下載億題庫(kù)APP

聯(lián)系電話:400-660-1360

下載億題庫(kù)APP

聯(lián)系電話:400-660-1360

請(qǐng)謹(jǐn)慎保管和記憶你的密碼,以免泄露和丟失

請(qǐng)謹(jǐn)慎保管和記憶你的密碼,以免泄露和丟失

2019年CFA考試《CFA一級(jí)》考試共240題,分為單選題。小編每天為您準(zhǔn)備了5道每日一練題目(附答案解析),一步一步陪你備考,每一次練習(xí)的成功,都會(huì)淋漓盡致的反映在分?jǐn)?shù)上。一起加油前行。

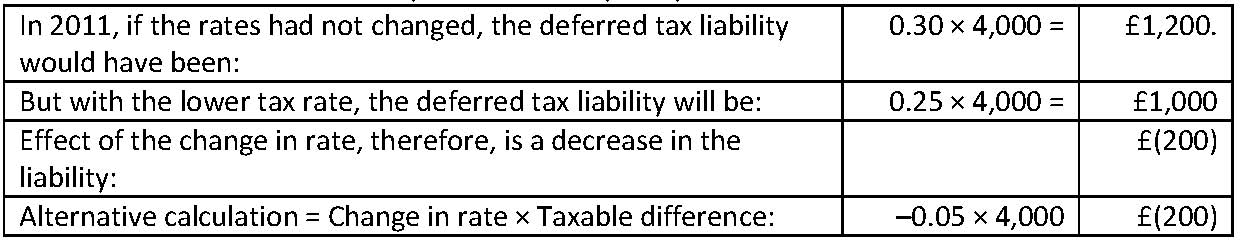

1、A company purchased equipment in 2010 for £25,000. The year-end values of the equipment for accounting purposes and tax purposes are as follows:Which of the following statements best describes the effect of the change in the tax rate on the company’s 2011 financial statements? The deferred tax liability:【單選題】

A.increases by £250.

B.decreases by £200.

C.decreases by £800.

正確答案:B

答案解析:“Income Taxes,” Elbie Antonites, CFA and Michael A. Broihahn, CFA

2、Which action is most likely considered a secondary source of liquidity?【單選題】

A.Increasing the availability of bank lines of credit

B.Increasing the efficiency of cash flow management

C.Renegotiating current debt contracts to lower interest payments

正確答案:C

答案解析:“Working Capital Management,” Edgar A. Norton, Jr., CFA, Kenneth L. Parkinson, and Pamela Peterson Drake, CFAC is correct. Renegotiating debt contracts is a secondary source of liquidity because it may affect the company’s operating and/or financial positions.

3、The null hypothesis is most likely to be rejected when the p-value of the test statistic:【單選題】

A.exceeds a specified level of significance.

B.is negative.

C.falls below a specified level of significance.

正確答案:C

答案解析:If the p-value is less than the specified level of significance, the null hypothesis is rejected.Section 2

4、All else being equal, a decrease in volatility of the underlying is most likely toresult in a(n):【單選題】

A.increase in call price and a decrease in put price.

B.decrease in call price and a decrease in put price.

C.increase in call price and a increase in put price.

正確答案:B

答案解析:所針對(duì)的標(biāo)的資產(chǎn)波動(dòng)性增加會(huì)同時(shí)增加看漲期權(quán)和看跌期權(quán)的價(jià)值,此時(shí)標(biāo)的資產(chǎn)的價(jià)格高于看漲期權(quán)行權(quán)價(jià)或者低于看跌期權(quán)行權(quán)價(jià)的可能性都增加,而所針對(duì)的標(biāo)的資產(chǎn)的波動(dòng)性若降低,則結(jié)論正好相反。

5、An analyst does research about impact to option due to interest rate and volatilityof the underlying.Which of the following statements best describes the effect ofthe level of interest rates and volatility of the underlying on the price of options?All else being equal, prices for:【單選題】

A.put options are positively related to the level of interest rates.

B.call options are positively related to the level of interest rates.

C.put options are negatively related to the volatility of the underlying.

正確答案:B

答案解析:當(dāng)利率越高時(shí),更多的人會(huì)選擇投資看漲期權(quán),因?yàn)榭梢匝雍筚?gòu)買資產(chǎn)的時(shí)間,即現(xiàn)在只要付一部分期權(quán)費(fèi)就可以買入將來(lái)購(gòu)買這項(xiàng)資產(chǎn)的權(quán)利,所以看漲期權(quán)與利率正相關(guān)。相反地,當(dāng)利率越高時(shí),更多的人會(huì)選擇賣出看跌期權(quán),導(dǎo)致看跌期權(quán)價(jià)格下跌,所以看跌期權(quán)與利率負(fù)相關(guān)。資產(chǎn)的波動(dòng)性與看漲期權(quán)及看跌期權(quán)的價(jià)格都是正相關(guān)。

459

459What are the indices for a skewed distribution?:What are the indices for a skewed distribution?

265

265What are the responsibilities of the members in reference to the CFA Institute?:Once accepted as a member:每年交述職報(bào)告和年費(fèi)but must not over promise the competency and future investment results.Case

640

640What members and candidates should notice in CFA examinations?:or security of the CFA examinations.(不能惡心CFA),考試不能作弊:考試內(nèi)容要保密:A. No.:Responsibilities as a CFA Institute Member.right④Case

微信掃碼關(guān)注公眾號(hào)

獲取更多考試熱門資料