下載億題庫(kù)APP

聯(lián)系電話:400-660-1360

下載億題庫(kù)APP

聯(lián)系電話:400-660-1360

請(qǐng)謹(jǐn)慎保管和記憶你的密碼,以免泄露和丟失

請(qǐng)謹(jǐn)慎保管和記憶你的密碼,以免泄露和丟失

2020年CFA考試《CFA一級(jí)》考試共240題,分為單選題。小編每天為您準(zhǔn)備了5道每日一練題目(附答案解析),一步一步陪你備考,每一次練習(xí)的成功,都會(huì)淋漓盡致的反映在分?jǐn)?shù)上。一起加油前行。

1、Which of the following is least likely to be a type of embedded option in a bond issue granted tobondholders? The right to:【單選題】

A.put the issue.

B.call the issue.

C.convert the issue.

正確答案:B

答案解析:The right to call an issue is a type of embedded option granted to issuers, not bondholders. The othertwo rights are embedded options granted to bondholders.

CFA Level I

"Fixed-Income Securities: Defining Elements," Moorad Choudhry and Stephen E. Wilcox

Section 5.1

2、An analyst does research about reinvestment risk.Which of the following securitiesis most likely to be subject to reinvestment risk during the period of time betweenissuance and maturity?【單選題】

A.Treasury bills.

B.Treasury notes.

C.Treasury coupon strips.

正確答案:B

答案解析:Treasury bills是美國(guó)國(guó)庫(kù)券,是短期債券,而且是完全折價(jià)債券,到期前沒(méi)有利息,到期時(shí)一次還本,所以沒(méi)有再投資風(fēng)險(xiǎn);Treasury coupon strips是美國(guó)本息剝離的國(guó)債,投資銀行將美國(guó)的中長(zhǎng)期國(guó)債的每一筆利息和本金拆分成不同期限的完全折價(jià)債券,所以也沒(méi)有再投資風(fēng)險(xiǎn);而Treasury notes是美國(guó)中期國(guó)債,每半年發(fā)放一次利息,會(huì)有再投資風(fēng)險(xiǎn)。

3、Bonds issued by a country's central government are referred to as sovereignbonds.Which of the following methods is used by central governments to issuesovereign bonds when it determines market conditions are advantageous?【單選題】

A.Regular cycle auction (multiple price).

B.An ad hoc auction system.

C.A tap system.

正確答案:B

答案解析:在市場(chǎng)適合的情況下,選擇發(fā)行債券屬于特別的拍賣系統(tǒng)。

4、A graphic depiction of a continuous distribution that shows the left tail to be longer than the right tail is best described as having:【單選題】

A.lepto-kurtosis.

B.positive skewness.

C.negative skewness.

正確答案:C

答案解析:“Statistical Concepts and Market Returns,” Richard A. DeFusco, Dennis W. McLeavey, Jerald E. Pinto, and David E. Runkle

2012 Modular Level I, Vol. 1, p. 401

Study Session 2-7-j

Explain skewness and the meaning of a positively or negatively skewed return distribution.

C is correct. A negatively skewed distribution appears as if the left tail has been pulled away from the mean.

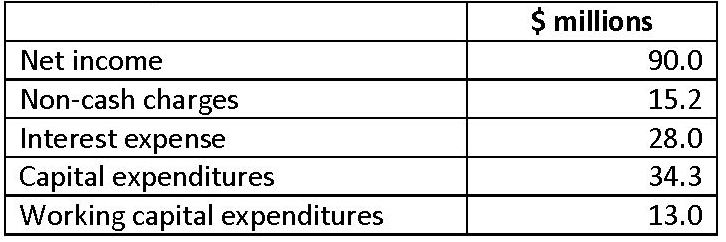

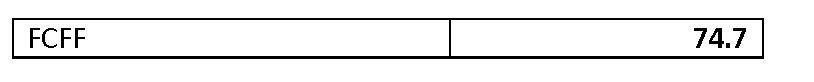

5、The following selected data are available for a firm:

If the firm’s tax rate is 40%, the free cash flow to the firm (FCFF) is closest to:【單選題】

A.57.9.

B.74.7.

C.87.7.

正確答案:B

答案解析:“Understanding Cash Flow Statements,” Elaine Henry, CFA, Thomas R. Robinson, CFA, Jan Hendrik van Greuning, CFA, and Michael A Broihahn, CFA

2013 Modular Level I, Vol. 3, Section 4.3

Study Session: 8–27-i

Calculate and interpret free cash flow to the firm, free cash flow to equity, and performance and coverage cash flow ratios.

B is correct.

Calculate FCFF:

459

459What are the indices for a skewed distribution?:What are the indices for a skewed distribution?

265

265What are the responsibilities of the members in reference to the CFA Institute?:Once accepted as a member:每年交述職報(bào)告和年費(fèi)but must not over promise the competency and future investment results.Case

640

640What members and candidates should notice in CFA examinations?:or security of the CFA examinations.(不能惡心CFA),考試不能作弊:考試內(nèi)容要保密:A. No.:Responsibilities as a CFA Institute Member.right④Case

微信掃碼關(guān)注公眾號(hào)

獲取更多考試熱門資料