What are the advantages and disadvantages of enterprise value multiple?

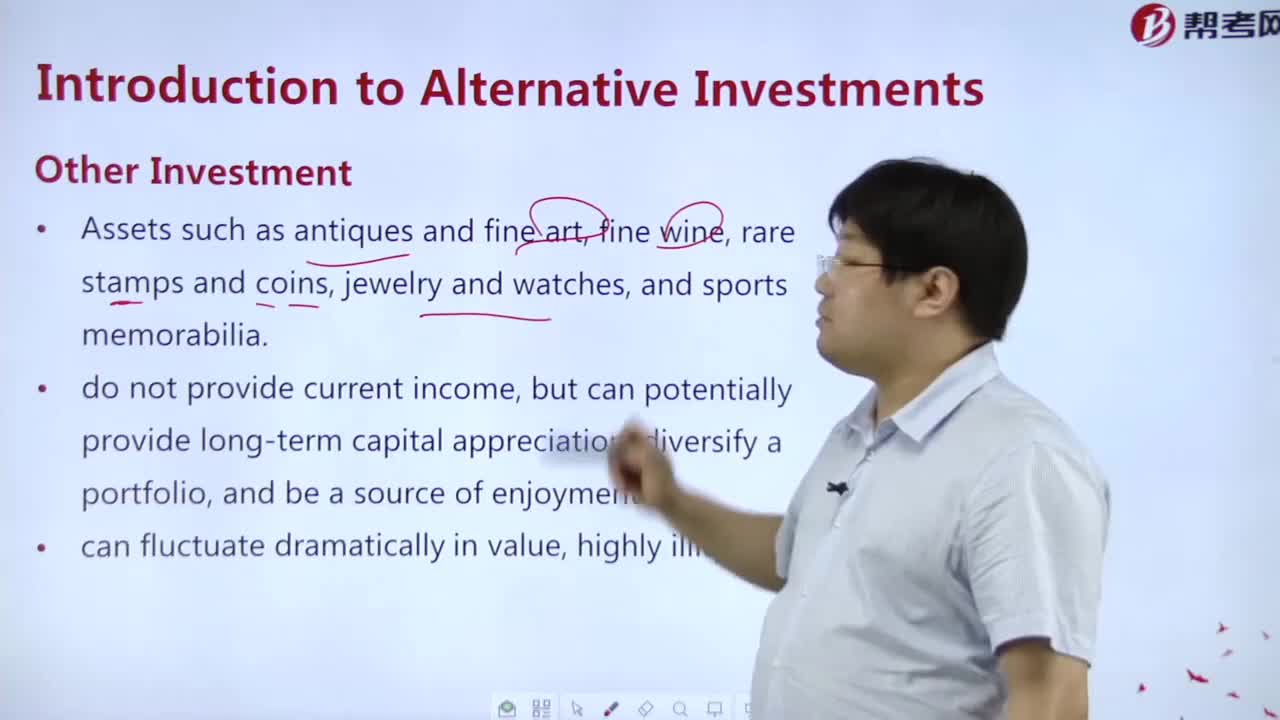

What are the other investments?

What are the types of private equity?

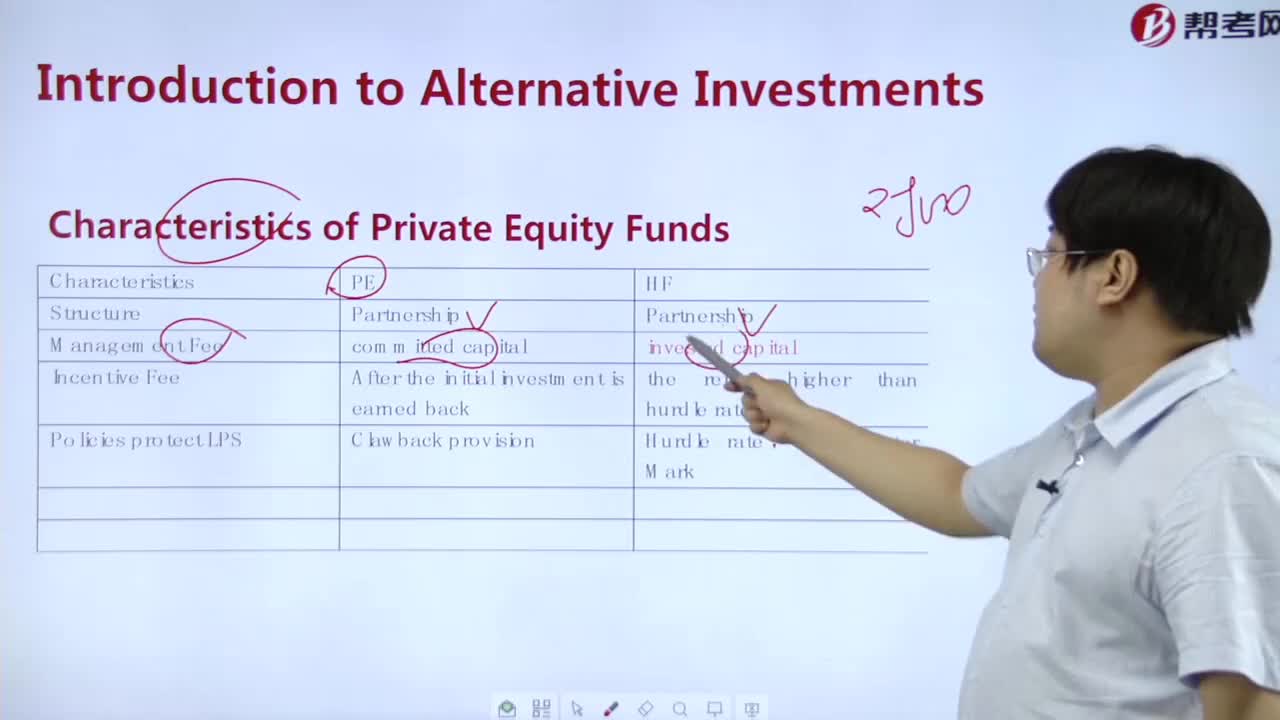

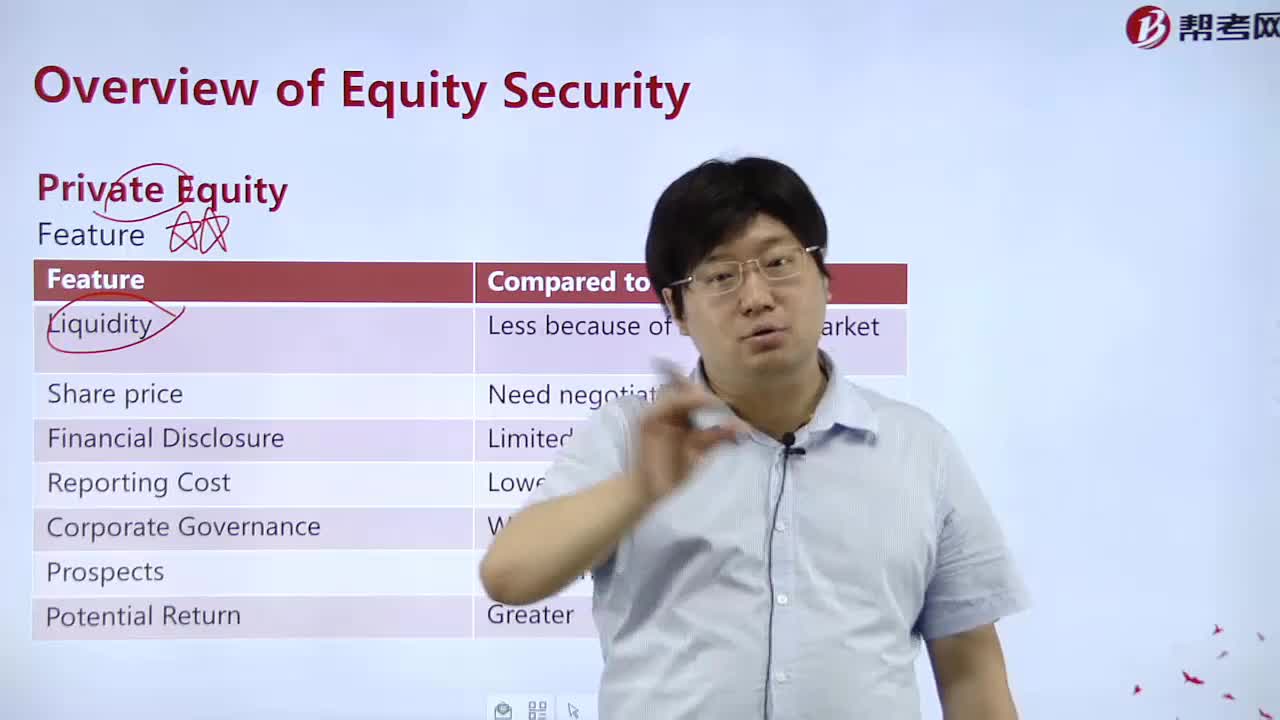

What are the characteristics of private equity?

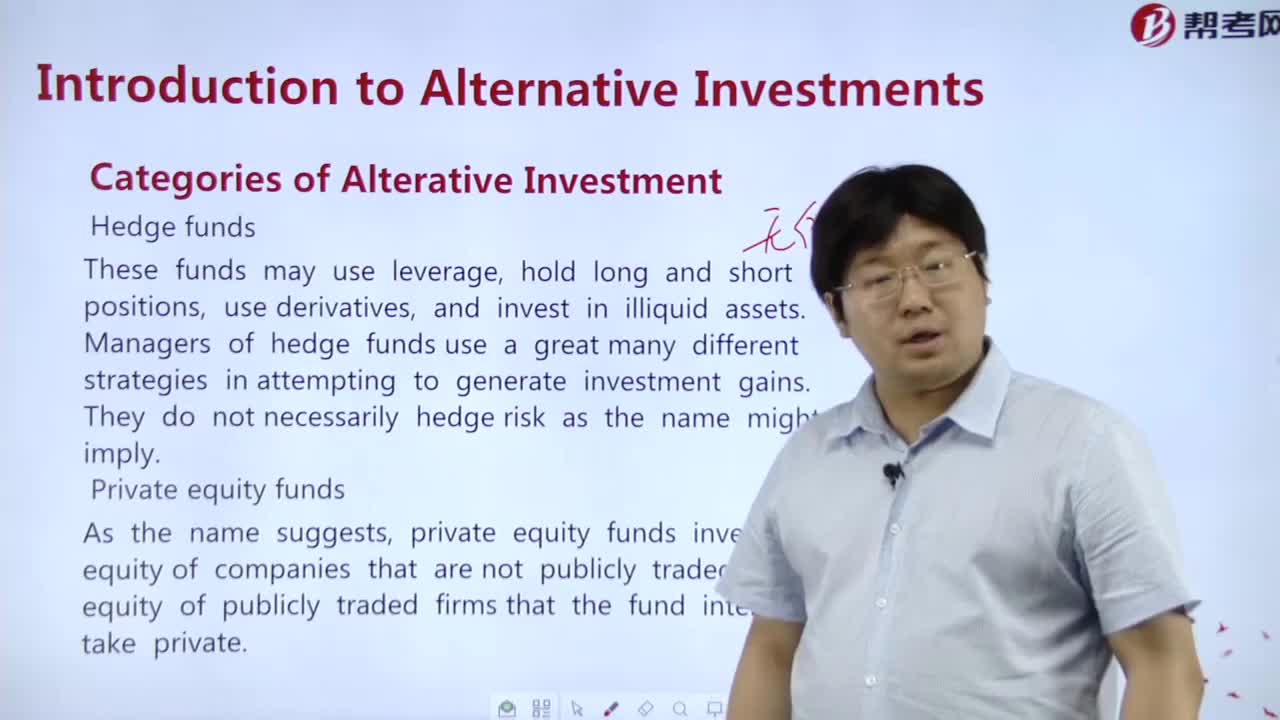

What are the types of alternative investments?

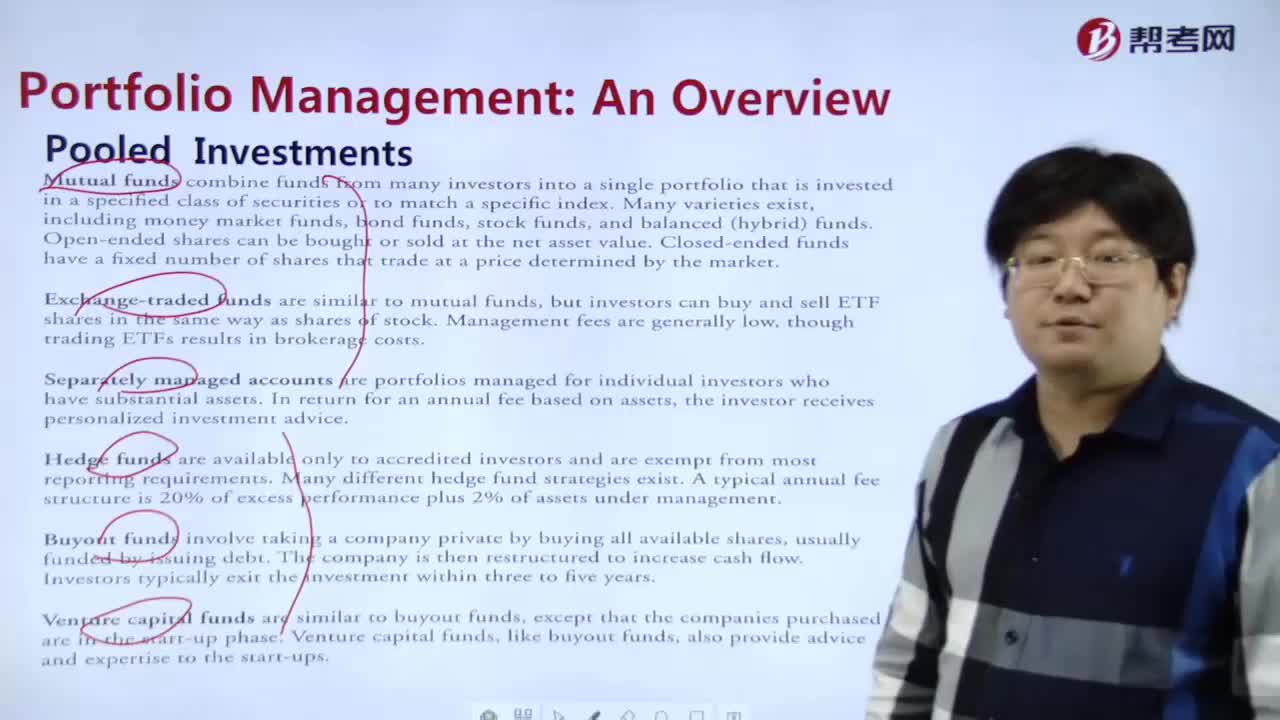

What is pooled investments?

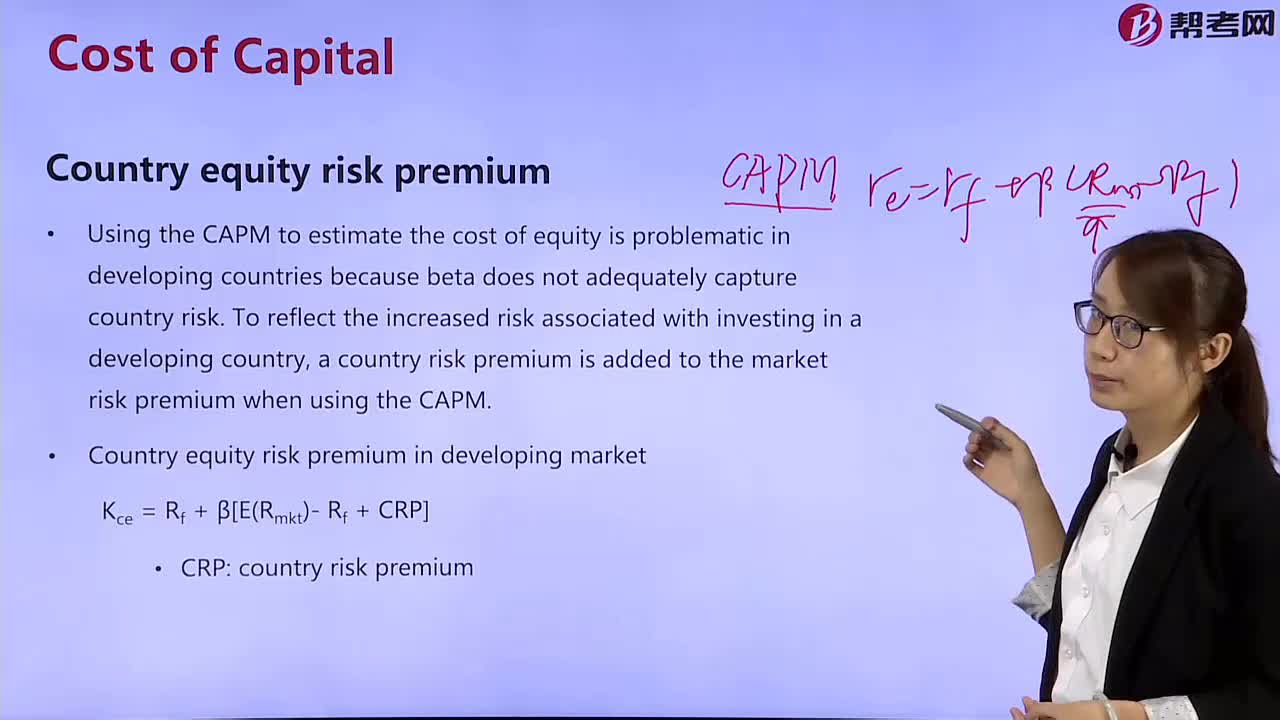

What is the National Equity Risk Premium?

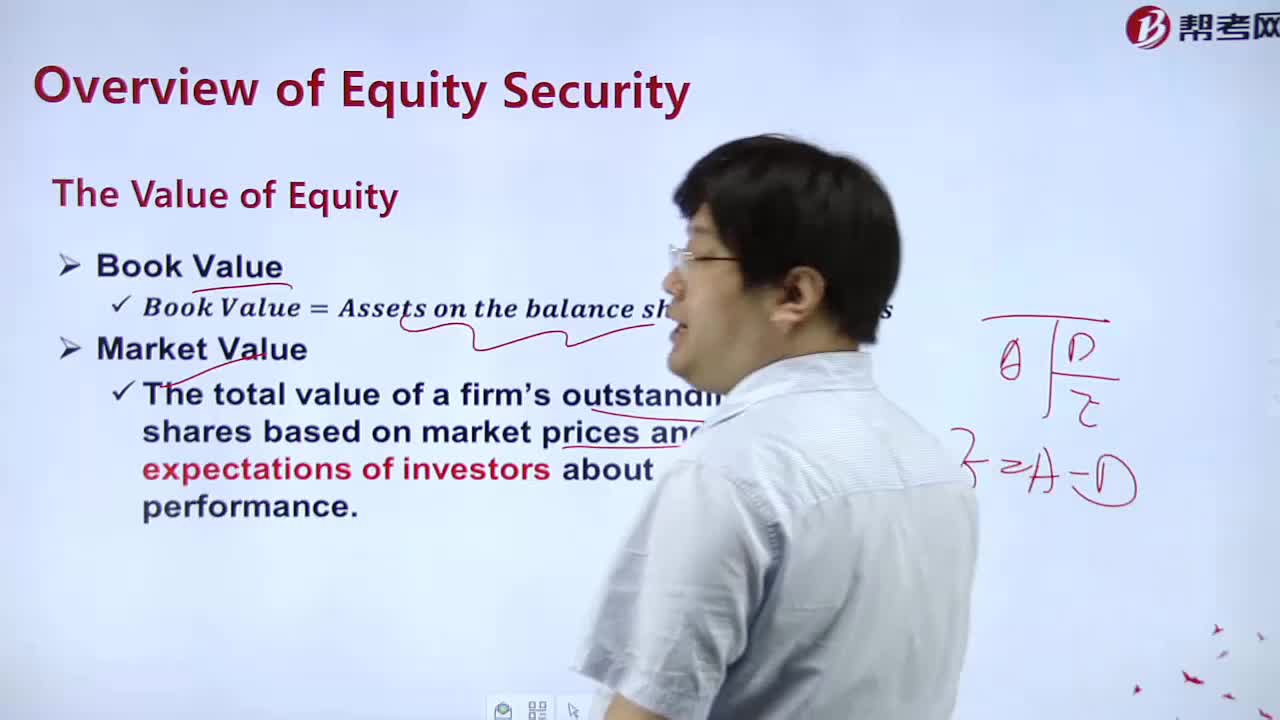

What is the value of the equity?

What is the nature of private equity?

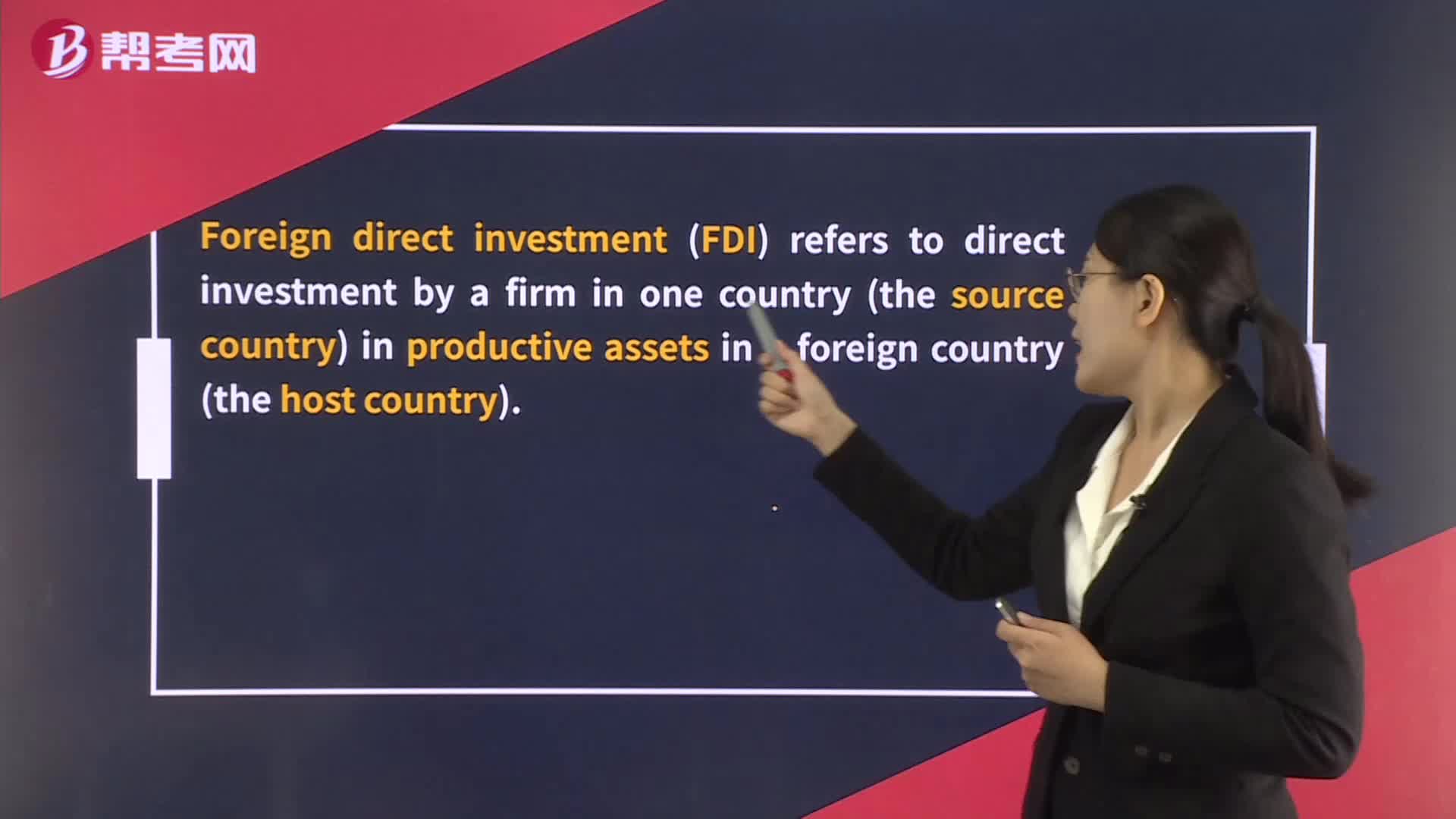

Foreign Investments

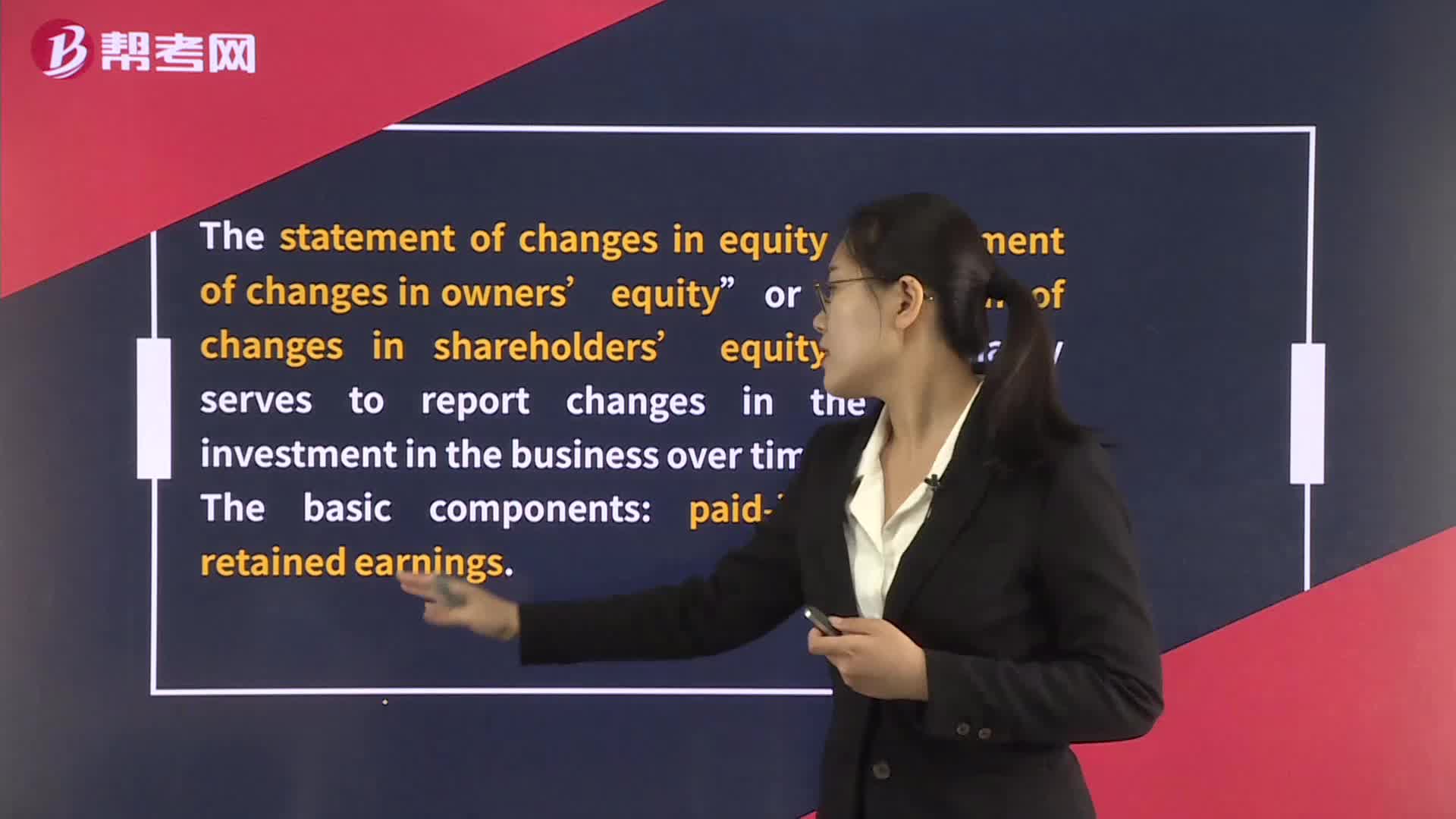

Statement of Changes in Equity

What are the responsibilities of the members in reference to the CFA Institute?

下載億題庫APP

聯(lián)系電話:400-660-1360