-

下載億題庫APP

-

聯(lián)系電話:400-660-1360

下載億題庫APP

聯(lián)系電話:400-660-1360

請謹慎保管和記憶你的密碼,以免泄露和丟失

請謹慎保管和記憶你的密碼,以免泄露和丟失

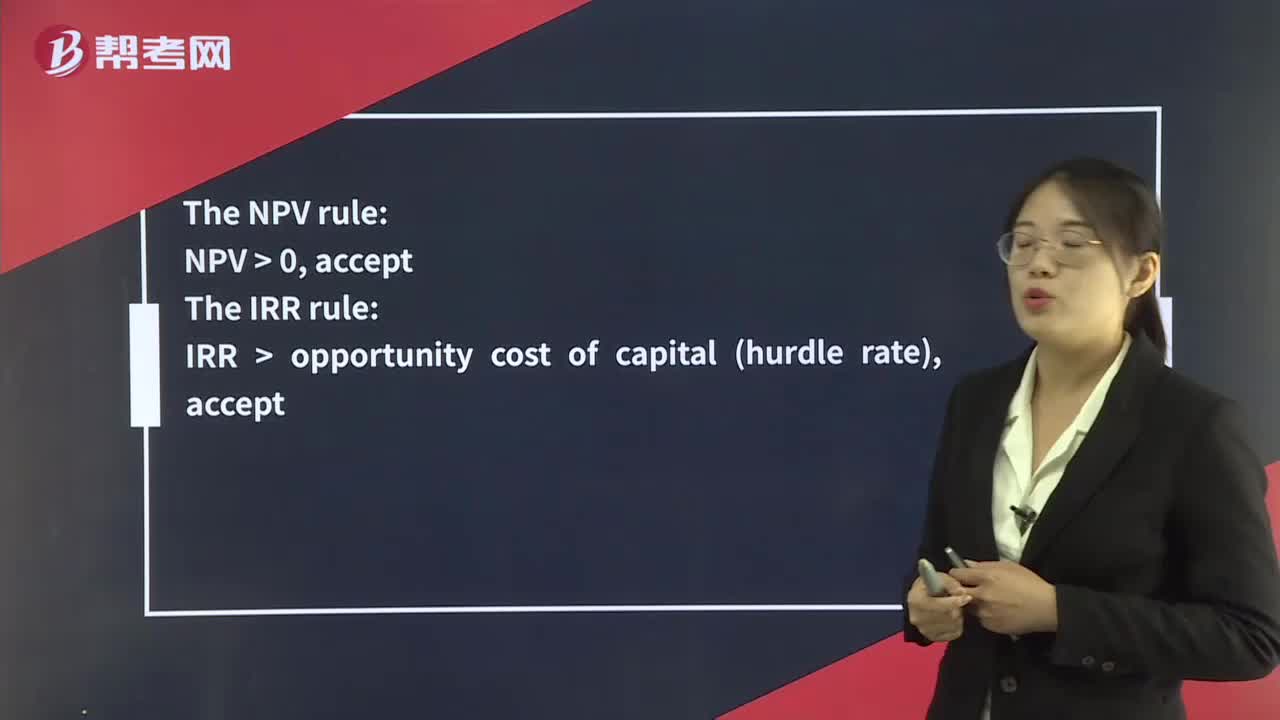

The NPV Rule & The IRR Rule

The NPV rule:

NPV > 0, accept

The IRR rule:

IRR > opportunity cost of capital (hurdle rate), accept

For mutually exclusive projects:

NPV rule: Choose the candidate with the higher positive NPV.

IRR rule: Choose the candidate with the higher IRR.

When the IRR and NPV rules conflict in ranking projects (due to size of projects, timing of cash flows), we should take directions from the NPV rule.

[Practice Problems] Suppose a company has only €1,000,000 available to invest. The three projects available are described in the table. If the opportunity cost of capital is 12%, which project should be accepted?

微信截圖_1596709502563220200806182654102.png)

[Solutions] The projects are mutually exclusive because the amount to invest is constrained to €1,000,000. The NPV rule should be used.

Project A NPV = –€1,000,000 + €1,200,000/(1.12) = €71,429

Project B NPV = –€1,000,000 + €1,600,000/(1.12)3 = €138,848

Project C NPV = –€500,000 + €850,000/(1.12)3 = €105,013

208

208

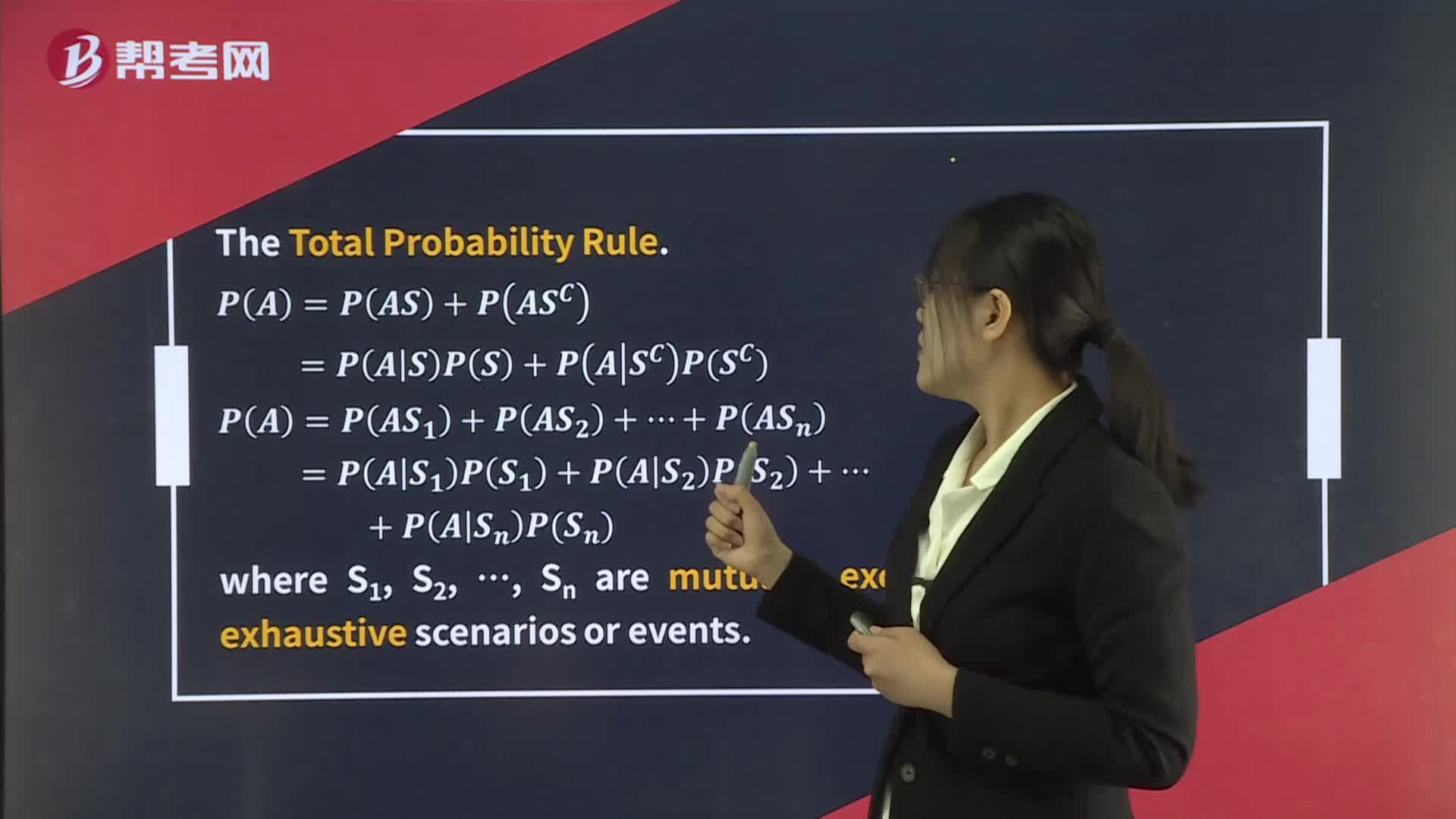

The Total Probability Rule:not-S,the two-quarter period in total.rulejoint probability of both A and B occurring is PAB = PAPB.

68

68

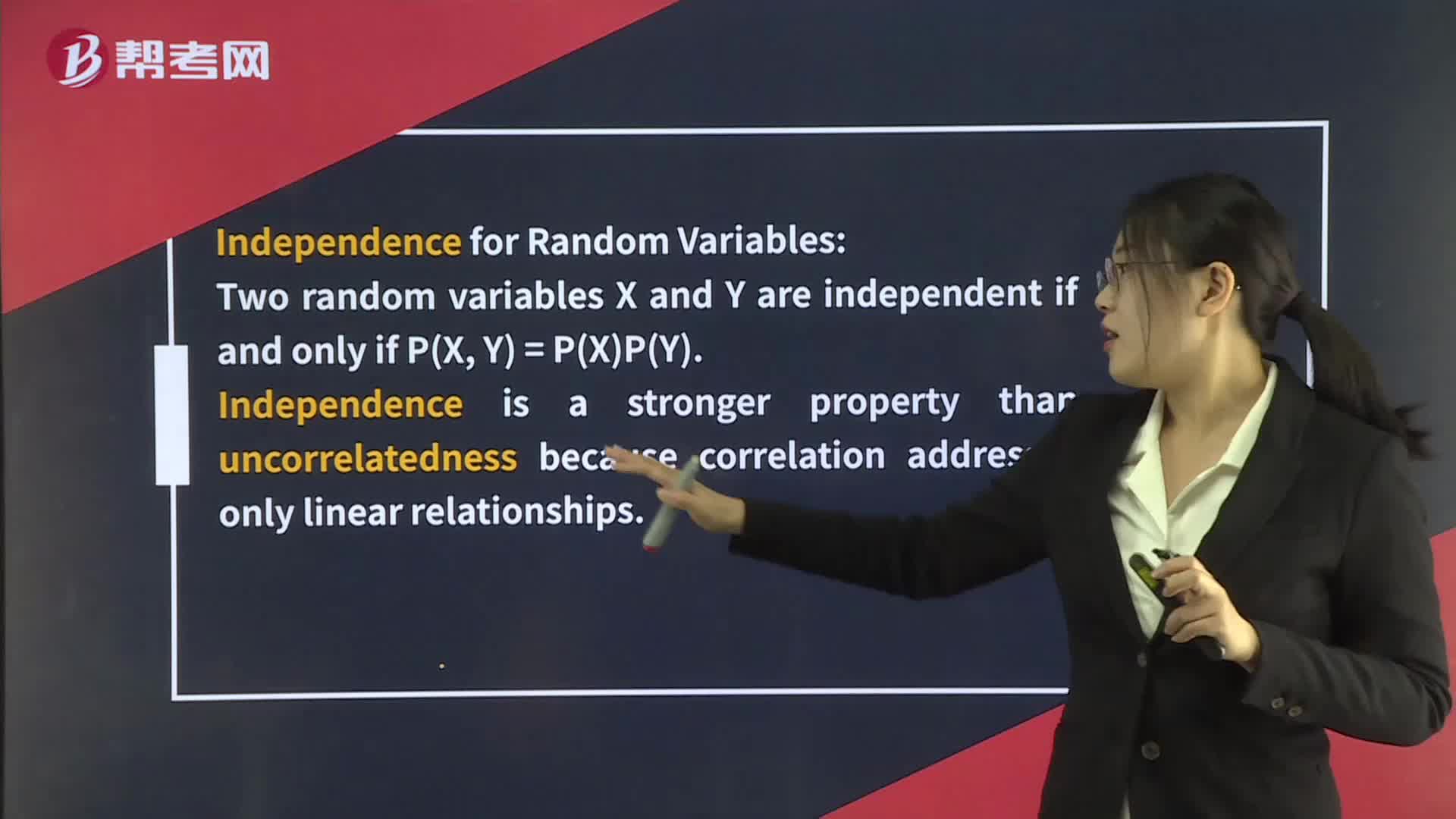

Multiplication Rule For Expected Value:Two random variables X and Y are independent:EXY = EXEY

312

312

The NPV Rule & The IRR Rule:IRR opportunity cost of capital hurdle:rate:accept,IRR.,[Practice,013

08:39

08:39

2020-05-18

04:30

04:30

13:18

13:18

13:11

13:11

06:13

06:13

2020-05-15

微信掃碼關注公眾號

獲取更多考試熱門資料