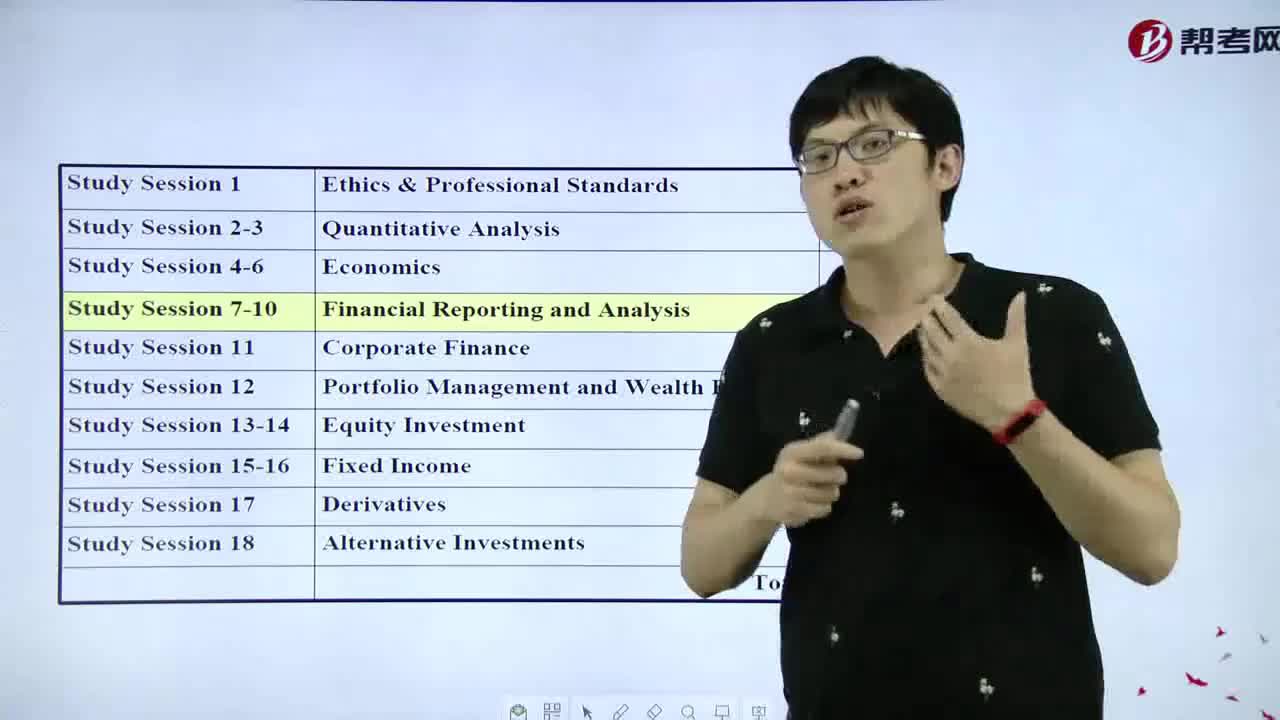

How to price options?

How to calculate MWRR?

How to explain Investment property?

How to understand Depreciation?

How to understand Inventory accounting?

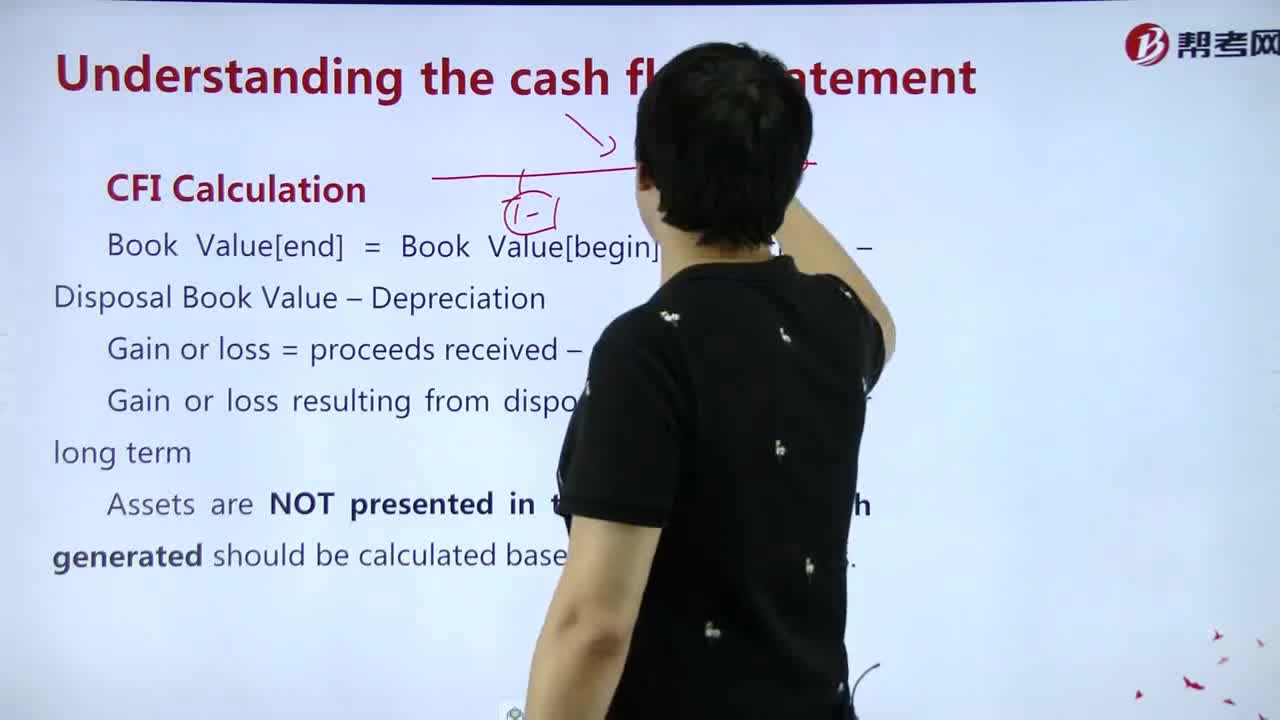

How to master CFI Calculation?

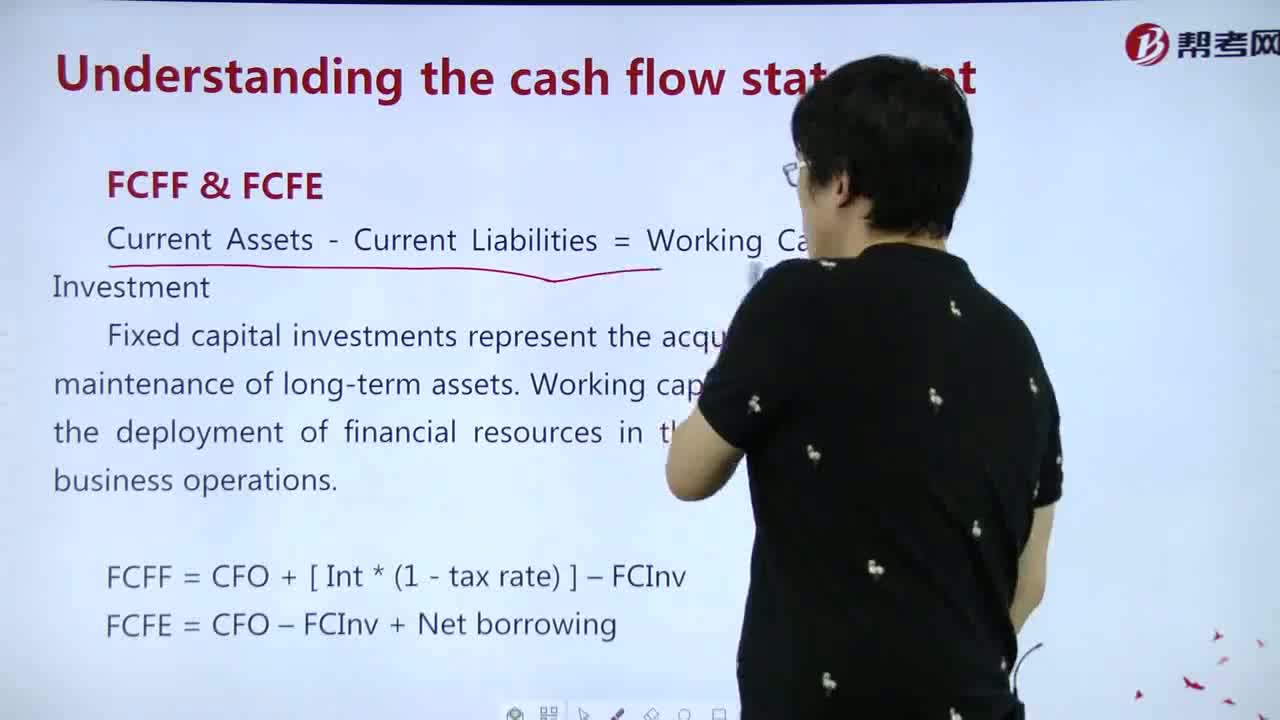

How to understand FCFF & FCFE?

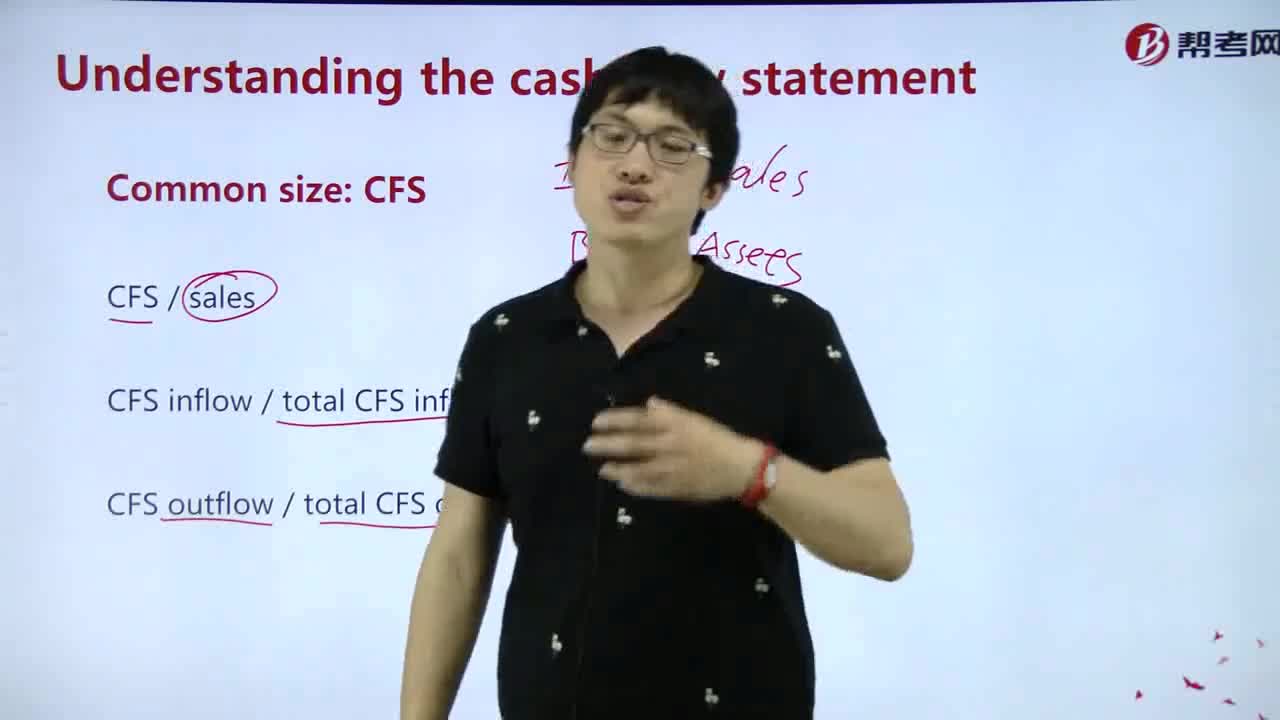

How to explainCommon size:CFS?

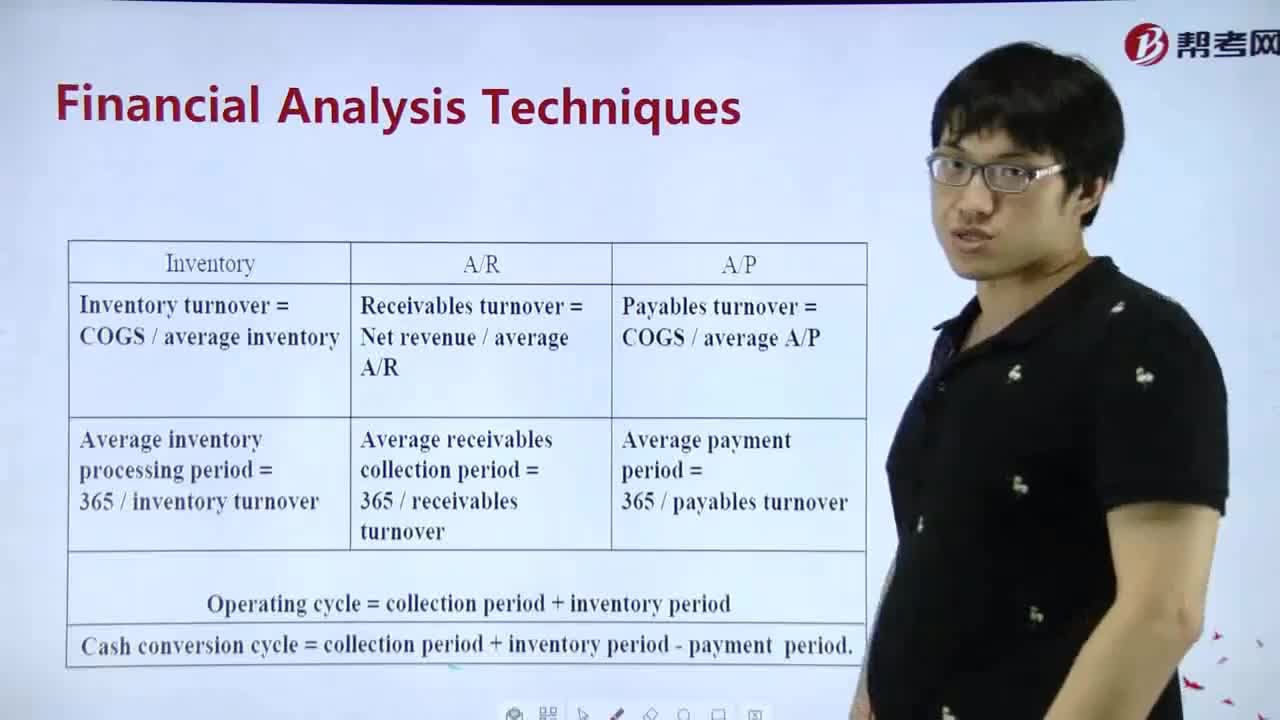

How to understand Activity Rations?

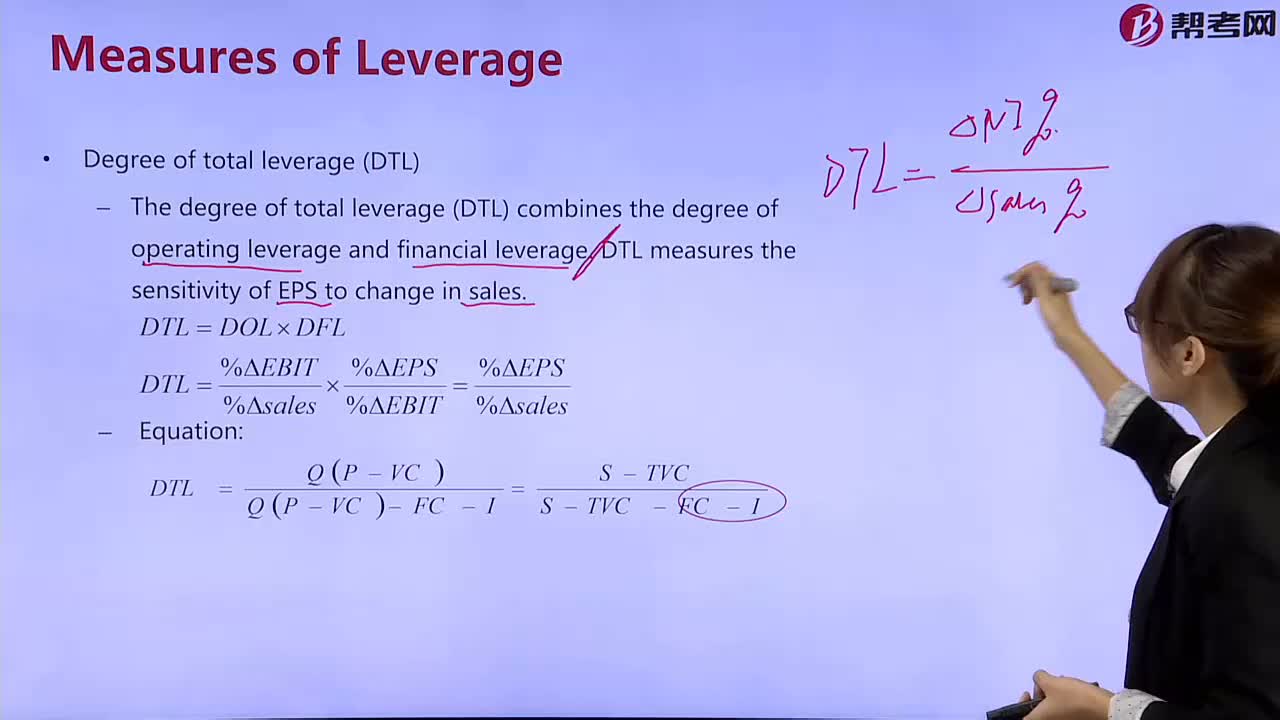

How To calculate total leverage?

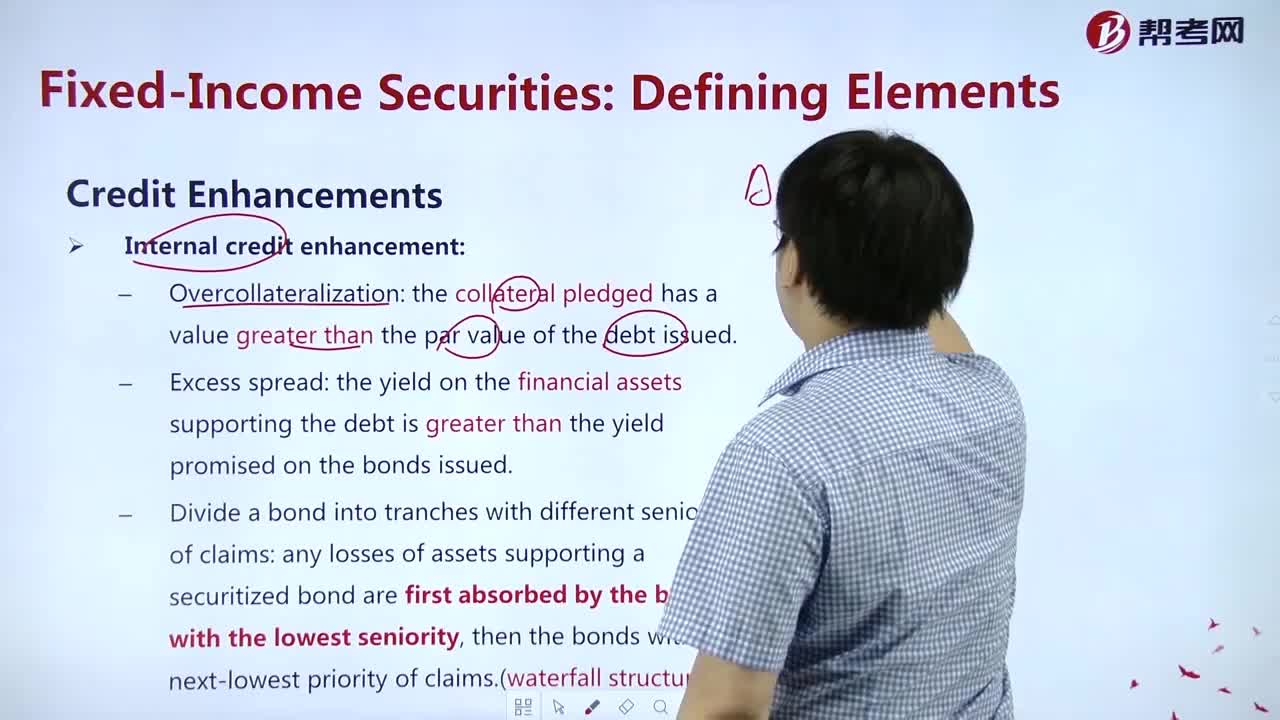

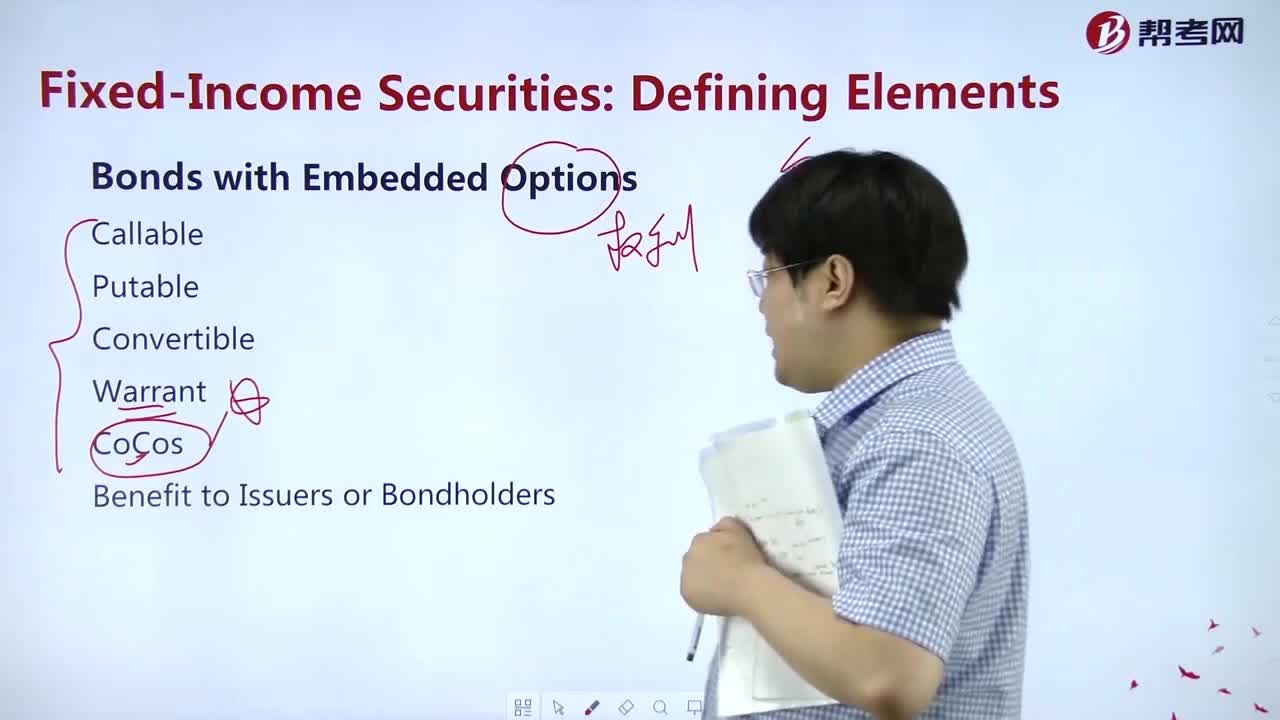

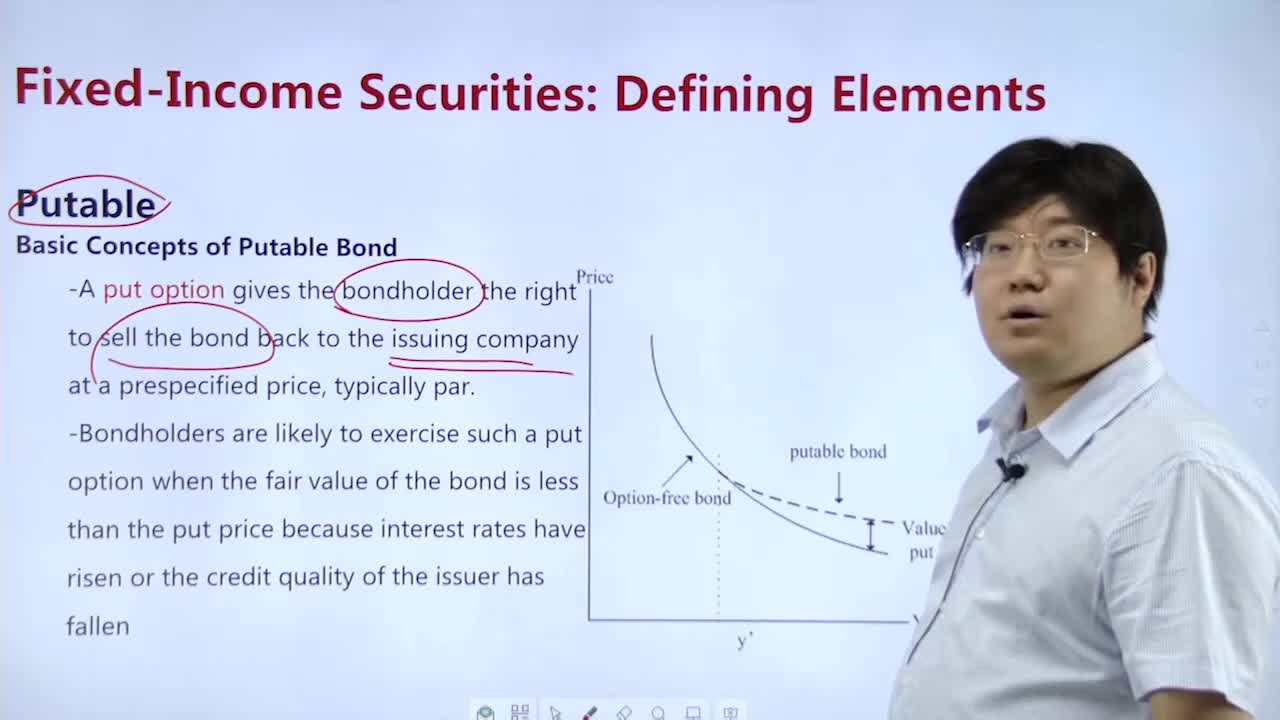

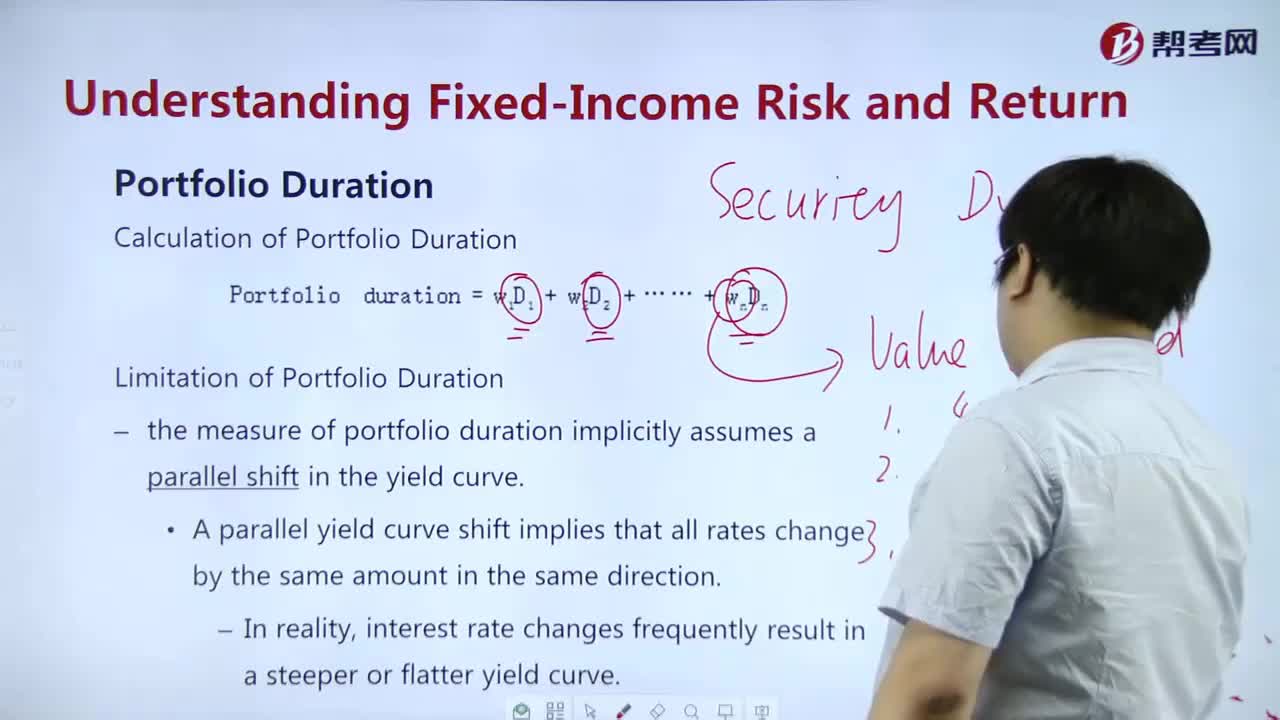

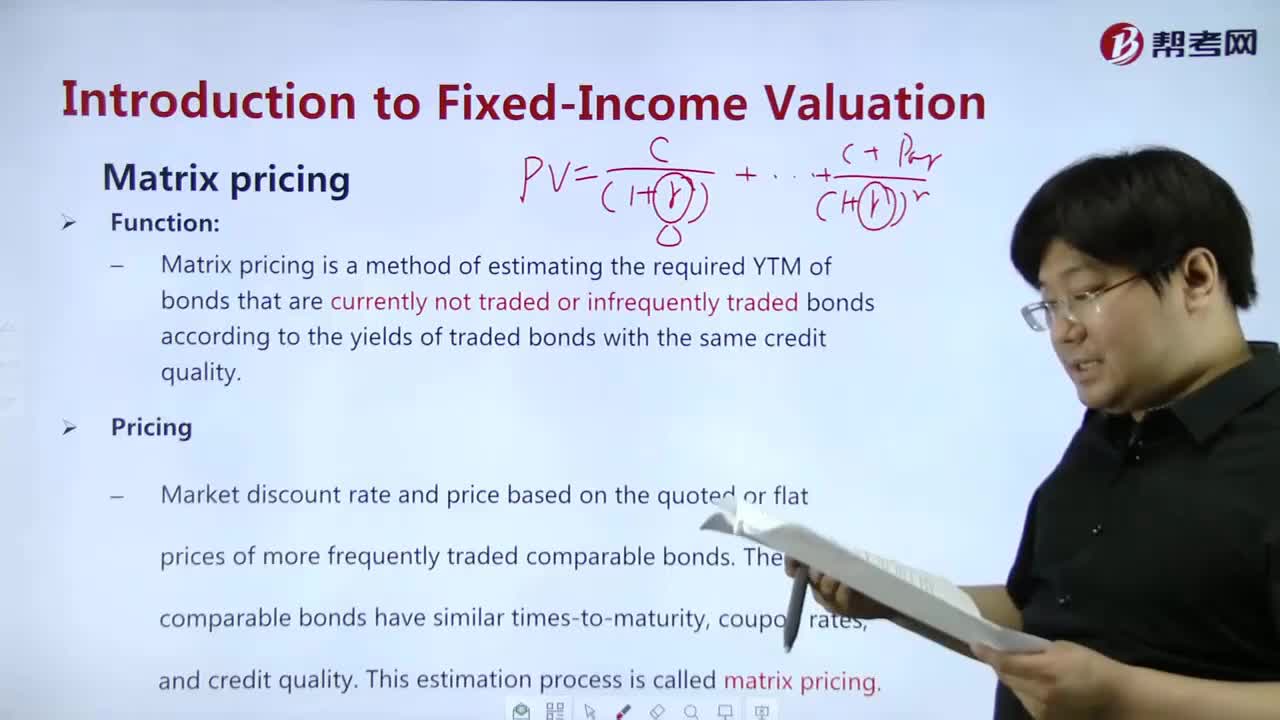

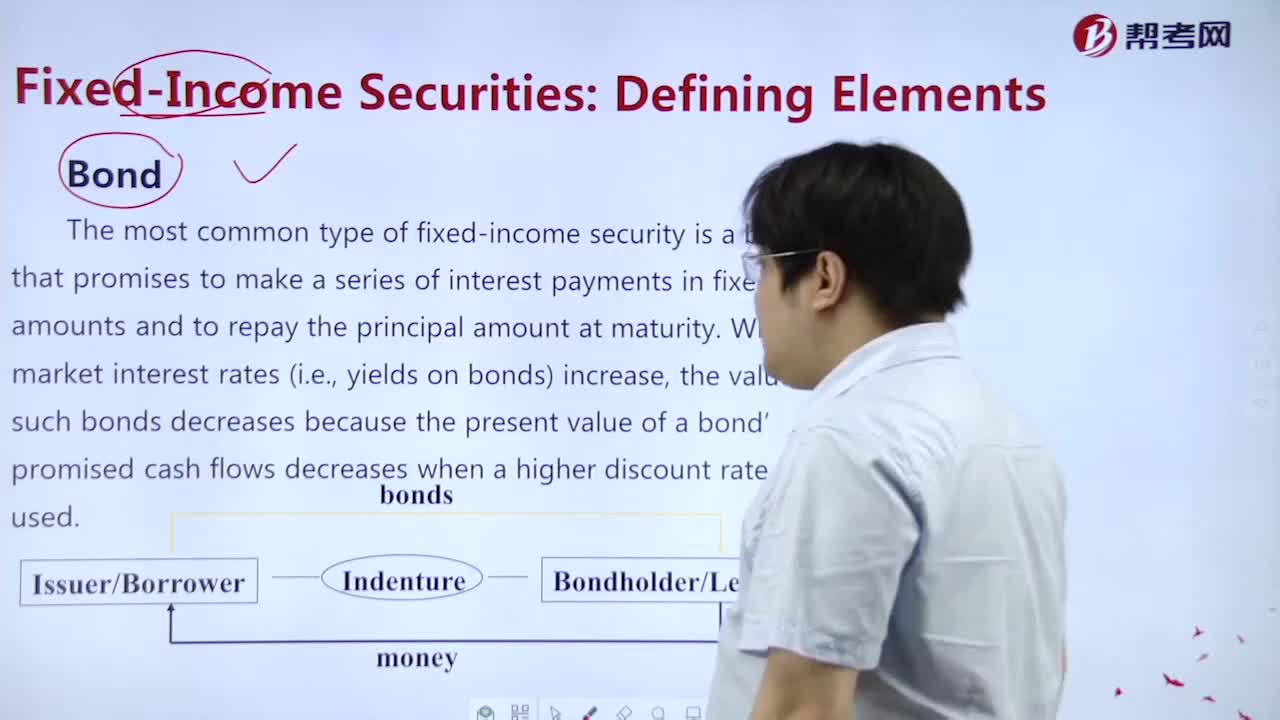

How to master Bond?

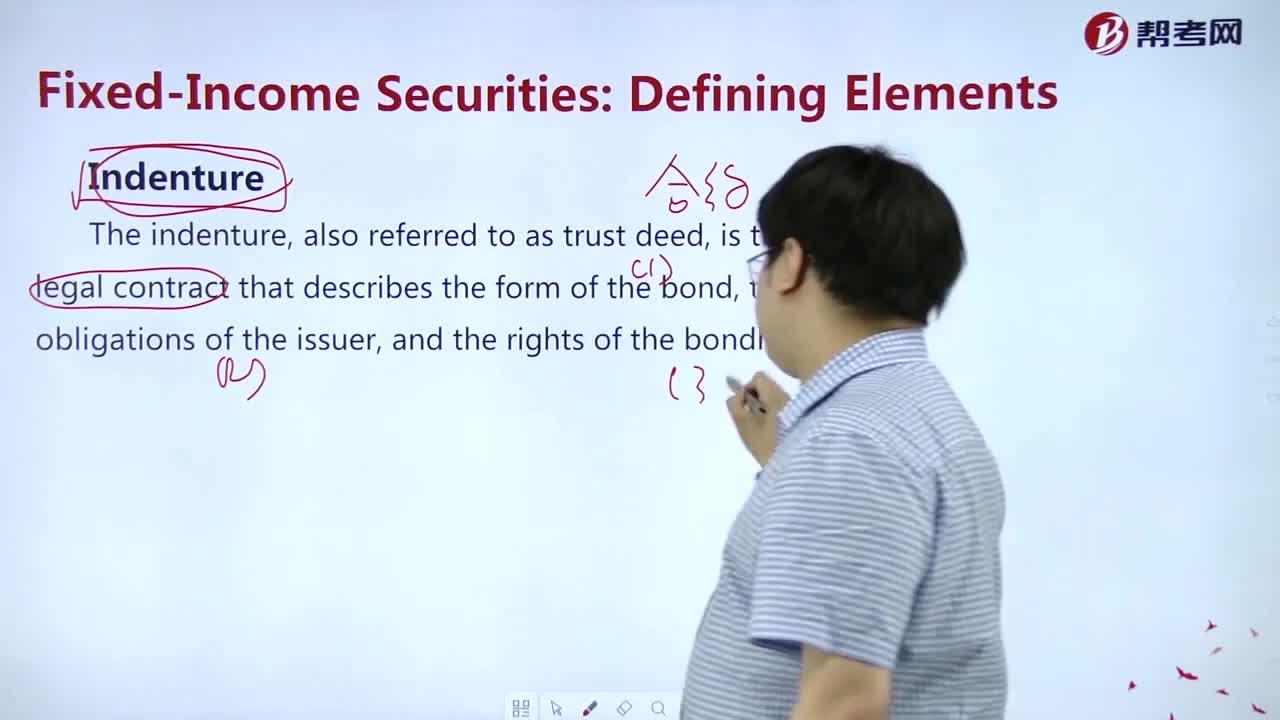

How to master Indenture?

下載億題庫APP

聯(lián)系電話:400-660-1360