下載億題庫APP

聯(lián)系電話:400-660-1360

下載億題庫APP

聯(lián)系電話:400-660-1360

請謹(jǐn)慎保管和記憶你的密碼,以免泄露和丟失

請謹(jǐn)慎保管和記憶你的密碼,以免泄露和丟失

The Fiscal Multiplier

G – T + B = Budget surplus OR deficit

Where

G = government spending

T = taxes

B = payment of transfer benefits

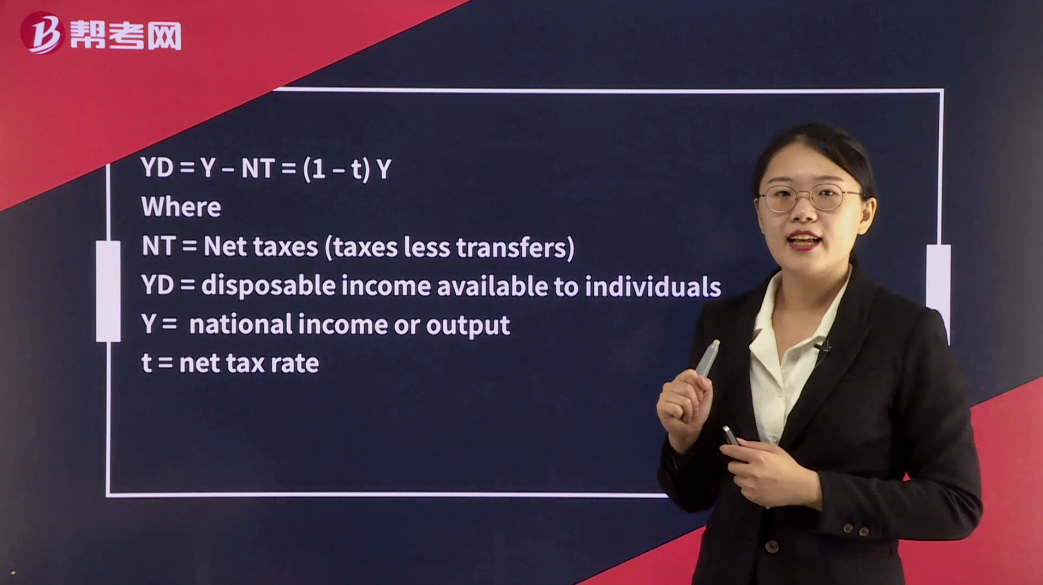

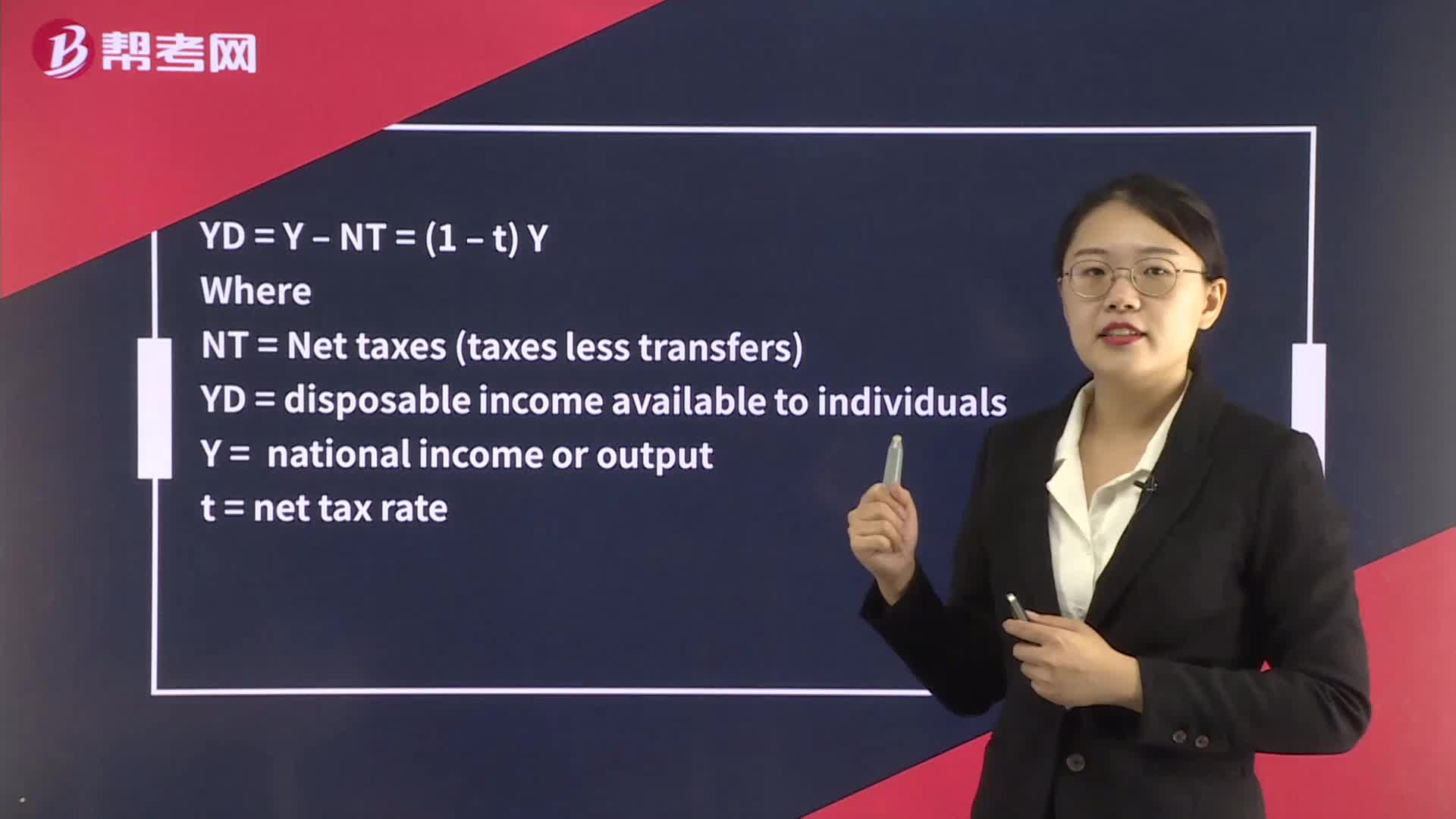

YD = Y – NT = (1 – t) Y

Where

NT = Net taxes (taxes less transfers)

YD = disposable income available to individuals

Y = national income or output

t = net tax rate

The fiscal multiplier is the ratio of the change in equilibrium output to the change in autonomous spending that caused the change.

It measures how much output changes as exogenous changes occur in government spending or taxation.

Fiscal multiplier = 1/[1 – c(1 – t)]

Where

c = marginal propensity to consume

t = tax rate

176

176The Relationship Between Fiscal and Monetary Policy:Policyassumption is made that wages and prices are rigid

271

271The Fiscal Multiplier:Wheret = tax rate

142

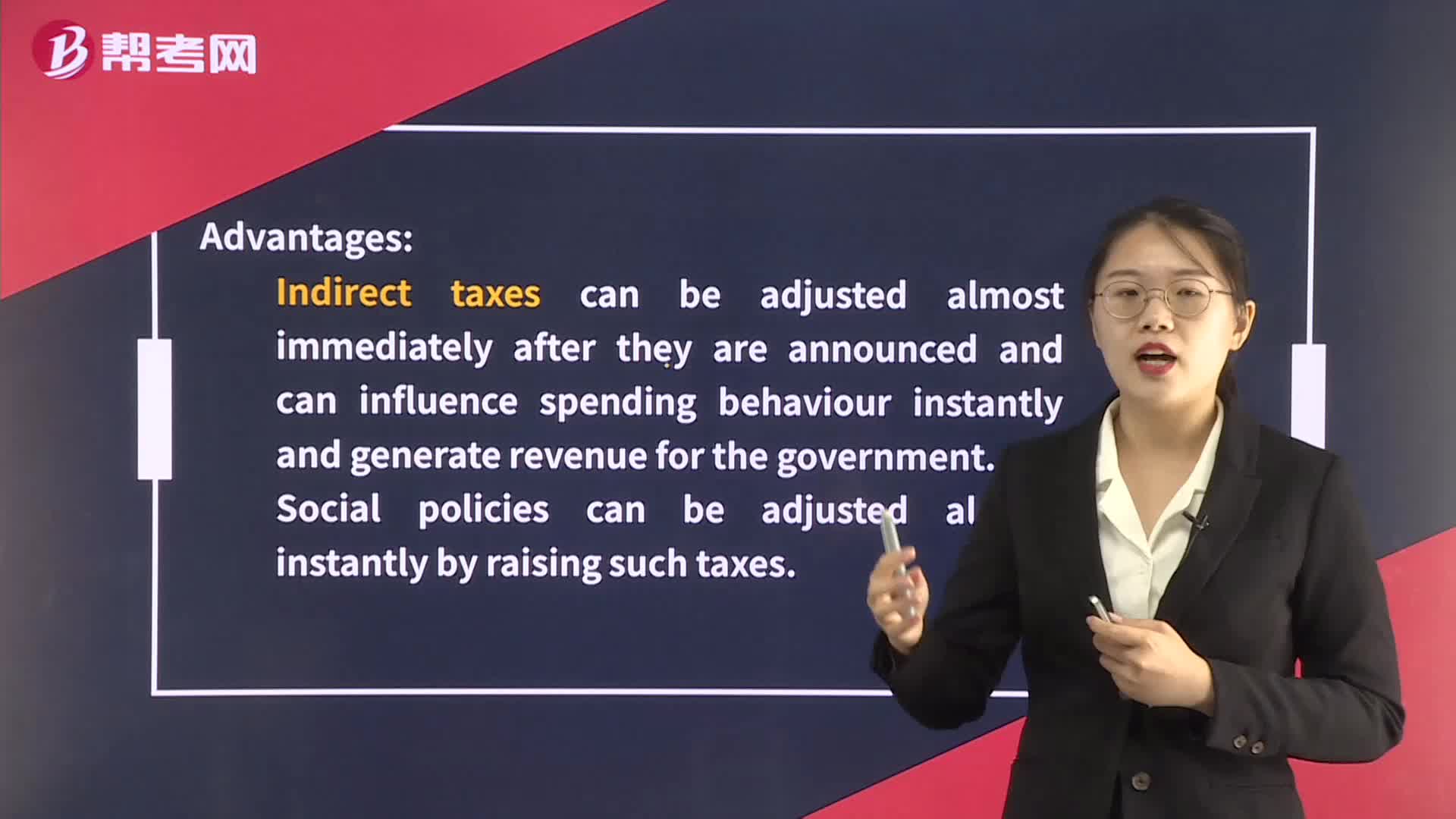

142The Advantages and Disadvantages of Using the Different Tools of Fiscal Policy:Different Tools of Fiscal Policy:DirectCapitalpowerful as the direct effects.

微信掃碼關(guān)注公眾號

獲取更多考試熱門資料