下載億題庫(kù)APP

聯(lián)系電話:400-660-1360

下載億題庫(kù)APP

聯(lián)系電話:400-660-1360

請(qǐng)謹(jǐn)慎保管和記憶你的密碼,以免泄露和丟失

請(qǐng)謹(jǐn)慎保管和記憶你的密碼,以免泄露和丟失

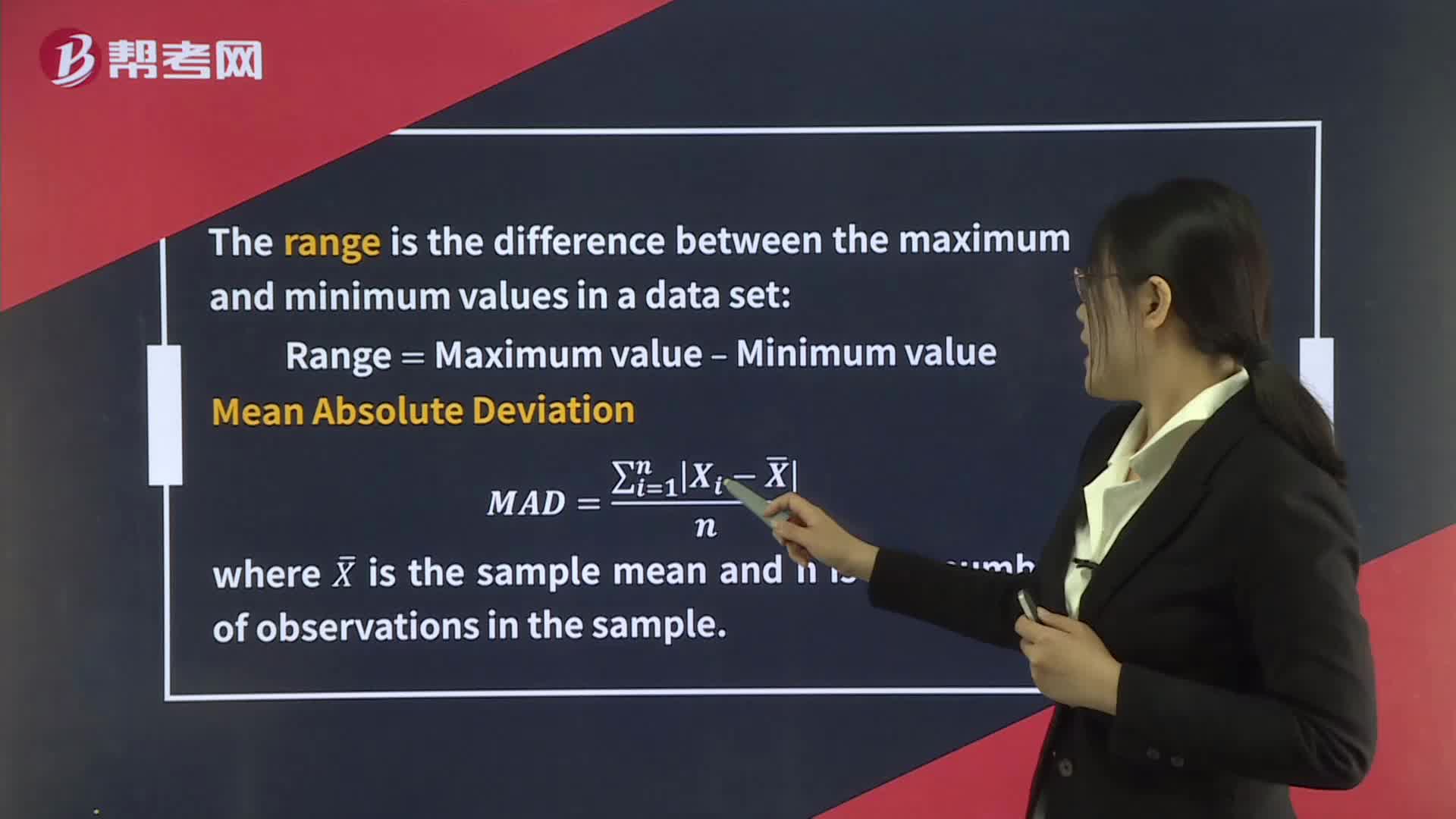

Dispersion

Measures of Dispersion

微信截圖_1596606386834420200805134643521.png)

微信截圖_1596606430887220200805134724743.png)

微信截圖_1596606469283320200805134808354.png)

微信截圖_1596606510608920200805134846325.png)

Chebyshev’s Inequality

Chebyshev’s Inequality.

According to Chebyshev’s inequality, for any distribution with finite variance, the proportion of the observations within k standard deviations of the arithmetic mean is at least 1 ? 1/k2 for all k > 1.

[Practice Problems] Over the past 240 months, an investor’s portfolio had a mean monthly return of 0.79%, with a standard deviation of monthly returns of 1.16%. According to Chebyshev’s inequality, the minimum number of the 240 monthly returns that fall into the range of ?0.95% to 2.53% is closest to:

A. 80. B. 107. C. 133.

[Solutions] C

The upper limit of the range is 2.53%, which is 2.53 ? 0.79 = 1.74% above the mean. The lower limit is ?0.95, which is 0.79 ? (?0.95) = 1.74% below the mean. k = 1.74/1.16 = 1.50 standard deviations. The proportion of observations within the interval is at least 1– 1/1.52 = 1 – 0.444 = 0.556, or 55.6%. Thus, the number of observations in the given range is at least 240 × 55.6%, which is ≈ 133.

Coefficient of Variation

微信截圖_1596606574851720200805134947982.png)

The Sharpe Ratio

微信截圖_1596606613128420200805135027670.png)

微信截圖_1596606648914720200805135101233.png)

Given a risk-free rate of return of 2.60%, which manager performed best based on the Sharpe ratio?

A. Manager 1

B. Manager 2

C. Manager 3

微信截圖_159660668491820200805135140526.png)

332

332Measures of Dispersion:Measures of Dispersion

649

649Dispersion:for any distribution with finite variance:[Practice,B.C.Manager 3

265

265What are the responsibilities of the members in reference to the CFA Institute?:Once accepted as a member:每年交述職報(bào)告和年費(fèi)but must not over promise the competency and future investment results.Case

微信掃碼關(guān)注公眾號(hào)

獲取更多考試熱門資料