下載億題庫APP

聯(lián)系電話:400-660-1360

下載億題庫APP

聯(lián)系電話:400-660-1360

請(qǐng)謹(jǐn)慎保管和記憶你的密碼,以免泄露和丟失

請(qǐng)謹(jǐn)慎保管和記憶你的密碼,以免泄露和丟失

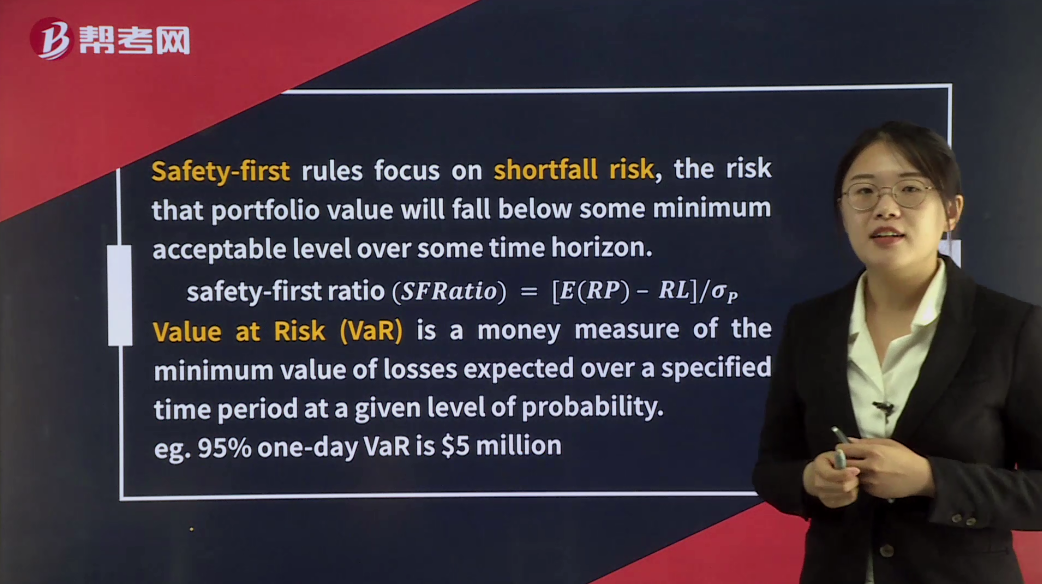

Applications of the Normal Distribution

Safety-first rules focus on shortfall risk, the risk that portfolio value will fall below some minimum acceptable level over some time horizon.

safety-first ratio(SFRatio) = [E(RP) – RL]/σP

Value at Risk (VaR) is a money measure of the minimum value of losses expected over a specified time period at a given level of probability.

eg. 95% one-day VaR is $5 million

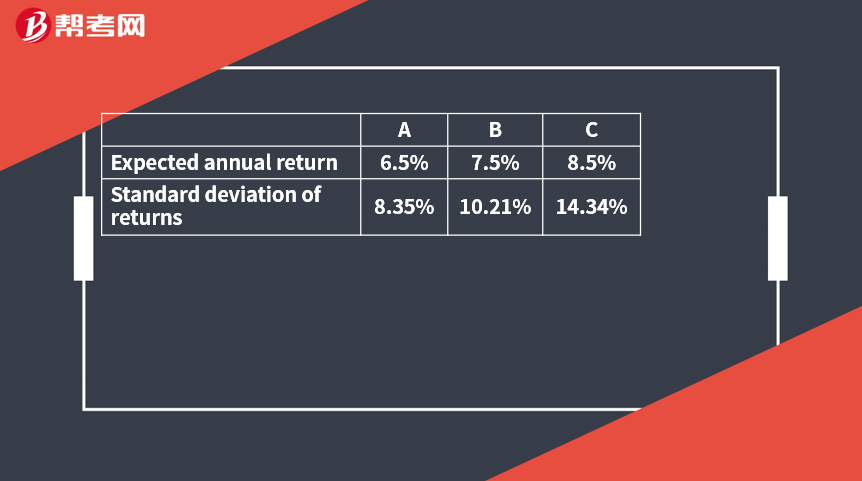

[Practice Problems] A client holding a £2,000,000 portfolio wants to withdraw £90,000 in one year without invading the principal. According to Roy’s safety-first criterion, which of the following portfolio allocations is optimal?

A. Allocation A

B. Allocation B

C. Allocation C

[Solutions] B

Allocation B has the highest SF ratio. The threshold return level RL is £90,000/£2,000,000 = 4.5%. To compute the allocation that is safety-first optimal, select the alternative with the highest ratio:

Allocation A = (6.5 – 4.5) / 8.35 = 0.240

Allocation B = (7.5 – 4.5) / 10.21 = 0.294

Allocation C = (8.5 – 4.5) / 14.34 = 0.279

191

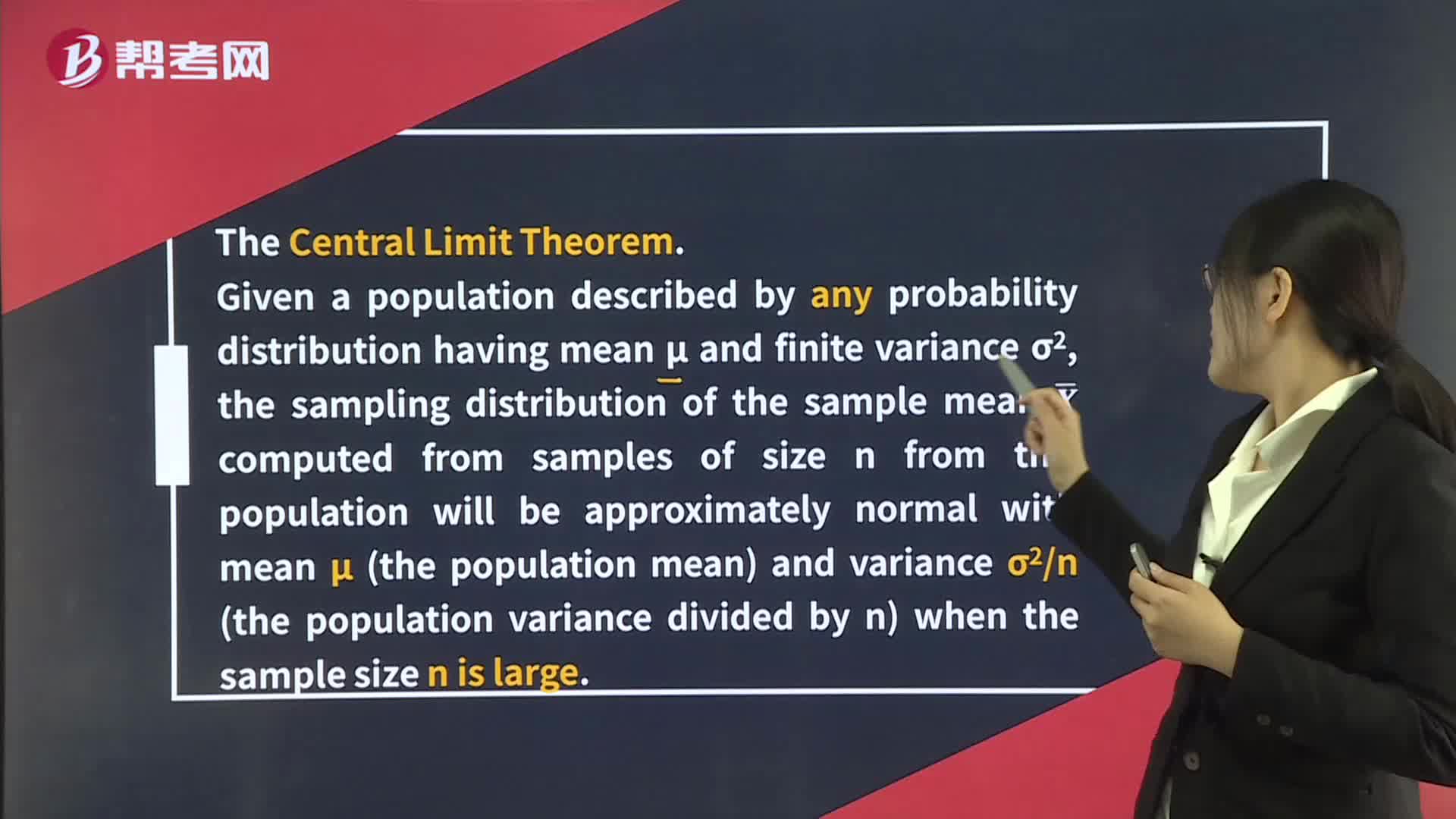

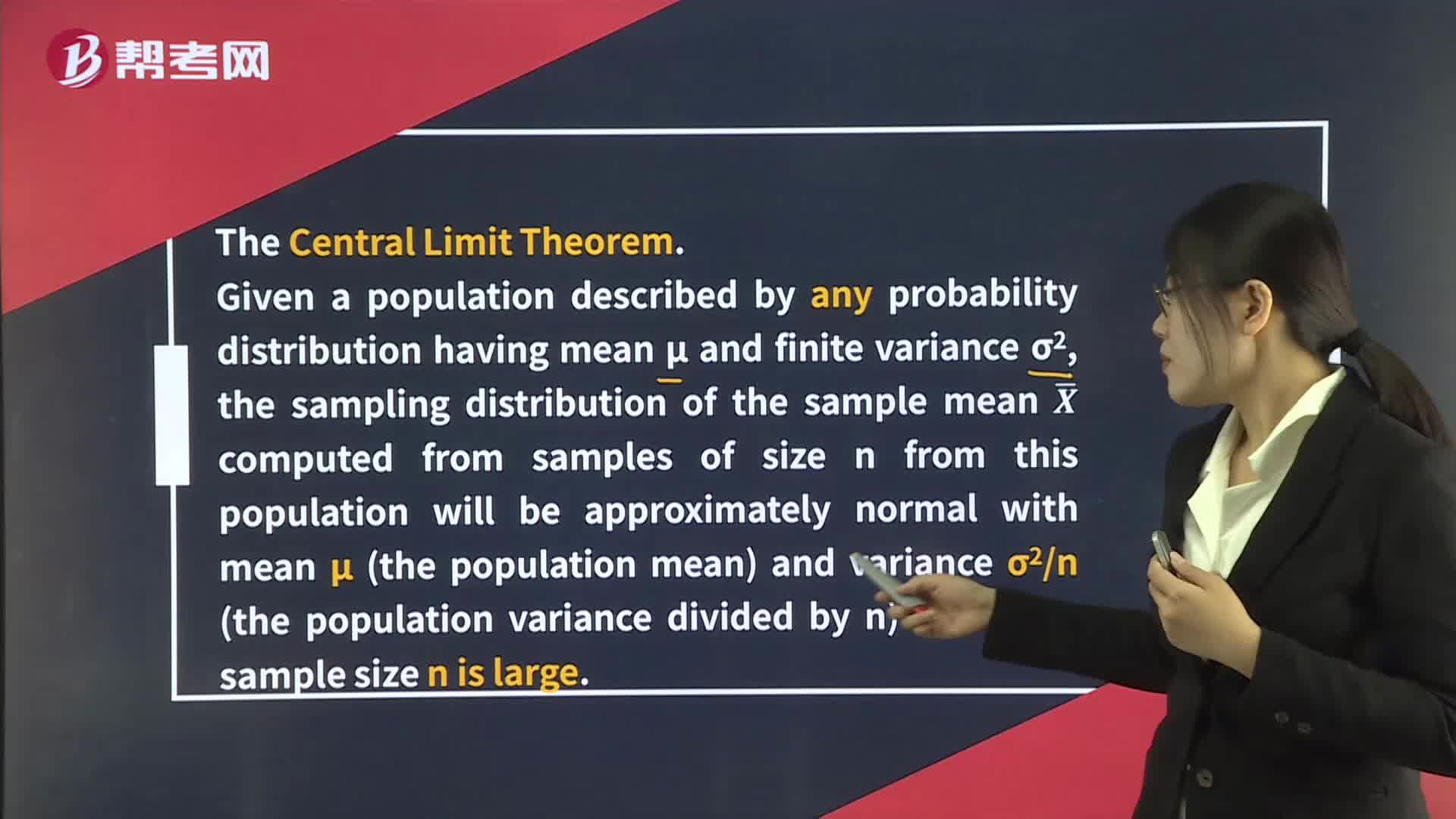

191Distribution of the Sample Mean:[Practicewhen the sample size is large.

168

168Distribution of the Sample Mean:The Central:[PracticeB.C.when the sample size is large.

599

599The Normal Distribution:μ;indicated as X ~ Nμ:Approximately 99% fall in μ ± 2.58σ.[PracticemeanNZ corresponding to 8% must equal 50%. So P8% ≤ Portfolio return ≤ 11% = 0.5832 – 0.50 = 0.0832 or approximately 8.3 percent.

微信掃碼關(guān)注公眾號(hào)

獲取更多考試熱門資料