下載億題庫(kù)APP

聯(lián)系電話:400-660-1360

下載億題庫(kù)APP

聯(lián)系電話:400-660-1360

請(qǐng)謹(jǐn)慎保管和記憶你的密碼,以免泄露和丟失

請(qǐng)謹(jǐn)慎保管和記憶你的密碼,以免泄露和丟失

Deficits and the National Debt

Budget surplus/deficit is the difference between government revenue and expenditure for a fixed period of time, such as a fiscal or calendar year.

微信截圖_159659307828020200805105915181.png)

Government revenue includes tax revenues net of transfer payments;

Government spending includes interest payments on the government debt.

If government spending and revenues are equal, then the budget is balanced.

An increase in a budget surplus would be associated with contractionary fiscal policy, while a rise in a deficit is an expansionary fiscal policy.

Government (or national) debt is the accumulation over time of government deficits.

Government deficits are financed by borrowing from the privatesector, often via private pension and insurance fund portfolio investments.

An important issue for governments and their creditors is whether their additional spending leads to sufficiently higher tax revenues to pay the interest on the debt used to finance the extra spending.

The arguments against being concerned about national debt:

The problem may be overstated because the debt is owed internally to fellow citizens.

A proportion of the debt may have been used for capital investment projects or enhancing human capital; leading to raised future output and tax revenues.

Large fiscal deficits require tax changes which may actually reduce distortions caused by existing tax structures.

Deficits may have no net impact because the private sector may act to offset fiscal deficits by increasing saving in anticipation of future increased taxes. The“Ricardian equivalence”

If there is unemployment in an economy, then the debt is not diverting activity away from productive uses.

We should be concerned about national debt because:

High levels of debt to GDP, higher tax rates, reduced labor effort and entrepreneurial activity, lower growth in the long run.

If markets lose confidence in a government, the central bank may have to print money to finance a government deficit. This may lead ultimately to high inflation.

Government borrowing may divert private sector investment from taking place (an effect known as crowding out); limited savings spent on investment, larger government demands, higher interest rates and lower private sector investing.

573

573National Economic Accounts and the Balance of Payments:where:SpC–Sg.productive resources and its ability to repay its liabilities.Current

195

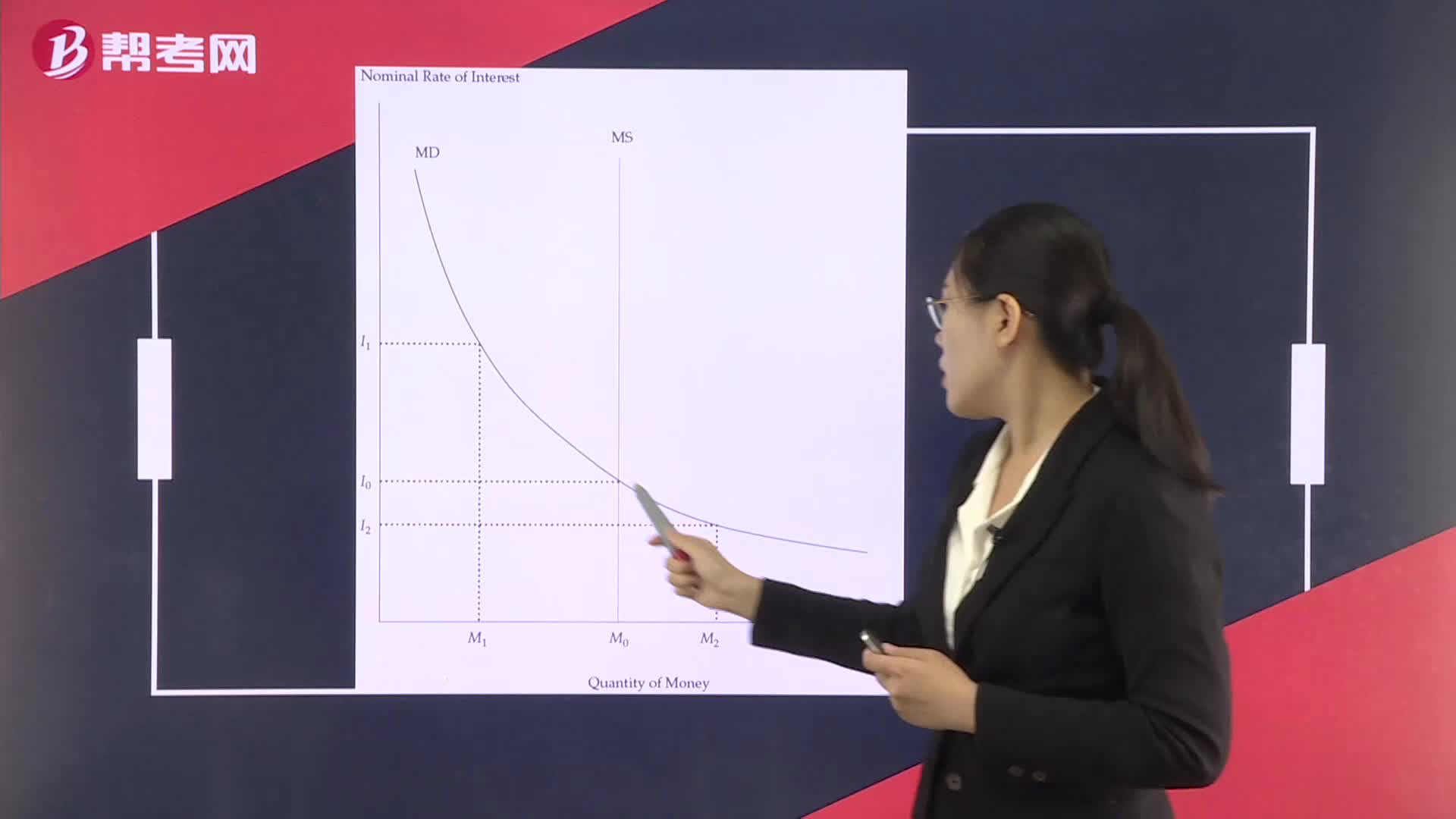

195The Supply and Demand for Money:Interest”rates effectively adjust to bring the market into:Moneythat the money supply can affect real things in the short run.

254

254Shifts in the AD and AS curves and Equilibriums:A decrease in AD lowers real GDP:contractions are associated with rising inflation and interest rates.

微信掃碼關(guān)注公眾號(hào)

獲取更多考試熱門資料