下載億題庫(kù)APP

聯(lián)系電話:400-660-1360

下載億題庫(kù)APP

聯(lián)系電話:400-660-1360

請(qǐng)謹(jǐn)慎保管和記憶你的密碼,以免泄露和丟失

請(qǐng)謹(jǐn)慎保管和記憶你的密碼,以免泄露和丟失

The New Classical School

New classical macroeconomics: an approach to macroeconomics that seeks the macroeconomic conclusions of individuals maximizing utility on the basis of rational expectations and companies maximizing profits.

The assumption is made that all agents are roughly alike.

Models without Money: Real Business Cycle (RBC) Theory

RBC models of the business cycle conclude that expansions and contractions represent efficient operation of the economy in response to external real shocks. Recommendation: government not to intervene.

In real business cycle models, cycles have real causes, such as changes in technology, whereas monetary variables, such as inflation, are assumed to have no effect on GDP and unemployment.

Models with Money

Inflation is often seen as a cause of business cycles, because when monetary policy ends up being too expansionary, the economy grows at an unsustainable pace—creating an inflationary gap.

The central bank will often intervene to limit inflation by “tightening” monetary policy. This response will decrease equilibrium GDP and can result in a recession.

Monetary policy can be incorporated into dynamic general equilibrium models with money.

In one type of model, the economy receives shocks from changes in technology and consumer preferences, but can also receive shocks from monetary policy.

Another group of models are the Neo-Keynesians or New Keynesians.

The Neo-Keynesian school attempts to place macroeconomics on sound microeconomic foundations. In contrast to the New Classical school the Neo-Keynesian school assumes slow-to-adjust (“sticky”) prices and wages.

Central banks try to manage the business cycle by raising interest rates when the economy is growing rapidly and inflation accelerates and cutting rates when the economy is weak.

312

312The NPV Rule & The IRR Rule:IRR opportunity cost of capital hurdle:rate:accept,IRR.,[Practice,013

216

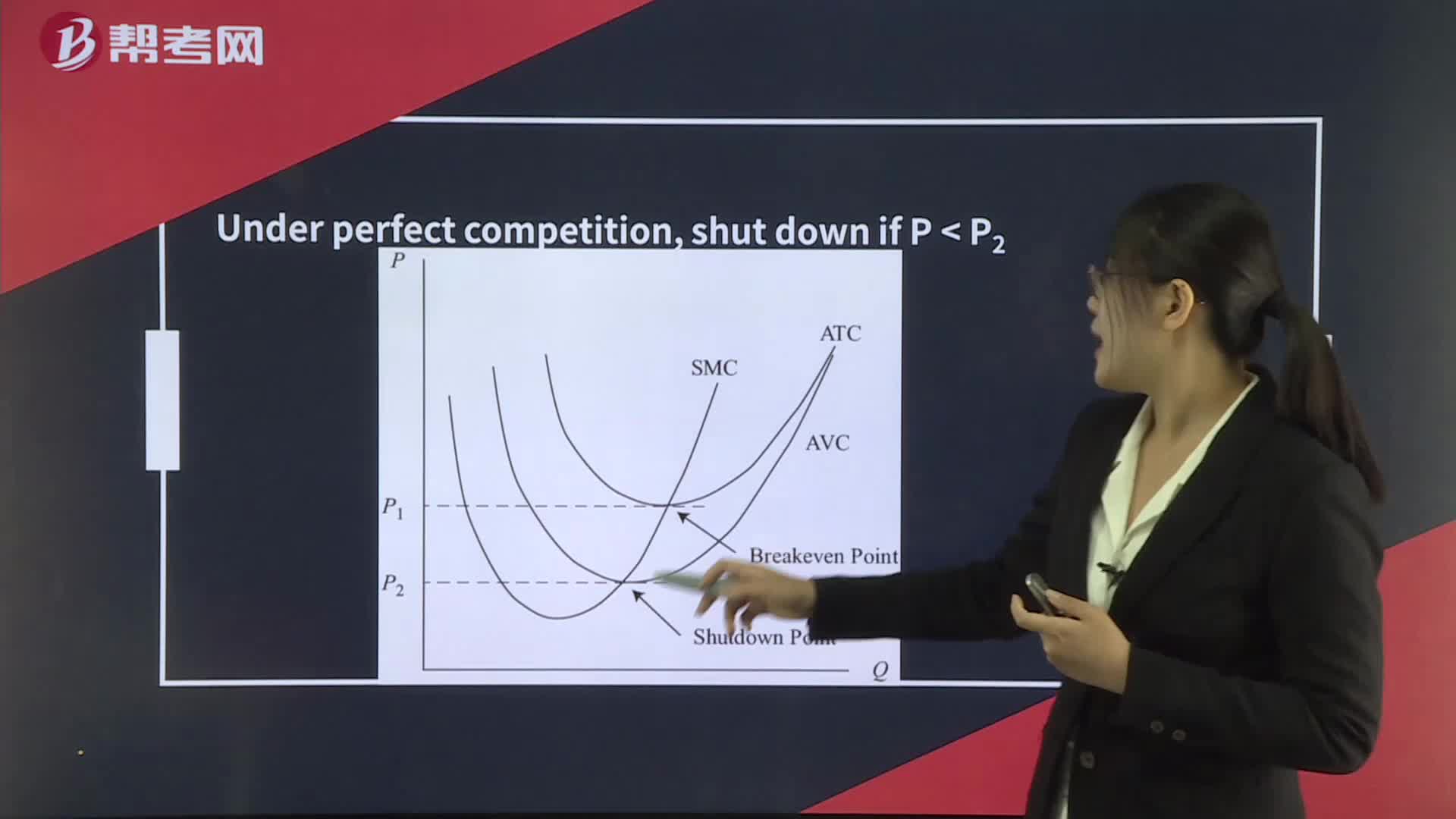

216The Shutdown Decision:The breakeven poin:[Practiceleast $7 million.

136

136The Neutral Rate:The neutral;underlying economy.:economyLong-runrates might make a bad situation worse.

微信掃碼關(guān)注公眾號(hào)

獲取更多考試熱門(mén)資料