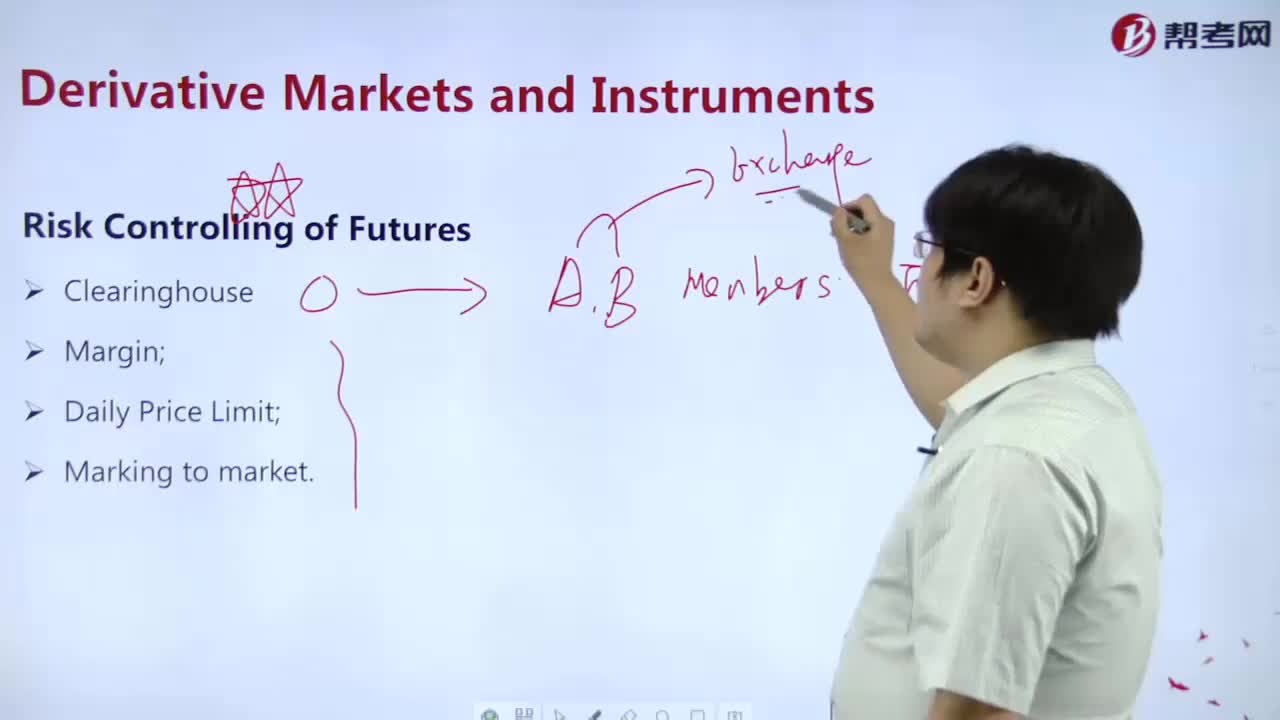

What does the risk control of futures include?

What does venture capital consist of?

What does alternative investment consist of?

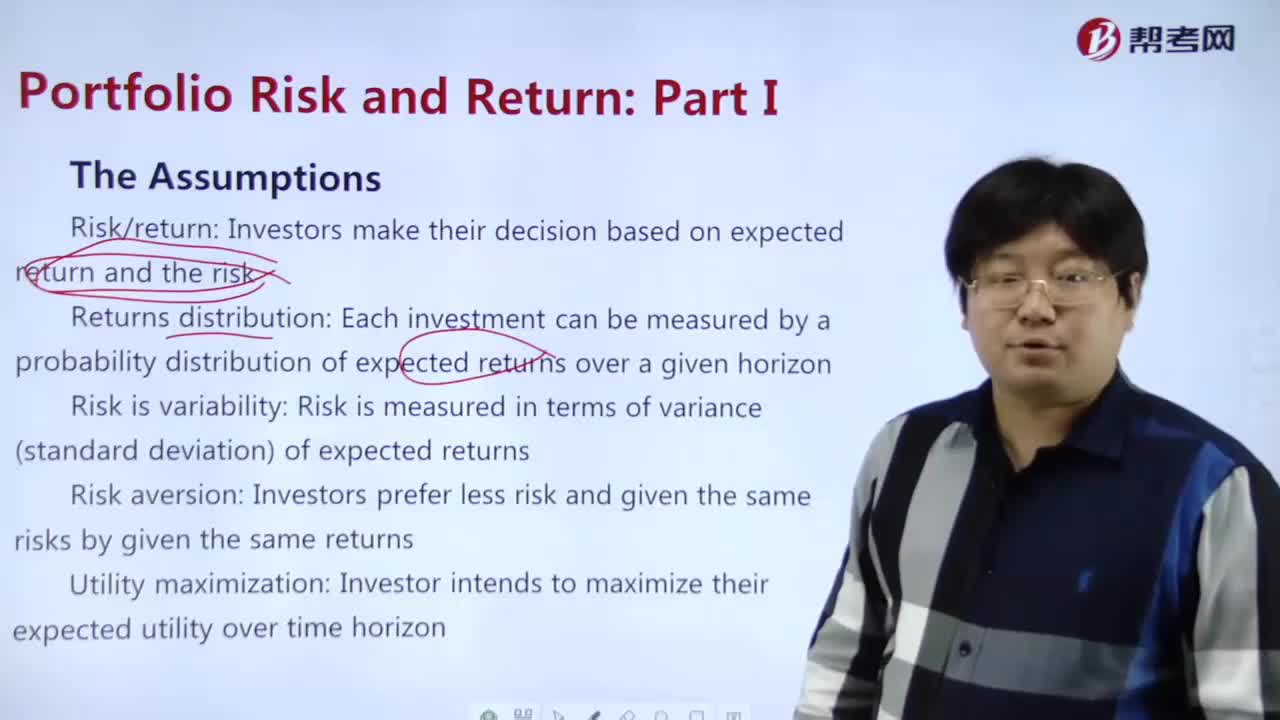

What is the assumptions in portfolio risk?

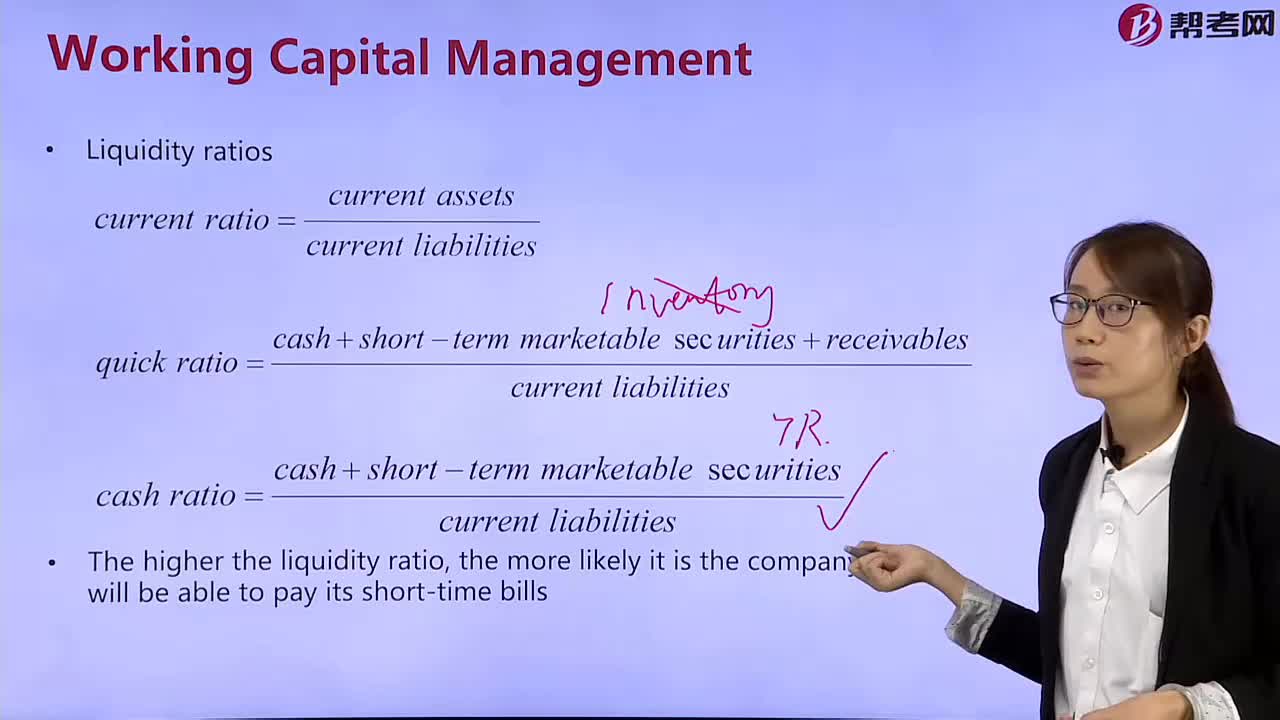

What does the liquidity ratio include?

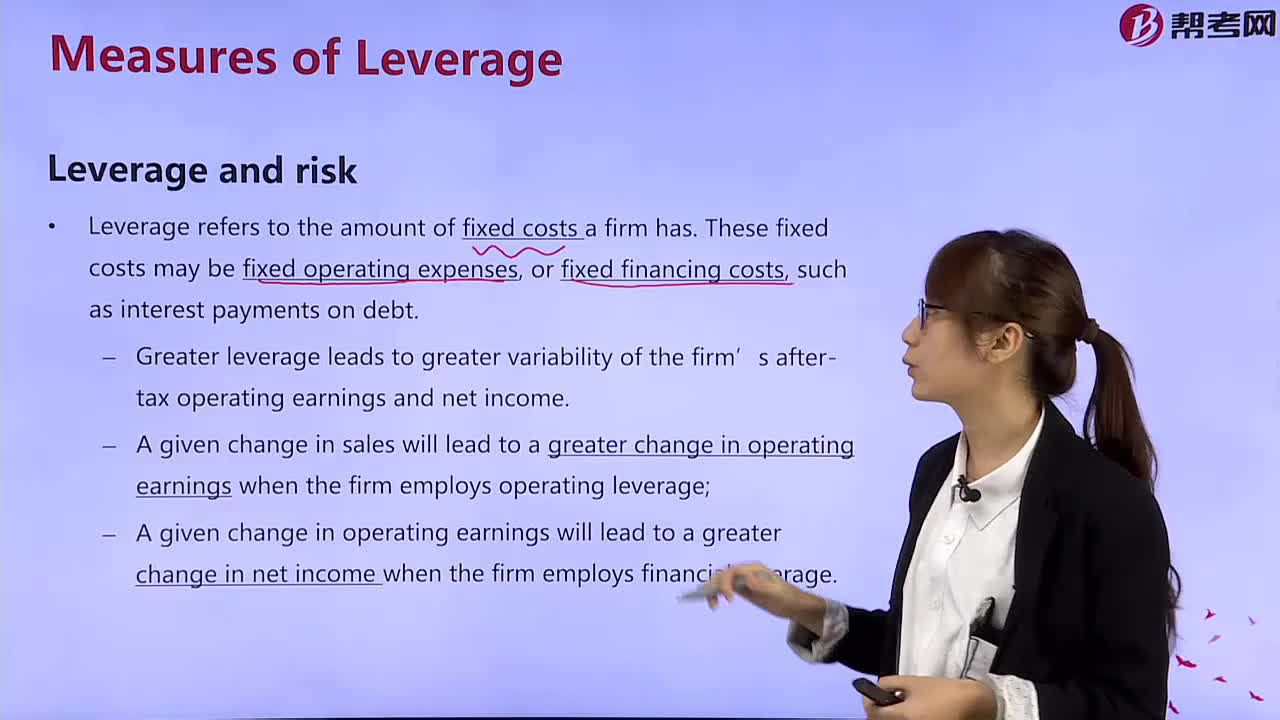

What does leverage and risk mean?

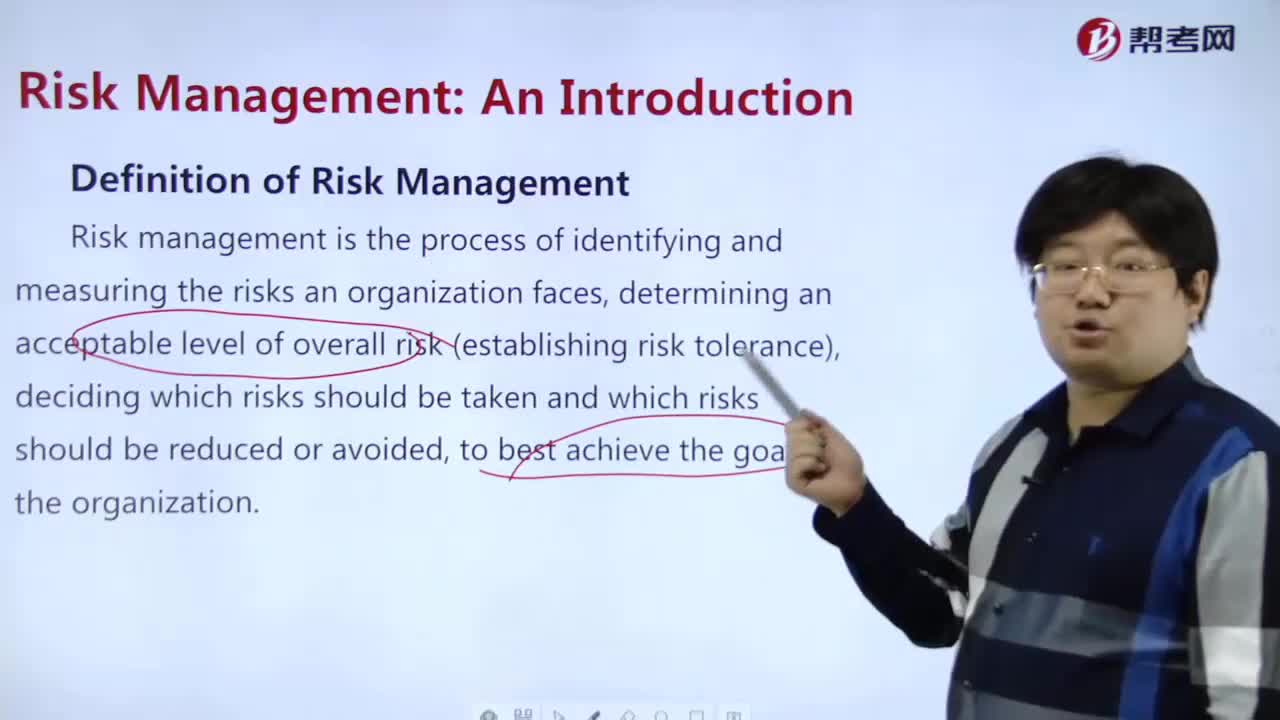

What is the definition of risk management?

What's the meaning of?Prepayment risk?

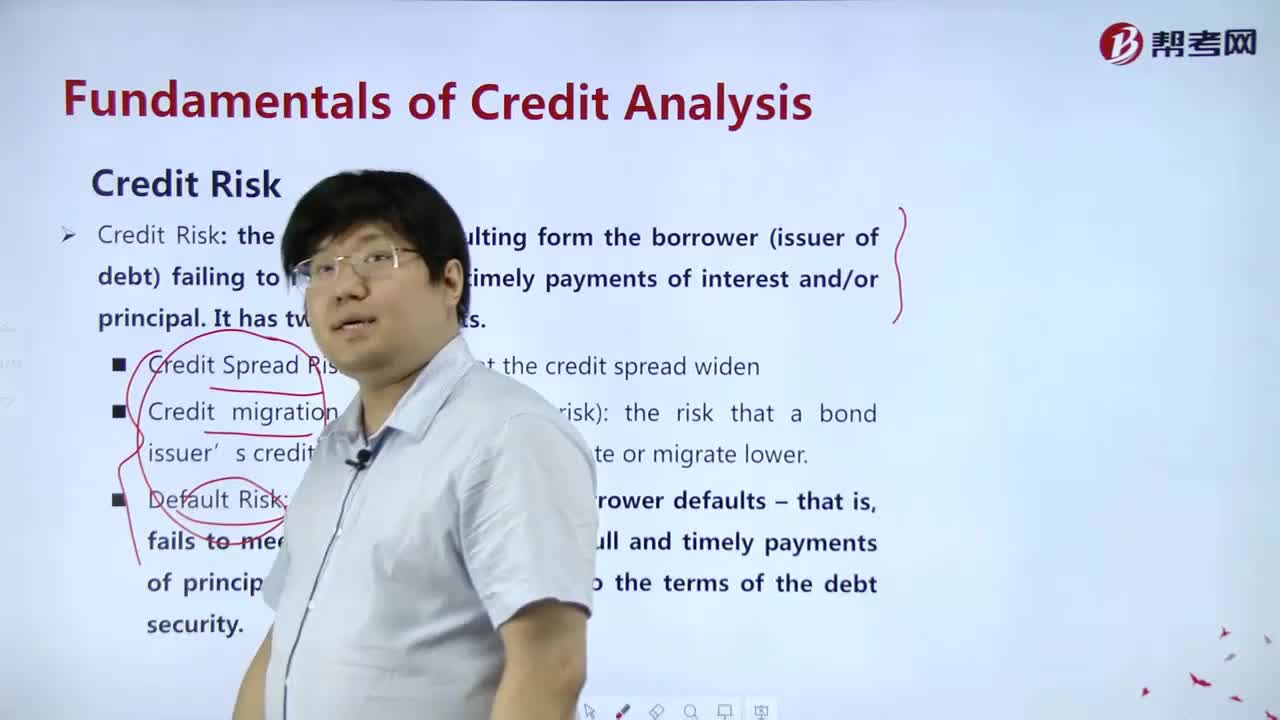

What's the meaning of Credit Risk?

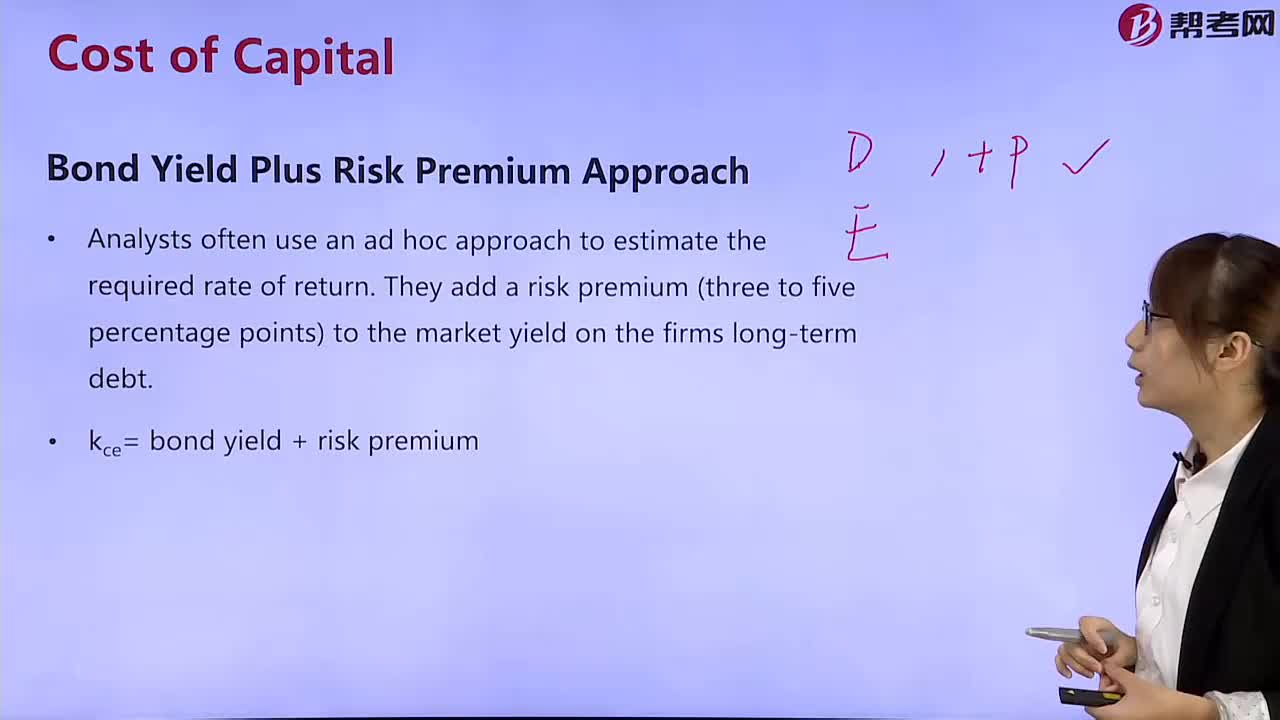

What are the methods of bond yield plus risk premium?

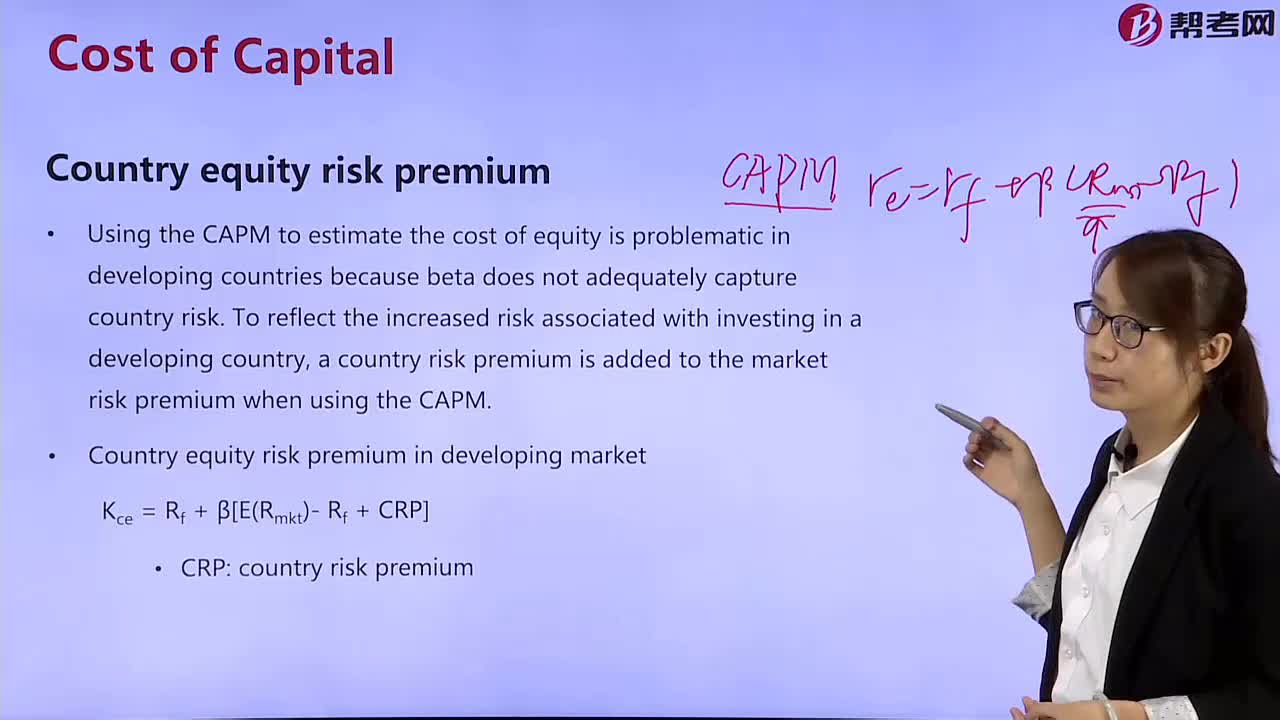

What is the National Equity Risk Premium?

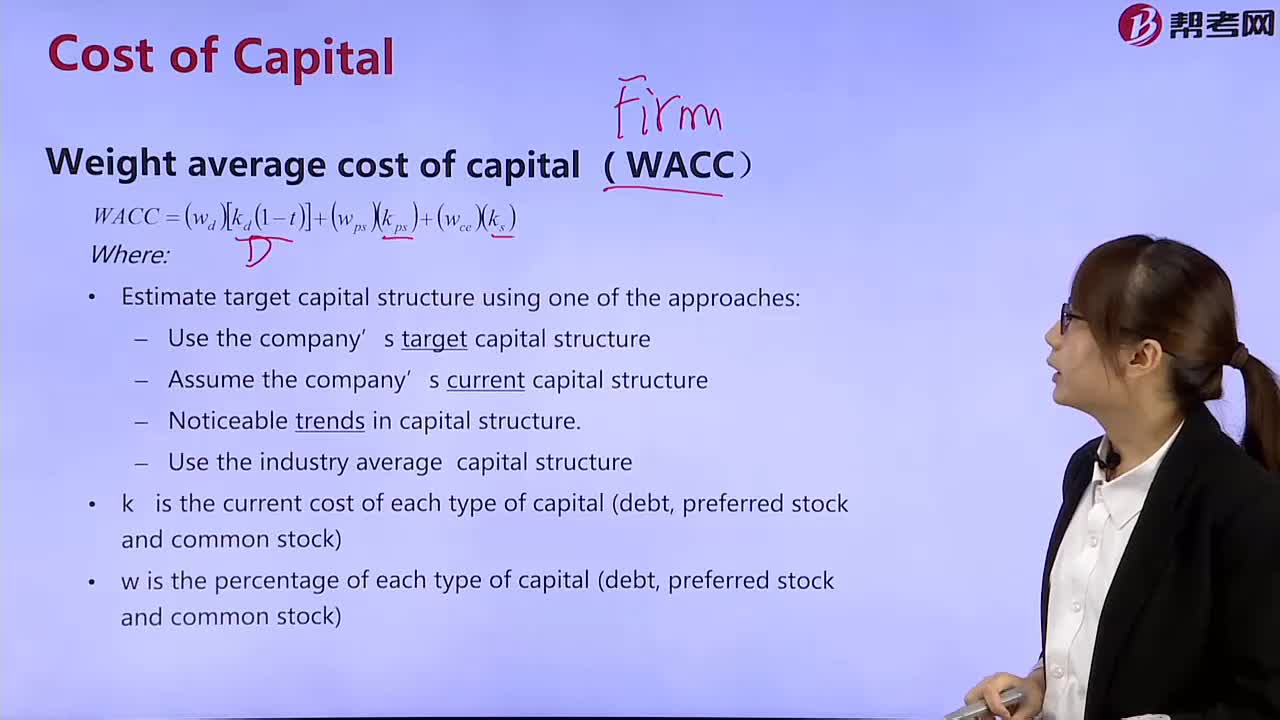

What does the Weighted average cost of capital include?

下載億題庫APP

聯(lián)系電話:400-660-1360