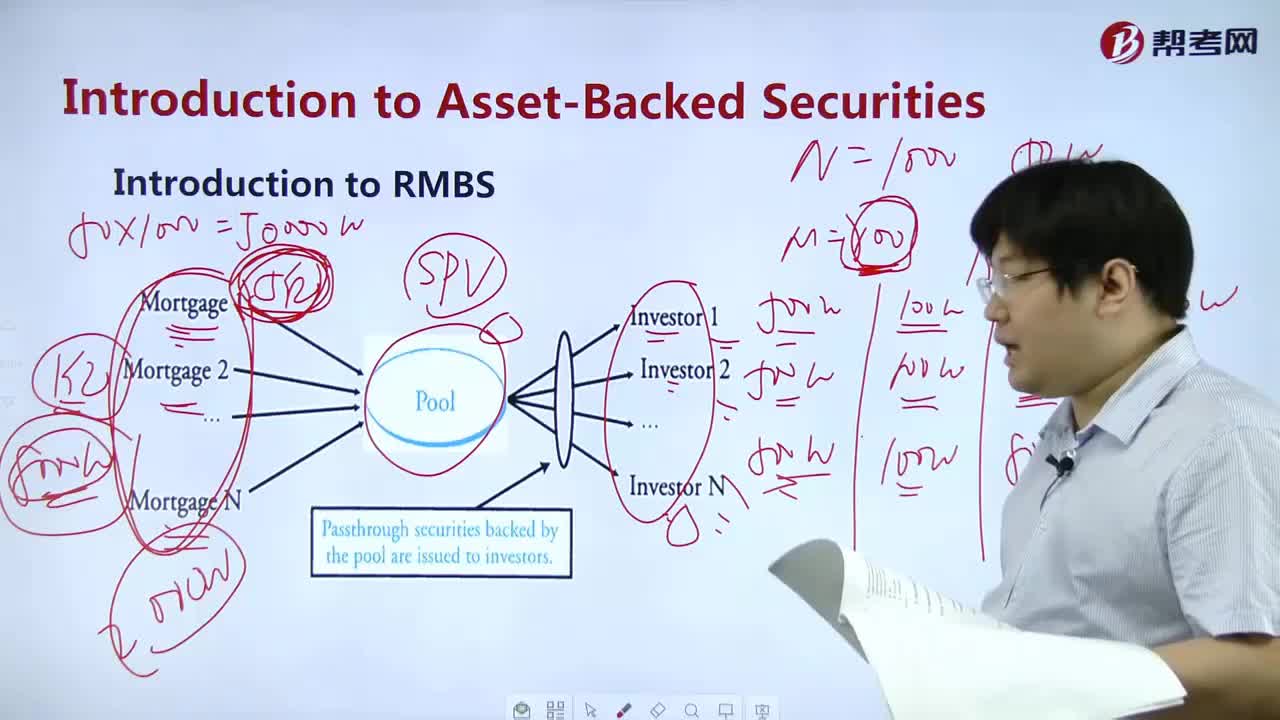

What does Introdution to RMBS mean?

What does Agency MBS mean?

下載億題庫(kù)APP

聯(lián)系電話:400-660-1360