下載億題庫APP

聯(lián)系電話:400-660-1360

下載億題庫APP

聯(lián)系電話:400-660-1360

請謹(jǐn)慎保管和記憶你的密碼,以免泄露和丟失

請謹(jǐn)慎保管和記憶你的密碼,以免泄露和丟失

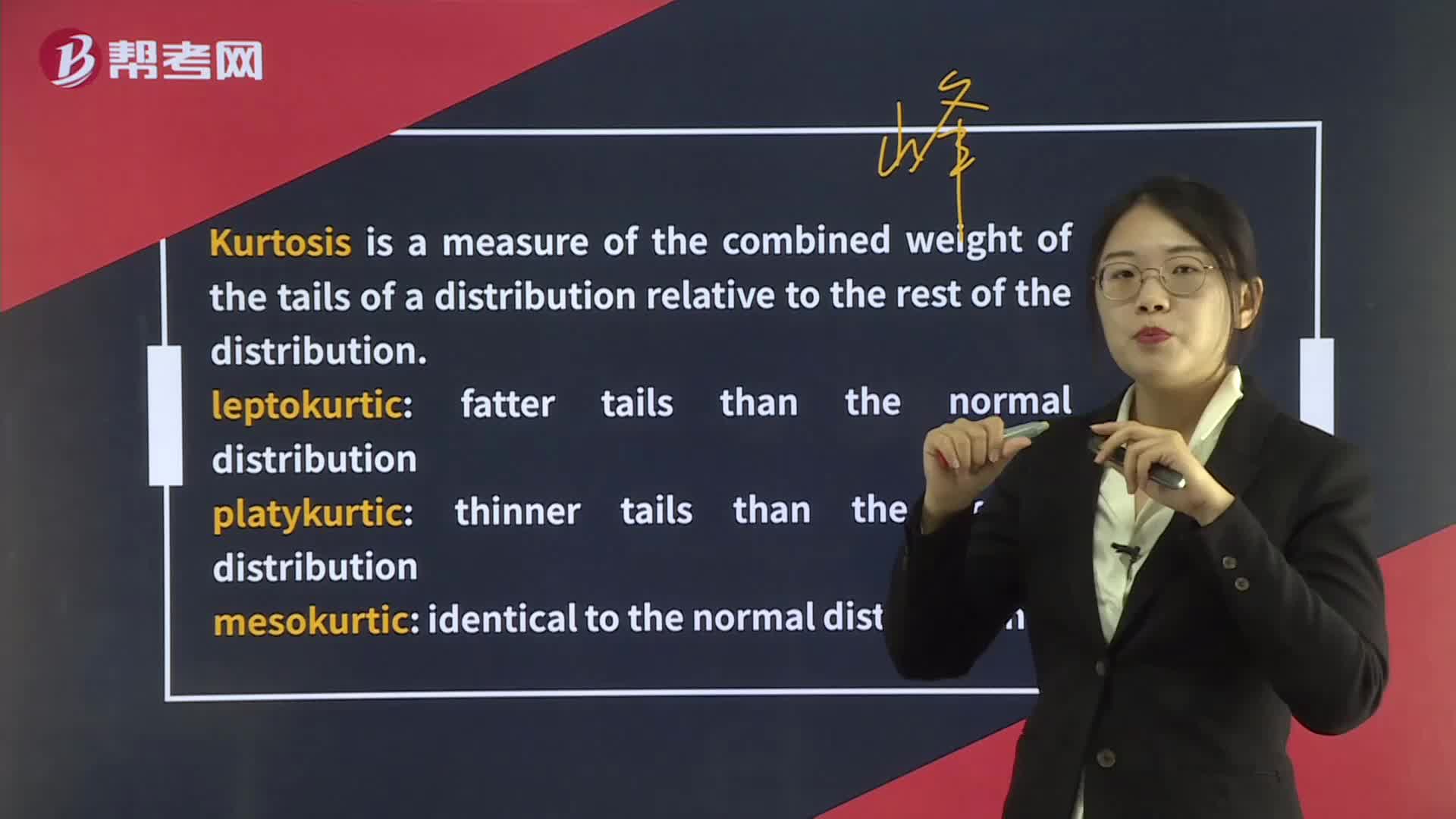

Kurtosis

Kurtosis is a measure of the combined weight of the tails of a distribution relative to the rest of the distribution.

leptokurtic: fatter tails than the normal distribution

platykurtic: thinner tails than the normal distribution

mesokurtic: identical to the normal distribution

微信截圖_1596761308807320200807085036813.png)

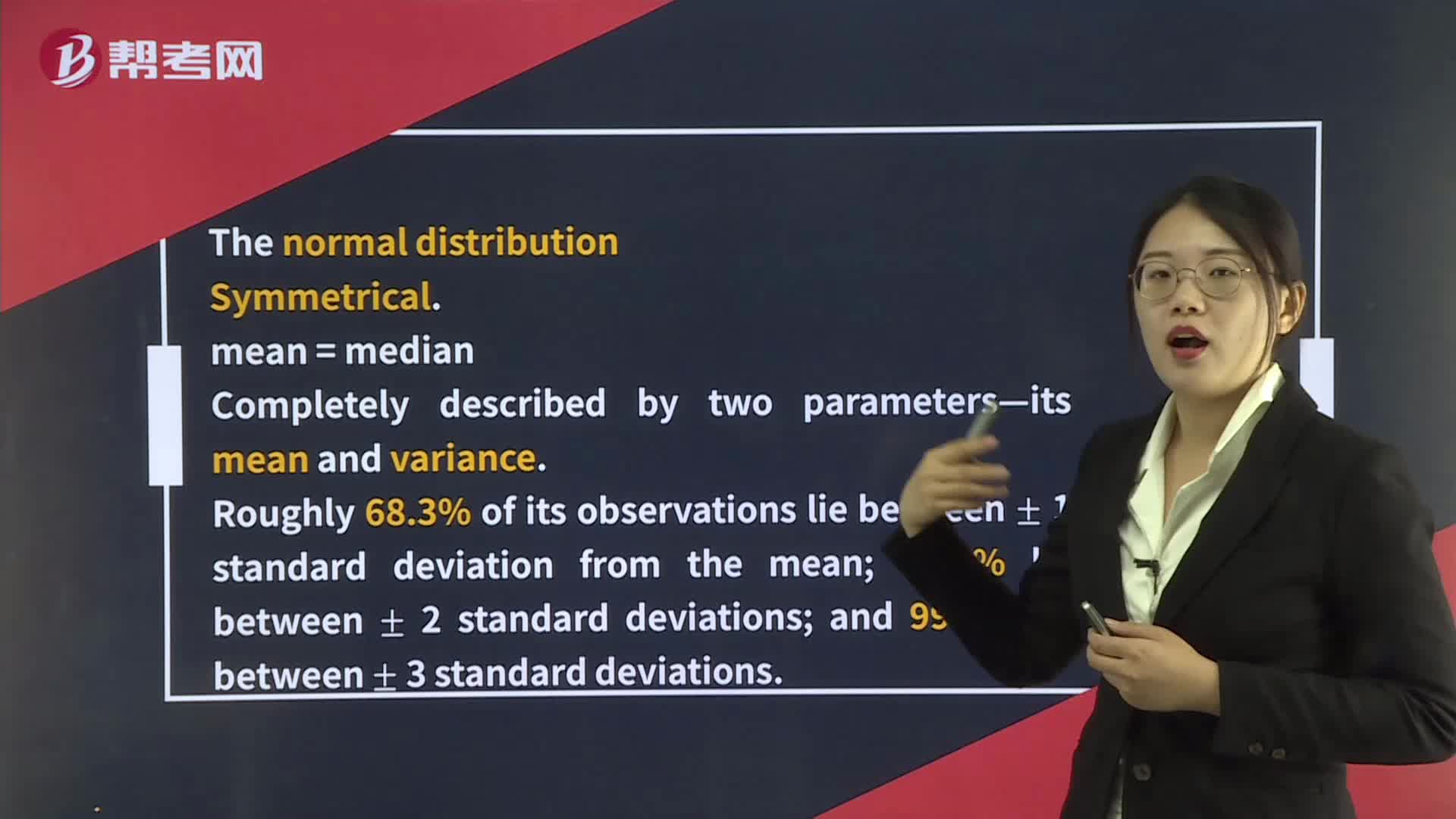

For all normal distributions, kurtosis is equal to 3.

Excess kurtosis: kurtosis minus 3. (Normal or other mesokurtic=0. Leptokurtic > 0, Platykurtic < 0.)

[Practice Problems] A portfolio has excess kurtosis of 6.2. Compared with a normal distribution, the distribution of returns for this portfolio most likely:

A. has less weight in the tails.

B. has a greater number of extreme returns.

C. has fewer small deviations from its mean.

[Solutions] B

The portfolio has positive excess kurtosis, which indicates that its return distribution is leptokurtic and has fatter tails than the normal. The fatter tails mean the portfolio has a greater number of extreme returns.

322

322Kurtosis:mesokurtic:[Practicereturns.mean the portfolio has a greater number of extreme returns.

644

644Symmetry, Skewness, Kurtosis:Symmetry,distribution,[Practice:A. For:C.[Practicereturns.C.

265

265What are the responsibilities of the members in reference to the CFA Institute?:Once accepted as a member:每年交述職報告和年費but must not over promise the competency and future investment results.Case

微信掃碼關(guān)注公眾號

獲取更多考試熱門資料